4x More Wealth (With Less Risk)

Why the Second Quintile is the Goldilocks zone of dividend investing.

👋 Howdy Partner,

In theory, investing is simple, but it’s not easy.

Buy great companies at fair prices, ignore the market, and wait.

But having patience isn’t easy, and Mr. Market can be hard to ignore.

It’s easy to get pulled into chasing the next big thing.

Especially when people seem to be making fast returns on gold, meme coins, or AI companies.

But we’re in this for steady income and to build true, generational wealth.

That means we need durability.

Markets crash. Bubbles burst. But quality dividends keep coming.

The High Yield Trap

When investors look for income, they usually make one mistake.

They sort a list of stocks by yield and buy the ones at the very top.

This is a trap.

If you blindly buy the highest yields, you’re often buying a group filled with companies in trouble.

The business model might be failing, the payout might be unsustainable, or a dividend cut might be on the way.

A Better Strategy

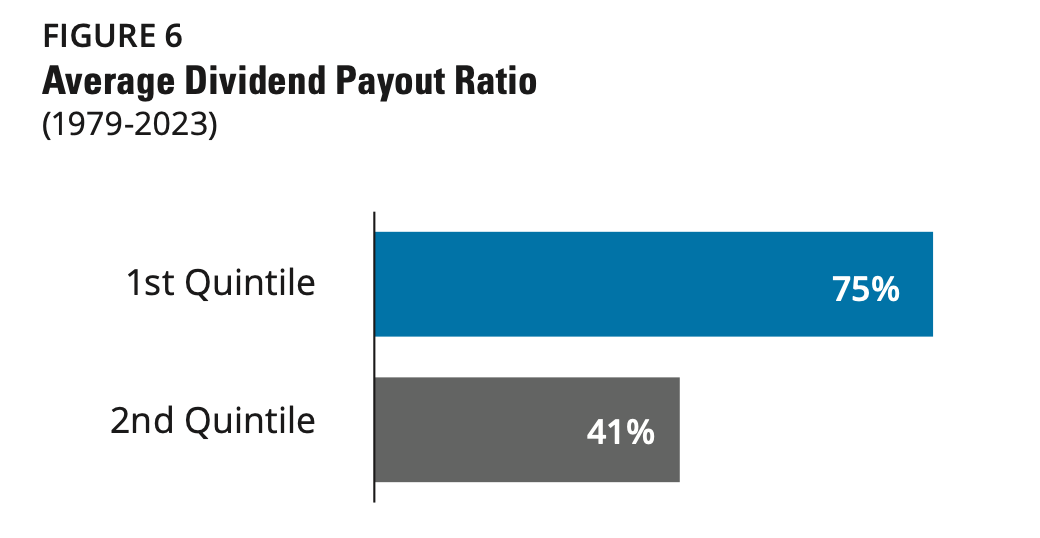

Savita Subramanian, Head of U.S. Equity Strategy at Bank of America, has a better way.

She divides the market into five groups (quintiles) based on their dividend yield.

1st Quintile: the 20% of the market with the highest yields

2nd Quintile: the 20% with the next highest yields

3rd - 5th Quintiles: lower yielders and non-payers

The secret to outperforming the market isn’t buying the first group.

It’s buying the second.

This one tends to hold solid businesses with healthy payout ratios.

How Does It Perform?

Hartford Funds looked at the performance of these groups from 1930 to 2023.

If you had invested $1,000 in the S&P 500, it would have grown to $8.6 million.

If you had invested that same $1,000 in the Second Quintile of dividend stocks, it would have grown to $31.2 million.

That is nearly 4x more wealth.

Why it Works

The Second Quintile is the Goldilocks zone of the stock market.

Safety: You avoid the yield traps and distressed companies in the top tier.

Quality: You own profitable companies with enough cash flow to pay you and grow the business.

Stability: Historically, this group has the fewest negative years of any quintile.

That third one is huge - protect the downside and the upside takes care of itself.

The Current Screen

We ran the numbers on the Russell 1000 to find the companies sitting in that Second Quintile today.

I’ve filtered this list further to find the Dividend Compounding Machines, the ones that also pass the Chowder Rule (Yield + Dividend Growth).

Let’s look at a few that are interesting:

