26 Stocks to Watch in 2026: Part 2

Last week, we covered 13 businesses that help keep the economy moving.

Today, we’re finishing the list.

Let’s dive into the final 13.

13. Canadian Tire ($CTC.A)

Company Profile

Canadian Tire is a legendary retail staple in Canada, operating a massive network of stores that sell everything from automotive parts to housewares and sporting goods. Beyond retail, it has a significant financial services arm and a majority stake in CT REIT.

Why It’s Interesting

Shareholder-First Culture: The company is family-controlled (by the Billes family), giving management a long-term mindset. They just announced their 16th consecutive year of dividend increases.

Aggressive Buybacks: Management is a serious buyer of their own stock, with an intention to repurchase up to CAD 400 million in shares through 2026.

Triangle Loyalty: Their Triangle Rewards program is one of the strongest in Canada, giving them data on roughly 11 million active members to drive repeat business.

12. General Mills ($GIS)

Company Profile

General Mills is the owner of brands like Cheerios, Nature Valley, Blue Buffalo, and Betty Crocker. They are a global leader in the branded consumer foods space.

Why It’s Interesting

A Leader in Every Aisle: They hold the #1 or #2 market share position in a staggering number of categories. This dominance gives them immense bargaining power with retailers.

Attractive Valuation: General Mills is trading at a low valuation and high dividend yield relative to its history.

Growth Strategy: They are heavily investing in product quality and “newness” (targeting 25% of 2026 sales from new products) to prevent consumers from switching to generic store brands.

