💸 44 Canadian Dividend Contenders

Plus learn to analyze stocks like Peter Lynch, and get 30 pearls of wisdom from J.P. Morgan.

Today is Dividend Day.

The series where I teach you 5 things about dividend investing in less than 5 minutes.

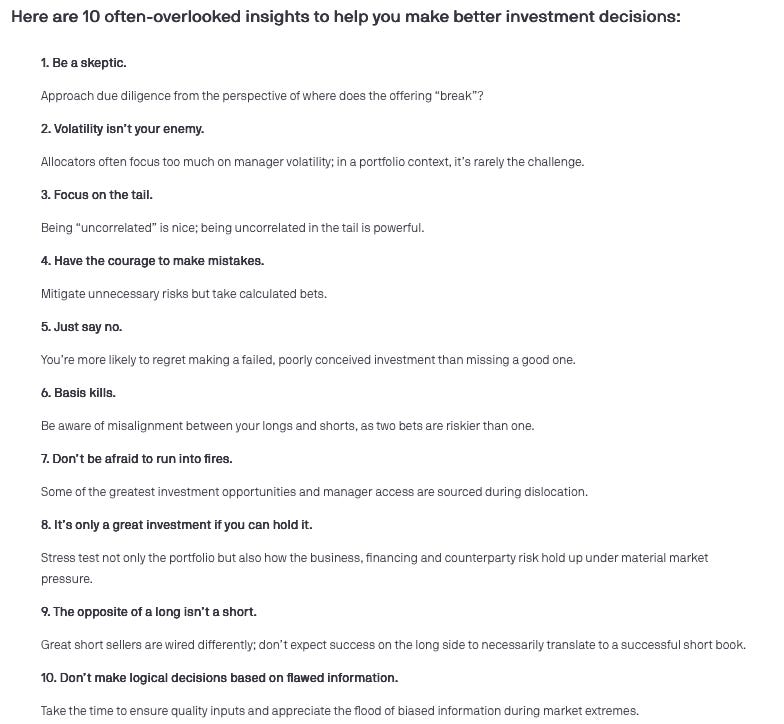

1️⃣ Canadian Dividend Contenders

Here’s a list of all of the stocks that have raised their dividends for at least 10 years in a row on the Toronto Stock Exchange.

Lists like these are always interesting to browse for ideas:

