10 Lessons from 2025

2025 was a crazy year in the markets.

From the tariff tantrum in April, to the AI excitement, to the worry about an AI bubble.

Let’s share 10 lessons from 2025 that we can make us better investors in 2026.

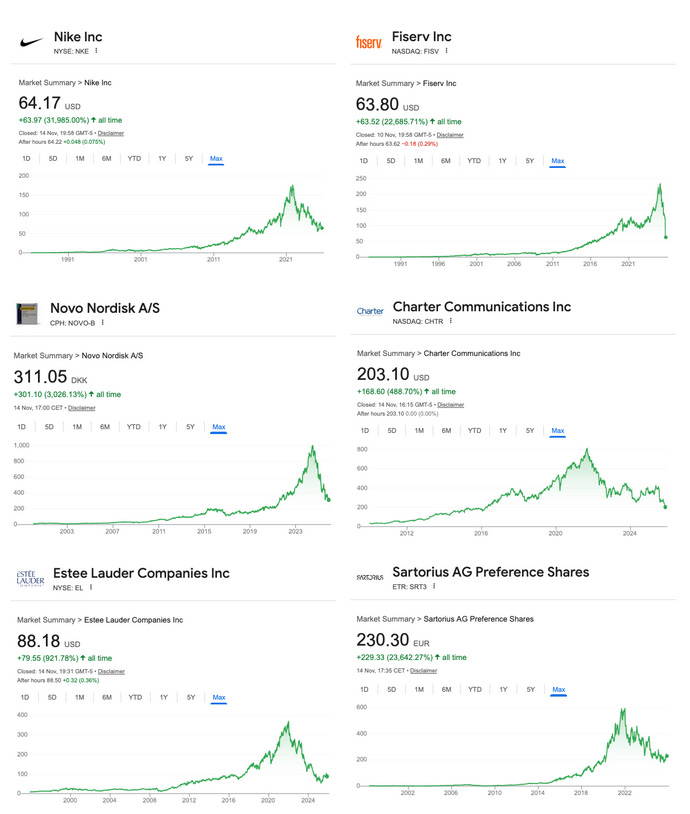

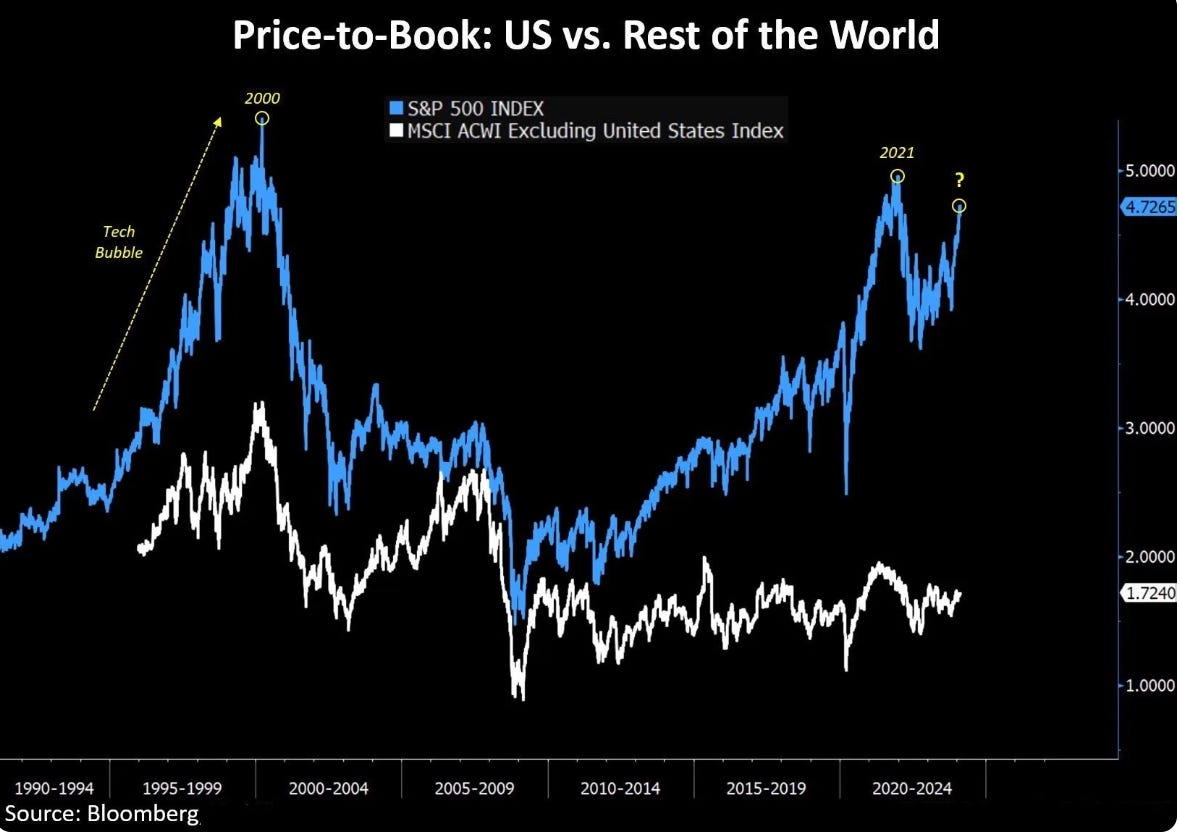

1. Valuation Matters

In 2025, many Great Companies became Bad Investments.

Even the best business in the world is a poor investment if you pay too much for it.

