7 Lessons From Howard Marks on Risk

Howard Marks is the co-founder of Oaktree Capital and one of the most respected investors in the world.

Even Warren Buffett says, “When I see memos from Howard Marks in my mail, they’re the first thing I open and read.”

Most investors focus only on returns - how much they can make.

Marks focuses almost entirely on risk - how much you can lose.

As dividend investors, our goal is to buy great companies and let them grow our income.

That means they have to survive a long time.

Let’s dive in to 7 lessons on risk from Howard Marks to help us make sure that happens.

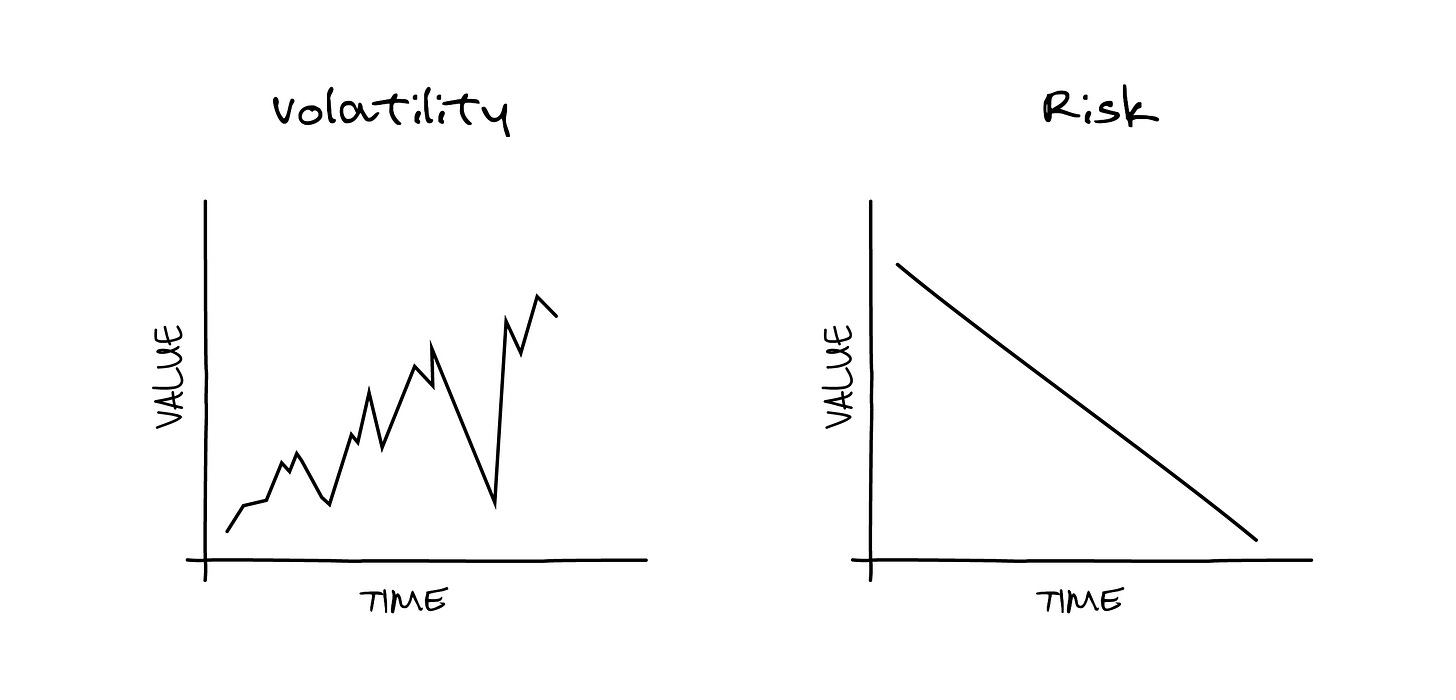

1. Risk is not volatility

“Academicians settled on volatility as the proxy for risk as a matter of convenience... but I just don’t think volatility is the risk most investors care about.”

- Risk (January 19, 2006)

Wall Street defines risk as volatility, or how much a stock price wiggles up and down.

