10 Finance Concepts You Should Know

👋 Howdy Partner,

Investing is simple, but not easy.

Most people overcomplicate it with complex strategies and hot tips. In reality, the most successful investors base what they do on a few timeless principles.

Today, we are breaking down 10 Finance Concepts that you should know.

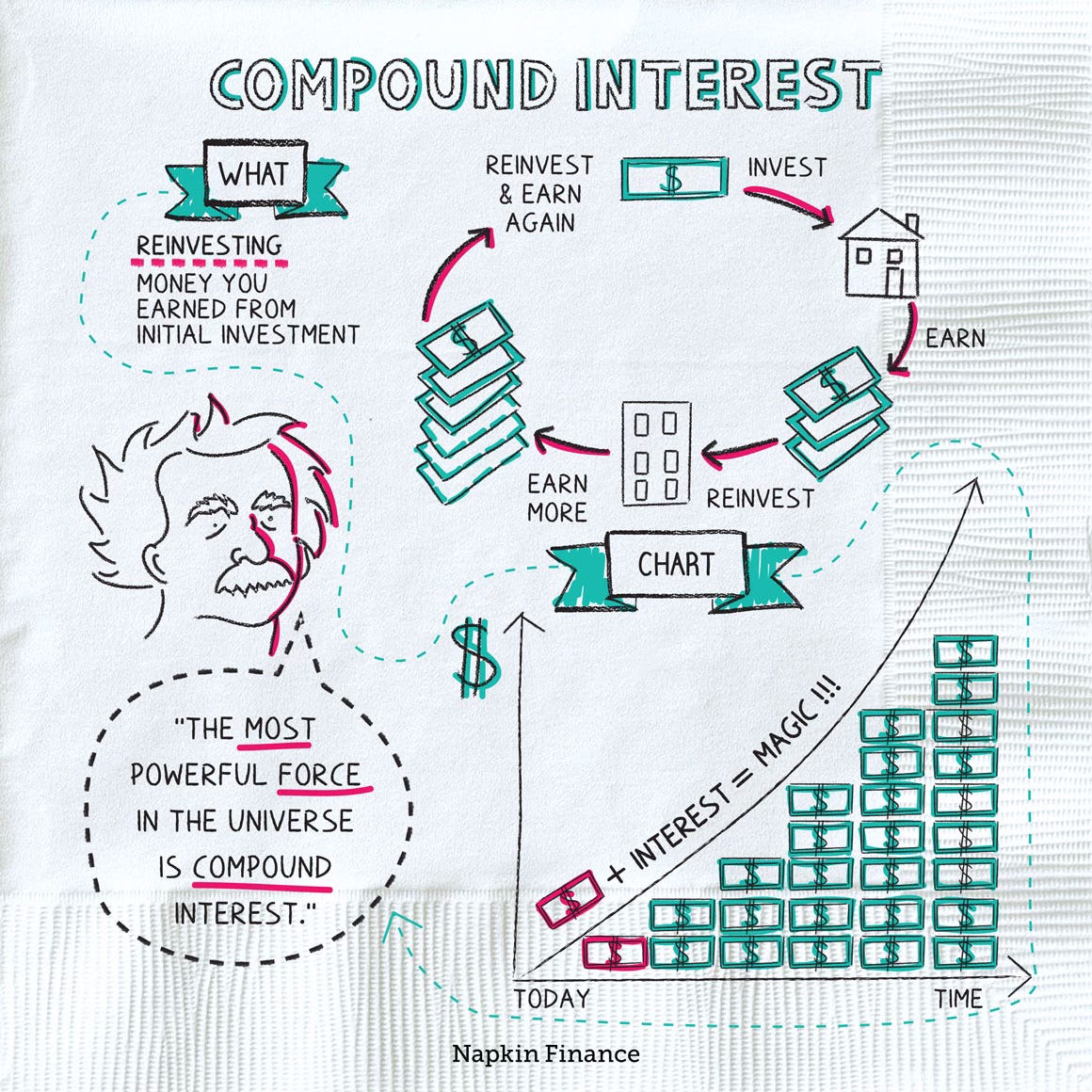

1. Compound Interest

Albert Einstein supposedly called it the eighth wonder of the world for a reason.

(In reality it was probably a clever advertisement writer for a savings and loan company.)

Regardless of who said what about compound interest, you should understand it, and use it to your advantage.

Compound interest is when your money makes money, and then that money makes money.

Start with $10,000 invested at a 10% annual return (like the historical S&P 500 average), and in 30 years, it could grow to over $174,000 - most of that from reinvested gains, not your initial capital.