Many of these stocks were at very expensive prices at the peak.

Quality makes sure you have upside, but valuation protects your downside.

Buying a wonderful company at a fair price beats buying a fair company at a wonderful price, but buying a wonderful company at an outrageous price is a recipe for underperformance.

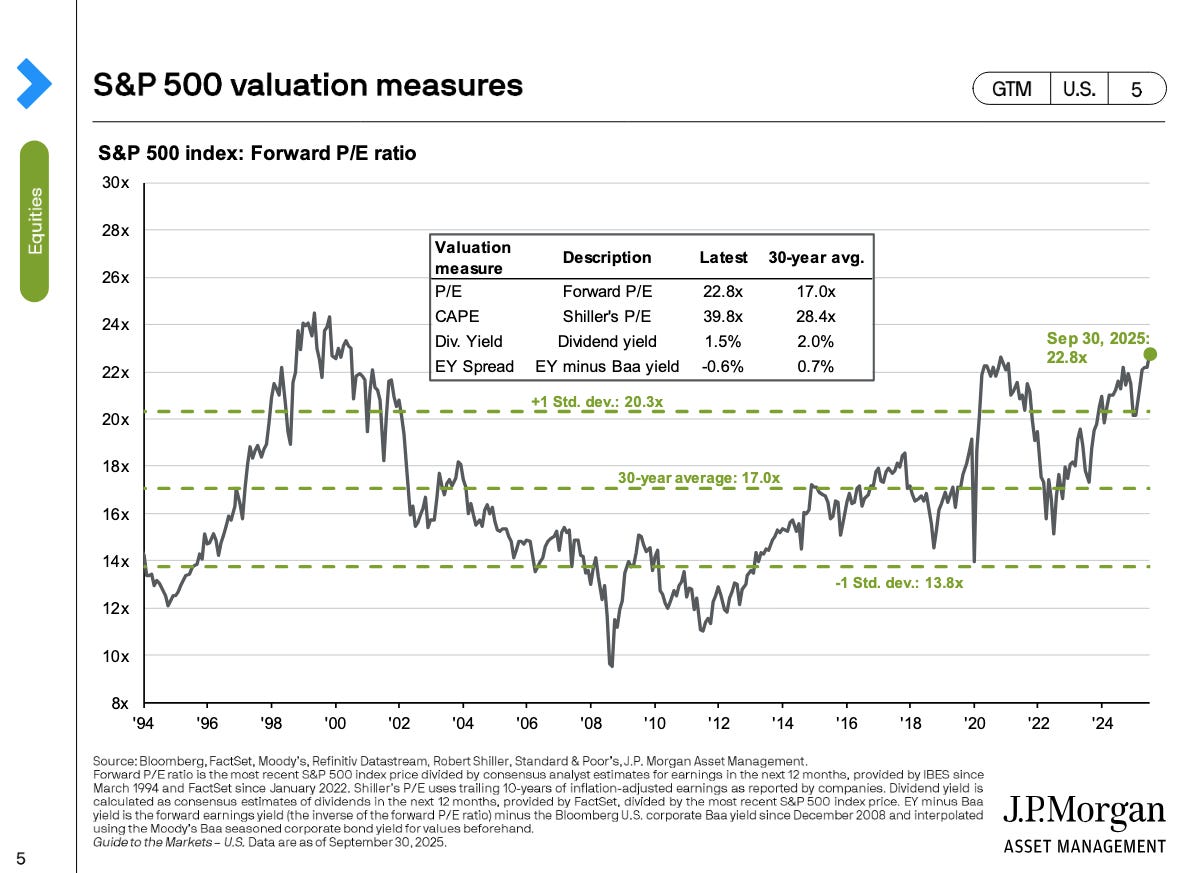

This is probably worth keeping in mind as we start 2026 with stocks at record valuations.

