5 Undervalued Dividend Growers

Solid companies with rising payouts - and discounted stock prices.

Here are some undervalued stocks:

Dividend growth is a great investing strategy.

You buy strong companies, and they earn more money every year.

They also give you part of the profits - called a dividend.

As these companies grow, your passive income grows too.

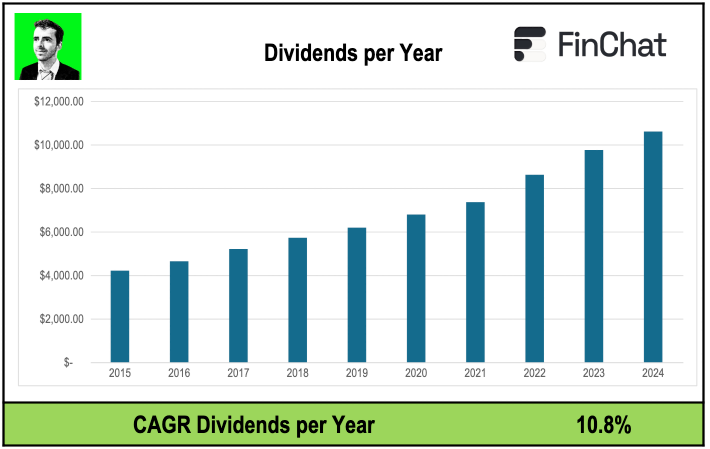

Take a look at how the dividends from Our Portfolio have grown:

This plan works even better when you buy a great company while the starting Dividend Yield is higher than normal.

That’s what we’re doing today - looking at 5 strong companies that pay growing dividends - and are cheaper than usual.

Let’s Dive In!