Key Takeaway: Time is your best friend. Start early, reinvest dividends, and let patience do the heavy lifting.

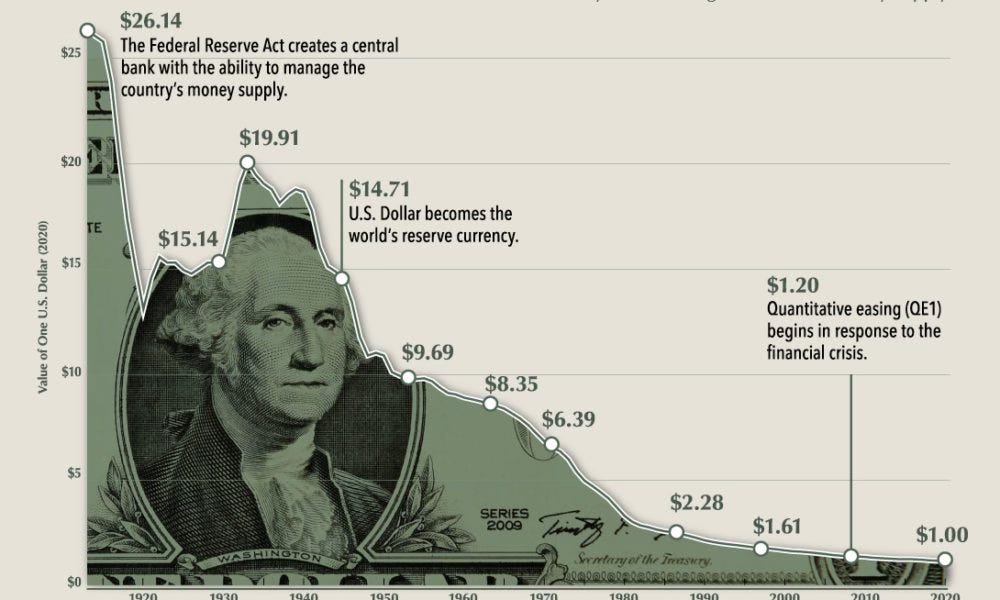

2. Inflation

Inflation is the rise in prices over time, which reduces what your dollar can buy.

If prices rise by 3% every year, your $100 will only buy $41 worth of goods in three decades.

That means your money has to earn at least the rate of inflation to keep its purchasing power over time.

Savings accounts yielding 1% won’t do it.

Key Takeaway: Beat inflation by investing in assets that outpace it like stocks, or real estate. Think of companies like Coca-Cola, which can raise prices without losing customers.

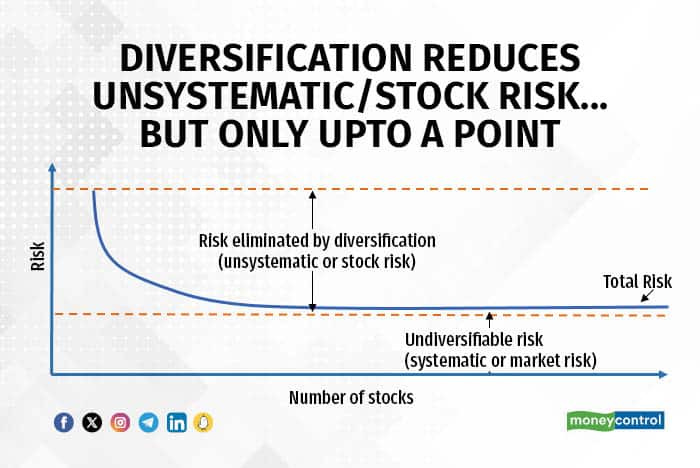

3. Diversification

Diversification spreads risk across different assets, sectors, or geographies.

But more diversification isn’t always better.

Charlie Munger calls it “Deworsification” when you buy too many things you don’t understand.

If you only have 1 stock, adding a second one does spread out the risk, but the benefits of adding more decay quickly.

Most studies find owning more than 20 - 25 stocks doesn’t add any benefit.

Key Takeaway: Own a concentrated portfolio of 15–25 high-quality businesses you know inside and out. If you want diversification beyond that, owning other asset classes like bonds or real estate is a better bet than adding more stocks.