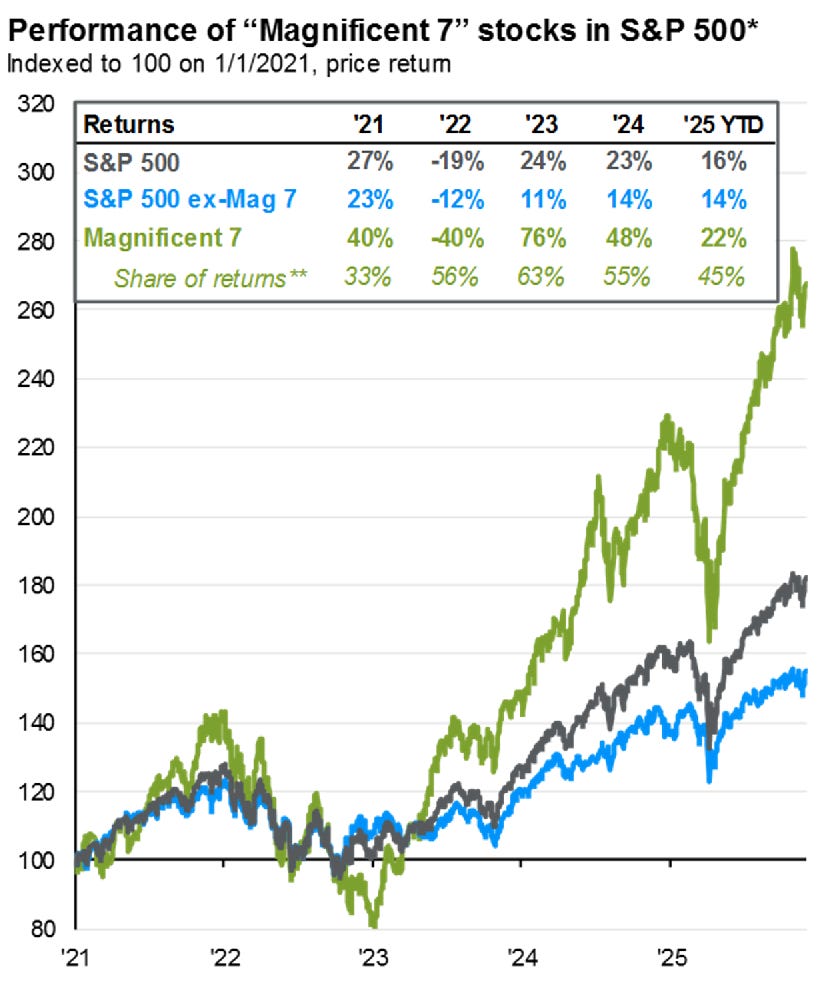

2. Concentration is a Double-Edged Sword

The Magnificent 7 drove the vast majority of the gains of the S&P 500 in 2025.

Concentration like this can create a lot of wealth.

But it also creates a danger.

If the pace of growth for these stocks slow down, and we see a multiple re-rating similar to what happened in the stocks in our first lesson, it would have a very significant impact on the entire market.