That’s because it’s easy to measure and easy to put into a spreadsheet.

But as a dividend investor, do you really care if your stock price drops 10% this month if the business is healthy and the dividend check clears?

Probably not.

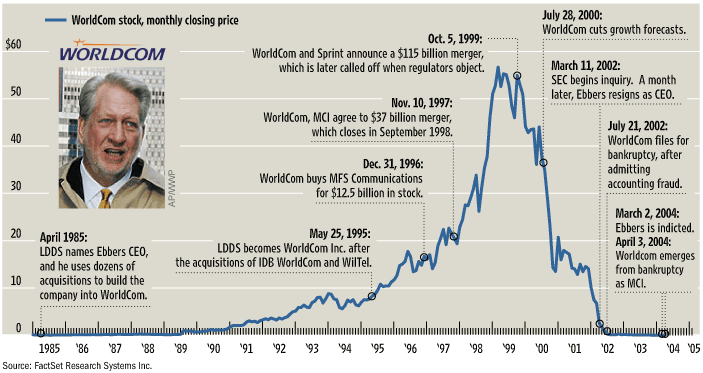

To Marks, the only risk that truly matters is the permanent loss of capital.

Price changes are temporary, but a bankrupt company is a permanent disaster.

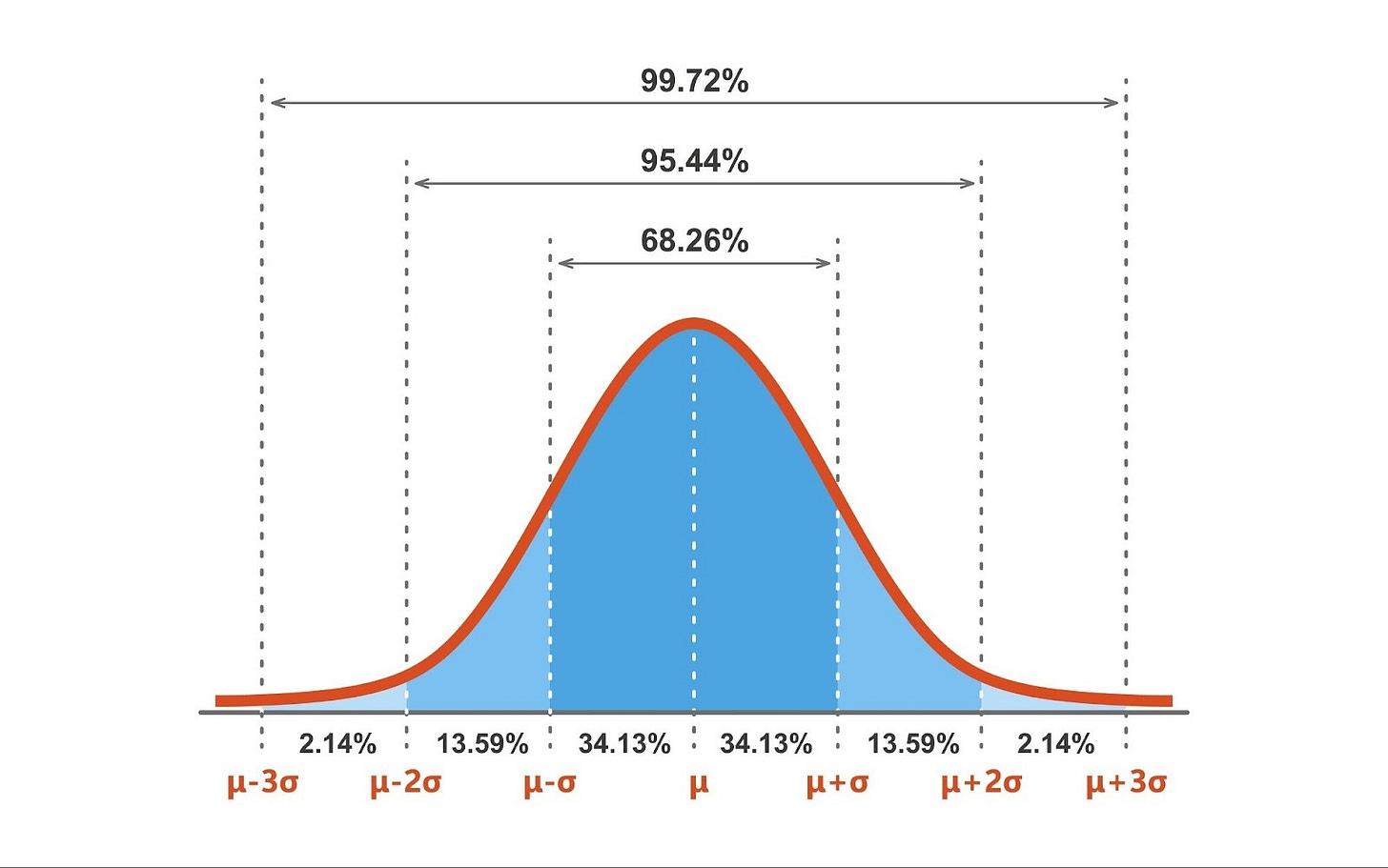

2. More things can happen than will happen

“Risk means more things can happen than will happen.”

-Risk Revisited (September 3, 2014)

We tend to look at the past and think it was inevitable.

But just because something did happen, doesn't mean that it had to.

Likewise, the future isn’t a single fixed path. It is a range of possibilities.

Marks (and mathematicians) call this a probability distribution.

You might have a 90% chance of being right, but that ‘alternative history’ with a 10% chance can still happen.

Remember that almost nothing about the future is certain.

