💸 3 Ways To Build Your Dividend Snowball

Even if you're starting small

👋 Howdy Partner,

Most investors get dividend investing backwards - they chase high yields today and ignore dividend growth.

The most successful dividend investors think differently.

They treat their portfolio like a snowball rolling downhill.

At first, they focus on adding more snow (their savings).

But as the snowball starts rolling, it gathers more snow on its own.

Dividend growth investing works the same way. Today, I'll show you three ways to build your dividend snowball.

Here's what we'll cover:

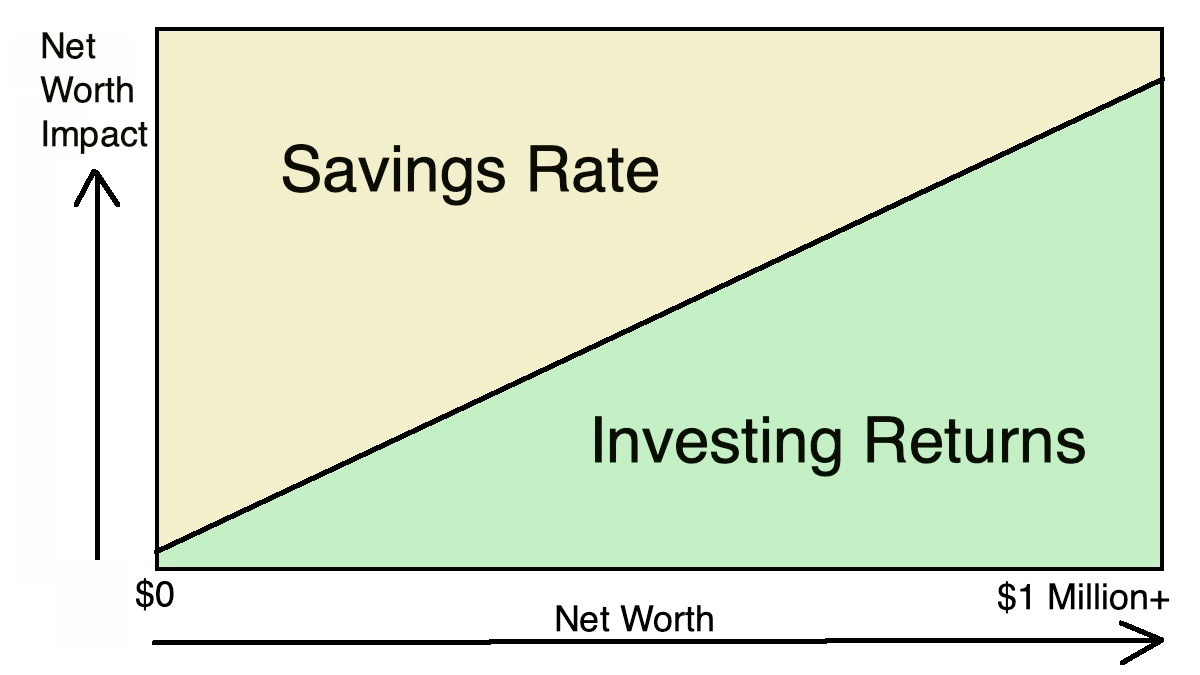

Why your savings rate matters more than your returns (at first)

The magic of dividend reinvestment

Why picking stocks that raise dividends faster than inflation matters

Let's roll into it (pun intended).

3 Ways to Build Your Dividend Snowball (Even if You're Starting Small)

To succeed in dividend investing, you need to understand how these three forces work together.

Let’s break them down.

1. Add New Money (The Core)

Think of this as packing snow onto your initial snowball.

Every dollar you invest now is like adding another handful of snow.

In this phase, your personal savings rate matters more than anything else.

The key to success? Automate your investments.

Vanguard's research shows investors who automate save over 50% more than those who don't.

2. Reinvest Dividends (Rolling Downhill)

This is where your snowball starts picking up speed.

Reinvest every dividend payment to buy more shares. Those new shares will generate more dividends.

