3 Dividend Growth Stocks To Buy

This research report is by Bob Ciura, President of Content at Sure Dividend.

The average dividend yield in the S&P 500 Index remains low at around 1.3%. As a result, many stocks have lower dividend yields than they did several years ago, due to rising share prices.

However, there are still quality dividend stocks with high dividend yields.

Note: Click here to instantly download your free spreadsheet of 200+ stocks with high 4%+ dividend yields.

The 3 stocks mentioned in this article possess over the following:

A dividend yield of more than 4%

10 Consecutive years of dividend growth

Secure dividend payouts

T. Rowe Price Group (TROW)

T. Rowe Price Group is one of the largest publicly traded asset managers. The company provides a broad array of mutual funds, sub-advisory services, and separate account management for individual and institutional investors, retirement plans and financial intermediaries. T. Rowe Price had assets under management of $1.54 trillion as of December 31st, 2023.

TROW has a long history of consistent dividend growth. On January 30th, 2024, T. Rowe Price declared a $1.24 quarterly dividend, representing a ~2% increase and marking the company’s 38th year of increasing its payout. The company is on the exclusive list of Dividend Aristocrats.

In the 2024 first quarter, revenue increased 13.6% to $1.75 billion, which was $50 million above estimates. Adjusted earnings-per-share of $2.38 compared to $1.69 in the prior year, which was $0.36 better than expected. During the quarter, assets under management (AUM) improved $97.7 billion, or 6.8%, to $1.54 trillion. Market appreciation of $105.7 billion was partially offset by $8 billion of net client outflows.

Asset managers like T. Rowe have low variable costs. As a result, higher revenues, driven primarily by increasing assets under management, allow for margin expansion and attractive earnings growth rates. Assets under management grow in two basic ways: increased contributions and higher underlying asset values.

Despite operating in the financials sector which is highly cyclical, TROW is a highly recession-resistant business due to its industry leadership. For example, during the Great Recession, T. Rowe posted earnings-per-share of $2.40, $1.82, $1.65, and $2.53 in the 2007-2010 period. This shows the company’s ability to bounce back. The company’s balance sheet is in excellent shape with zero long-term debt.

TROW stock has a current dividend yield of 4.2%. With a projected 2024 dividend payout ratio of 59%, the dividend payout is highly secure.

Verizon Communications (VZ)

Verizon is a giant communications services provider in the United States, with a market capitalization of $170 billion. Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~300 million people and 98% of the U.S.

The company has continued to generate steady growth and strong free cash flow to begin 2024. In the first quarter, revenue increased 0.3% to $33 billion. Adjusted earnings-per-share of $1.15 compared unfavorably to $1.20 in the prior year, but this was $0.03 more than expected. For the quarter, Verizon had postpaid phone net losses of 68K, which were fewer than the net losses of 127K that the company had in the same quarter a year ago.

Wireless revenue increased 3.3% to $19.5 billion while the Consumer segment increased 0.8% to $25.1 billion. Broadband totaled 389K net new customers during the period, the seventh consecutive quarter of at least 300K net adds. This included 151K fixed wireless net additions, which was a 10.2% increase from the prior year and the best quarterly result to date.

Verizon has grown its earnings-per-share by 4% per year for the past 10 years. We have reaffirmed our forward growth rate to 2%-3% to better reflect the long-term trend combined with guidance for the year.

Verizon’s key competitive advantage is that it is widely considered to be the best wireless carrier in the U.S. This is evidenced by the company’s wireless net additions and very low churn rate. Reliable service allows Verizon to maintain its customer base as well as give the company an opportunity to move customers to higher-priced plans. Verizon’s 5G service coverage area gives it an advantage over other carriers.

Free cash flow grew 17.4% year-over-year to $2.7 billion. Verizon reaffirmed guidance for 2024 as well. The company still expects wireless service revenue to grow 2% to 3.5% and adjusted earnings-per-share in a range of $4.50 to $4.70. At the midpoint of full-year EPS guidance, Verizon has a projected dividend payout ratio of 58% for 2024. This indicates a secure dividend.

The combination of steady revenue and EPS growth along with strong free cash flow generation allows VZ to maintain a high dividend payout, plus modest annual increases to the dividend. Verizon has increased its dividend for 19 consecutive years, and the shares currently yield 6.6%.

