4 Lessons from the Analyst Who Was Banned for Life

I came across a story the other day proving that analysts don't always have their incentives aligned with yours.

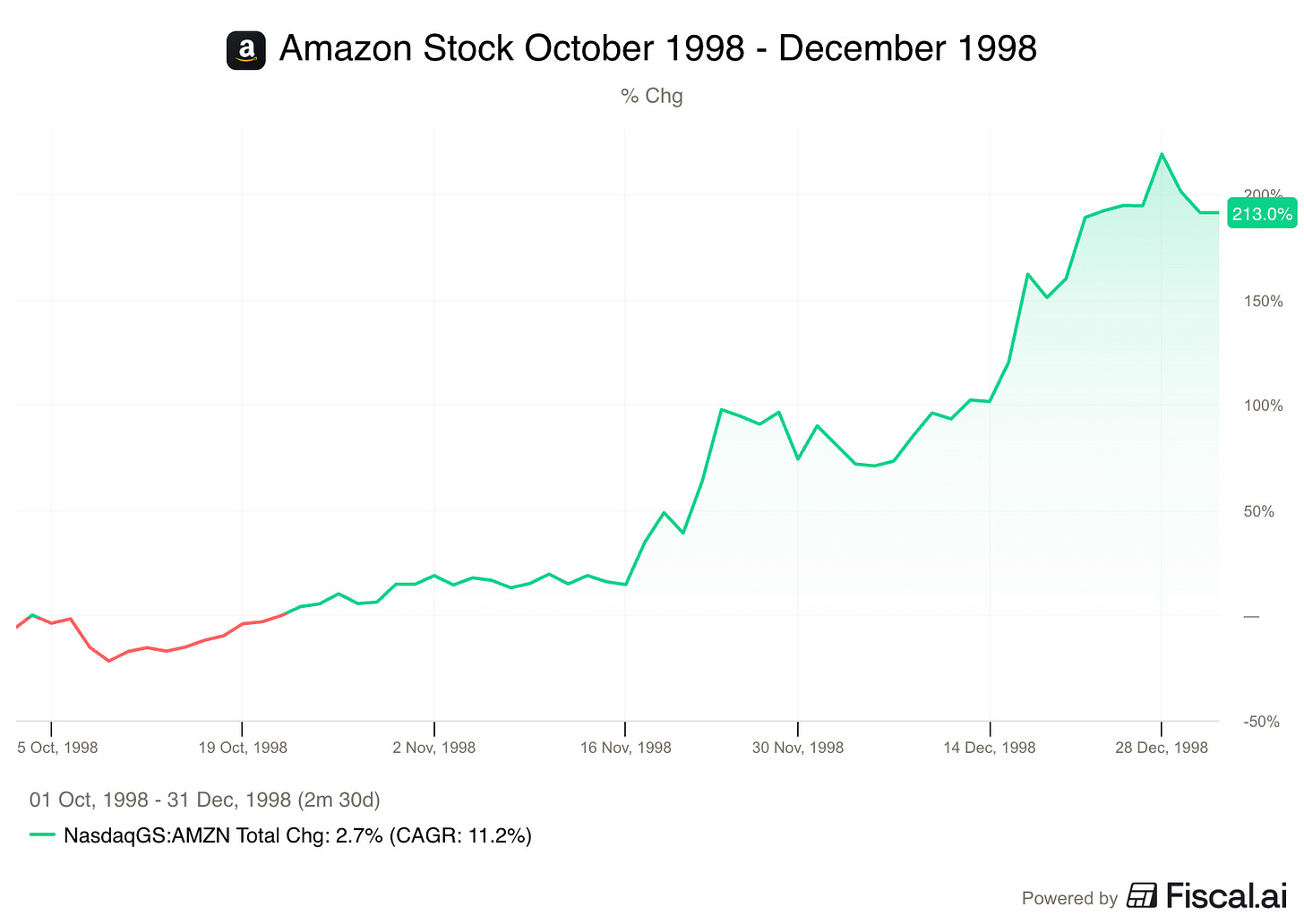

In 1998, Henry Blodget, a CNN business-news intern made a name for himself with a bold call on Amazon.com.

He predicted that Amazon’s shares would double within a year.

This was considered very unlikely.

It only took 3 weeks for Blodget to be proven right.

He became an instant Wall Street celebrity, and looked like a genius.

By December of 1998, Amazon’s stock had doubled again.

Right Too Early

At the same time Blodget made his call, Merrill Lynch’s internet analyst, Jonathan Cohen, was convinced that Amazon’s shares would fall.

Cohen was fired, and Blodget was hired with one of the highest salaries for an internet analyst.

By 2001, Blogdet had accepted a buyout offer from Merrill and left the firm.

Blodget’s Scandal

In 2002, New York’s Attorney General published private emails in which Blogdet called stocks he was publicly recommending ‘garbage’, and much worse.

If you’re familiar with the acronym POS, you get the idea.

In 2003 he was charged with civil securities fraud, paid a $4 million fine and received a lifetime ban from the SEC.

There’s a few things we can take away from this.

Both Were Right

The first and most obvious being that analysts have incentives that have nothing to do with getting their assessment of a company right.

The second being that analysts can be right for the wrong reasons, or just lucky.

But a less obvious thing that I took away is that both analysts turned out to be right.

It just depends on what timeframe you’re looking at.

Blodget was right in the short term. Amazon’s stock had a ton of momentum, hit his price target, then doubled again, all within a year.

But by the end of 2000, Jonathan Cohen was proven right, with Amazon down 9% from where it started October of 1998.

By the end of 2001, Amazon stock had seen a drawdown of more than 90%.

How to Use Analyst Reports

When you see an analyst on TV or read a research report, remember that you shouldn’t be looking for a ‘buy’ or ‘sell’ recommendation.

You should be trying to figure out if what they’re saying is actually useful to you.

Here are four lessons from Henry Blodget’s story:

1. Timeframe Matters

If the analyst is giving you a 12-month price target based on momentum, but you’re a buy and hold investor looking at a 10-year horizon, their analysis won’t be helpful to you.

2. Always Consider the Incentives

Analysts aren’t always paid to be right.

Sometimes they’re paid to attract attention, and bring in clients.

If they get paid via commissions or deal flow, they’re incentivized to be active and get attention, not necessarily be accurate.

3. Consider Luck VS Skill

It’s hard to tell skill from luck, even after the fact.

Amazon did hit Blodget’s price target in less than a month, but that was just one possibility out of many.

The other possible outcomes are what Nassim Taleb calls “Alternative Histories.”

It’s possible that Bloget knew what he was talking about.

It’s also possible that he happened to get lucky.

4. Do Your Homework

Read the reasons behind the advice, not just the rating or price target.

The argument the analyst is making is the most important, and useful thing.

To understand their argument, you have to understand the business and the industry.

This is why staying in your Circle of Competence is so important.

Conclusion

The next time you see a bold price target or a strong buy rating, take a breath before you take action.

Remember:

Price targets are fleeting; business fundamentals are (usually) forever

Noise sells, but due diligence is the most important thing

You are the only one truly incentivized to protect your own capital

Analyst reports can be useful, but filter their data through your own goals, check their incentives, and always make sure you’re playing the same game, on the same timeframe, as the person giving the advice.

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal: Financial data

🚨 Don’t Miss Out: The Doors Are Opening Soon

On February 24th, we are opening a limited number of discounted spots for new members.

These spots aren’t expected to last long!

You don’t want to miss your chance to get in at a discount (and get all the exclusive bonuses as well).

You’ll also immediately get a copy of my 10 favorite cannibal stocks when you do.

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.