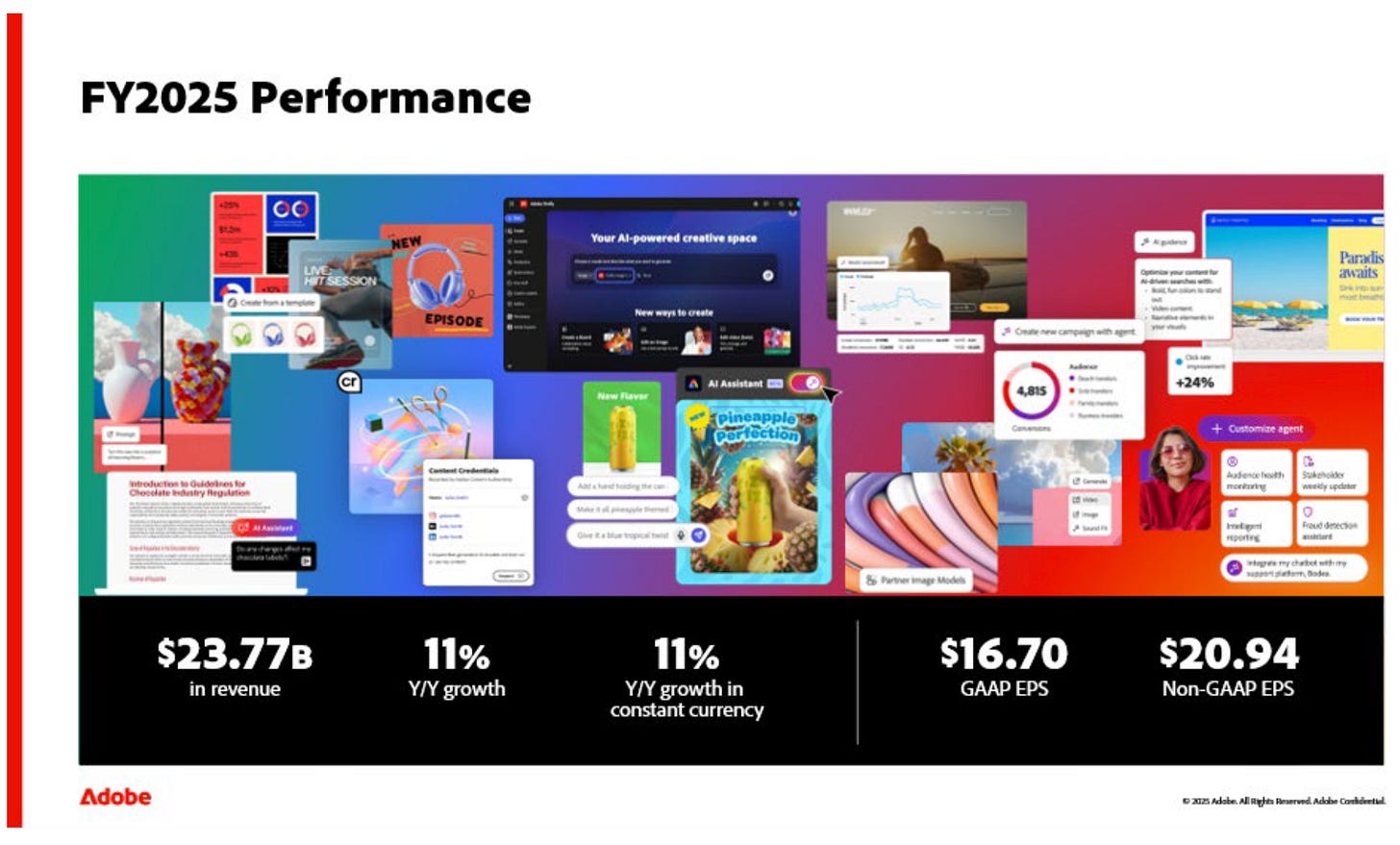

11. Adobe ($ADBE)

Company Profile

Adobe is the undisputed king of creative software. From Photoshop to Acrobat, their products are essential tools for the digital economy, delivered through a high-margin subscription model.

Why It’s Interesting

A Serious Share Cannibal: Adobe is using its massive free cash flow to buy back shares at a historic rate, reducing their share count by over 6% in 2025 alone.

Low Valuation: After being caught up in the AI hype cycle, the stock has recently traded at a much more reasonable valuation.

AI Monetization: Their Firefly generative AI is being rapidly adopted by enterprise clients, creating a new upsell lever that is just starting to impact the bottom line.

10. Air Products & Chemicals ($APD)

Company Profile

Air Products provides essential industrial gases (like oxygen, nitrogen, and hydrogen) to customers in the electronics, energy, and healthcare sectors.

Why It’s Interesting

Necessary Products: Industrial gases are a tiny fraction of a customer’s total cost but are vital for production. This makes for long customer relationships and high switching costs.

The Long-Term Contracts: Most of their revenue is secured via 15-to-20-year “take-or-pay” contracts, creating predictable cash flows.

Hydrogen Leadership: They are currently a front-runner in the global transition to blue and green hydrogen, providing a long-term growth tailwind.

