💸 8 High Yield Stocks

Today is Dividend Day.

The series where I teach you 5 things about dividend investing in less than 5 minutes.

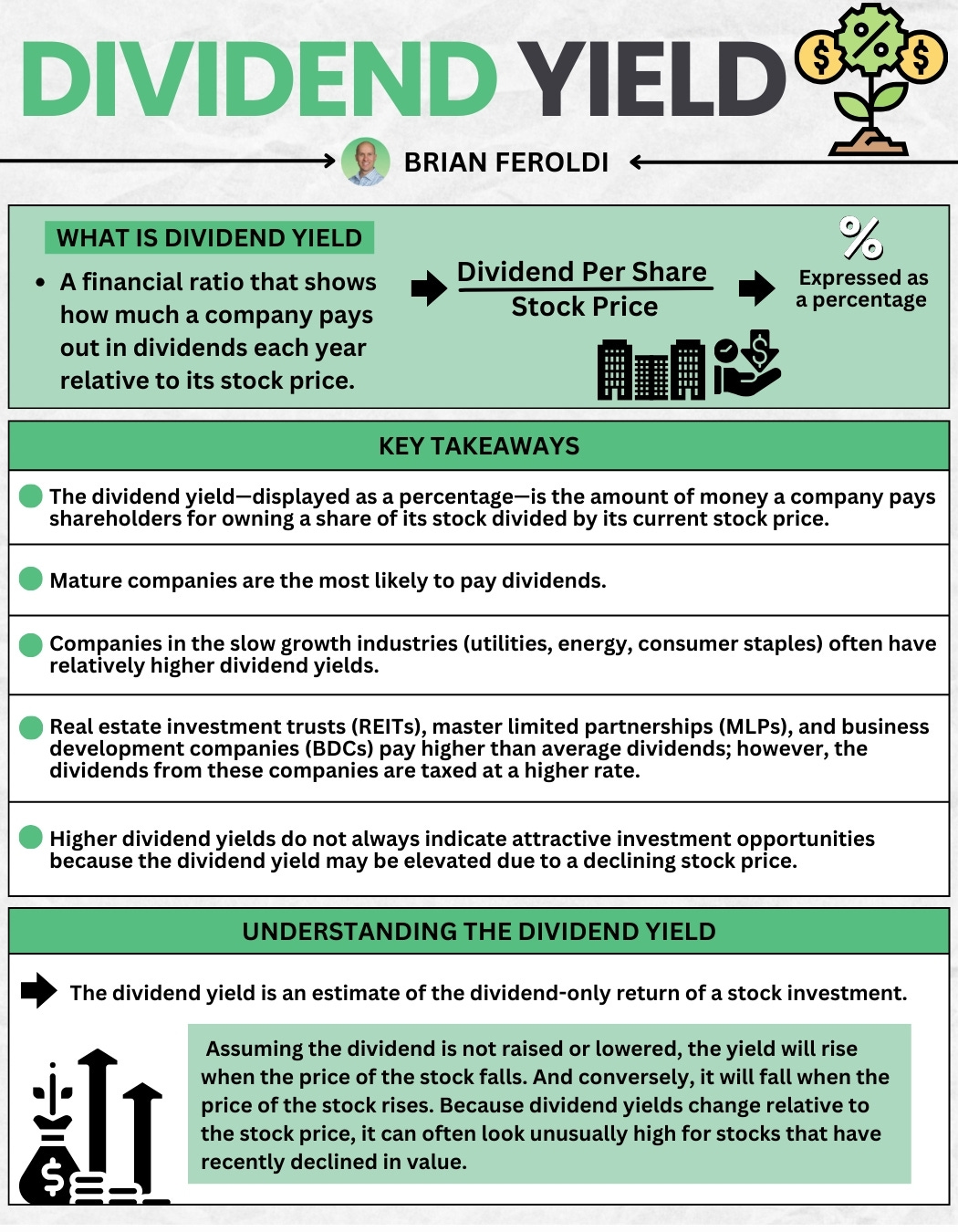

1️⃣ Dividend Yield Explained

Dividend yield is a critical metric to understand.

This visual from Brian Feroldi explains it simply.

It’s calculated as Dividend Per Share / Stock Price.

Yield shows you the return you can expect from the dividend payout, but it can also be used as a valuation metric.

