Warren Buffett is one of the best investors in the world.

$1 invested in Berkshire in 1965 is worth more than $1.2 million (!) today.

Buffett is known as a value investor, but his top holdings have one thing in common…

Dividends.

Warren Buffett’s Dividend Portfolio

Berkshire collected more than $4.5 billion in dividends last year from just 8 stocks:

Source: carbonfinance

Warren doesn’t pay dividends (yet) but he seems to enjoy receiving them!

Here’s what he said about Coca-Cola in his 2022 letter:

“The cash dividend we received from Coke in 1994 was $75 million. By 2022, the dividend had increased to $704 million. Growth occurred every year, just as certain as birthdays. All Charlie and I were required to do was cash Coke’s quarterly dividend checks. We expect that those checks are highly likely to grow.”

If you’d like to build an income stream like Buffett, you can follow his strategy.

Focus on buying companies with:

A competitive advantage

Stable cash flows

Growing dividends

Then, be like Buffett and hold them for a long time.

Your dividend payments will grow over time thanks to the power of compounding.

Let’s look at 8 of the companies that paid Berkshire dividends in 2023.

8️⃣ Citigroup

How does the company make money?

Citigroup is one of the largest banks in the United States and a major player in the global financial industry.

They make money by providing banking, credit cards, and investment services to consumers and corporations.

Why is it an interesting dividend stock?

Current dividend yield: 3.8%

Payout ratio: 58.3%

2-Year Forward Dividend Growth: 5.3%%

2–Year Forward Revenue Growth: 2.5%

Source: Finchat

7️⃣ Occidental Petroleum

How does the company make money?

Occidental Petroleum makes money by finding, producing, and selling oil and natural gas.

They also earn money from their chemicals business, carbon capture, and other sustainable energy solutions.

Source: Occidental Investor Relations

Why is it an interesting dividend stock?

Current dividend yield: 1.5%

Payout ratio: 8.7%

2-Year Forward Dividend Growth: 12.4%

2–Year Forward Revenue Growth: 4%

6️⃣ American Express

How does the company make money?

American Express issues credit cards and provides payment processing services for businesses.

They make money through fees charged for processing transactions and from interest and fees on credit card accounts.

Why is it an interesting dividend stock?

Current dividend yield: 1.2%

Payout ratio: 19.4%

2-Year Forward Dividend Growth: 11.6%

2–Year Forward Revenue Growth: 9%

Source: Finchat

5️⃣ Kraft Heinz

How does the company make money?

Kraft Heinz makes money by making and selling packaged food and beverages.

In addition, they collect royalties from licensing their iconic brands like Oscar Mayer and Jell-O.

Source: Money

Why is it an interesting dividend stock?