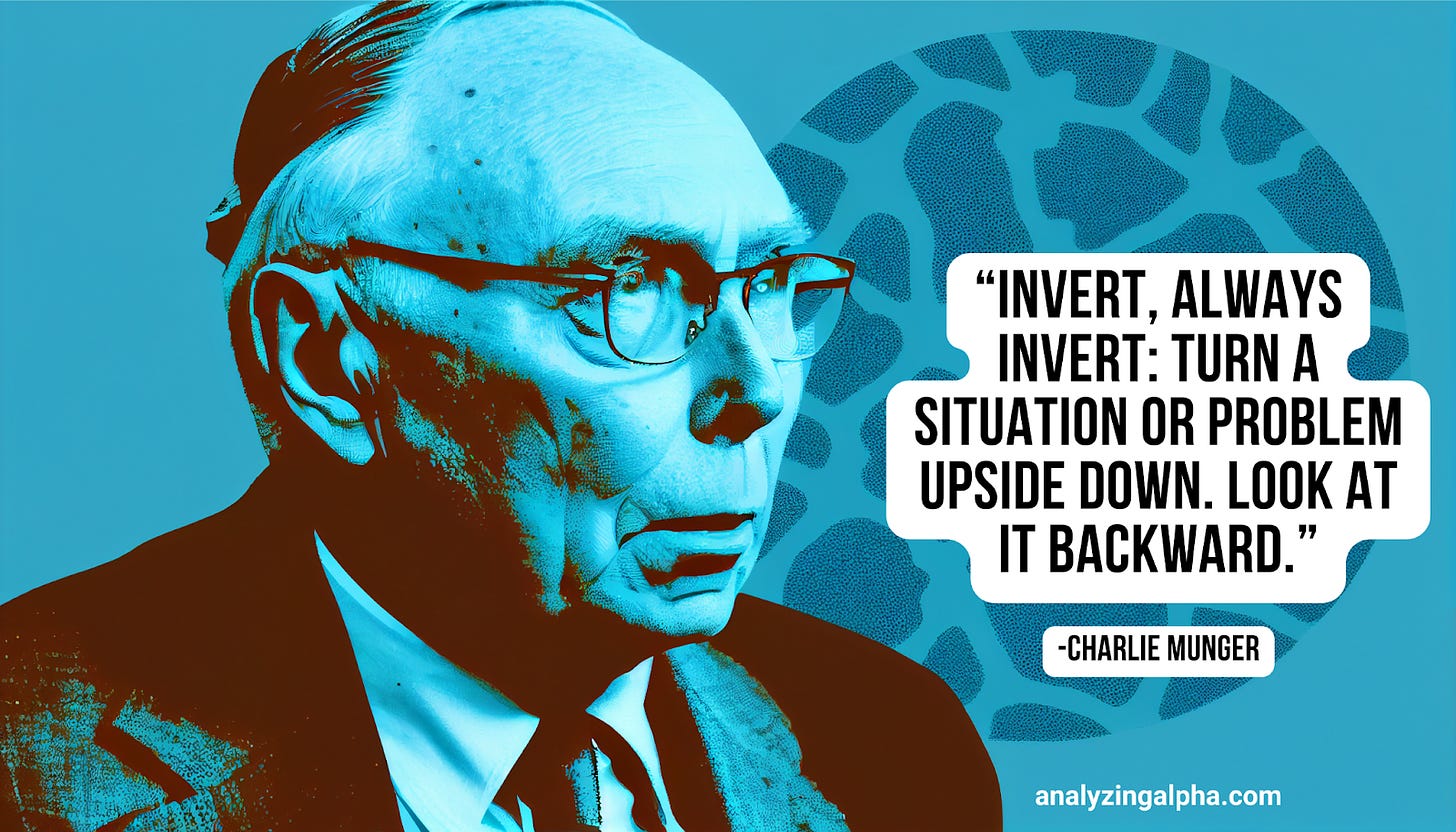

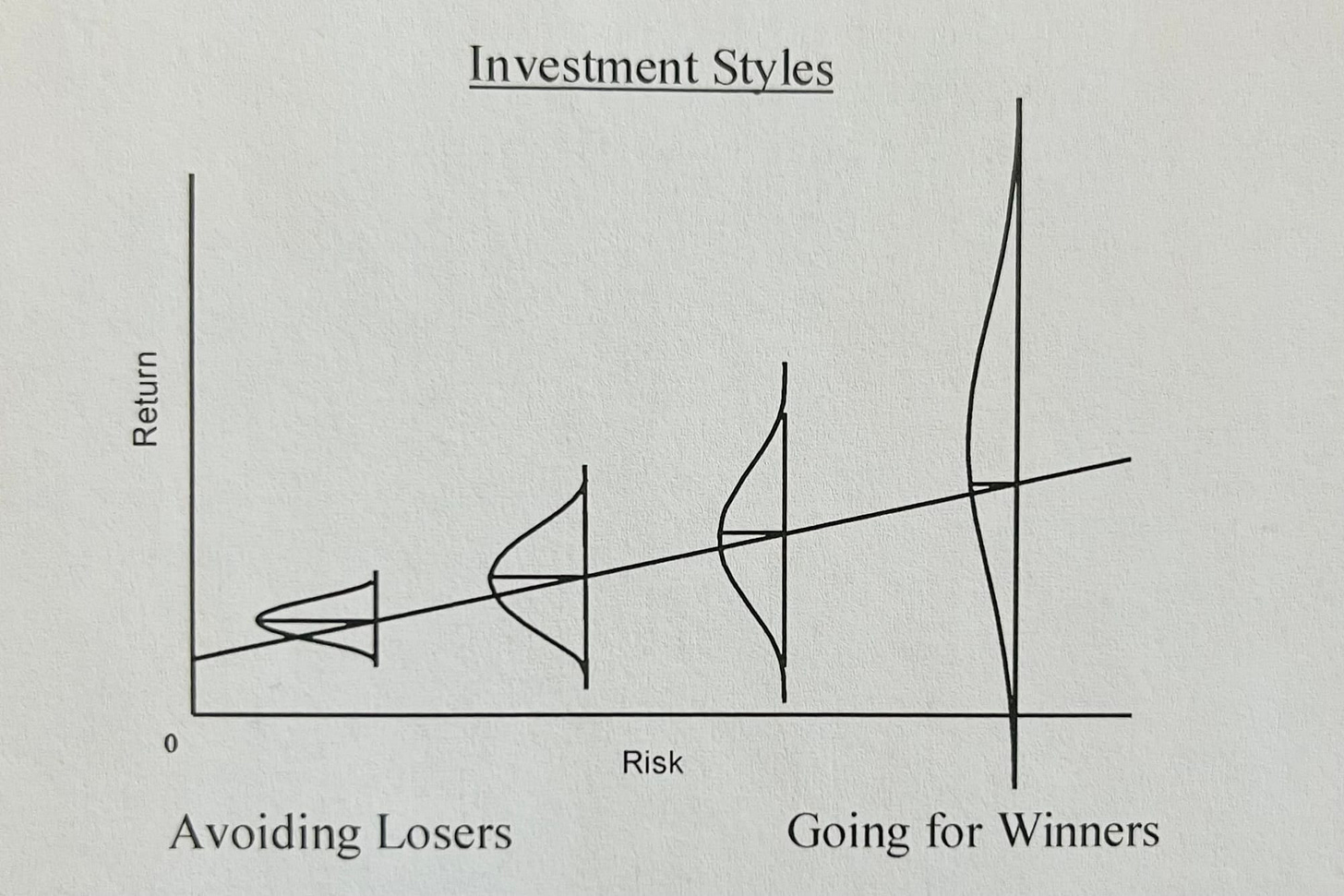

3. The “Negative Art” of avoiding losers

“Improving performance... not through what they buy, but through what they exclude, not by finding winners, but by avoiding losers.”

-Fewer Losers, or More Winners? (September 12, 2023)

Marks describes bond investing as a “negative art.”

If you buy a bunch of 8% bonds, you know what your return is going to be if you hold them to maturity and none of them default.

You don’t need to find a superstar bond that will outperform, you just need to avoid the ones that default.

Dividend investing is similar.