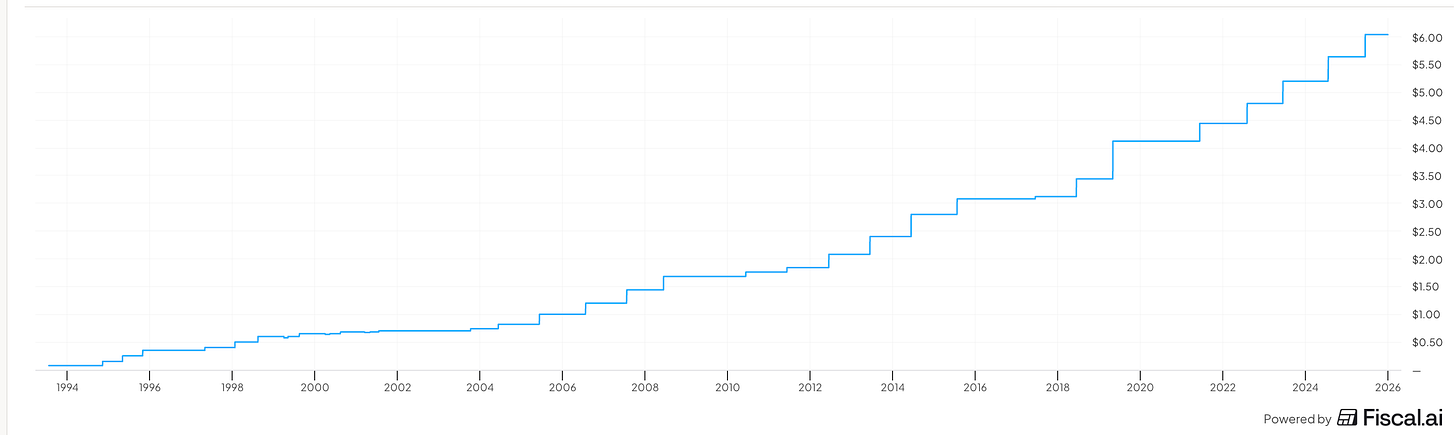

3. Always Follow the Cash Flow

Management can lie with numbers like “Adjusted EBITDA” or “Pro-forma earnings.”

They cannot lie with a dividend check.

A company that consistently raises its dividend is telling you three things:

They are profitable.

They are confident in the future.

They respect you as a partner.

Always follow the cash flow.

Caterpillar has raised its dividend for 31 years in a row.

In April, there was a lot of fear that tariffs would hurt the business.

In August management raised the dividend.

Caterpillar’s stock price went up about 60% in 2025.

4. Interest Rates Don’t Kill Good Businesses

We were told high rates and high tariffs would destroy the market. They didn’t.

Strong businesses with low debt and high pricing power simply passed the costs along.

Don’t focus on the Fed or policy from D.C.

Focus on the balance sheet and the business.

Buy companies with a moat that can survive any interest rate environment.

