30 Of The Best European Dividend Stocks

A very special edition of the Best Buys for February 2025

A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into this update and show you some of my favorite stocks.

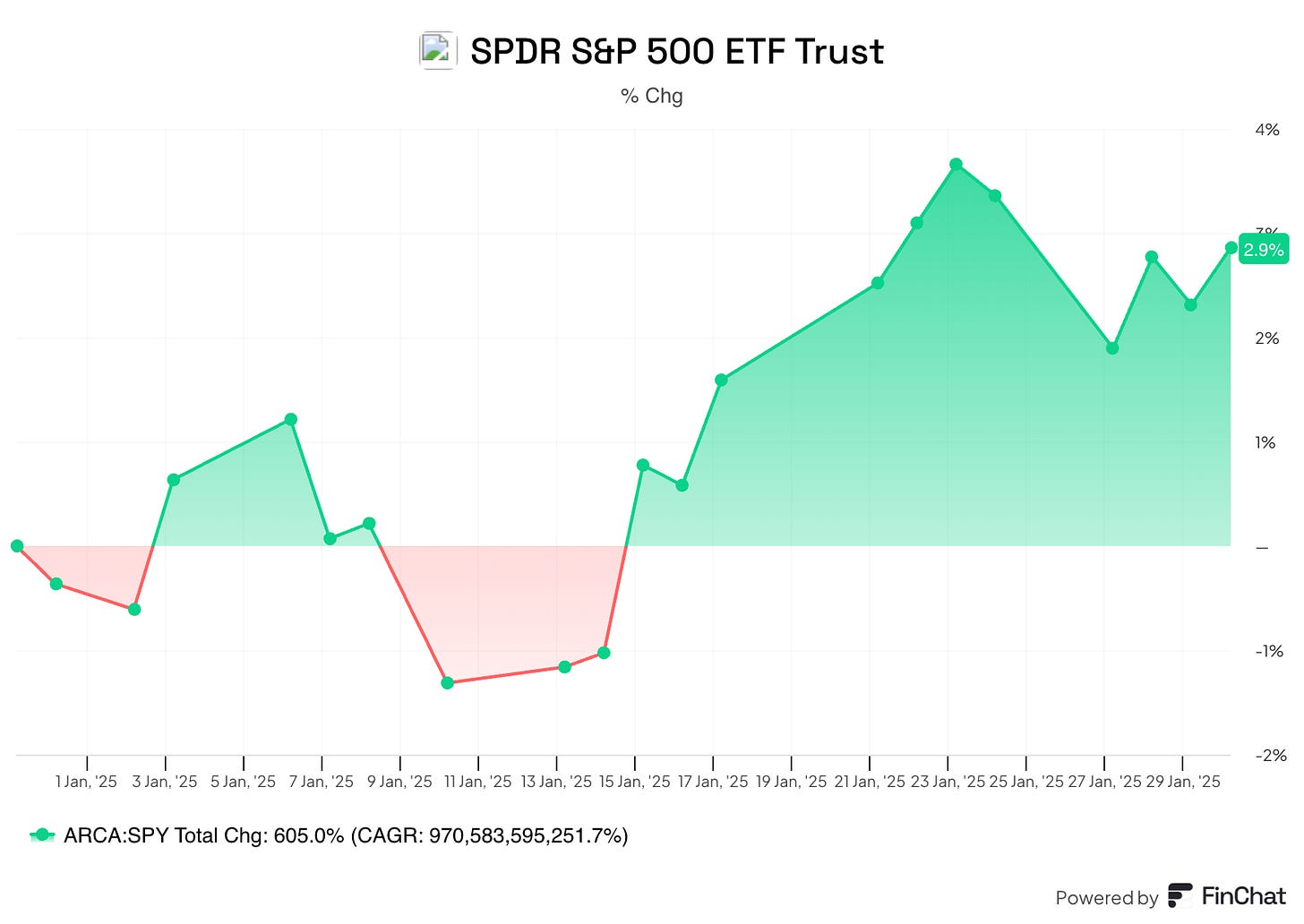

January 2025

In January the S&P 500 increased by 2.9%

Source: Finchat

The Fear & Greed Index indicates that we ended January in ‘Neutral’ Mode.

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

Worst performers

The cheaper we can buy great companies, the better.

The biggest decliner this month? Edison International.

Edison International is an electricity company that operates in Southern California.

The company’s equipment may have caused several of the recent destructive wildfires near Los Angeles.