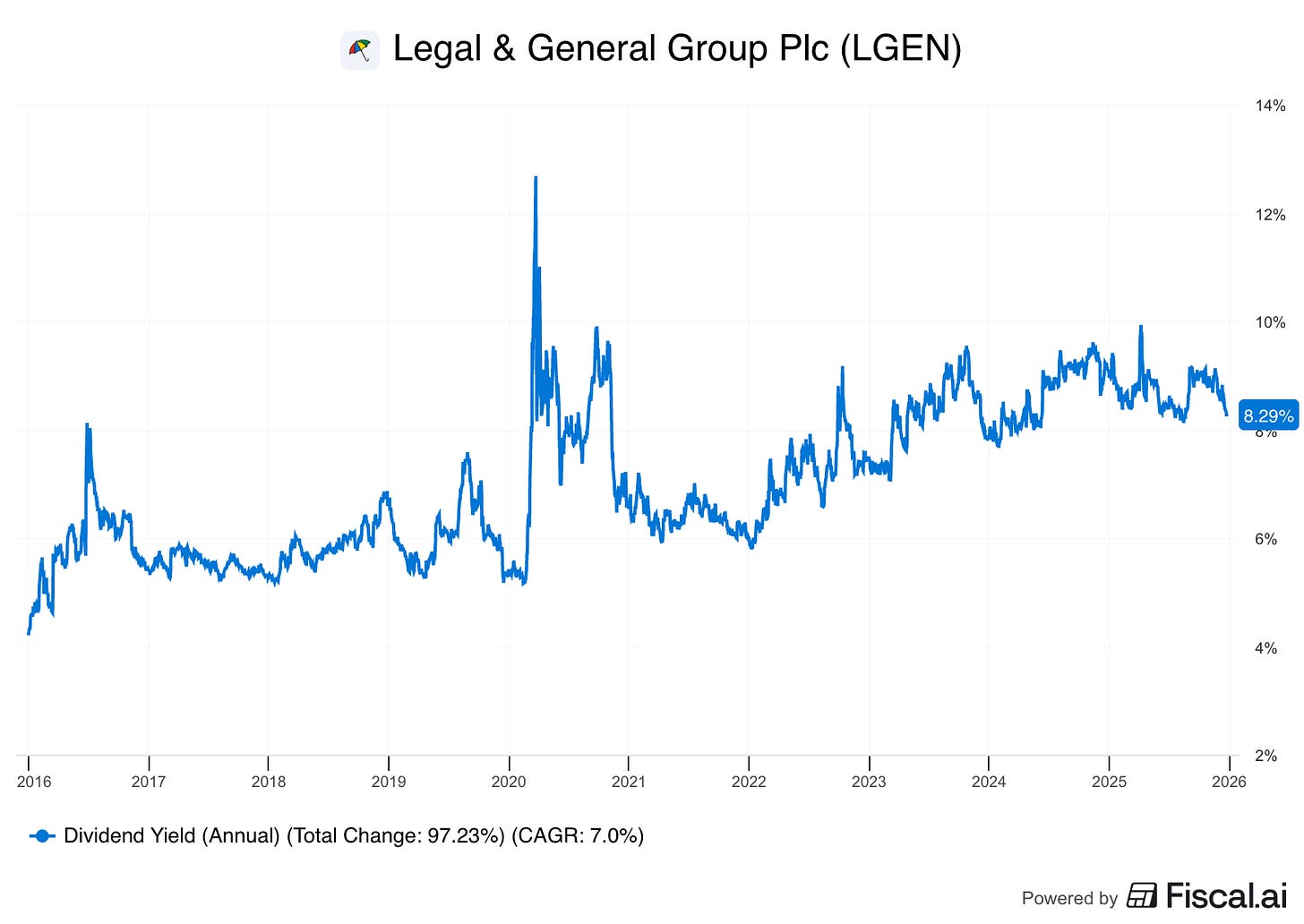

9. Legal & General ($LGEN.L)

Company Profile

Based in the UK, Legal & General is a financial services giant specializing in pension risk transfer, asset management, and insurance.

Why It’s Interesting

Sustainable High Yield: The stock has a dividend yield north of 8%, supported by a massive free cash flow of £4+ billion.

Aging Demographics: As baby boomers retire, the demand for pension de-risking services is exploding, which is a market where Legal & General is a global leader.

Simplified Strategy: Management has recently pivoted to focus on their core, high-return businesses, which should lead to more consistent capital returns.

8. Extra Space Storage ($EXR)

Company Profile

Extra Space Storage is the largest self-storage operator in the U.S. (by store count), managing over 4,000 properties across the country.

Why It’s Interesting

Capital-Light Growth: A significant portion of their business is managing stores for other owners. This generates high-margin fee income without the need to own the real estate.

Consolidation Opportunity: The self-storage industry is still highly fragmented. Extra Space uses its tech platform to identify and acquire smaller operators.

Inflation Hedge: Because storage leases are usually month-to-month, they can adjust pricing much faster than office or retail landlords when inflation rises.