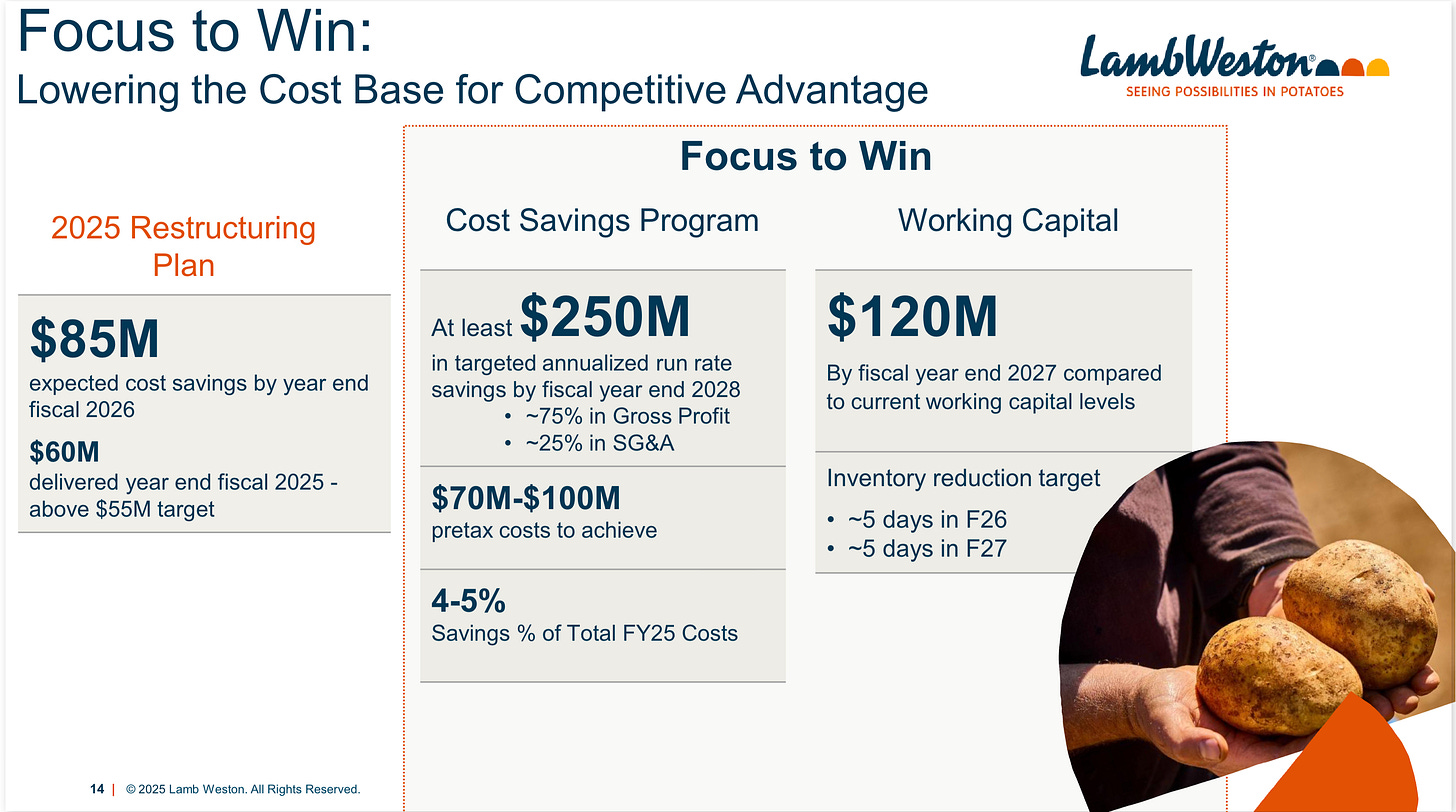

Lamb Weston (LW)

How they make money:

Lamb Weston is the largest producer of frozen potato products in North America and the second-largest globally. They primarily sell french fries, sweet potato fries, and tater tots to restaurants and retailers.

The Fry Industry is attractive

High Demand: Global frozen potato demand historically grows at 5% annually

High Margins: French fries are incredibly profitable for restaurants, with an average gross margin of 81%

Lamb Weston’s Competitive Advantages

Low Cost: Their potatoes come from the Columbia Basin and Idaho, where ideal conditions lead to 10%-20% lower costs per pound

Entrenched Relationships: They have long-term partnerships with chains like McDonald’s (their largest customer), Wendy’s, and Burger King

Dividend Yield: 3.3%

5-Year DPS CAGR: 10.0%

Chowder Score: 13.3%

You’ve seen the first company, but you’re only seeing 20% of the story.

Lamb Weston is a fantastic business, but it is just one piece of the puzzle.

I’ve identified four more high-quality compounding machines currently sitting in the second quintile.

These are businesses with massive moats, from the global leader in vertical transportation to the invisible giant of the backyard.

Paid partners of Compounding Dividends get the full list of all five companies, plus the complete, updated spreadsheet of every single stock currently in the Second Quintile.

Want the Full Spreadsheet for Free?

I am opening a limited number of discounted membership spots on February 24.

If you sign up for the waiting list today, I will send you the full Second Quintile Spreadsheet immediately. No waiting.

Why join the list?

Immediate Access: Get the full list of Second Quintile stocks sent to your inbox right now.

Deep Discounts: Lock in one of our limited, discounted membership rates

Exclusive Bonuses: Waitlist members will receive a suite of exclusive bonuses (including 10 Dividend Stocks to Own Forever) that won’t be available to the general public:

📘 E-book with one-pagers of all our stocks

📊 Spreadsheet with the dividend growth of the portfolio

🚀 2 exclusive stock ideas for the launch

🎥 Video course: How to find great dividend stocks

🛒 Report: 3 Dividend Stocks to Buy

⭐ Report: Pieter’s 3 Favorite Stocks

🔍 Report: How to find 100-baggers

💵 10 Dividend Stocks to Own Forever

🏗️ Masterclass: Build Your Dividend Machine

🙋♂️ Exclusive Q&A With TJ and Pieter

Don’t leave your wealth to chance. Join the waiting list and get the spreadsheet now.

That’s it for today.

Here is what you learned:

Simple strategies can work. Buying quality companies and letting compounding work for you is a proven way to build wealth

Balance yield and growth. The second quintile of dividend yield gives you attractive payments now, and room for growth later

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.

Check out Dividend Farmer!

Dividendfarmer.substack.com