💸 Top 10 Dividend Stocks for 2025

👋 Howdy Partner,

Today is Dividend Day.

The series where I teach you 5 things about dividend investing in less than 5 minutes.

1️⃣ Top 10 Dividend Stocks

Here are 10 dividend stocks picked for 2025 by Morningstar.

These are stable, slow growers.

Most of them have long histories of dividend growth as well.

P.S. - did you know you can get Morningstar reports in Fiscal.ai?

2️⃣ More Than 1,500 Millionaires Were Created Every Day Last Year

Want to be one of them?

Compounding can make it happen.

Here’s the stats of Our Portfolio:

Yield on cost: 3.7%

5-Year DPS CAGR: 14.9%

5-Year Price Growth: 9.6%

Using those numbers, if you invest $1,000 per month, you’ll be a millionaire in 17 years!

3️⃣ An Investing Quote

Want proof that consistent habits (like saving, investing, and compounding) build wealth?

John Jacob Astor was America’s first multi-millionaire, building a fortune in fur trading and real estate in the 1800s.

As he put it:

“Wealth is largely the result of habit.”

— John Jacob Astor

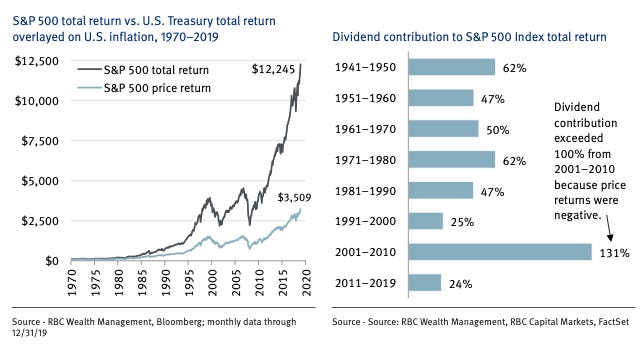

4️⃣ Creating Wealth Through Dividends

RBC Wealth Solutions has an interesting report on the wealth-building power of Dividends.

Over the past 50 years, 72% of the total return of the S&P 500 Index can be attributed to reinvested dividends and the power of compounding.

There’s a lot of data showing how dividends are responsible for a lot of the total return of stocks over the long term.

One of my favorite nuggets?

That during the decade from 2001-2010, dividends made up 131% of the total return because prices were negative!

Click on the image to download the whole report:

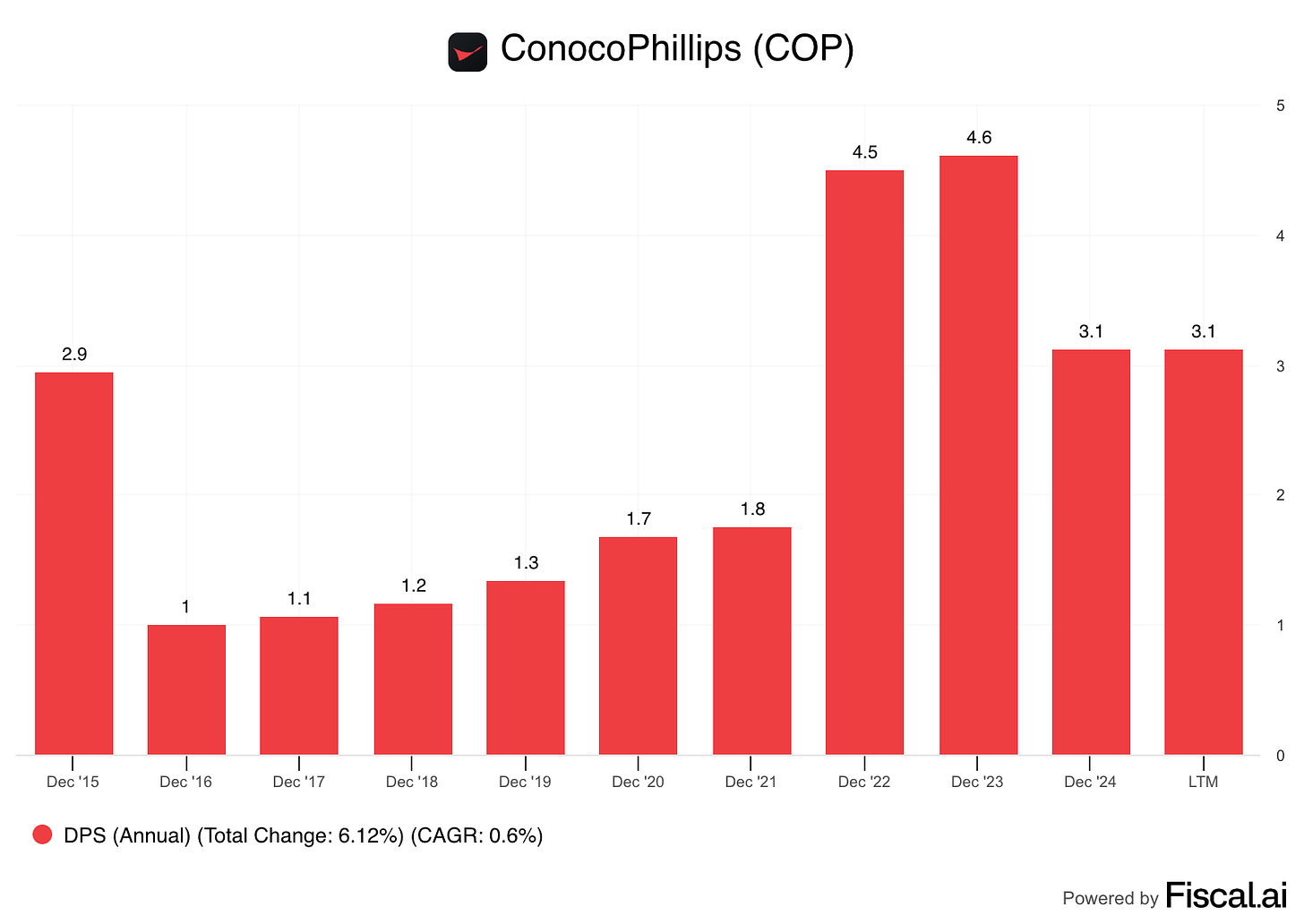

5️⃣ Example of a Dividend Stock

ConocoPhillips was one of the stocks in our first bullet.

ConocoPhillips (COP) is a global energy company that explores for, produces, and transports oil and natural gas.

Profit Margin: 16.1%

Forward PE: 16.2x

Dividend Yield: 3.4%

Payout Ratio: 39.4%

That’s it for today!

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data