5 Pieces of Advice From Warren Buffett

That are guaranteed to make you a smarter investor

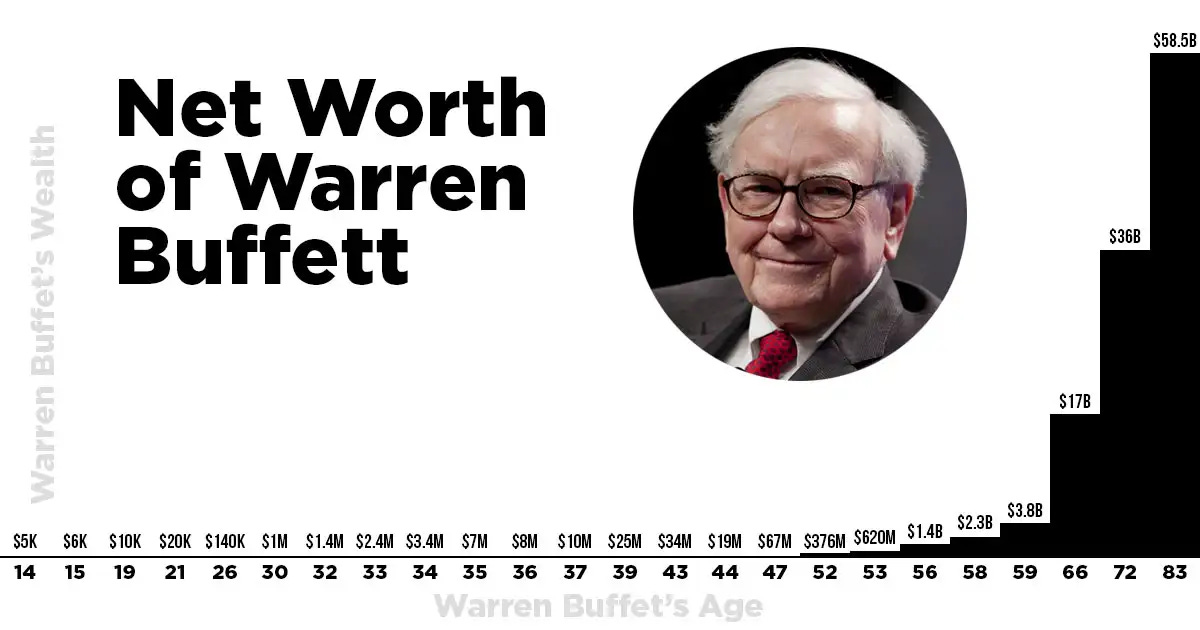

Warren Buffett isn’t just a great investor—he’s the greatest of all time.

He turned a few thousand dollars into billions by following a simple philosophy.

Most investors complicate things. They think they need fancy degrees, expensive software, or the “perfect” system to beat the market.

Buffett says you don’t.

After studying his approach for years, I’ve picked 5 key lessons.

They aren’t flashy - in fact, they’re common sense.

But following them could save you from making costly mistakes—and help you build real, lasting wealth.

Here they are:

1. Invest in What You Understand (and Nothing More)

If you can’t explain how a company makes money, don’t invest in it.

Buffett said it best: “Never invest in a business you cannot understand.”

Too many people chase hot trends—biotech breakthroughs, cutting-edge tech stocks, cryptocurrencies.

But if you don’t know what drives the profits, and where they’ll be 5 or 10 years from now, you’re gambling, not investing.

Peter Lynch was a fan of simple businesses too:

There are thousands of companies out there. Stick to the ones you really understand.

2. Plan to Hold Your Stocks Forever

This might sound strange, but hear me out—

Buffett once said, “If you aren’t thinking about owning a stock for ten years, don’t even think about owning it for ten minutes.”

Why?

Because great businesses compound wealth over time. They grow earnings, increase dividends, and reward patient shareholders.