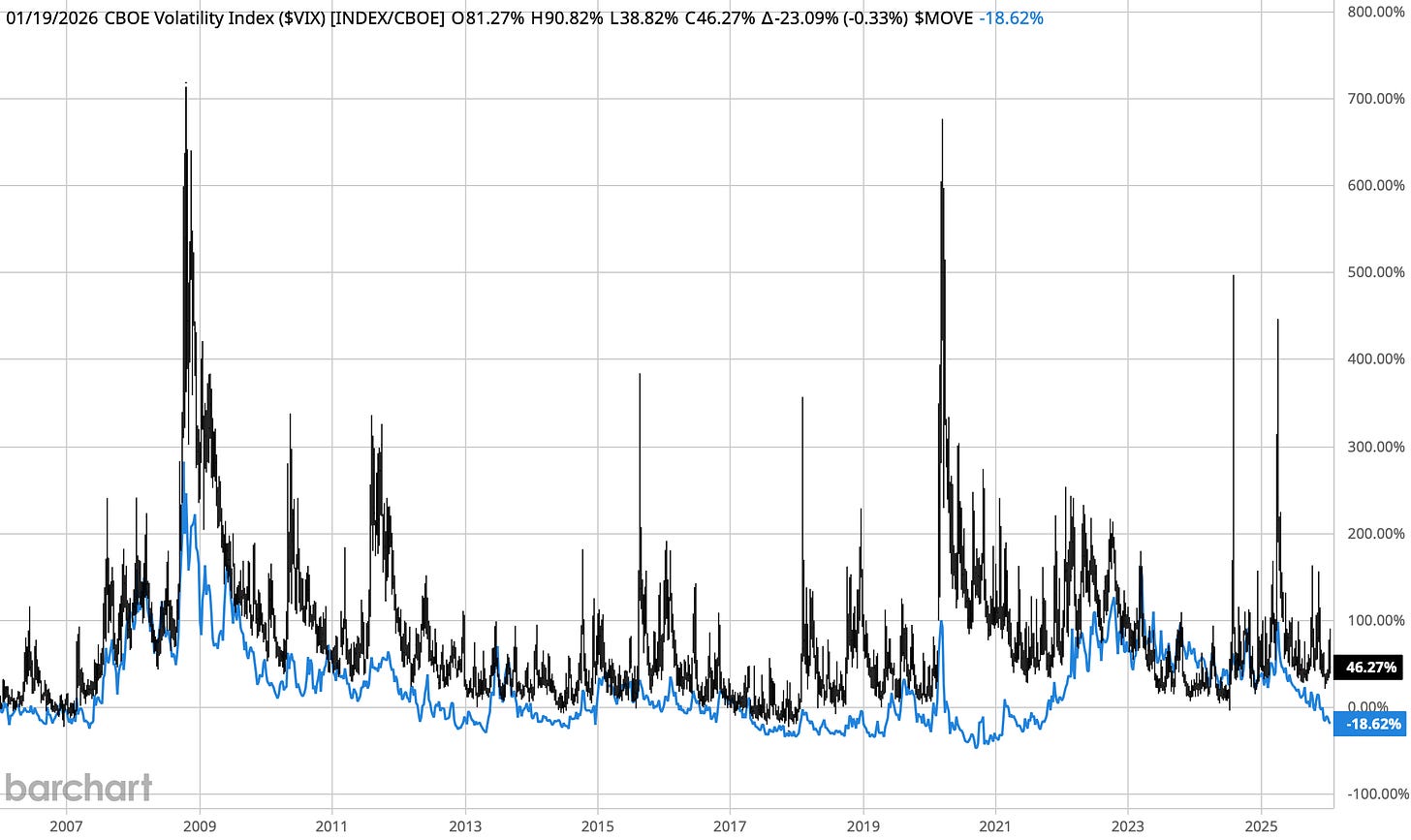

4. Risk vs. Return

In the short term, stocks are volatile.

In the long term, they have higher returns than other asset classes.

The image shows the VIX and MOVE indexes.

The VIX tracks how much investors expect stock prices to move up and down.

The MOVE index does the same for bonds.

Don’t mistake volatility for risk. They are not the same thing.

Risk is the probability of a permanent loss of capital..

Volatility is the price of admission for the higher long-term returns from stocks.

As Charlie Munger famously said:

“If you can’t stomach a 50% decline in your investment, you will get the mediocre returns you deserve.”

Key takeaway: If you aren’t prepared to watch your portfolio swing wildly, sometimes dropping 20%, 30%, or even 50, then you simply shouldn’t be in stocks.