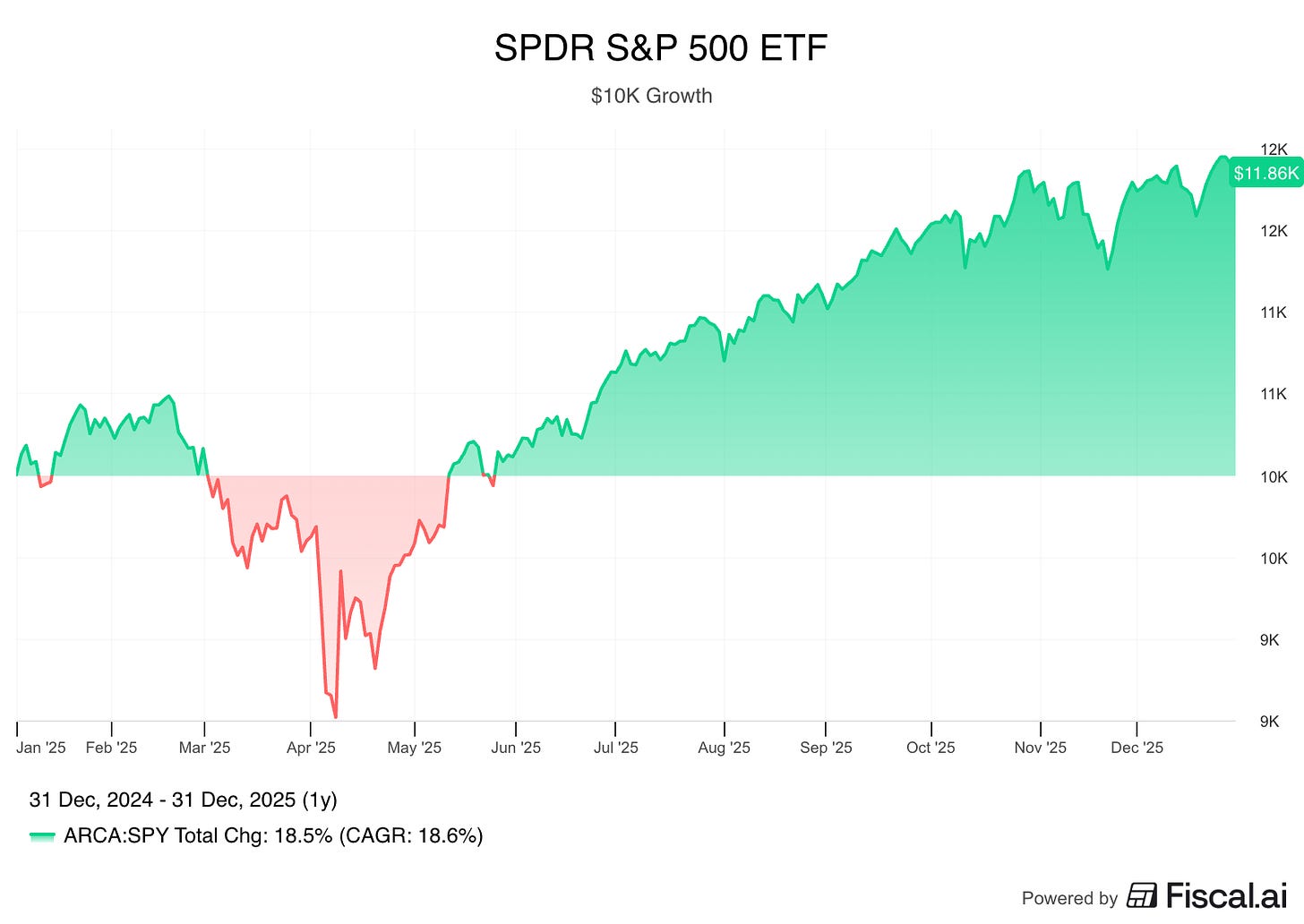

5. Doing Nothing is a Valid Strategy

Liberation Day in April triggered a wave of panic selling.

The investors who made the most money in 2025 were those who did the least.

The stock market is a device for transferring money from the active to the patient.

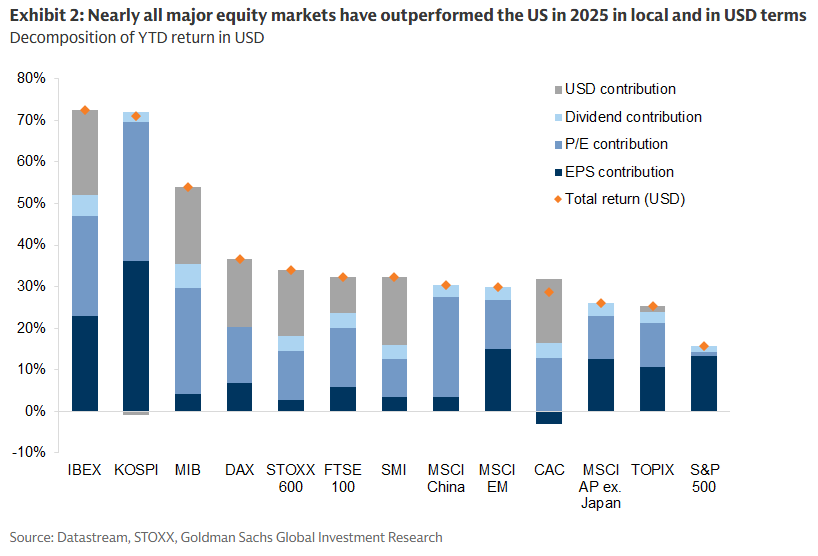

6. Global Income Has a Place

The US is the best place to build a business, but not always the best place to find a bargain.

In 2025, while US valuations were stretched, the UK and Europe offered high-quality yields at a significant discount.

And those markets outperformed the U.S.

Home bias is a risk.

There are great companies everywhere in the world.