Current dividend yield: 3.8%

Payout ratio: 58.3%

2-Year Forward Dividend Growth: 5.3%

2–Year Forward Revenue Growth: 2.5%

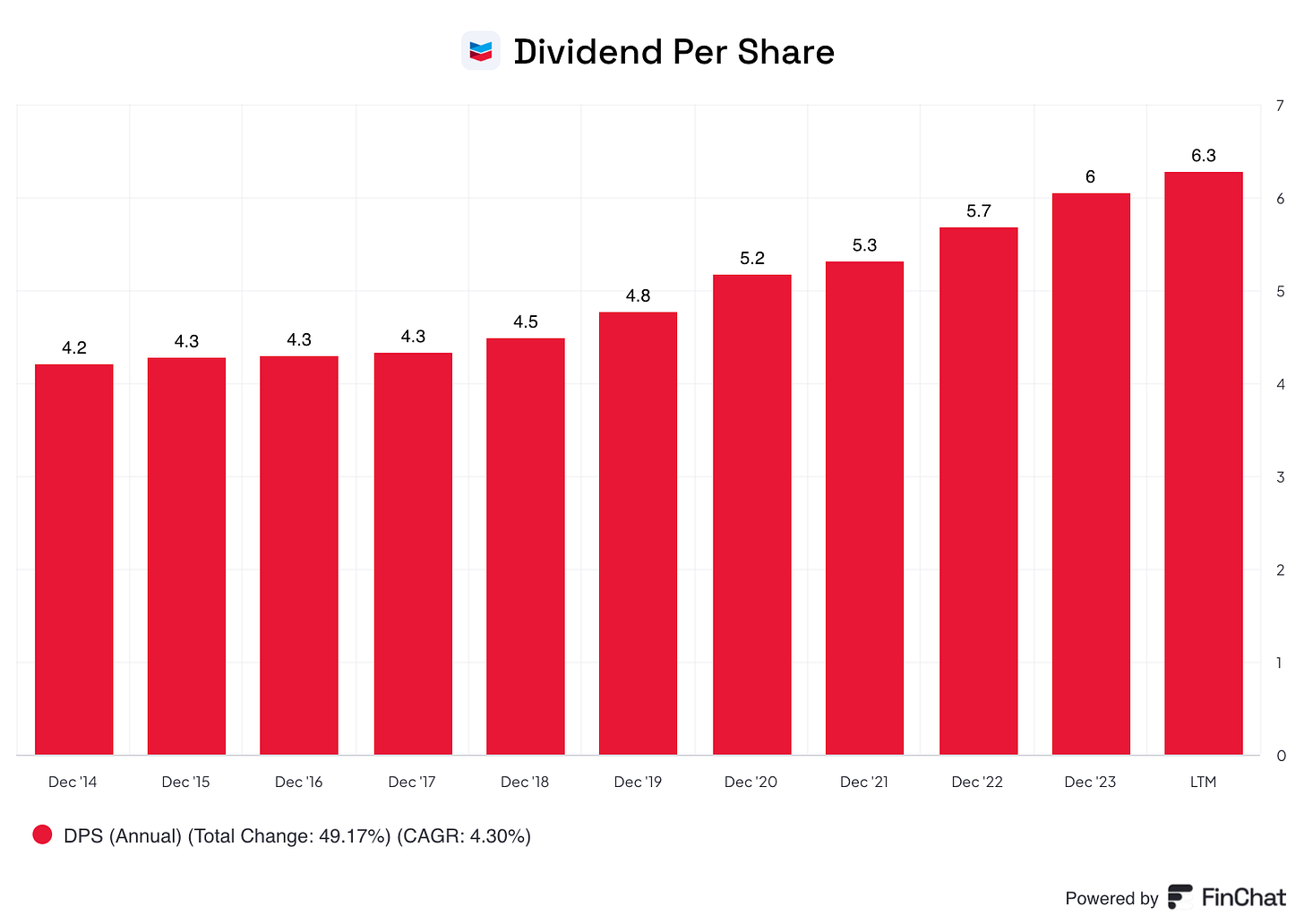

4️⃣ Chevron

How does the company make money?

Like Occidental, Chevron makes money by finding, producing, and selling crude oil and natural gas.

Unlike Occidental, Chevron also participates in transporting, storing, refining, and marketing petroleum products like gasoline, diesel, and jet fuel.

Why is it an interesting dividend stock?

Current dividend yield: 4.5%

Payout ratio: 62%

2-Year Forward Dividend Growth: 6.6%

2–Year Forward Revenue Growth: -0.25%

Source: Finchat

3️⃣ Coca-Cola

How does the company make money?

Coca-Cola is one of the best-known brands in the world.

They make money by making and selling beverage concentrates and syrups to bottling partners, selling beverages directly to consumers, and by licensing their brands.

Why is it an interesting dividend stock?