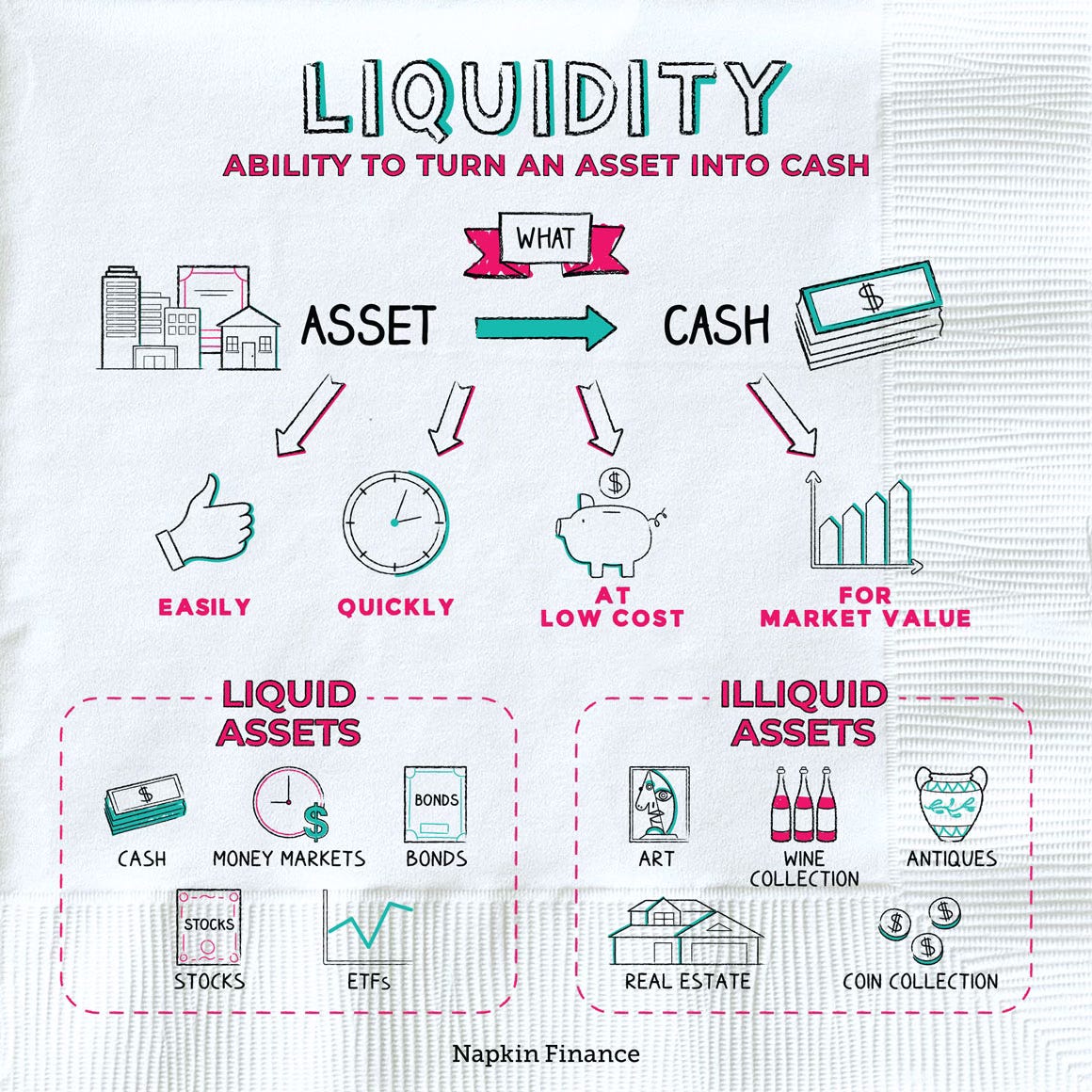

5. Liquidity

Liquidity is how fast you can turn an asset into cash at the market value.

Cash is king for liquidity, but it doesn’t offer much return.

Even though stocks, ETFs, and bonds tend to be liquid, you should still keep a cash emergency fund.

Why?

You never want to be forced to sell your stocks during a market crash just to pay your bills.

Key takeaway: Maintain a cash buffer (3-6 months of expenses is usually recommended), but don’t hoard cash - it usually loses to inflation in the long run.

