10 Simple Rules to Think Smarter (That Work Every Time)

Cut through the noise. These mental shortcuts will make your decisions faster and more effective.

👋 Howdy Partner,

Want to know a secret? Thinking clearly isn’t about being the smartest person in the room. It’s about knowing which ideas to ignore.

Most investors get lost in endless data, news cycles, and expert opinions. They’re looking for the next big insight. But the truth is, the best decisions don’t come from complexity. They come from simplicity.

Philosophical "razors" cut away the nonsense so you can focus on what really matters.

Today, we’re going to talk about 10 of the best mental shortcuts to make better decisions - whether you’re investing, running a business, or just navigating life.

1. Occam’s Razor: Simplicity Wins

When faced with multiple explanations, choose the simplest one.

Markets are unpredictable. But one thing is certain: the simplest businesses tend to perform best over time. A company with a straightforward business model (think Coca-Cola or insurance firms) will outlast the ones chasing hype.

Apply it: Avoid investments that require complex explanations or too many assumptions.

2. Hanlon’s Razor: Don’t Assume Malice

Most mistakes happen because of incompetence, not conspiracy.

Think about the Federal Reserve. People love to believe it’s controlling markets with a master plan. But history suggests it’s just making educated guesses - often wrong ones.

Apply it: Before assuming corruption, consider that bad decisions are usually just... bad decisions.

3. Hitchens’ Razor: Prove It or Ignore It

If someone makes a claim without evidence, you can dismiss it without evidence.

The media constantly pushes narratives about market crashes, booms, or trends. But where’s the proof? If a claim isn’t backed by data, it’s just noise.

Apply it: When evaluating an investment, look for hard facts, not opinions.

4. Popper’s Principle: If It Can’t Be Proven Wrong, It’s Not Science

A real theory must be testable - and disprovable.

Gold is often called the ultimate safe haven. But does it actually perform better than stocks over time? (Spoiler: It doesn’t.) That’s why good investors test their beliefs, rather than just accept them.

Apply it: Question everything - even your favorite investment strategies, and try to prove them wrong.

5. Sagan’s Standard: Big Claims Need Big Proof

Extraordinary claims require extraordinary evidence.

Crypto is the future? Maybe. But without clear adoption trends, it’s just speculation. The best investments aren’t based on what could happen. They’re based on what is happening.

Apply it: Avoid speculative plays unless the data overwhelmingly supports them.

6. Brandolini’s Law: BS Is Harder to Fix Than to Create

Bad information is easier to create than to correct.

This is why you see the same bad investing advice pop up over and over. (“Buy IPOs! Bitcoin is dead! Gold will hit $10,000!”) Debunking bad ideas takes effort, but avoiding them in the first place is easy.

Apply it: Be skeptical of anything that sounds too good - or too scary - to be true.

