💸 31 Cannibal Companies

Today is Dividend Day.

In this series, I will teach you 5 things about dividend investing in less than 5 minutes.

1️⃣ REITs Explained on a Napkin

Want to invest in real estate without the headaches of being a landlord?

Look at REITs (Real Estate Investment Trust) - these are companies that own or finance income-producing real estate.

Instead of buying properties yourself, you buy shares in a REIT. They collect rent, you collect dividends.

Here’s why investors love them:

Steady Cash Flow – By law, REITs must pay 90% of their taxable income as dividends

Diversification – Own a mix of properties - apartments, office buildings, shopping centers - without lifting a finger.

Liquidity – Unlike real estate, most REITs trade on stock exchanges and are easy to buy or sell any time

2️⃣ How Buffett Finds Great Companies

Warren Buffett is the greatest investor of all time.

His strategy? Simple.

Find great businesses with a tailwind, a strong competitive edge, and smart leadership - then buy at a fair price.

It works. Especially for dividend investors like us.

3️⃣ An investing quote

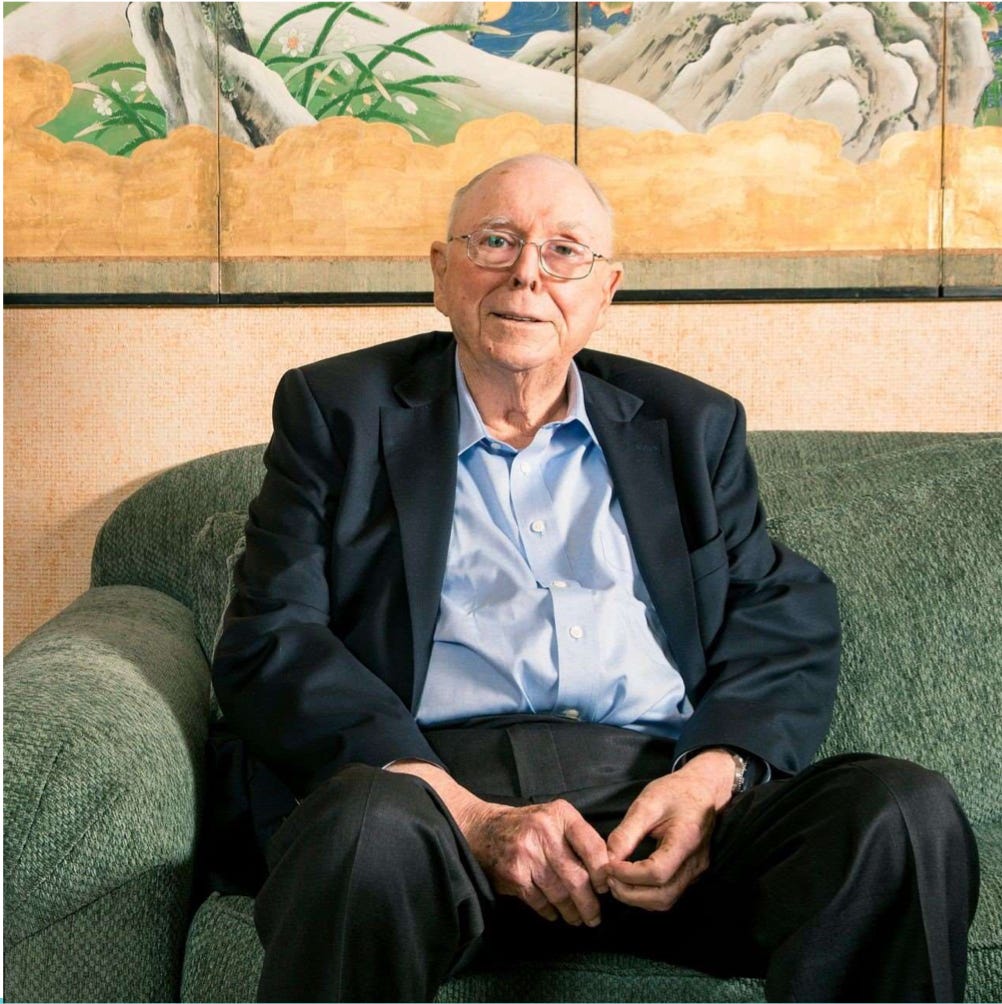

Charlie Munger was best known as the vice chairman of Berkshire Hathaway, alongside Warren Buffett.

Munger was admired for his sharp intellect, wisdom, and unique approach to investing.

One of his unique views?

To pay attention to companies buying back a lot of their own stock.

“Pay close attention to the cannibals – the businesses that are eating themselves by buying back their stock.” - Charlie Munger

4️⃣ 31 Cannibal Companies

Companies that aggressively buy back their own shares can be great investments.

Here’s why:

Bigger Slice of the Pie – Fewer shares mean each one is worth more

Smart Money Move – Buybacks signal confidence - management thinks the stock is cheap

Boosted EPS – Fewer shares = higher earnings per share (EPS), attracting more investors

Cash in Your Pocket – It’s a way to return cash, like dividends, but often more tax-efficient

Here are 31 of them from Mohnish Pabrai:

We’ll dive into a few more Cannibal Companies in Saturday’s article.

5️⃣ Example of a dividend stock

Let’s dive deeper into one of Mohnish’s Cannibals.

H&R Block provides tax preparation services and software to help individuals and businesses file their taxes accurately and efficiently.

They’ve also bought back nearly 40% of their shares since 2016.

Profit Margin: 16.5%

Forward PE: 10.6x

Dividend Yield: 2.9%

Payout Ratio: 36.1%

That’s it for today!

PS…Don’t miss our latest buy:

The company has grown its dividend by 21% per year for the last 25 years!

Other articles you might be interested in:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Funny I should see eBay on the list!

I used to ride my bike by their headquarters in the 90s on Hamilton Avenue in San Jose all the time and didn't think much of it.

The company is on my watchlist. Every so often it drops like a rock off a cliff, find it's wings on the way down, and soars back up. I need another one of those magic moments.