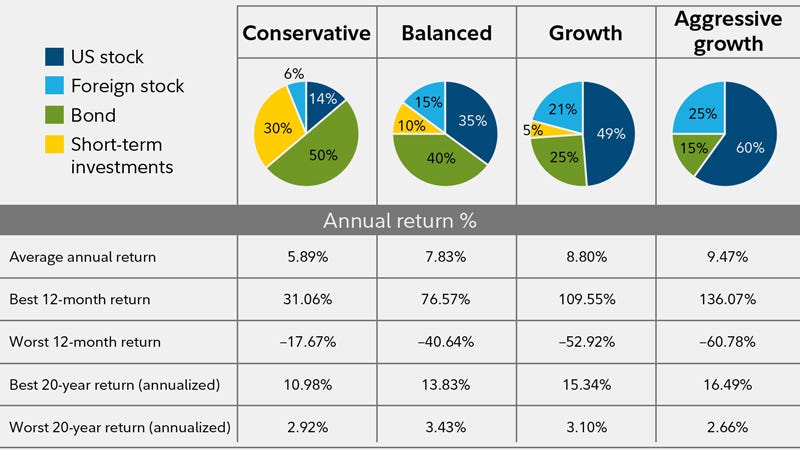

6. Asset Allocation

This is simply how you split your money between asset classes like stocks, bonds, and cash.

It’s an important determinant of your long term returns.

There are lots of ways to do it, but the general advice is that the longer your investing time horizon, the more aggressive you should be.

As your investment time horizon shrinks, you should move to a more conservative allocation.

Key Takeaways: As you age, shift toward stability, and don’t forget to rebalance

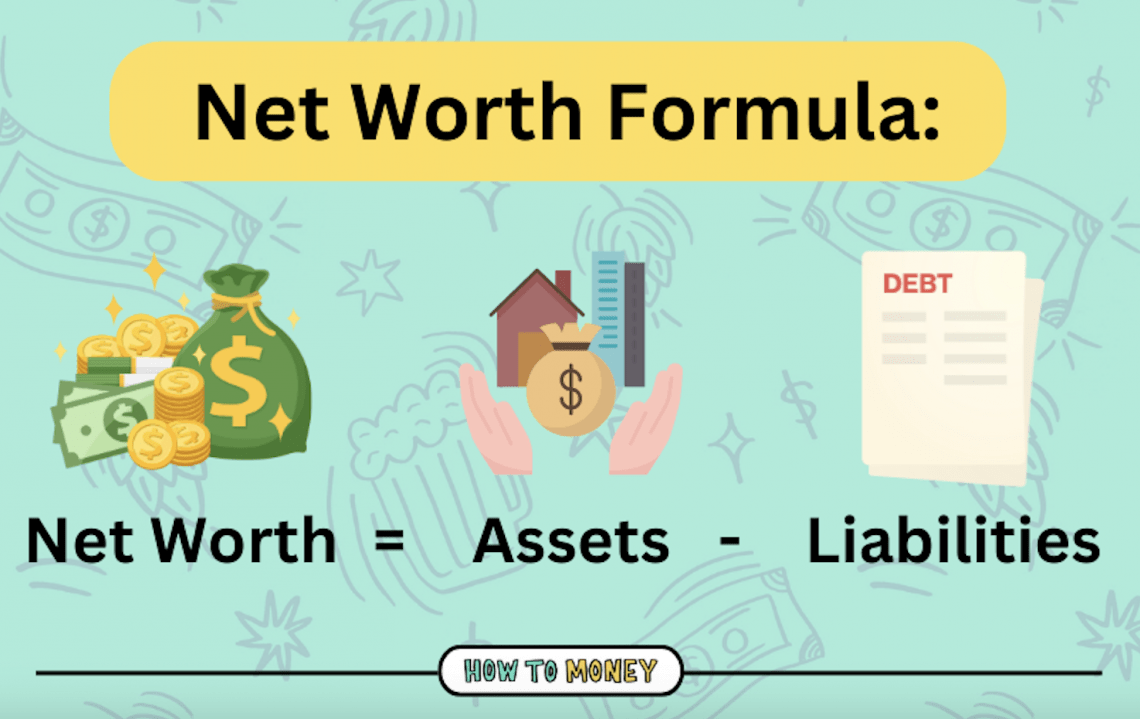

7. Net Worth

Your Net Worth is one way to keep a financial score card.

Here’s how to calculate it:

Net Worth = Everything you Own – Everything you Owe

Track it quarterly or yearly to gauge progress.

A strong net worth builds financial freedom.

Key Takeaway: Increase assets (investments, savings) and reduce liabilities (debt) to improve your number.