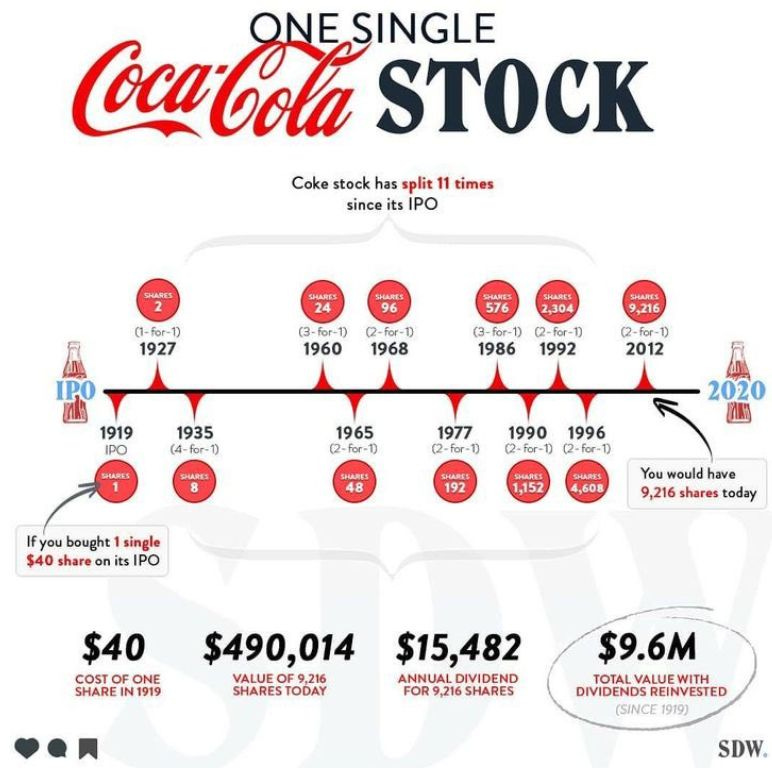

A single share of Coke bought at the 1919 IPO is now more than 9,000 shares.

$40 turned into more than $580,000, and pays you over $18,000 per year in dividends.

Trading in and out of stocks only racks up fees and taxes. Worst of all, it makes you vulnerable to emotional, short-term thinking.

Instead, find a great business—buy it right—then sit tight.

3. Ignore the Noise—Most News Doesn’t Matter

Financial news is designed to make you act.

Sell this, buy that, panic over earnings reports.

But Buffett warns: “The stock market is designed to transfer money from the active to the patient.”

Most of the headlines are irrelevant noise.

Great companies have faced countless challenges and crises over the decades—yet they survive and thrive.

The trick? Ask yourself one simple question:

Does this news impact the company’s long-term ability to earn money?

If the answer is no, do nothing. Maybe even buy more.

4. Investing Is Simple, But Not Easy

Buffett doesn’t believe you need to be a genius to invest successfully.

What you do need is discipline.

There’s no “Easy Button” to get rich. Anyone promising one is selling you snake oil.

Investing is still difficult, and requires thinking. It shouldn’t feel easy.

“It’s not supposed to be easy. Anyone who finds it easy is stupid.” – Charlie Munger

Stick to timeless principles: value, patience, and understanding your investments.

5. Boring Is Beautiful

Buffett loves boring companies.

Why?

Because they often make the most money.

Think Coca-Cola, Johnson & Johnson, or McDonald’s. They aren’t glamorous, but they generate steady cash year after year.

“…approval is often counter-productive because it sedates the brain and makes it less receptive to new facts or a re-examination of conclusions formed earlier. Beware the investment activity that produces applause; the great moves are usually greeted by yawns.” Buffett said in his 2008 letter.

You don’t need the next tech superstar to get rich. Just find solid companies that compound wealth over time.

That’s it for today!

These 5 ideas are simple—but they aren’t always easy to follow.

If you can, you’ll avoid the traps that destroy most investors’ returns.

You’ll think long-term.

You’ll focus on quality.

And you’ll move closer to your financial goals with every passing year.

Remember, investing isn’t about being a genius—it’s about making fewer mistakes and sticking to what works.

Buffett’s advice can help you do just that.

One Dividend at a time,

TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Coca-Cola's rise from $40 in 1919 to today's $580k is a CAGR of about 7.9%. That's pretty good, especially when considering all the turmoil between 1919 and today: the Great Depression, World II, the Korean War, JFK's assassination, the Vietnam War, the Nifty Fifty, Watergate, Stagflation, the Savings and Loan scandal, the Dot-Com boom and bust, the Great Financial Crisis, and the COVID crash. Oh, and that's what hit America. Shall we list out what hit the rest of the world? 😏

Yep, for a fizzy, sugary drink and some snacks ... not bad! Coca-Cola did what it was meant to do. 👍

Ultimately, patience wins. 😊