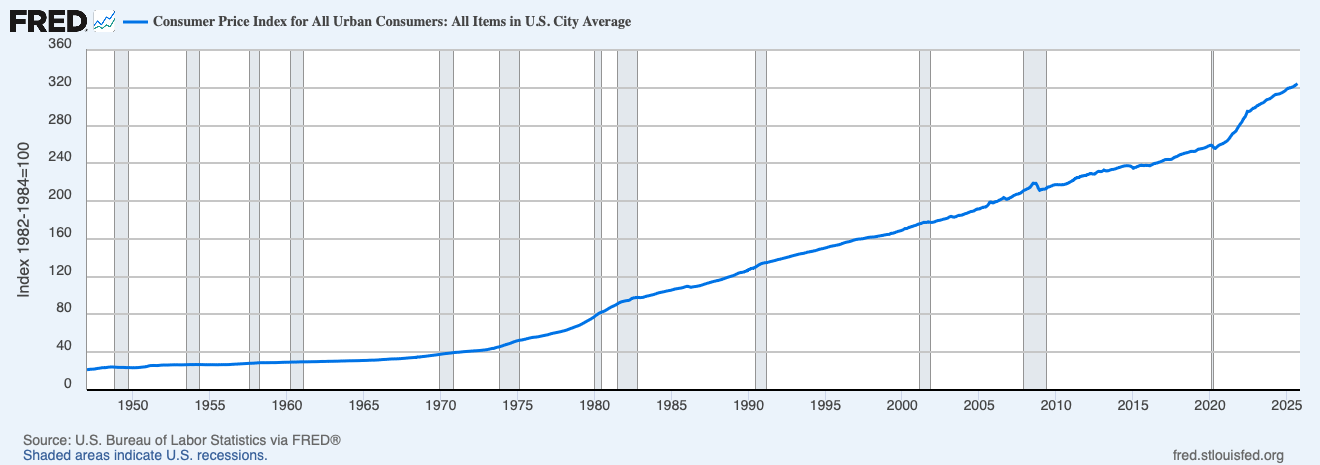

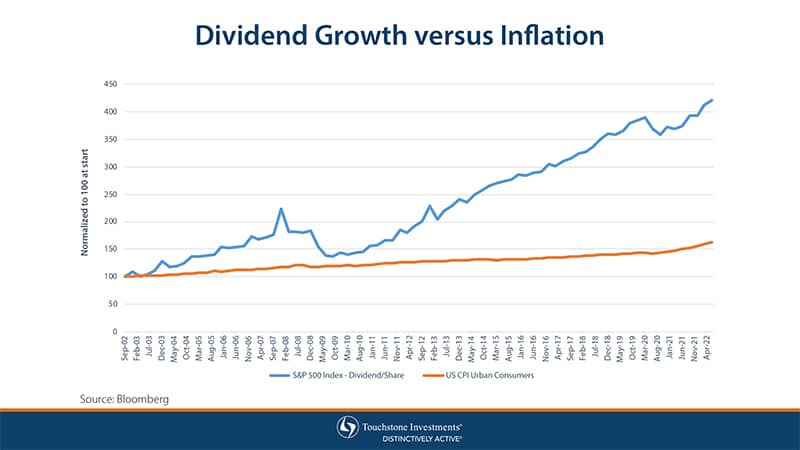

7. Dividends are “Inflation Insurance”

Inflation remained sticky in 2025.

A bond pays a fixed amount that buys less every year.

A growing dividend pays an increasing amount that protects your purchasing power.

Income that doesn’t grow is shrinking buying power.

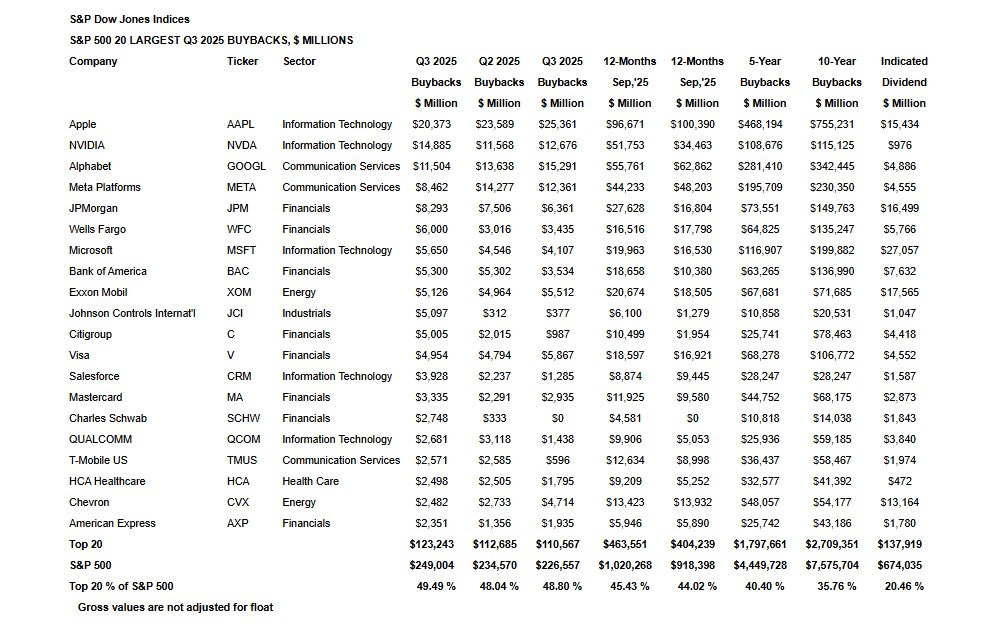

8. Buybacks vs. Dividends

2025 saw a record number of share buybacks.