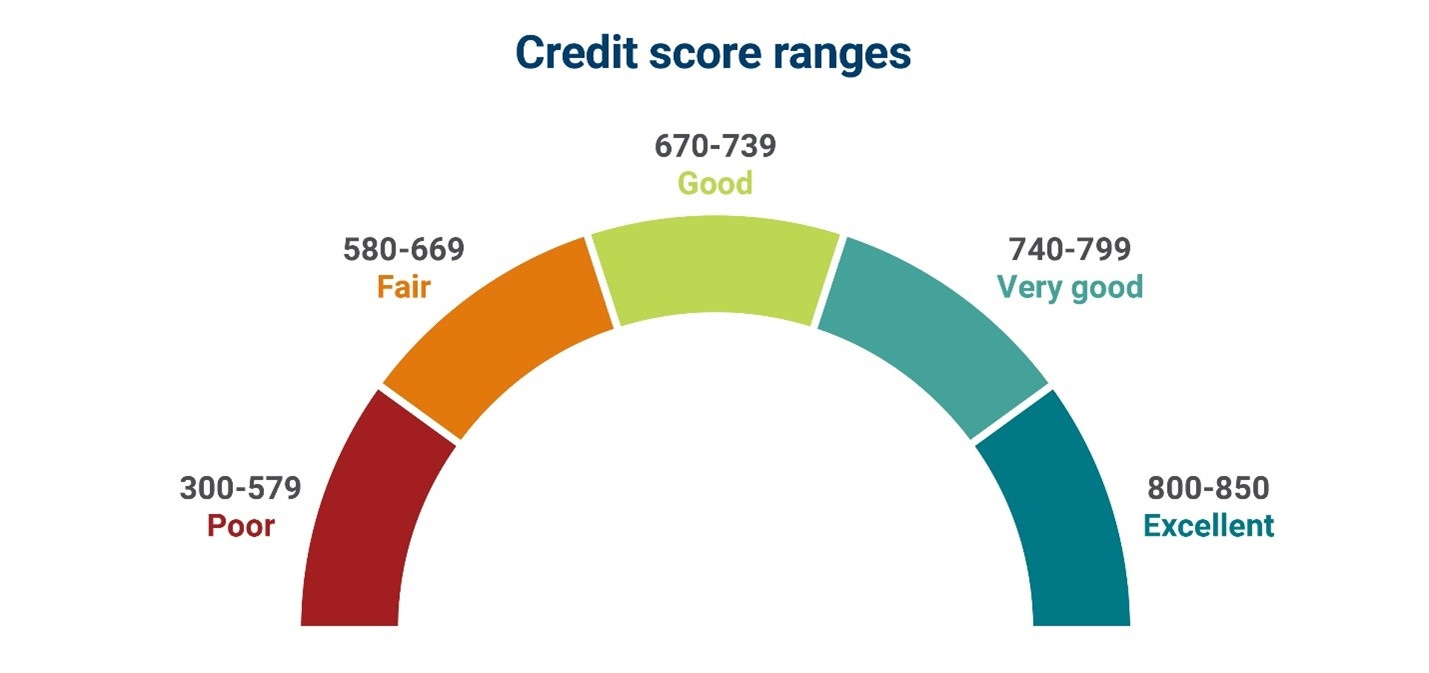

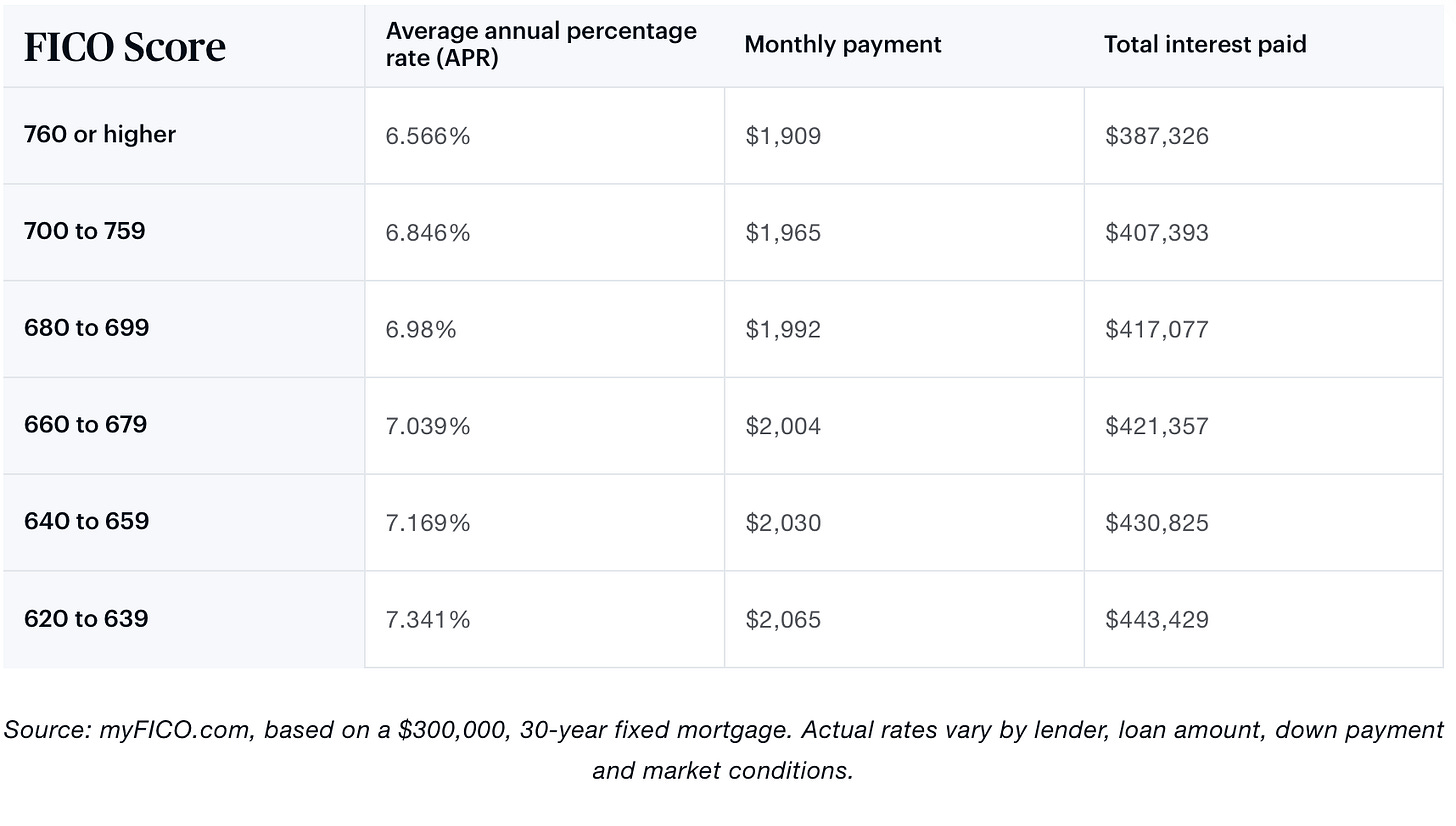

8. Credit Score: Your Access to Cheap Capital

Your credit score affects loan rates, rentals, even jobs.

Factors include:

Your payment history (35%)

How much you owe (30%)

Length of credit history (15%)

and more

A high score (750+) lets you borrow money at lower rates.

A lower interest rate on a home mortgage can save you more than $50,000 over 30 years.

Key takeaway: Pay bills on time, keep utilization low, and avoid new credit inquiries. A high score saves thousands in interest over time.