You don’t need to find the next Amazon to get rich.

If you simply build a portfolio of quality companies and avoid the dividend cuts and bankruptcies, the survivors will take you where you need to go.

This is closely related to Munger’s idea of inversion.

4. “No Risk, No Reward” is a lie

“If riskier investments reliably produced higher returns, they wouldn’t be riskier!”

- Risk Revisited Again (June 8, 2015)

Investors tend to think that if they want to make more money, they just need to “take more risk.”

This is a dangerous trap.

Riskier investments must appear to offer higher returns, otherwise nobody would buy them.

But there is no guarantee those returns will actually materialize.

Taking risk doesn’t mean you’ll be successful, it just means the range of possible outcomes has become wider, or that the “bad” outcomes have become worse.

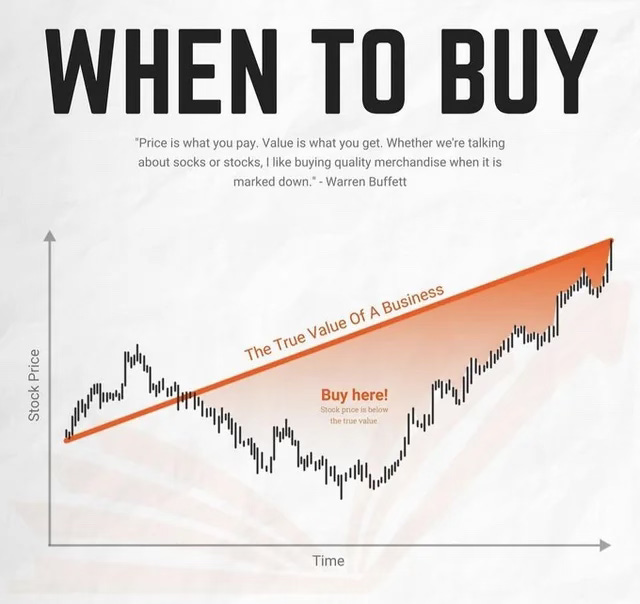

5. Risk is counterintuitive

“The riskiest thing in the world is the widespread belief that there’s no risk.”

- Risk Revisited Again (June 8, 2015)

When the market is booming and everyone is making easy money, people become less cautious.

They stop doing their homework and start chasing trends.

This is exactly when risk is at its highest.