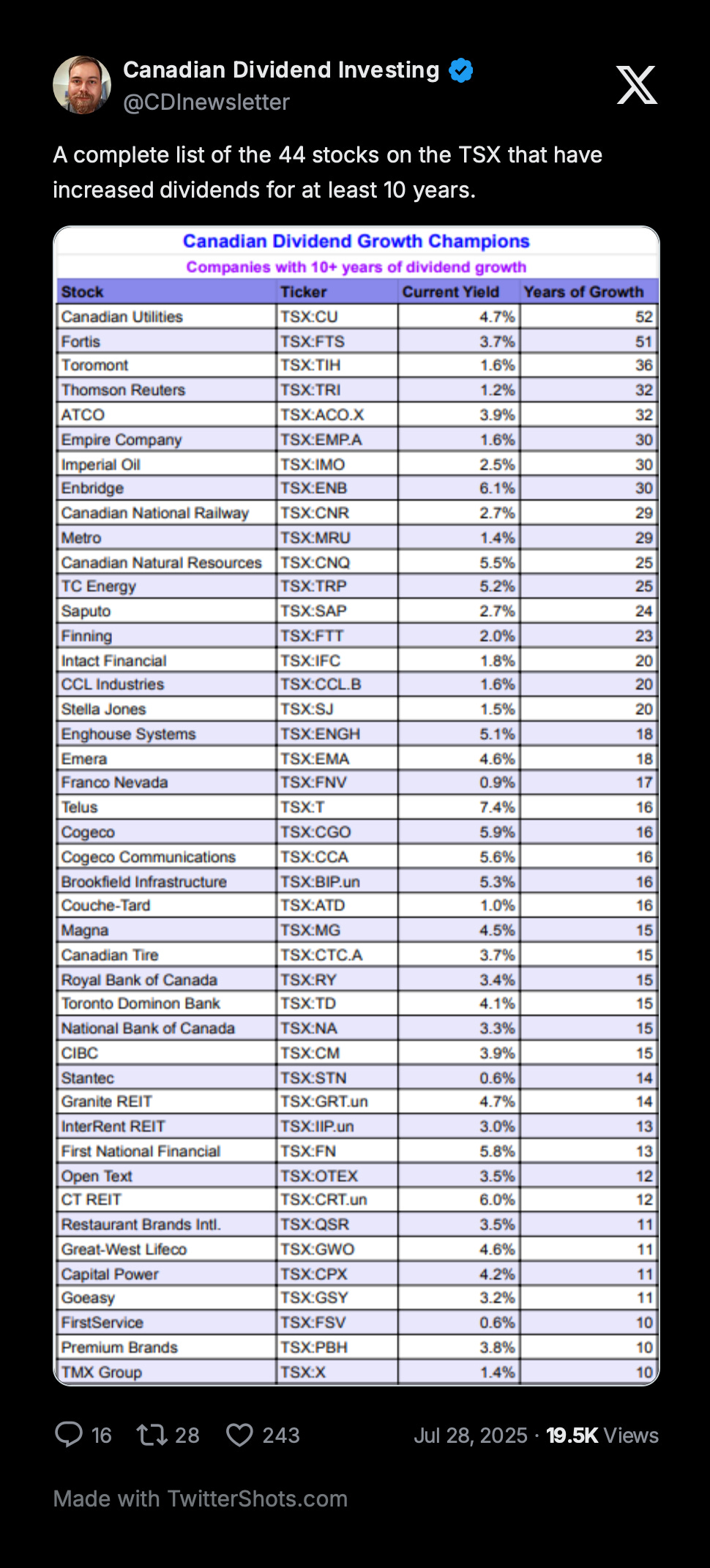

2️⃣ Analyze Stocks Like Peter Lynch

Peter Lynch ran the Fidelity Magellan Fund from 1977–1990, averaging a 29% annual return - more than double the S&P 500.

His approach? Buy what you understand, focus on fundamentals, and ignore the noise. This 6-step framework captures his timeless wisdom in one graphic.

It’s a great framework, but we go one step further:

The company must also pay a growing dividend.

That way, you get paid while you sleep.

3️⃣ An Investing Quote

Peter Cundill required the company to be paying a dividend as well.

He was a renowned value investor often called “Canada’s Warren Buffett.” His fund returned 15%+ annually for over 25 years.

The company must be paying dividends. Preferably the dividend will have been increasing and have been paid for some time.

-Peter Cundill

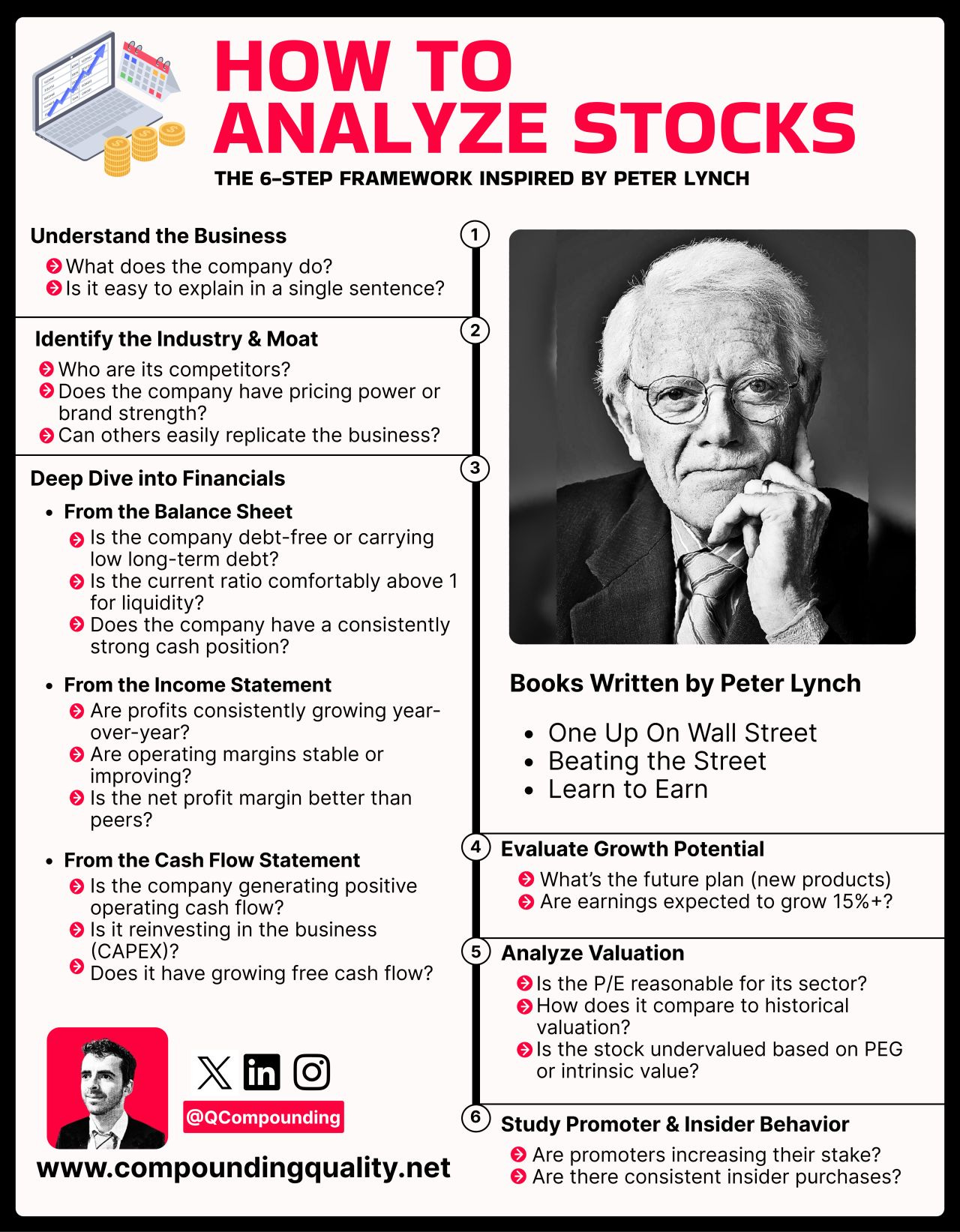

4️⃣ 30 Pearls of Wisdom for 30 Years

J.P Morgan Alternative Asset Management (JPMAAM) shared 30 pearls of wisdom for their 30th anniversary.