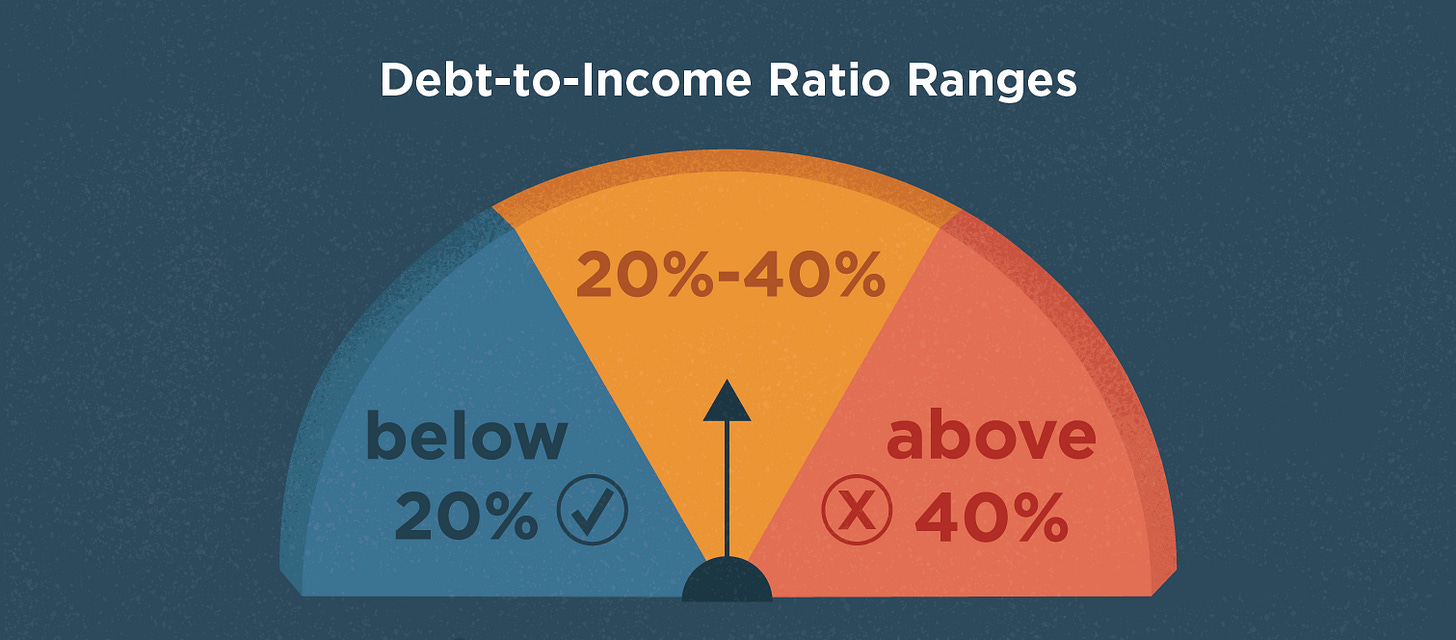

9. Debt-to-Income (DTI)

Lenders look at how much of your monthly income goes toward debt.

DTI = Monthly Debt Payments / Gross Monthly Income.

Most lenders like this number under 36% - higher than that is an indication that you might be over-leveraged.

Key Takeaway: Use debt wisely, for appreciating assets like education or a home, not depreciating ones like cars. Pay down high-interest debt first to free up cash for investing.

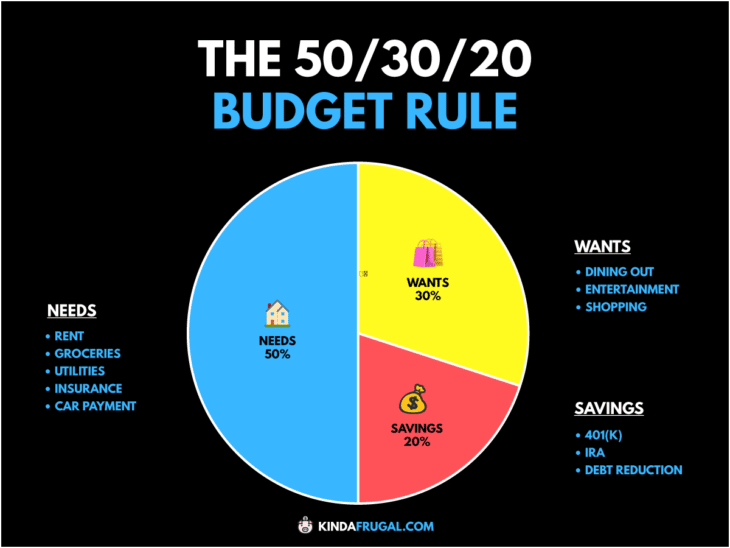

10. Budgeting

Think of budgeting as your spending plan.

Budgeting tracks income vs. expenses, ensuring you live below your means.

The 50/30/20 Rule is a simple way to keep a budget:

50% for Needs (Rent, Food).

30% for Wants (Dining out, Hobbies).

20% for Savings.

Key Takeaway: Plan your spending before you get paid. Automate your savings to make budgeting easier.

Here’s What You Learned Today

Building wealth is about mastering the basics.

If you understand these ten principles, you are already ahead of 99% of investors.

Compound Interest: Your money grows faster because your gains earn their own profits over time

Inflation: The cost of living goes up, so your money has to grow to keep its value

Diversification: Don’t put all your eggs in one basket, but only buy what you truly understand

Risk vs. Return: Big price swings are the fee you pay for the chance to make more money later

Liquidity: Keep enough cash ready so you never have to sell your stocks during a bad market

Asset Allocation: How you split money between stocks and bonds is the main driver of your wealth

Net Worth: This is your real scorecard - what you own minus what you owe

Credit Score: A high score helps you borrow money at a lower cost

Debt-to-Income: This shows if you owe too much money compared to what you earn each month

Budgeting: A simple plan to track your spending and make sure you pay yourself first

Whenever you’re ready

Whenever you’re ready, here’s how I can help you:

✍️ Three articles per week (Monday, Wednesday, and Saturday)

📚 Full access to our entire library of data-driven articles

📈 An insight into our Portfolio full of interesting Dividend Stocks

🔎 Full investment cases about interesting companies

The doors for Compounding Dividends will reopen to a limited of people on the 24th of February.

You don’t want to miss it? And you also want to receive all the exclusive bonuses?

You’ll also immediately get a copy of my 10 favorite cannibal stocks when you do.

One Dividend At A Time

TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.

Brilliant list. Thank you for putting this out. I would suggest one addition - free cashflow