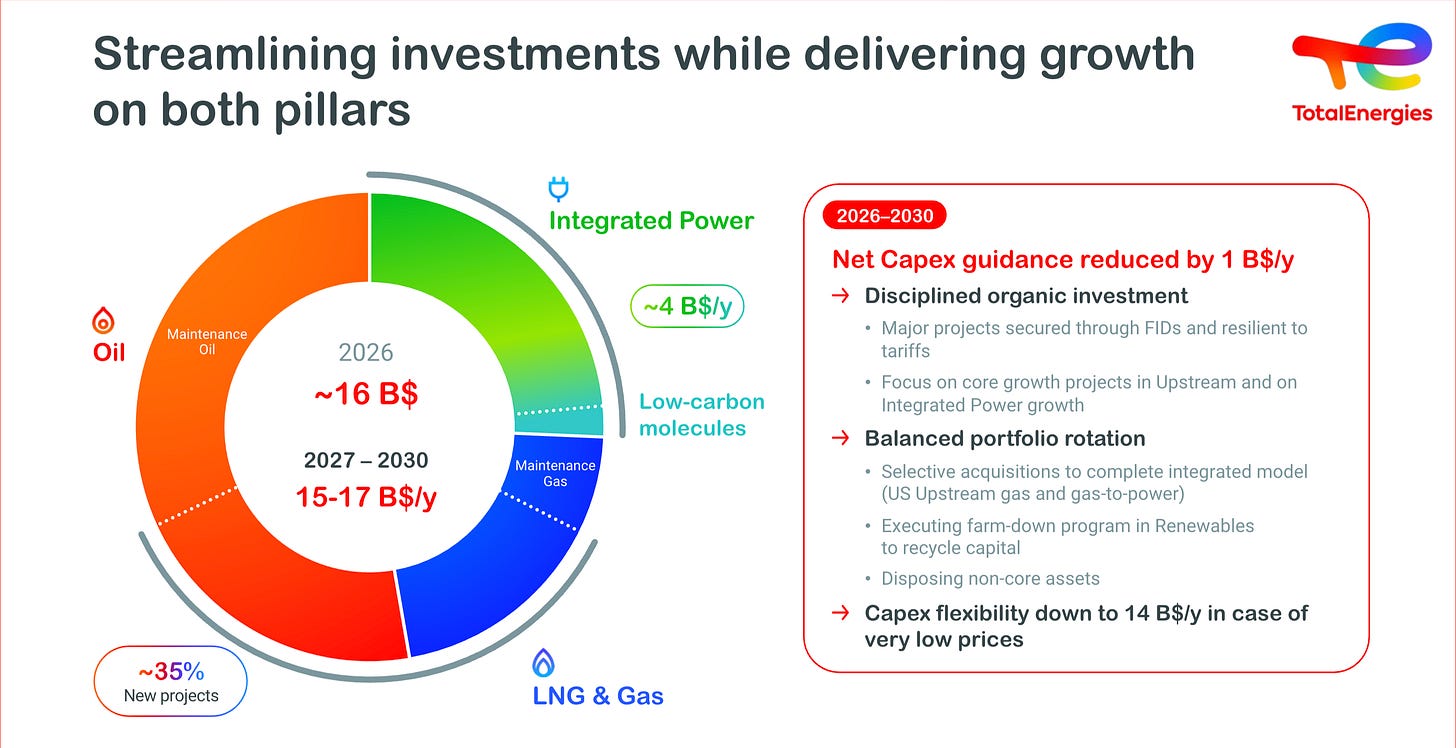

7. TotalEnergies ($TTE)

Company Profile

TotalEnergies is a French multi-energy giant. While they are a major oil and gas producer, they are transitioning faster than almost any other peer into renewables.

Why It’s Interesting

Diversified Energy Strategy: TotalEnergies is reinvesting oil profits into a massive portfolio of wind and solar assets, aiming to be a top-5 global renewable power producer by 2030.

Low Cost Producer: Their traditional oil projects have some of the lowest production costs in the industry, allowing them to remain profitable even at low oil prices.

Valuation: Like many European energy firms, it trades at a significant discount to its U.S. peers (like Exxon or Chevron) despite having a more progressive transition plan.