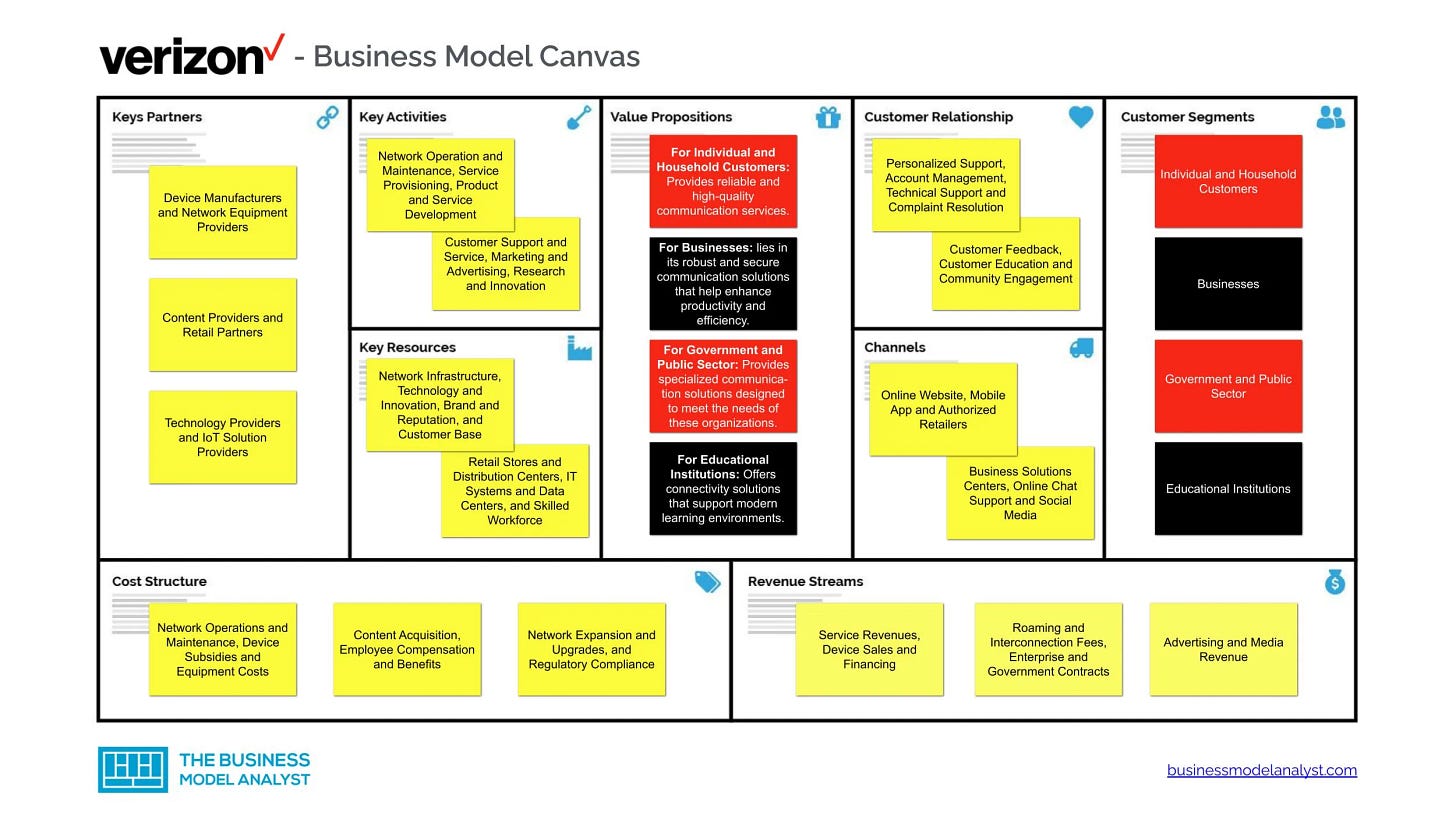

Source: businessmodelanalyst.com

UGI Corp. (UGI)

UGI Corporation is a gas and electric utility that operates in Pennsylvania, in addition to a large energy distribution business that serves the U.S. and other parts of the world. The company operates in four reporting segments: AmeriGas, UGI International, Midstream & Marketing, and UGI Utilities.

UGI Corporation reported strong financial results for the fiscal quarter ending March 31, 2024, with GAAP diluted EPS reaching $2.30 and adjusted diluted EPS at $1.97, compared to $0.51 and $1.68 respectively in the prior-year period.

Despite warmer weather across its service territories, the company achieved higher margins from natural gas marketing activities and reduced operating expenses, leading to robust second-quarter performance.

Additionally, UGI affirmed its commitment to returning value to shareholders through dividend payments, marking the 140th consecutive year of paying dividends. UGI has paid consecutive dividends since 1885.

As a utility stock, UGI can be counted on for steady (albeit low) earnings-per-share growth over time, even during recessions. We expect approximately 1.2% annualized growth over the next five years. UGI completes acquisitions periodically, further bolstering future growth.

UGI’s main competitive advantage is in its highly diversified business model. It has electric and gas utilities, propane distribution that covers a wide geographic area and diverse customer base, as well as a variety of other energy generation and distribution activities.

The company remained profitable during the Great Recession and the coronavirus pandemic, which allowed it to continue raising its dividend. UGI has increased its dividend for 36 years, placing it on the list of Dividend Champions. UGI stock currently is certainly a high dividend stock based on its 6.6% yield.

Disclosure: No positions in any stocks mentioned

That’s it for today

That’s it for today.

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

I totally agree with you on TROW. That company, and its dividend, is not going anywhere. Total cash is something like ~$2.5 B and total debt is $380 M. TROW has multiple income streams and is well managed.

VZ ... oooo! I beg to differ. It's debt and cash levels are upside down compare to TROW. $180 B in total debt and $2.4 B in cash. Their debt level is higher than their market cap. When buying into VZ I feel like you are buying into their debt like a bond but without the benefits of a bondholder. I understand their revenue is contractual and probably pretty steady. They can count on the monthly bills of the subscribers being paid like clockwork. Still ... that kind of debt doesn't inspire confidence in me.