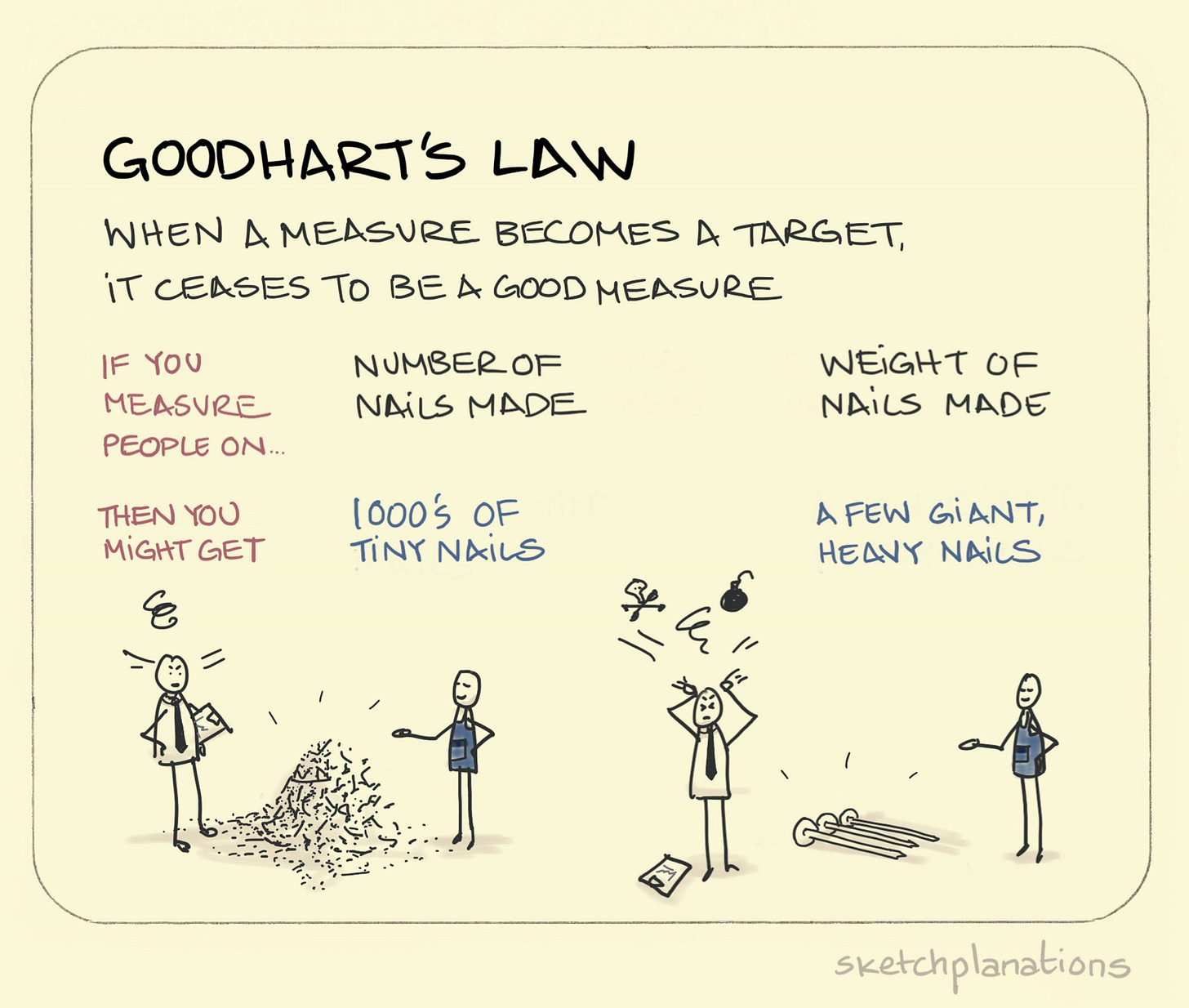

7. Goodhart’s Law: Metrics Get Manipulated

When a metric becomes a target, it stops being useful.

Companies manipulate earnings to look good. Governments tweak inflation data. Every number you see has a story behind it.

Apply it: Look beyond the numbers. Read financial statements, and understand the underlying business, not just the headlines.

8. Sturgeon’s Law: Most Things Are Garbage

90% of everything - books, news, investment ideas - is junk.

Most stocks won’t outperform the market. Most financial “experts” don’t beat a simple index fund.

Apply it: Be selective. Only follow advice from proven, successful investors.

9. Tesler’s Law: Complexity Moves, It Doesn’t Disappear

Every time you simplify something, complexity shows up elsewhere.

Take index funds. They simplify investing, but they also create distortions in pricing and risk. There’s no free lunch.

Apply it: When something seems too easy, look for the hidden risks.

10. Cunningham’s Law: Want the Right Answer? Post the Wrong One Online

People love correcting mistakes.

This is why debating investing ideas publicly can be so useful. The fastest way to refine your thinking is to put your ideas out there and let others challenge them.

Apply it: Ask questions. Share your investing thesis. Let the smartest people poke holes in it.

That’s it for today!

Here’s What You Learned:

Simplicity beats complexity.

Skepticism saves you from bad ideas.

Metrics and narratives can be misleading.

The best investors aren’t the ones with the most information. They’re the ones who know which information to ignore.

Start applying these mental shortcuts today - and watch how much clearer your thinking becomes.

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data