Best Performers

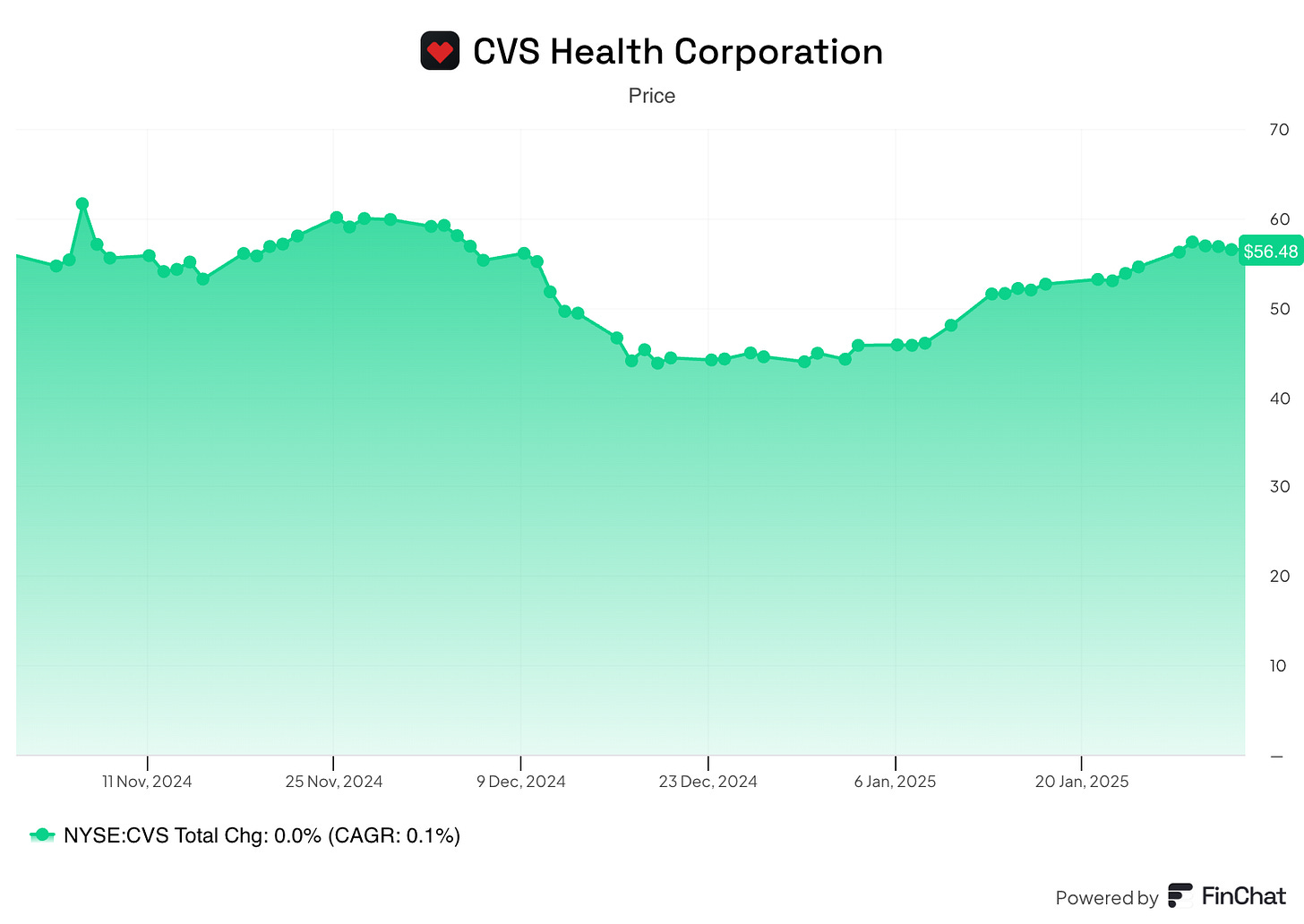

CVS was this month’s best performer, rising almost 31%.

An interesting fact?

CVS was on our worst performing stocks list last month.

The image shows the stock price over the past 3 months, including December’s fall and January’s recovery.

Source: Finchat

30 Great European Dividend Stocks

“I view diversification not only as a survival strategy but as an aggressive strategy because the next windfall might come from a surprising place.” –Peter Bernstein

Peter Bernstein points out that you can’t predict where the next winner will come from.

Since the bottom of the Global Financial Crisis in March of 2009, U.S. stocks have outperformed almost every other asset.

But U.S. stocks don’t always outperform.

The chart compares the performance of the MSCI USA index to the MSCI World index.

