27 Companies That Have Paid Dividends for 100+ Years

👋 Howdy Partner,

Dividend investors love one thing above all else: reliability.

Finding a company that can keep paying a dividend through wars, recessions, and market crashes is rare. Finding one that’s done it for more than 100 years straight? That’s nearly impossible.

In fact, out of more than 6,000 U.S. stocks, only 27 companies have paid a dividend every year for over a century.

That’s just 0.4% of the market.

This small group of companies has proven it can survive - and keep paying shareholders - through the Great Depression, two World Wars, the 1970s inflation crisis, the dot-com bust, and the 2008 financial crisis.

Let’s take a look at this exclusive club.

1. York Water (YORW)

The oldest of them all. York Water has paid a dividend every year since 1816 more than 200 years without missing a payment.

Forward Dividend: $0.88 per share

Yield: 2.8%

Payout Ratio: 63.4%

Fun Fact: York has raised its dividend for 28 straight years, making it a Dividend Champion.

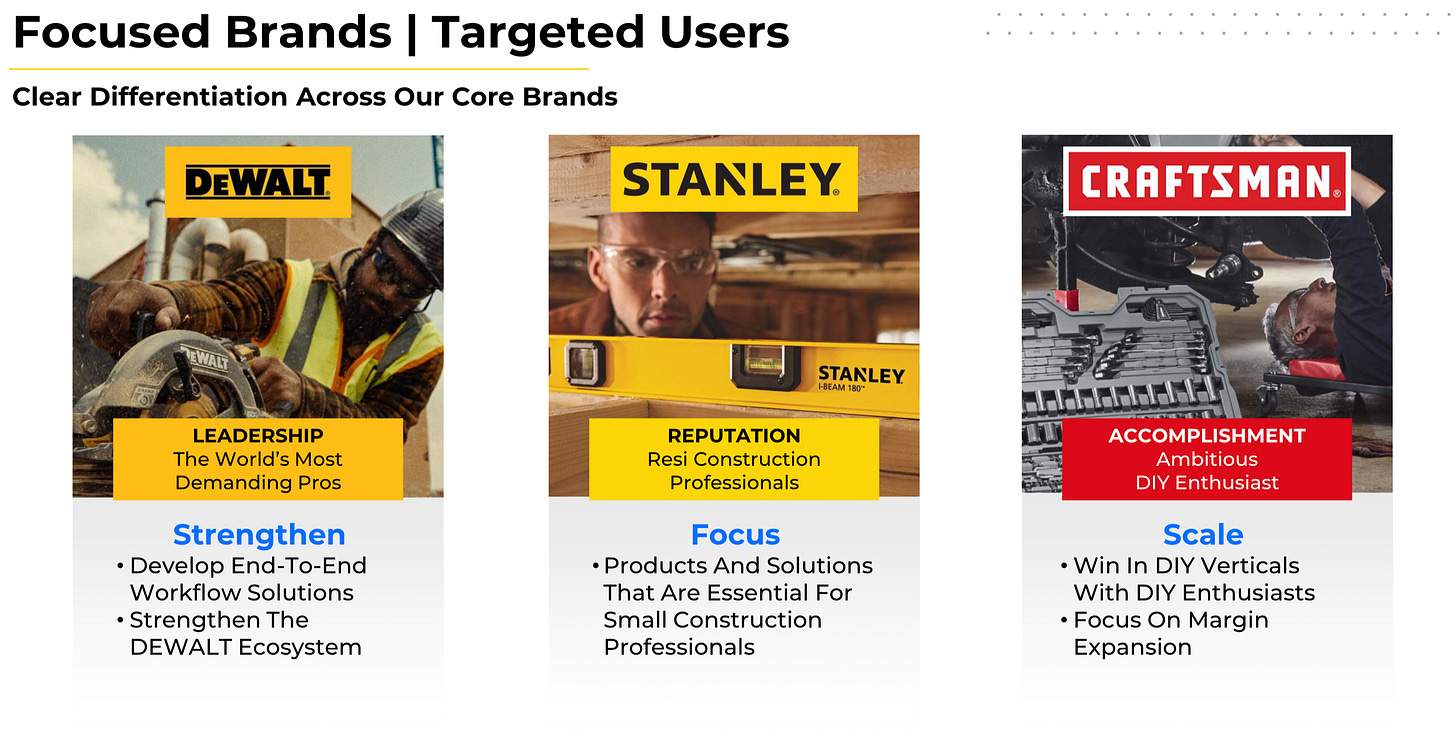

2. Stanley Black & Decker (SWK)

Founded in 1843 (before the Civil War!), this company is best known for its tools and storage products.