Current dividend yield: 2.8%

Payout ratio: 76.6%

2-Year Forward Dividend Growth: 5%

2–Year Forward Revenue Growth: 2.7%

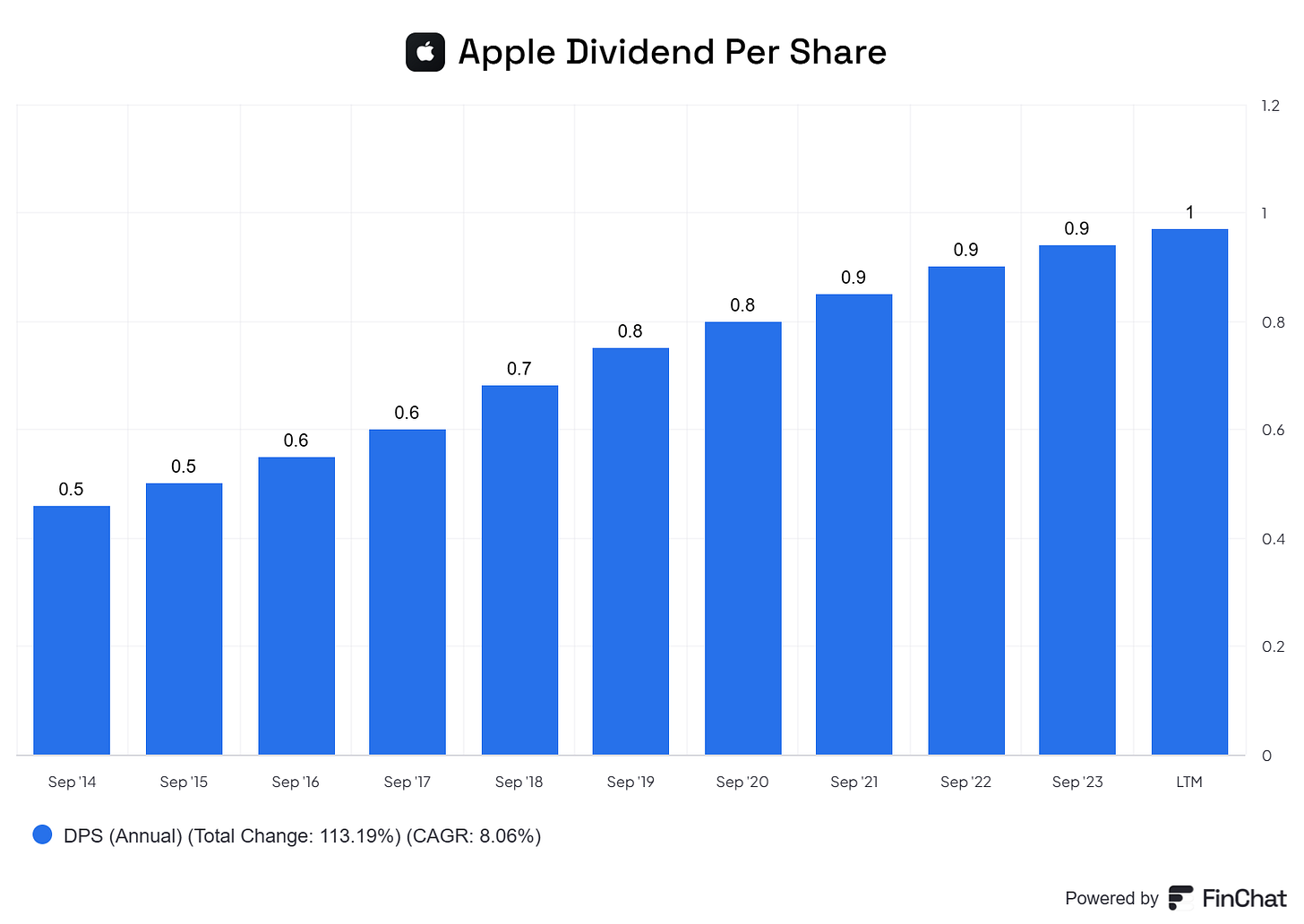

2️⃣ Apple

How does the company make money?

Apple makes money by creating and selling consumer electronics like the iPhone, Mac computers, and wearables like the Apple Watch.

They also earn money from services and subscriptions like the App Store, Apple Music, Apple TV+, iCloud storage, and Apple Pay.

Why is it an interesting dividend stock?

Current dividend yield: 0.47%

Payout ratio: 14.7%

2-Year Forward Dividend Growth: 5.1%

2–Year Forward Revenue Growth: 4.5%

Source: Finchat

1️⃣ Bank of America

How does the company make money?

Bank of America is one of the largest banks in the U.S.

They make money from interest on loans and mortgages and fees from banking services like credit cards, investment management, and transaction processing.

Source: Bank of America Investor Relations

Why is it an interesting dividend stock?

Current dividend yield: 2.7%

Payout ratio: 33.5%

2-Year Forward Dividend Growth: 8.3%

2–Year Forward Revenue Growth: 3.9%

Conclusion

Buffett’s strategy isn’t complicated, but it does require patience.

Buy companies with strong competitive advantages.

These businesses can consistently grow earnings and dividends over time.

Then, let the power of compounding build you a reliable and growing income stream - just like Buffett.

Here are the 8 dividend stocks Warren Buffett owns:

Citigroup

Occidental Petroleum

American Express

Kraft Heinz

Chevron

Coca-Cola

Apple

Bank of America

That’s it for today

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Well done! 👍

A couple interesting notes to consider about these dividend paying companies.

First, look at the payout ratios. They are very reasonable. Coca-Cola's may seem high but the company has a strong moat around its brand and the revenues are reliable. It can support the dividend. Occidental Petroleum has a very, very low payout ratio. Earnings could be cut a in half a couple times before the payout ratio become dangerously high.

Second, your dividend chart goes back 10 years but the dividend growth goes back even further. Seeking Alpha shows Coca-Cola dividend growing from as far back as 1989. During that time the company has survived all sorts of economic storms, booms, crashes, etc.

Third, I think crafting your own dividend portfolio like Warren Buffett did is not difficult to do. I think it would be possible to apply many of the sames qualitative and quantitative metrics from Compounding Quality to Compounding Dividends. An investor would still want a company with an economic moat with strong financials and is foundational to modern society. A lousy company can't sustain, let alone grow, a dividend. Rather than buy into a dividend focused ETF, cherry pick 5 - 8 companies, maybe 1 or 2 CEFs, 1 or 2 investment grade bonds, and park some cash in a money market account. Done right, you will have a wonderful dividend portfolio!