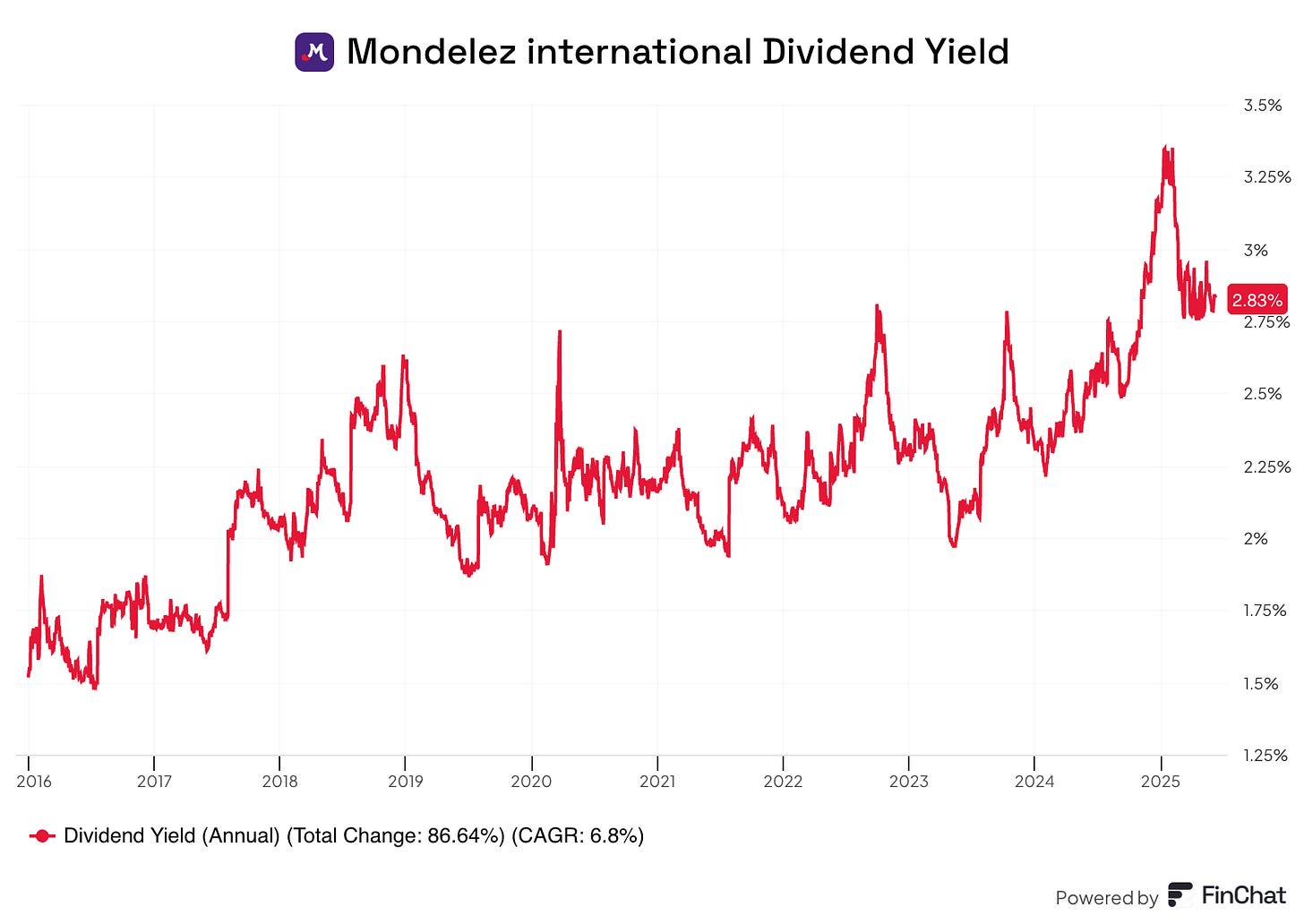

Mondelez International ($MDLZ)

How does the company make money?

Mondelez makes its money by selling snacks and confectionery - think Oreo cookies, Cadbury chocolate, Triscuit crackers, Ritz crackers, and Toblerone.

Why it might be interesting

Steady income from strong brands – Its iconic brands offer pricing power and repeat buyer behavior

Reliable dividend increases – Mondelez raises its dividend each year, rewarding long-term holders

Defensive business – Snack foods tend to hold up well in downturns, providing a smoother ride

The fundamentals look like this:

Dividend Yield: 2.8%

Payout Ratio: 67.7%

10-year Dividend CAGR: 12%

Net Profit Margin: 9.9%

Forward P/E: 21.1x

Mondelez has consistent cash flow, a strong global brand portfolio, and a history of dividend increases, making it a compelling option for steady income seekers.