Dividend History: Since 1877

Forward Dividend: $3.32 per share

Yield: 4.2%

Payout Ratio: 103.5%

Streak: 59 years of growth (Dividend King)

3. Exxon Mobil (XOM)

Exxon’s history goes back to John D. Rockefeller’s Standard Oil, founded in 1870.

Dividend History: Since 1882

Forward Dividend: $3.96 per share

Yield: 3.7%

Streak: 42 years of growth (Dividend Aristocrat)

4. Eli Lilly (LLY)

The pharma giant has paid a dividend since 1885, though it doesn’t raise it every year.

Forward Dividend: $6.00 per share

Yield: 0.8%

Payout Ratio: 36.5%

5. Consolidated Edison (ED)

The first electric utility on this list, Con Ed has been paying dividends since 1885.

Forward Dividend: $3.40 per share

Yield: 3.5%

Streak: 52 years of growth (Dividend King)

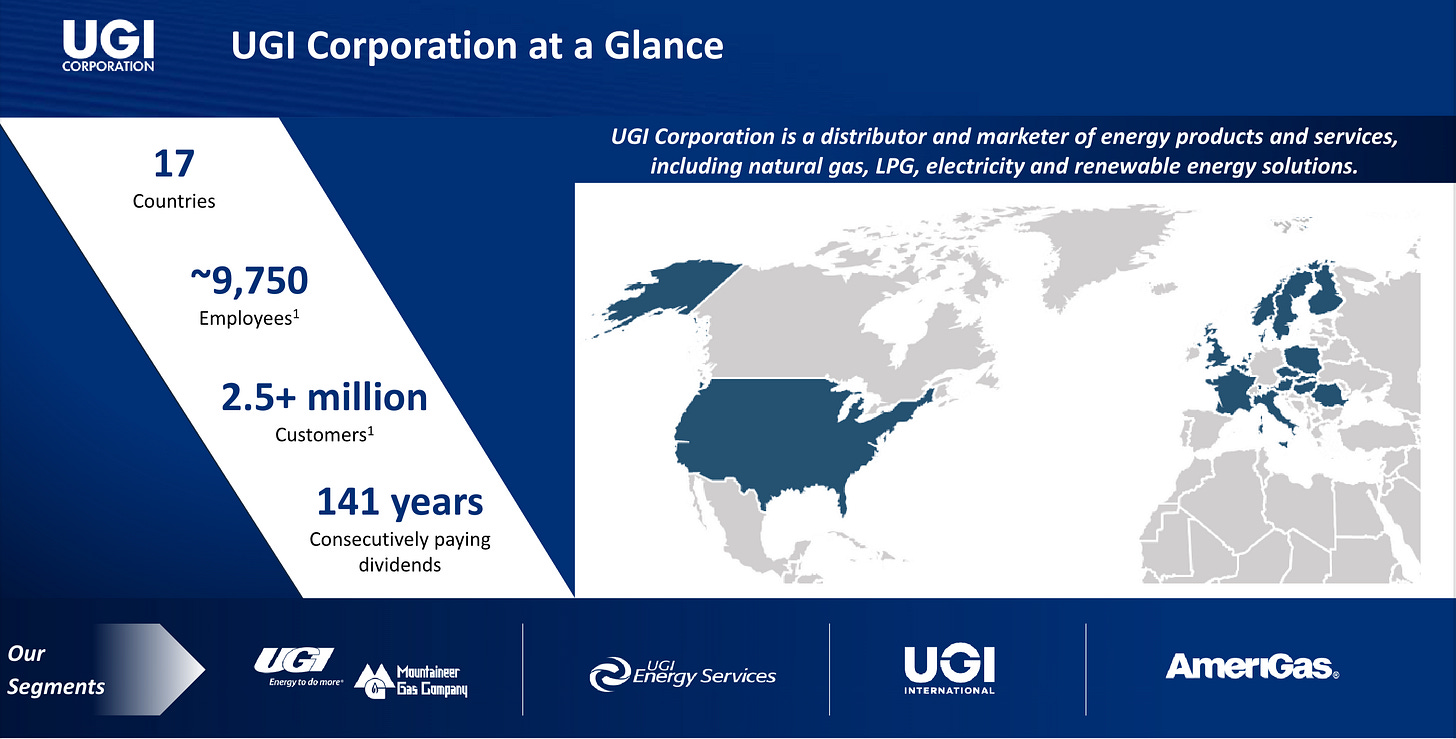

6. UGI Corporation (UGI)

A lesser-known energy company with propane, natural gas, and utility businesses.

Founded: 1882

Dividend History: Since 1885

Yield: 4.3%

Fun Fact: Has raised its dividend for 37 straight years, making it a Dividend Champion.

7. Johnson Controls (JCI)

Started in 1885, this company now focuses on HVAC, fire, and security systems.