On the other hand, when everyone is terrified and believes the world is ending, prices drop so low that the risk of losing more money actually decreases.

As Marks says, “it’s the price you pay that determines the risk.”

6. Survival is the only goal

“Never forget the six-foot-tall man who drowned crossing the stream that was five feet deep on average.”

- Risk Revisited Again (June 8, 2015)

In investing, you don’t just have to be right on average over 20 years.

You have to survive every single day along the way.

If you use too much leverage or take on too much risk at the wrong time, a temporary dip can “drown” you, even if the “average” outcome was positive.

Dividend investing is a great survival strategy because it focuses on the steady flow of cash.

Businesses that consistently generate cash and aren’t overleveraged don’t go bankrupt.

7. Risk control vs. Risk avoidance

“Risk avoidance usually equates to return avoidance.”

- The Indispensability of Risk (April 17, 2024)

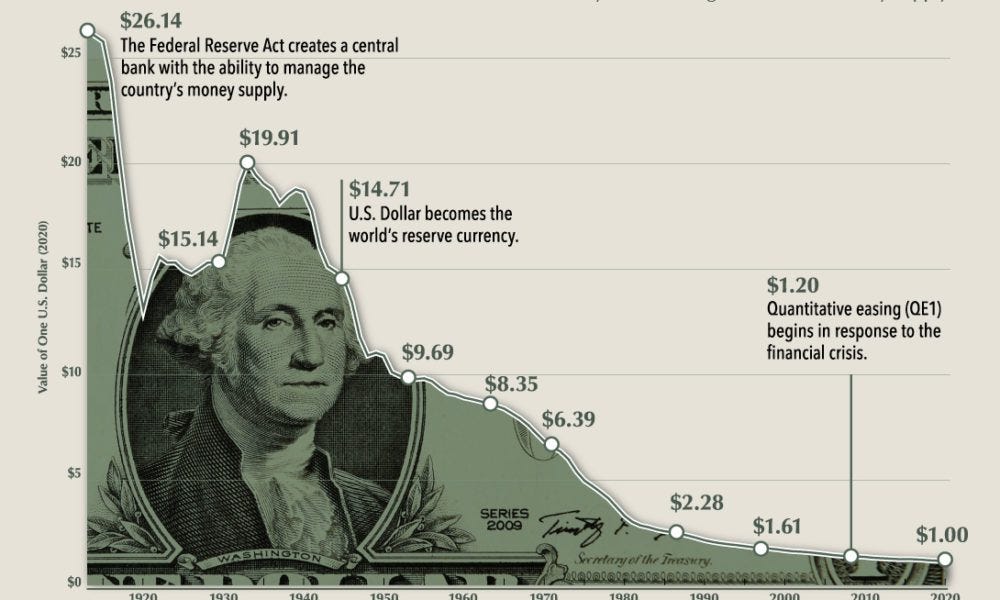

You cannot build wealth without taking some risk.

If you put all your money under a mattress, you avoid the risk of a market crash, but inflation destroys your purchasing power.

The goal is not to avoid risk, but to control it.

This means analyzing what can go wrong, diversifying your holdings, and making sure you are investing with a margin of safety.

Conclusion

As Charlie Munger said: “Investing is not supposed to be easy. Anyone who finds it easy is stupid.”

Invest long enough and some things won’t go your way.

But these 7 lessons will help you bear risk intelligently, which is the whole game.

One Dividend At A Time,

– TJ

Whenever you’re ready

Whenever you’re ready, here’s how I can help you:

✍️ Three articles per week (Monday, Wednesday, and Saturday)

📚 Full access to our entire library of data-driven articles

📈 An insight into our Portfolio full of interesting Dividend Stocks

🔎 Full investment cases about interesting companies

The doors for Compounding Dividends will reopen to a limited of people on the 24th of February.

You don’t miss it? And you also want to receive all the exclusive bonuses?

You’ll also immediately get a copy of my 10 favorite cannibal stocks when you do.

One Dividend At A Time

TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.

Cashflow is King.

It is like oxygen.

Trend and hypes can be fun but eventually it is about cashflow, to survive the day.