As they say:

The times may have changed, but the wisdom remains the same

There are some great lessons in this list.

The first 10 are all about making better decisions.

Click the picture for the whole article.

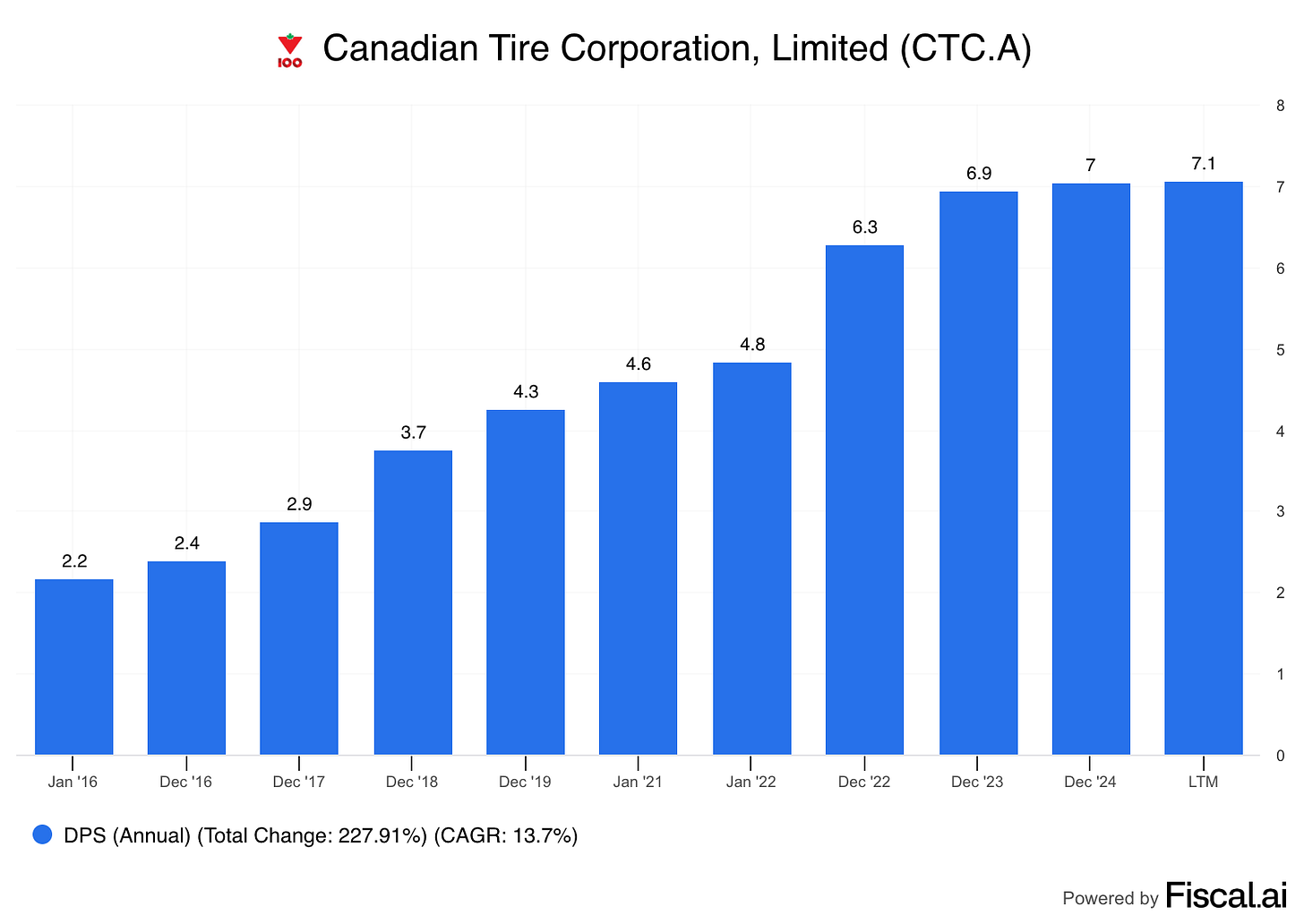

5️⃣ Example of a Dividend Stock

We’ll go back to our list of Canadian Dividend Champions for our example today.

Canadian Tire Corporation is a leading Canadian retail company, offering a wide range of products across automotive, hardware, sports, leisure, and home goods.

It serves millions of Canadians through well-known banners like Canadian Tire, SportChek, Mark’s, and PartSource.

Profit Margin: 5.1%

Forward PE: 14.1x

Dividend Yield: 3.7%

Payout Ratio: 45.9%

That’s it for today!

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data