When the ratio goes up, it means U.S. stocks are doing better than the rest of the world. When it goes down, U.S. stocks are lagging behind the global market.

This ratio can’t keep growing forever - if it did, U.S. stocks would eventually make up 100% of global stocks.

Another reason to look at stocks outside the U.S.?

They’re cheaper.

Here are the global valuations by CAPE ratio and Price to Book Ratio.

To find the U.S., follow the chart title all the way to the right.

It’s literally off the chart expensive.

The cheaper you buy stocks, the better your returns will be.

That’s why today we’re looking at some of the best Dividend Stocks in Europe.

Introducing The Noble 30

The Noble 30 is a group of European stocks with a record of at least 20 years of consistent or growing dividends, created by my friend European Dividend Growth Investor.

Here’s what he says about them:

The ‘Noble 30’ represents an exclusive selection of genuine European Dividend Aristocrats, each boasting a track record of at least 20 years of consistent or growing dividends. Hence, I consider these the best of the best International dividend stocks from Europe.

To qualify as European Dividend Aristocrats, companies must:

have shown resilience during the Great Recession and the 2020 pandemic. They have either increased or sustained their dividend since at least the beginning of 2000.

the company is of blue-chip nature, hence having at least a 5 billion market cap.

If you’re looking to invest outside of the U.S., the Noble 30 is a great list to start with.

Let’s dive into this list and see what interesting opportunities we can find.

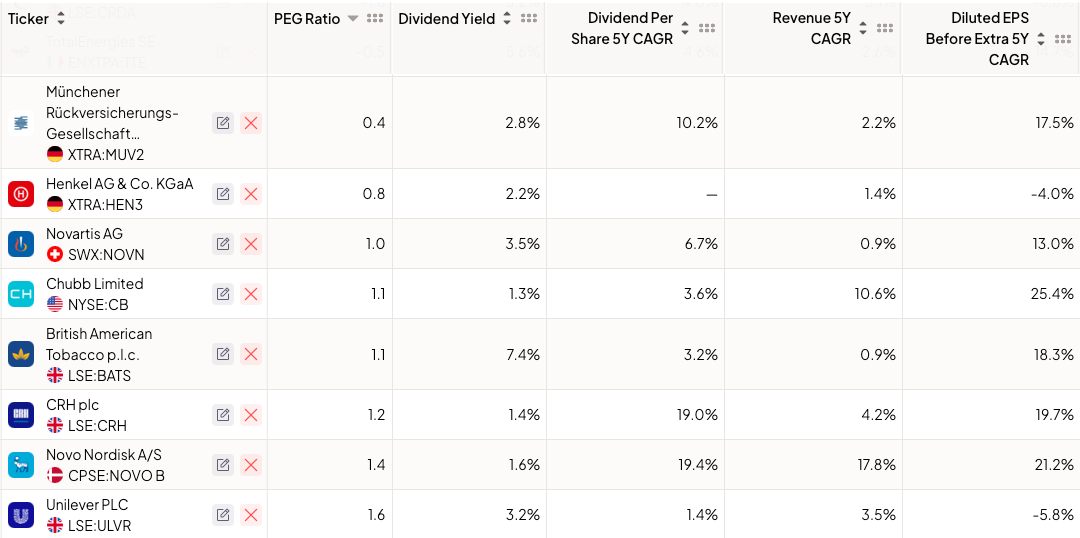

PEG Rato

Peter Lynch often used the Price/Earnings to Growth or PEG ratio to value stocks.

Here’s the formula:

PEG Ratio = P/E ratio / Earnings Growth Rate You can pay a higher P/E multiple for stocks that are growing earnings faster.

Here are the companies with the lowest (non-negative) PEG ratios:

Source: Finchat

Companies like Chubb Limited and Novo Nordisk A/S have been growing their revenue and EPS quickly.

A low PEG ratio tells you that you’re not paying a lot for this growth if it continues in the future.

Highest Dividend Yield

The current Dividend Yield of the STOXX 600 index is 2.6%.

Source: Finchat

Companies like British American Tobacco, TotalEnergies, and Nestlé all have significantly higher Dividend Yields than the index.

The 5 Most Interesting

This list is full of great companies.

To come up with 5 that I think are the most interesting I looked at:

Current Dividend Yield VS historical

Current P/E ratio VS historical

Historical and forward growth of Revenue, Earnings, and Dividend payments

The company’s competitive advantages

Valuation

I’ve also included a spreadsheet of the Noble 30 with some interesting metrics from Finchat.