Forward Dividend: $1.48 per share

Yield: 1.4%

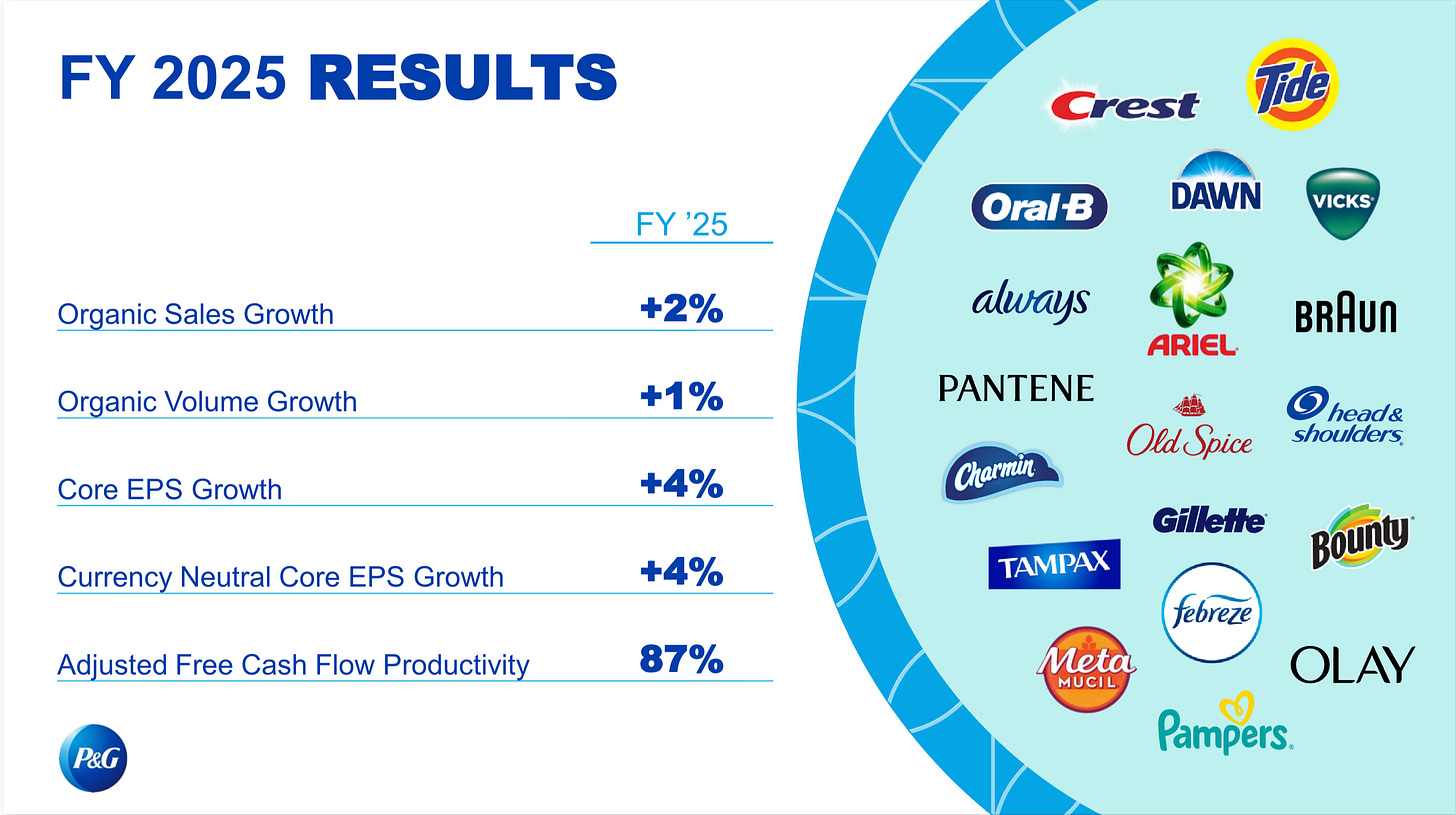

8. Procter & Gamble (PG)

One of the most reliable consumer staples companies in the world, with brands like Tide, Gillette, Pampers, and Crest.

Dividend History: Since 1891

Yield: 2.7%

Streak: 70 years of increases (Dividend King)

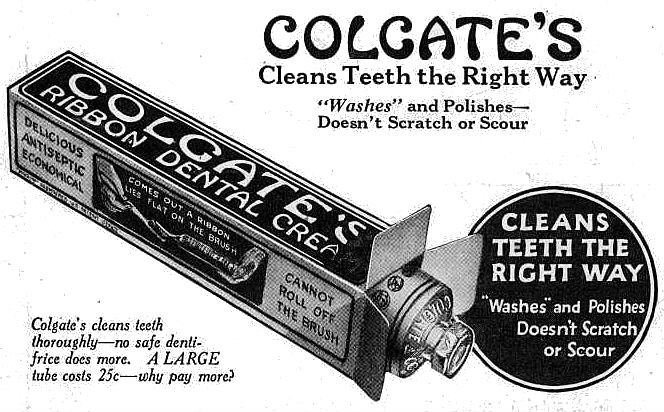

9. Colgate-Palmolive (CL)

Known for Colgate toothpaste, Palmolive soap, Irish Spring, and more.

Dividend History: Since 1895

Yield: 2.5%

Streak: 63 years of growth (Dividend King)

10. General Mills (GIS)

The famous maker of Cheerios, Pillsbury, and Haagen-Dazs.

Dividend History: Since 1898

Yield: 4.6%

11. Union Pacific (UNP)

America’s largest railroad, founded in 1862 as part of the transcontinental railroad project.

Dividend History: Since 1898

Yield: 2.5%

Fun Fact: Owns parts of a Mexican railroad and operates 32,000+ miles of track.

12. PPG Industries (PPG)

Started as Pittsburgh Plate Glass in 1883, now a global paint and coatings leader.

Dividend History: Since 1899

Yield: 2.4%

Streak: 55 years of growth (Dividend King)

13. Church & Dwight (CHD)

The company behind Arm & Hammer, OxiClean, and Trojan.

Dividend History: Since 1901

Yield: 1.2%

14. Chubb Limited (CB)

An insurance company with roots going back to 1882.

Dividend History: Since 1902

Yield: 1.4%

That wraps up the first half of the list of stocks that have paid dividends for over 100 years. The full list of all 26 companies can be downloaded as a spreadsheet using the link below.

Why This List Matters

These companies are special because they’ve proven they can survive almost anything - wars, crashes, and recessions - while still rewarding shareholders.

For dividend growth investors, that kind of reliability and staying power is exactly what makes them worth a closer look.

Many of these companies are also Dividend Kings or Aristocrats, meaning they haven’t just paid dividends but grown them for decades.

If you’re a dividend growth investor looking for rock-solid businesses, this list is a great place to start your research.

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

What a cool review! 😎

It's interesting to see the long term total returns here. Some of these companies beat holding SPY!

I'm looking at the total return for York Water since May 3, 1999. That's as far back as SeekingAlpha goes. The total return is 952.74% and SPY's total return is 678.11%. Dividends matter in this case!

I'll post the chart in Circle!