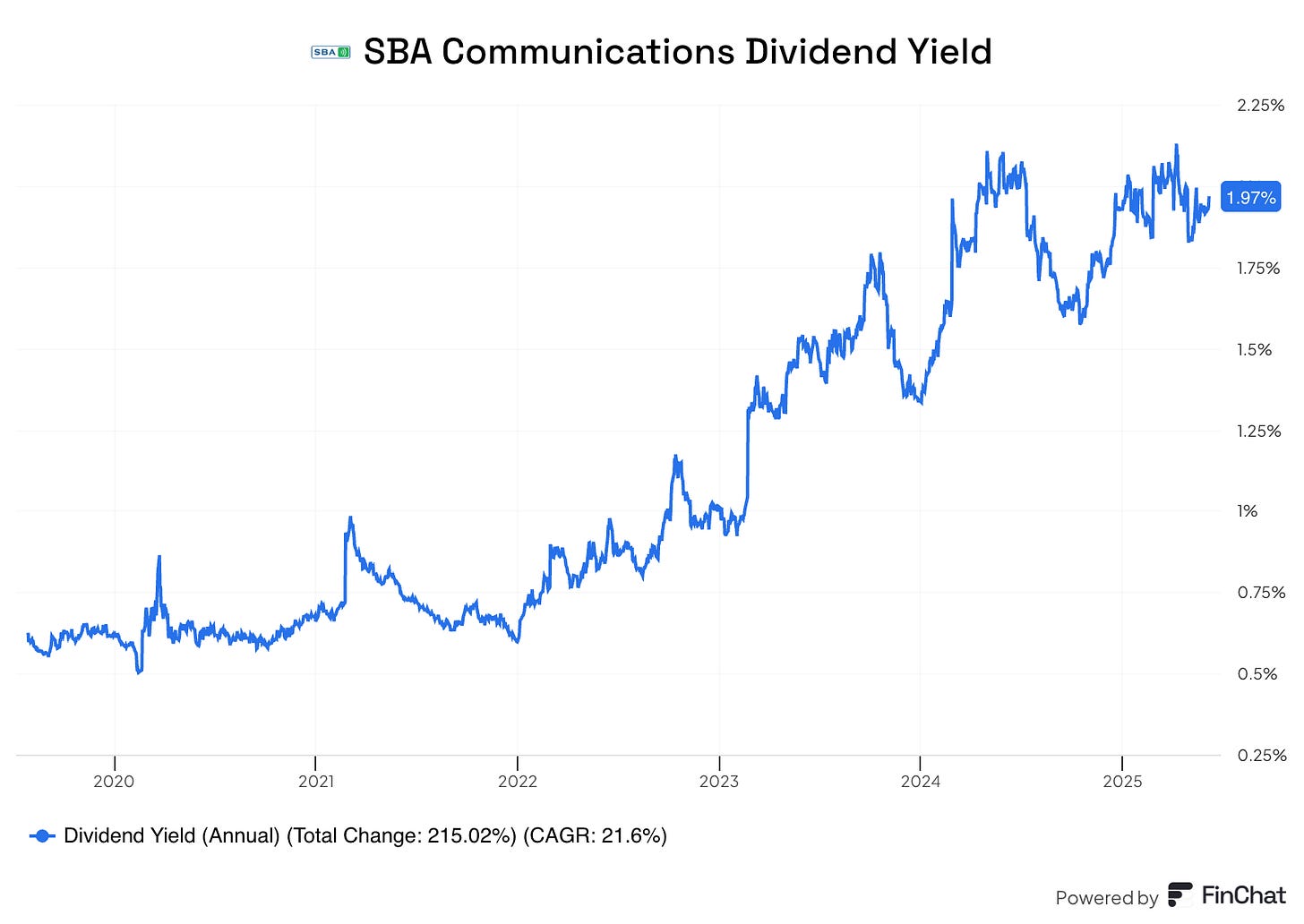

SBA Communications ($SBAC)

How does the company make money?

SBA owns and leases wireless communication towers and infrastructure worldwide.

It collects rent from mobile carriers, broadband providers, and private networks.

Why it might be interesting

Toll-booth-like income – It’s essentially infrastructure that generates recurring lease payments

Rising telecom demand – As data usage and 5G rollout grow, SBA benefits naturally

Dividend backed by contracts – With long-term leases, dividends have a predictable revenue base

The fundamentals look like this:

Dividend Yield: 1.8%

Payout Ratio: 53.4%

5-year Dividend CAGR: 19.4%

Net Profit Margin: 30.4%

Forward P/E: 26.1x

SBA is a telecom-infrastructure play with stable payouts - ideal for patient dividend growth investors banking on long-term digital connectivity trends.