The Good: Buying back undervalued shares increases your ownership.

The Bad: Buying back overvalued shares destroys shareholder value.

As an investor, you must ask: Is management retiring shares to help me, or just to offset their own stock-based compensation?

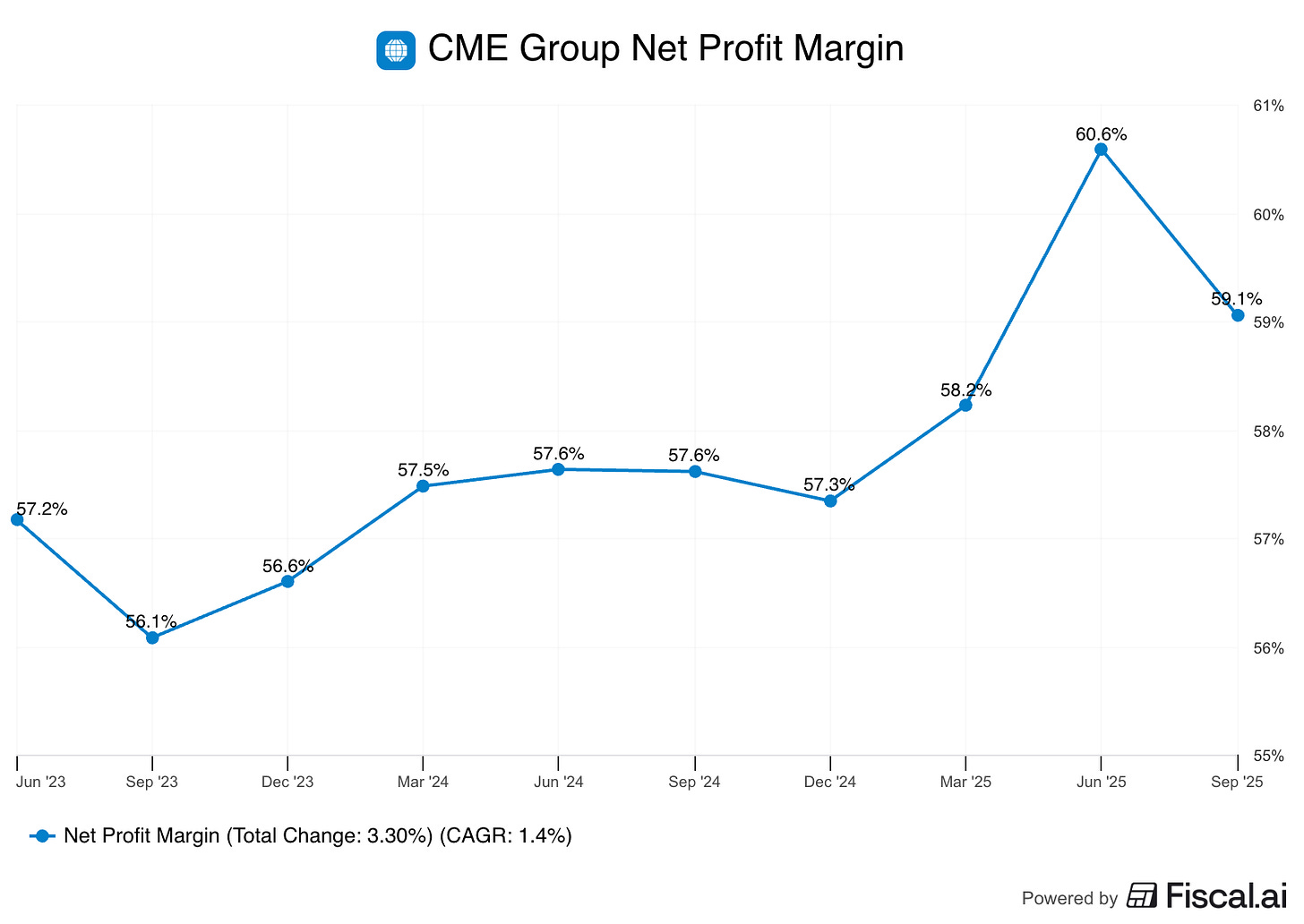

9. International Markets are Still Cheap

Even though international stocks outperformed U.S. stocks this year, they still look cheap in comparison.

