3 Railroad Stocks You Shouldn’t Ignore

Massive cash flow, growing dividends - see which one wins.

👋 Howdy Partner,

Today, we’re comparing 3 railroads.

Why?

Because they are some of the most reliable, cash-generating machines in the market.

Most people don’t realize this, but railroads are still the backbone of commerce in North America. They move all kinds of things - grain, coal, oil, cars, chemicals. If you can ship it, a railroad is probably moving it.

And here’s what makes them special: they make money no matter what.

Let’s break down why:

They Have Pricing Power

Railroads don’t have real competition. They own the tracks. No one is building new ones. That means they can raise prices steadily without losing customers.

They Print Cash

Running a railroad is expensive upfront, but once the infrastructure is in place, it throws off huge cash flows. That’s why they can afford to pay - and grow - dividends.

High Barriers to Entry

No one is going to start a new railroad company. The costs are too high. The regulations are too tight. The existing railroads have a monopoly, and they know it.

They Survive Recessions

Sure, recessions slow things down. But railroads always bounce back. They move essential goods, and the economy can’t function without them.

Railroads pass our 3 step test:

To find the best ideas, you should try to find reasons to say ‘no’ as fast as possible.

For each company, ask yourself:

Do I understand how the company makes money?

Does this company interest me?

Can I make an educated guess about where this company will be in 10 years?

Railroads make money by shipping goods. That’s a service that will always be needed, so we can make some guesses where they’ll be in 10 years.

The Contenders

Three railroad stocks dominate North America:

Canadian Pacific Kansas City the only railroad to span Canada, the US, and Mexico.

Canadian National covers Canada, the U.S., and three coasts, the Pacific, Atlantic, and Gulf of Mexico. Its also has partnerships with the ports of Prince Rupert and Vancouver giving it a role in the Asian import/export market

Union Pacific is the king of the Western U.S., controlling key routes to ports in Los Angeles, Long Beach, and beyond

The Scorecard

We’ll rank them based on capital allocation, dividend growth, balance sheet strength, and growth potential, assigning points in each category.

The best-scoring stock is the most attractive company - simple.

Capital Allocation

We’ll start by looking at how management allocates capital.

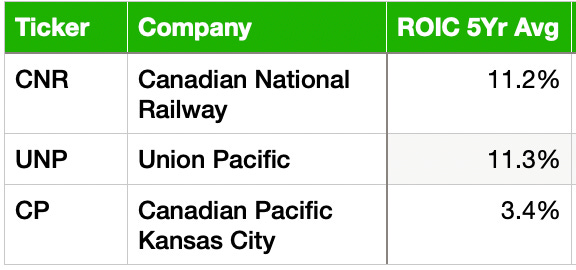

Using the average ROIC for the past 5 years, we’ll give one point to any company with an ROIC > 8% (the average return of the stock market).

Every company but Canadian Pacific gets a point here.

1 Point = Canadian National (+1), Union Pacific (+1)

0 Points = Canadian Pacific

Dividend Growth

We want companies that will grow the dividend over time.

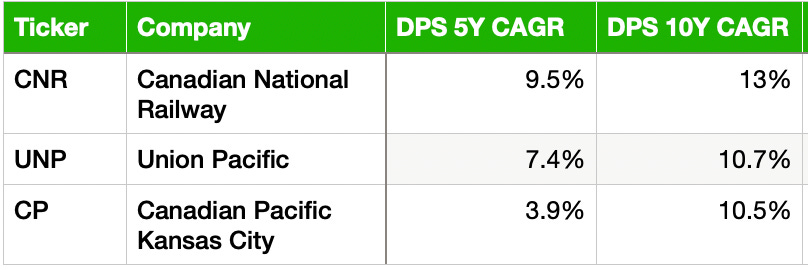

We’ll aware one point for companies with dividend growth rates >5% over both the 5 and 10 year time horizons.

The company with the best dividend growth? Canadian National and Union Pacific both get 2 points.

Canadian Pacific also earns a point for its 10-year dividend growth of 10.5%.

3 Points = Canadian National (+2), Union Pacific (+2)

1 Point = Canadian Pacific (+1)

Balance Sheet

Strong balance sheets are important, but in the railroad industry debt is normal.

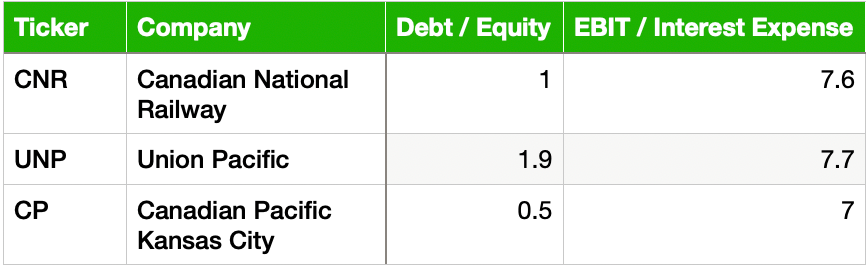

It’s capital intensive and the steady revenues can support a heavier debt load than in less predictable industries. We’ll adjust our targets as follows:

We’ll give one point for a Debt/Equity of 1 or less, and another point for Interest Coverage >5x.

Every company gets a point for Interest Coverage.

Canadian National and Canadian Pacific also earn points for their Debt/Equity ratios.

5 Points = Canadian National (+2)

4 Points = Union Pacific (+1)

3 Points = Canadian Pacific (+2)

Next we’ll dive into how these companies return capital to shareholders, how they’ve grown in the past, and how they’re expected to grow into the future.

Ready to see which company comes out on top?