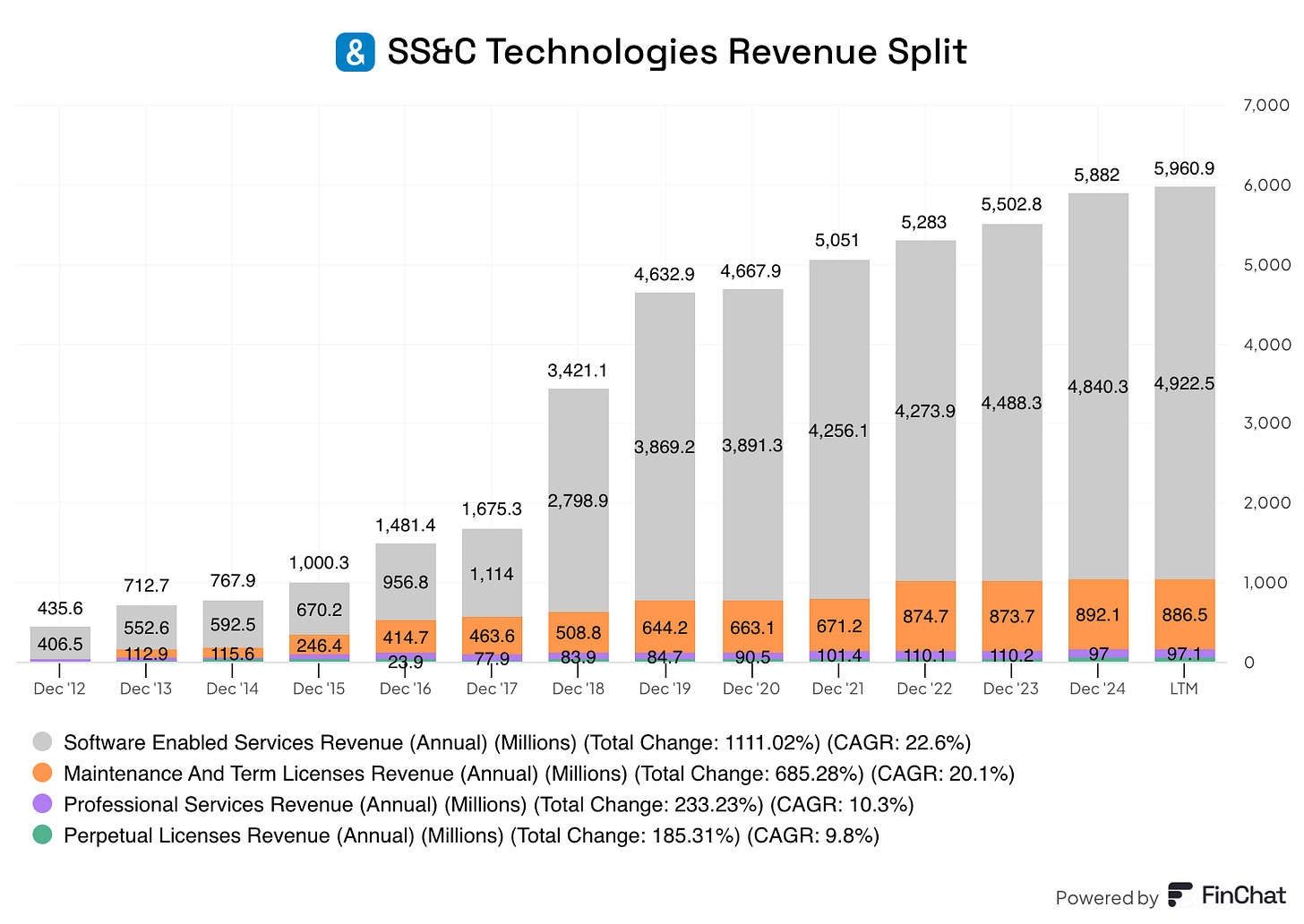

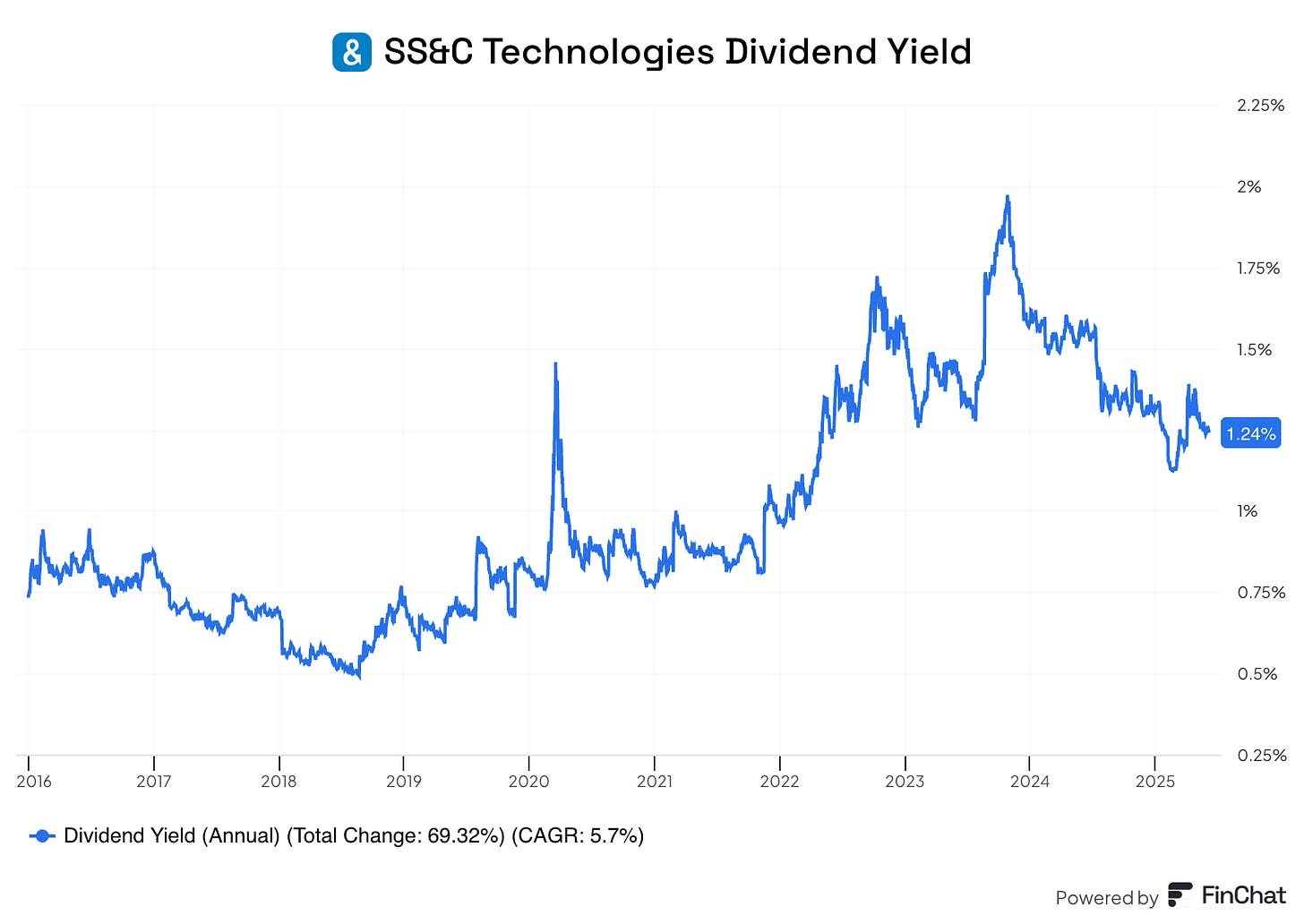

SS&C Technology Holdings ($SSNC)

How does the company make money?

SS&C offers software and tech services to financial institutions - like asset managers, insurance companies, and banks. Its products include portfolio analytics, accounting platforms, and enterprise tech.

Why it might be interesting

Subscription-style revenue – Recurring fees support predictable cash flow

Strong dividend track record – SS&C has grown its payout for nearly a decade

Lean payout ratio – Keeps meaningful earnings for reinvestment while funding dividends

The fundamentals look like this:

Dividend Yield: 1.3%

Payout Ratio: 29.9%

10-year Dividend CAGR: 23%

Net Profit Margin: 13.7%

Forward P/E: 13.4x

SS&C combines steady subscription revenue, solid profitability, and room to grow – all while sustaining dividend growth.