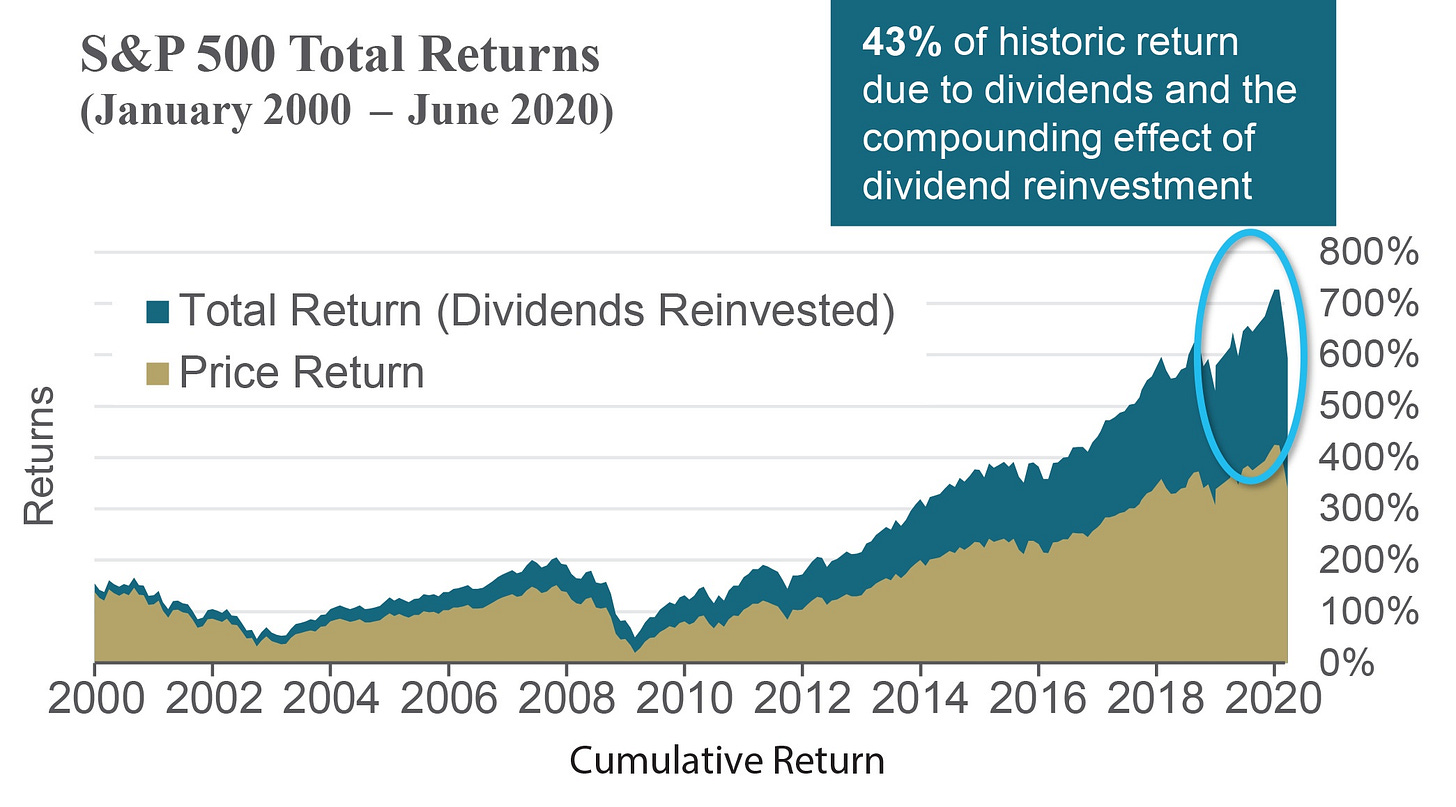

Take the S&P 500.

43% of the total return from 2000 to 2020 was from the compounding of reinvested dividends.

The magic isn’t in a high starting yield. It’s in the compounding from reinvestment.

3. Focus on Dividend Growth (Snowball to Avalanche)

This is when your snowball becomes an avalanche.