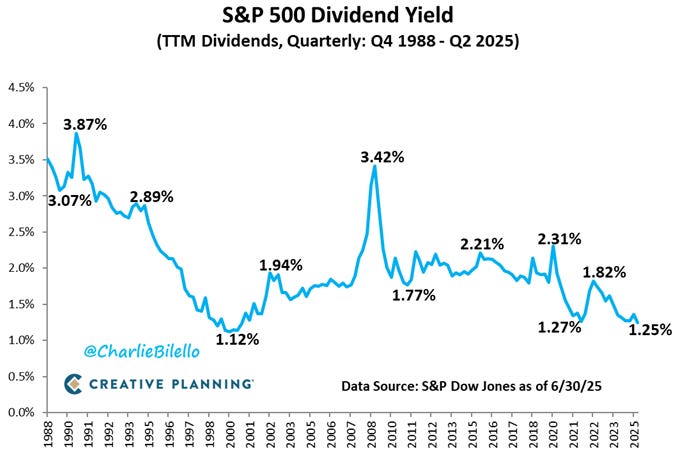

2️⃣ S&P 500 Dividend Yield

A higher stock price will lead to a lower dividend yield, and a lower stock price will lead to higher dividend yield.

The S&P 500 currently has a low dividend yield of 1.25%.

This is an indicator that U.S. stocks look expensive.

3️⃣ An Investing Quote

John Bogle, the founder of Vanguard and father of index funds, built his career reminding investors to focus on the long term.

He believed most of Wall Street’s noise was a distraction from what actually matters.

Here’s one of his timeless reminders:

The market is often stupid, but you can't focus on that. Focus on the underlying value of dividends and earnings.

-John Bogle

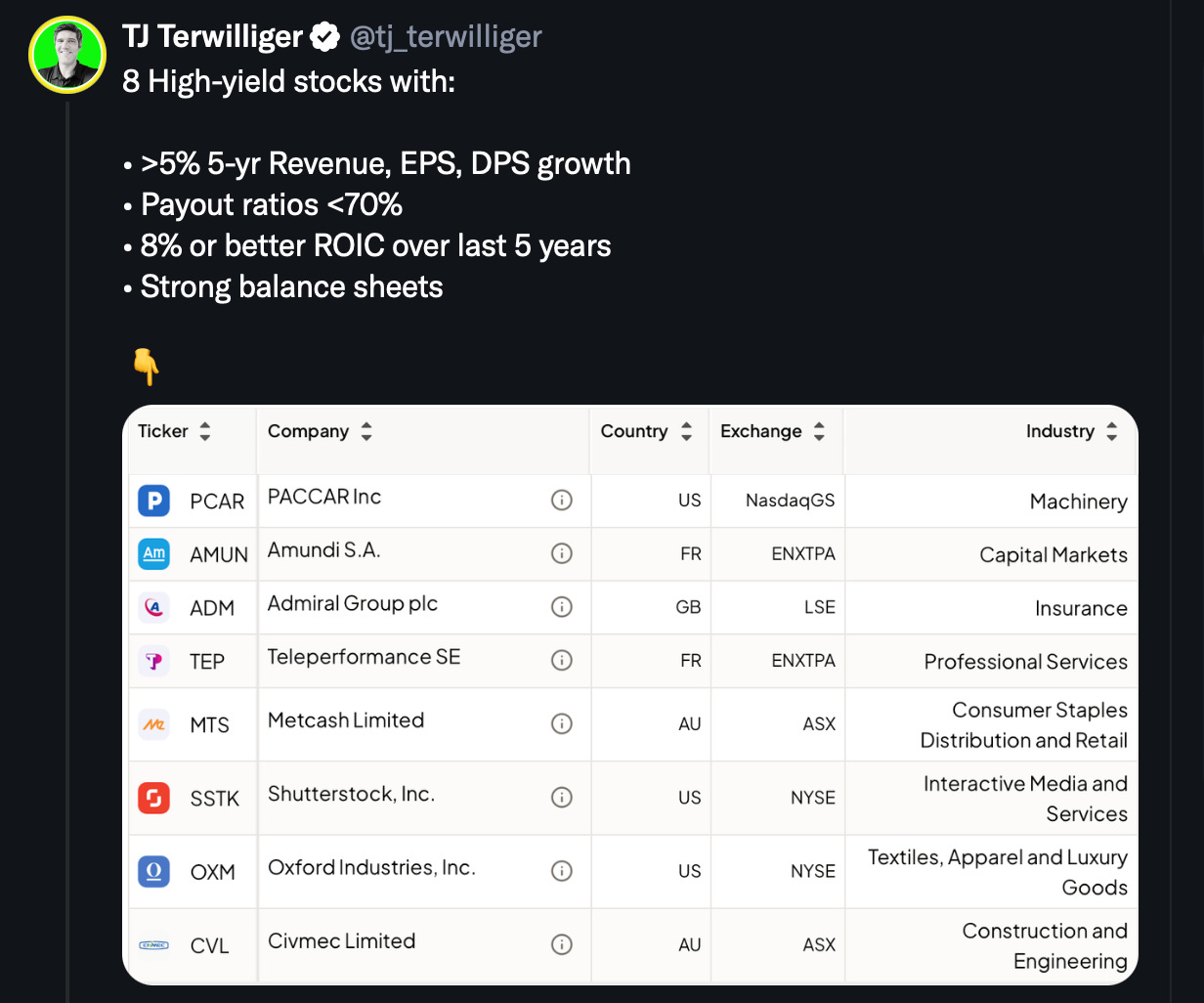

4️⃣ 8 High Yield Stocks

I ran a screen for stocks yielding 3.7% or higher with histories of growth, good ROIC, and solid balance sheets.