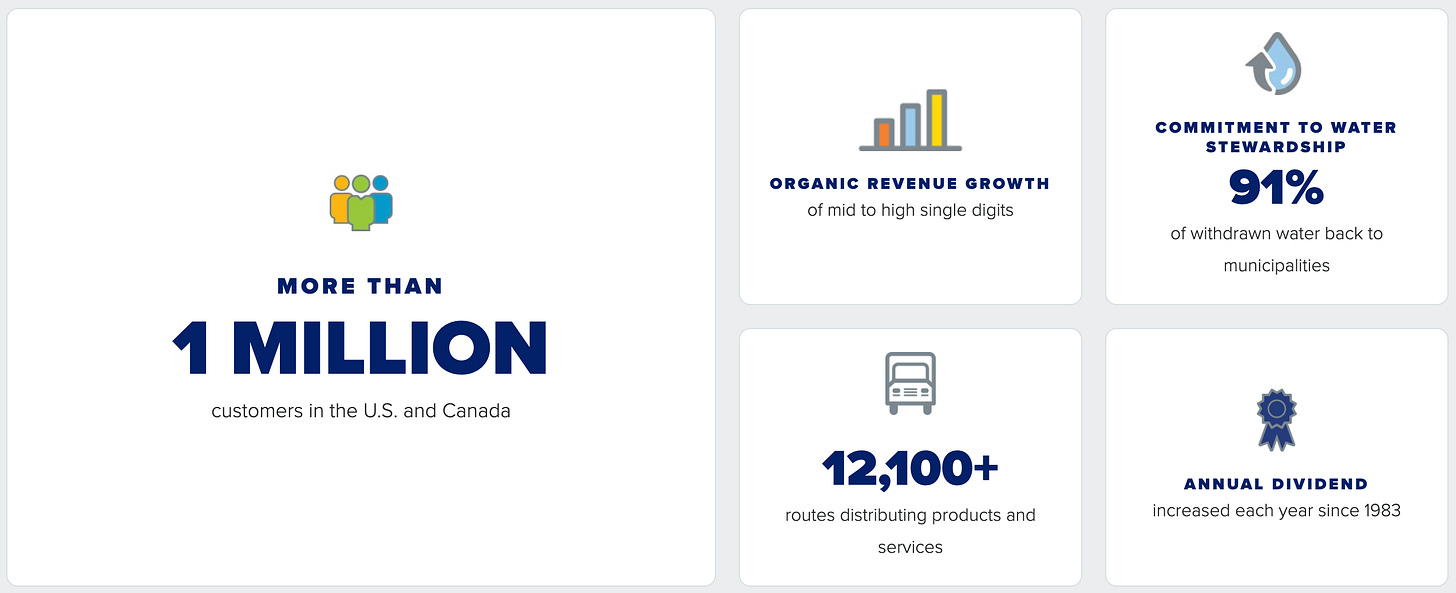

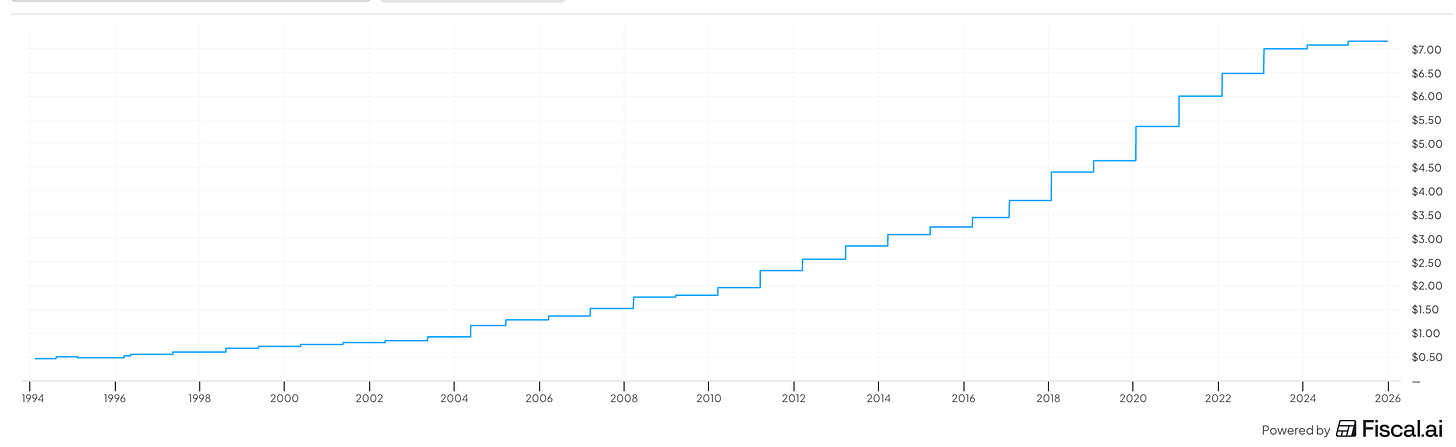

6. Cintas ($CTAS)

Company Profile

Cintas provides branded workwear, facility services (mats, mops), and first aid kits to over one million businesses.

Why It’s Interesting

Route Density: Once a Cintas truck is already stopping at a customer’s location to drop off uniforms, it costs almost nothing to also sell them soap, mats, and fire protection.

Consistent Growth: Historically, Cintas has grown its earnings at a multiple of US GDP growth, showing incredible resilience across different economic cycles. They’ve also proposed a merger with UniFirst, which would result in a big jump in customer numbers.

Operational Excellence: They consistently operate at high margins, reflecting a culture obsessed with efficiency and customer retention.

Here’s where we stop.

Because the best ideas are still ahead.

The final five compound year after year.

They raise dividends.

And they make patient investors rich.

We’re not sharing those publicly.

When a limited number of discounted memberships to Compounding Dividends opens up, people on the waiting list will be notified before everyone else.

And if the waiting list takes all the spots, then they’re gone.

If you want your name on that list, go here:

You’ll also get a copy of my 10 favorite cannibal stocks when you do.

Conclusion

There you have it - 26 names on my radar for 2026.

From the toll-booth moat Canadian National Railway to the share-cannibal cash flows of Adobe and H&R Block, the theme remains the same: quality companies necessary to the economy.

As I said at the beginning of this series, I don’t have a crystal ball.

I don’t know where the S&P 500 will close on December 31st, 2026, and frankly, I don’t the experts don’t either.

What I do know is that businesses with high switching costs, dominant market shares, and a commitment to sharing profits with owners tend to win over the long haul.

In the coming months, I’ll be performing deep dives into several of these names to see which ones deserve a spot in Our Portfolio.

While the rest of the market is busy making guesses, we’ll be busy watching the cash flow.

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data