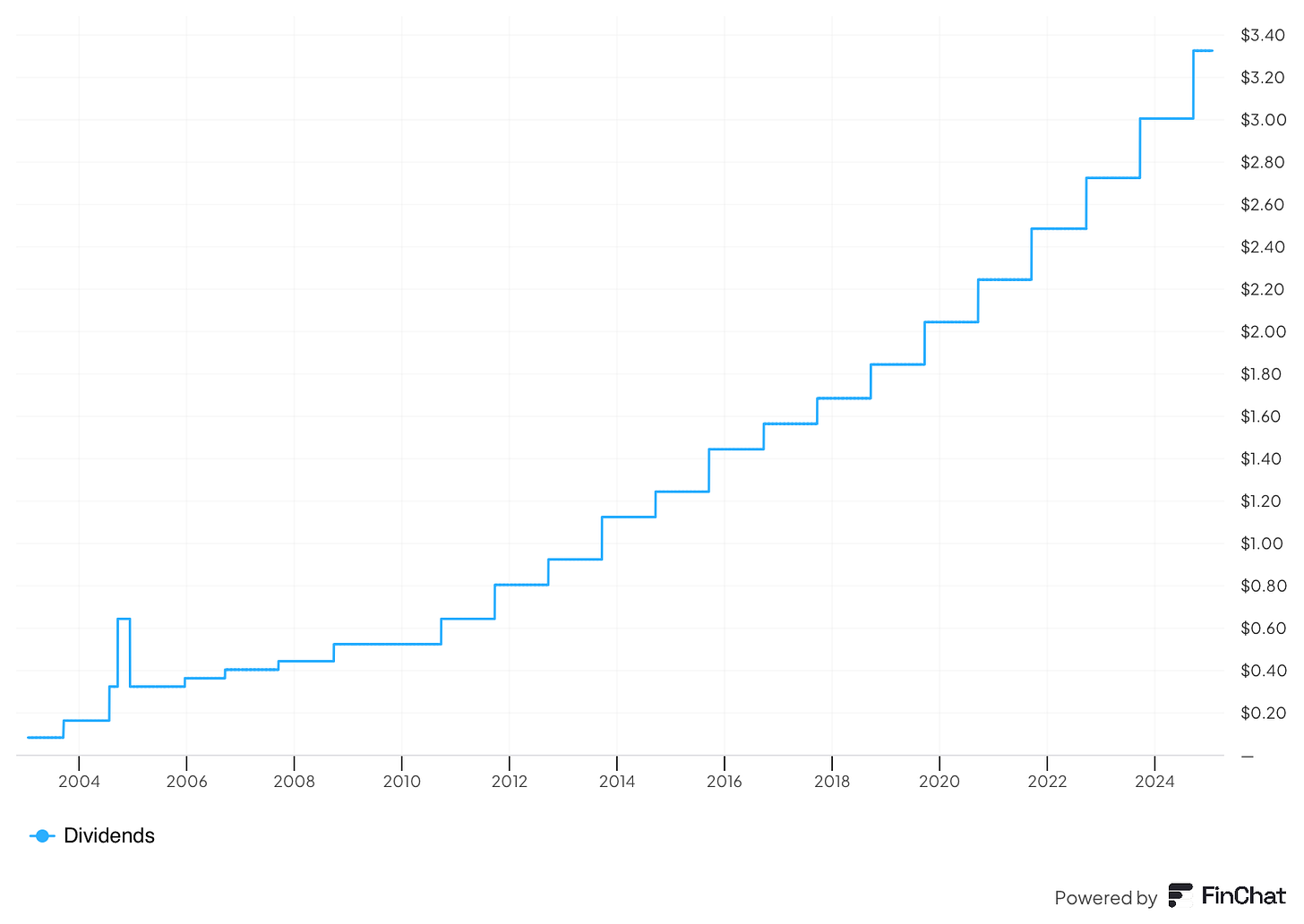

Companies that consistently raise their dividends can multiply your wealth.

Microsoft has increased its dividend by more than 530% since 2010.

Source: Finchat

That means every $100 in dividend income in 2010 became more than $600 annually - without buying a single additional share.

The beauty of this strategy is that it works regardless of market conditions.

That’s it for today

Here's what you learned:

Your savings rate matters more than your returns in the early years

Dividend reinvestment creates exponential growth over time

Focus on dividend growth rates, as well as the current yield

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

PS… whenever you’re ready:

“By far the best investment you can make is in yourself.”

- Warren Buffett

Partners of Compounding Dividends get the following:

📈 Access to my Portfolio with 100% transparency

📚 Access to my ETF Portfolio

🔎 Full investment cases about interesting companies

✍️ And much more!

That's me to a tee.

I chased yield in the beginning. My additions to a holding overwhelmed any dividend or any bit of capital appreciation.

I made sure to enable dividend reinvesting while adding regularly to my holdings.

Some of the holdings grew their dividends and I saw the snowball turn into an avalanche. Other holdings did not grow their dividend and the snowball stayed a snowball. Having both to compare in my accounts was a blessing.

Starting in December, I rejiggered my income portfolio to focus on dividend growers. Many holdings were let go ($CHI, $PFLT, $STWD, etc) and some new ones came in ($GIS, $TROW, $VICI, etc). I would love to see consumer staples like Pepsi and Hershey come down in price so they reach my 4% threshold. Coca-Cola, Proctor & Gamble, and Colgate at 4% would be a dream come true!