Here are the only 8 that met my criteria.

You can find the whole thread on my X profile.

If you don’t have X, click the link in the caption to see the thread.

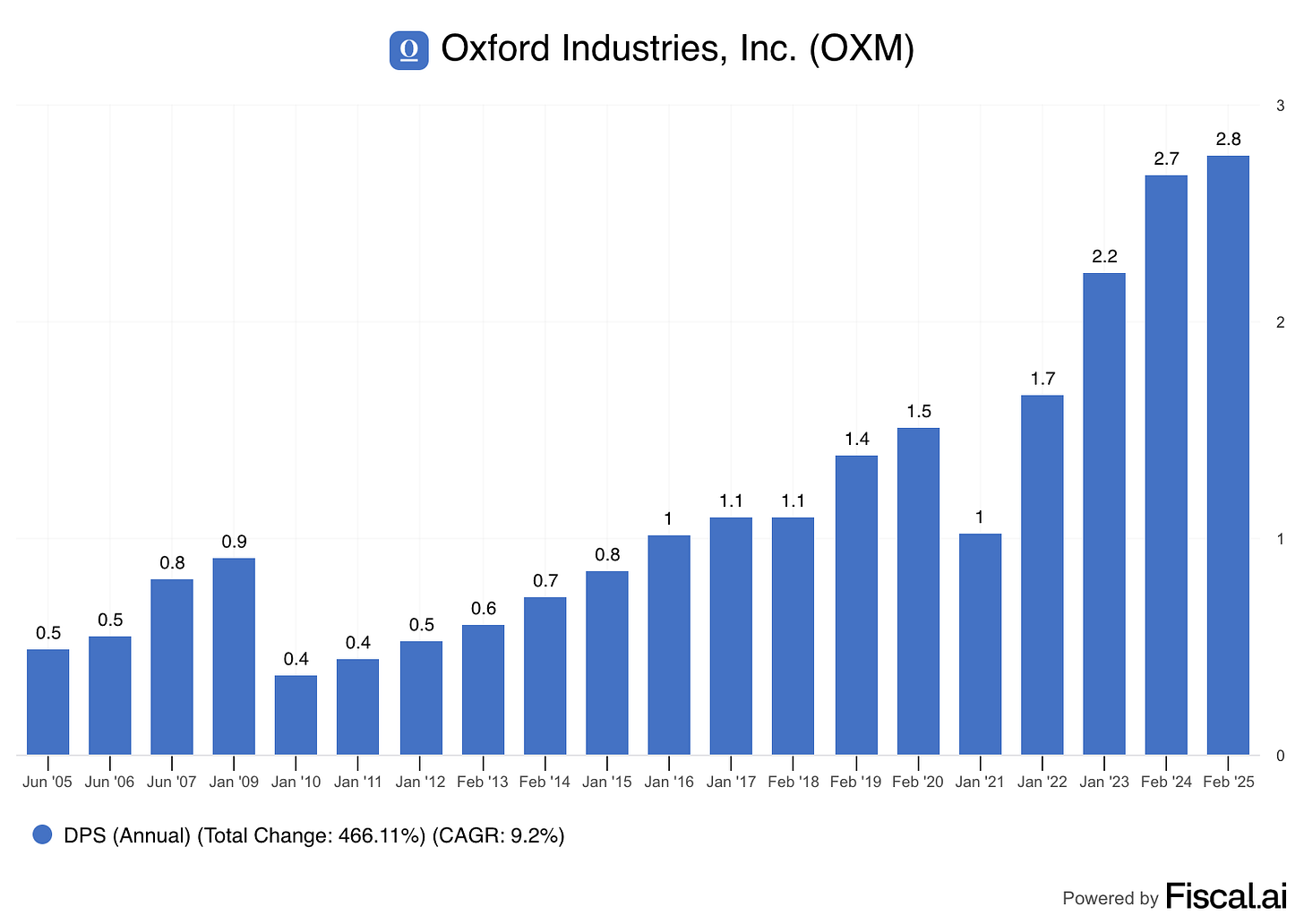

5️⃣ Example of a Dividend Stock

Here’s one from my screener: Oxford Industries is a clothing company best known for owning Tommy Bahama, Lilly Pulitzer, and Southern Tide.

They sell higher-end, lifestyle-focused apparel that caters to vacation, resort, and coastal living.

The business makes money through retail stores, online sales, and wholesale partnerships.

Profit Margin: 5.3%

Forward PE: 15.0x

Dividend Yield: 6.5%

Payout Ratio: 52.0%

That’s it for today!

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data