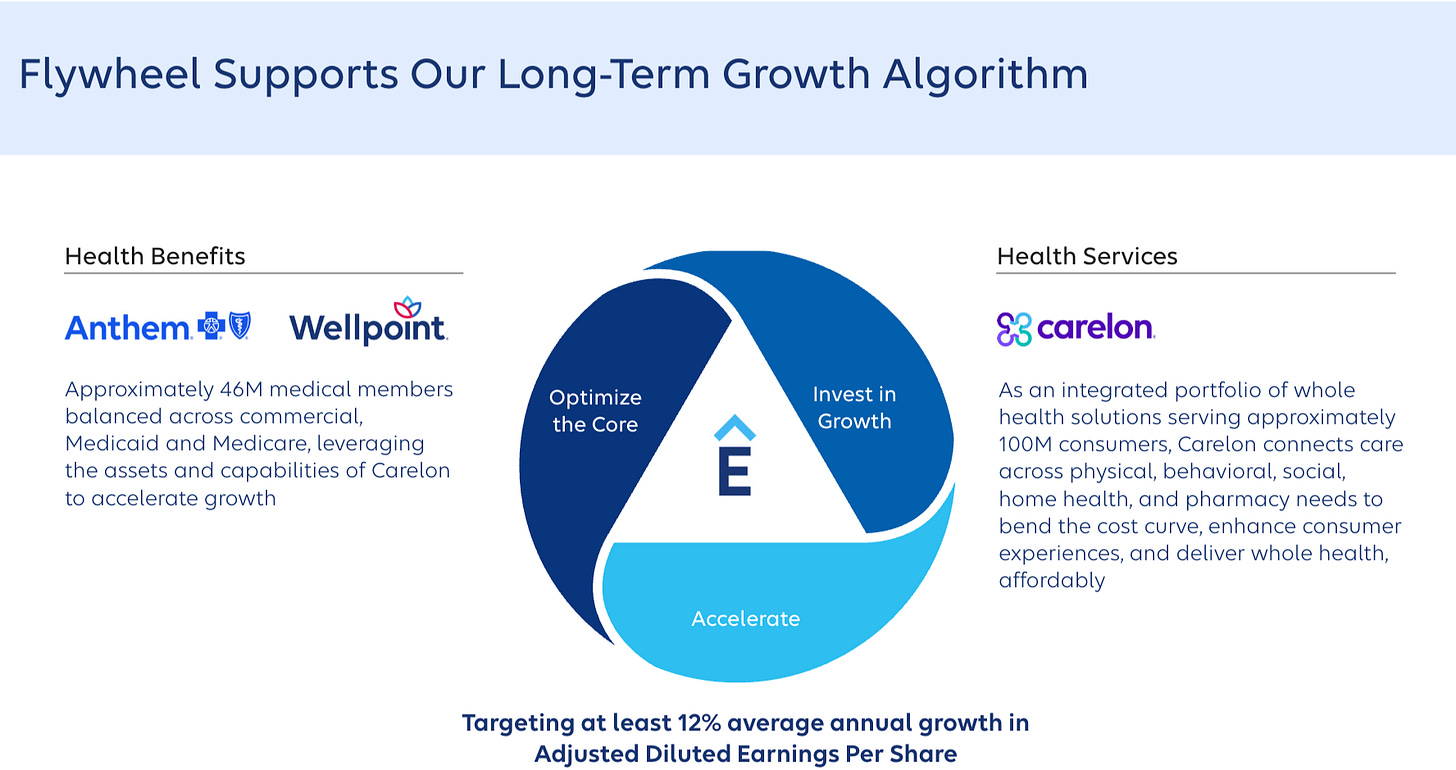

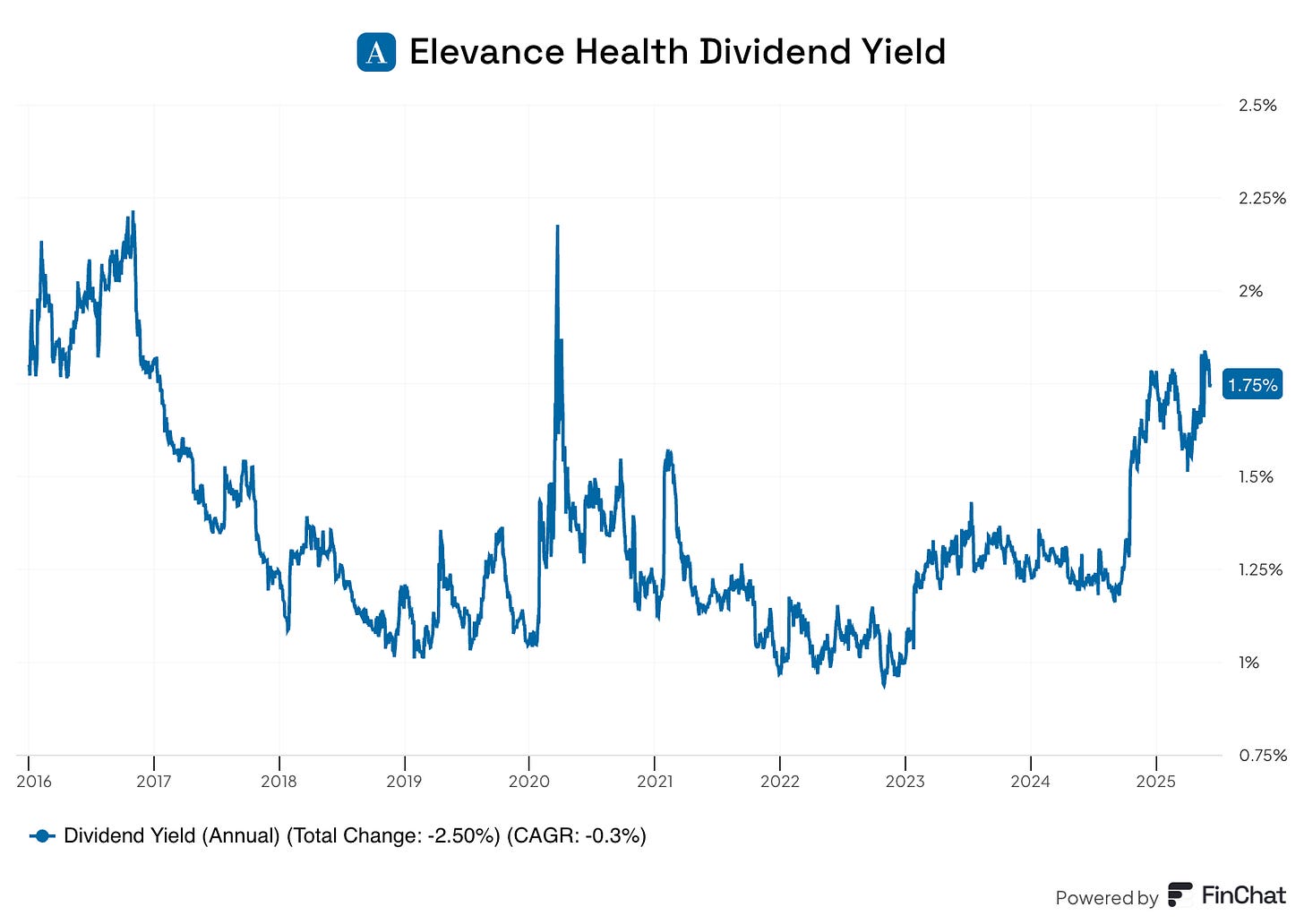

Elevance Health ($ELV)

How does the company make money?

Elevance (formerly Anthem) sells health insurance plans across the U.S., covering individuals, employers, and government programs like Medicaid/Medicare.

Why it might be interesting

Defensive industry – Health coverage demand is stable regardless of the economy

Profit-backed dividends – With strong cash flow from premiums, the dividend has solid support

Sophisticated business model – Tech-driven care-management tools aim to improve margins over time

The fundamentals look like this:

Dividend Yield: 1.7%

Payout Ratio: 25.7%

10-year Dividend CAGR: 13%

Net Profit Margin: 3.2%

Forward P/E: 11.1x

Elevance offers a blend of steady policy premiums, margin growth potential, and a responsibly flagged dividend path - for those in it for the long haul.