Many European companies trade at significantly lower valuation of their US peers despite having similar margins.

Diversification across geographies is a great way to protect your wealth.

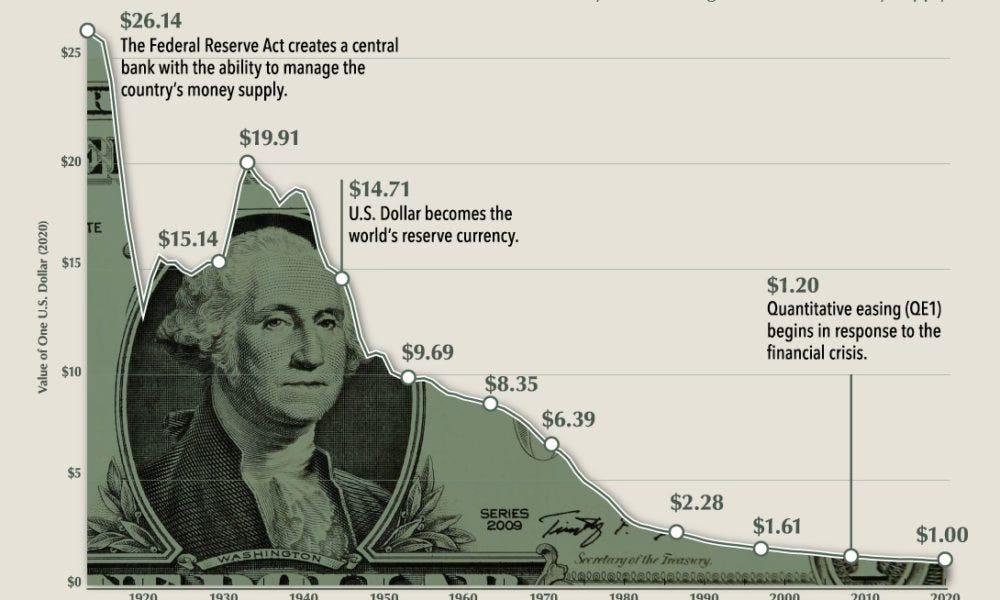

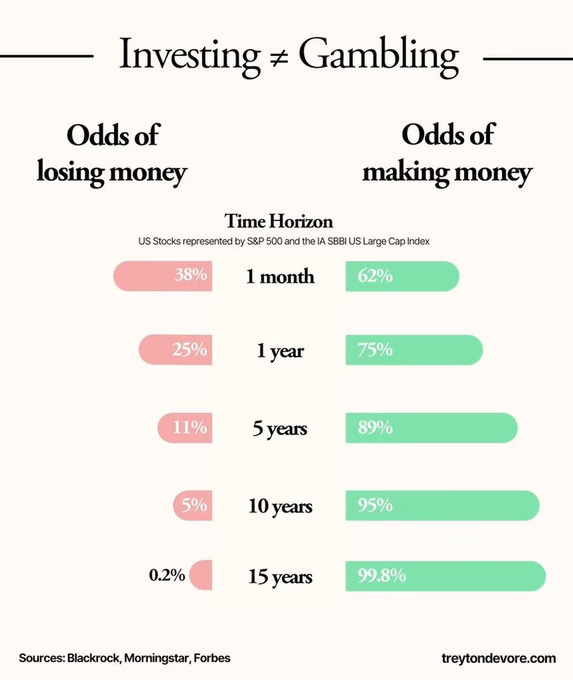

10. Not investing is risky

In the short term, investing is risky.

In the long term, not investing is risky.

Inflation eats away at your purchasing power when your cash isn’t earning a return.

But the longer you invest, the better your odds of making money.

One Dividend At A Time,

-TJ

P.S…

We will have a limited number of discounted memberships that will reopen later in 2026.

If you want your name on the list, so you get notified before anyone else,

you can do that here:

You’ll also get a copy of my 10 favorite cannibal stocks when you do.

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data