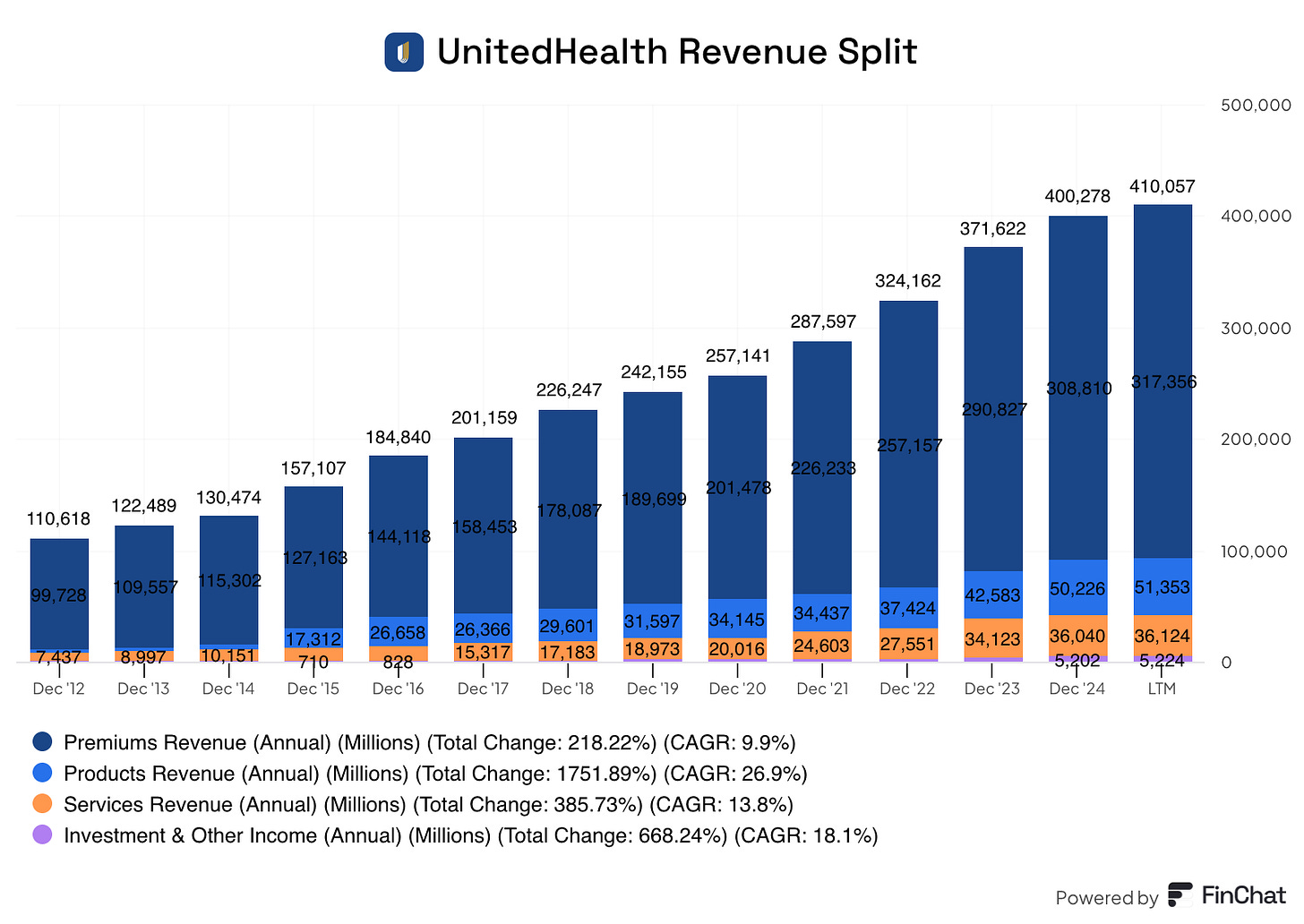

UnitedHealth Group ($UNH)

How does the company make money?

UnitedHealth owns two segments: health insurance (UnitedHealthcare) and care-services (Optum).

Health plan premiums makes up the majority of UnitedHealth’s revenue:

Why it might be interesting

Diversified healthcare exposure – Insurance + tech + services is a stable, growth-minded mix

Consistent dividend hikes – UnitedHealth has annually increased its dividend for decades

Earnings growth fuel – Optum’s high-margin services arm drives long-term EPS growth

The fundamentals look like this:

Dividend Yield: 2.2%

Payout Ratio: 34.9%

10-year Dividend CAGR: 18.8%

Net Profit Margin: 5.4%

Forward P/E: 13.2x

UnitedHealth blends defensive health-insurance cash flow with growth from its Optum services arm, creating a durable and rising dividend profile.