An Update on PayPal

While I love investing, every once in a while it’s important to step away from the noise, and find time to think.

I like to do that outside, so this week I took my dog grouse hunting.

If you’re not familiar with them, grouse are birds that live mostly on the ground in very thick cover - picture the sections of the woods that are so thick with trees and thorns that you can’t imagine trying to walk thorough them.

Hunting them means walking miles through that nasty, thick cover and trying to flush one.

There can be long stretches where nothing happens, then things get exciting very quickly.

If you’ve never seen, or heard a grouse flush, it’s like an explosion, loud and over very quickly.

Grouse hunters measure success in flushes per hour. Notice it’s not birds bagged - they have a unique ability to make hunters look like terrible shots, and often very silly. One of the best ways to get one to flush is to do something like tie your shoe.

We flushed 1.25 birds per hour, but of course, that’s not the whole story.

80% of our flushes happened in less than an hour.

Investing can be like grouse hunting - long stretches where nothing happens, then everything seems to happen at once.

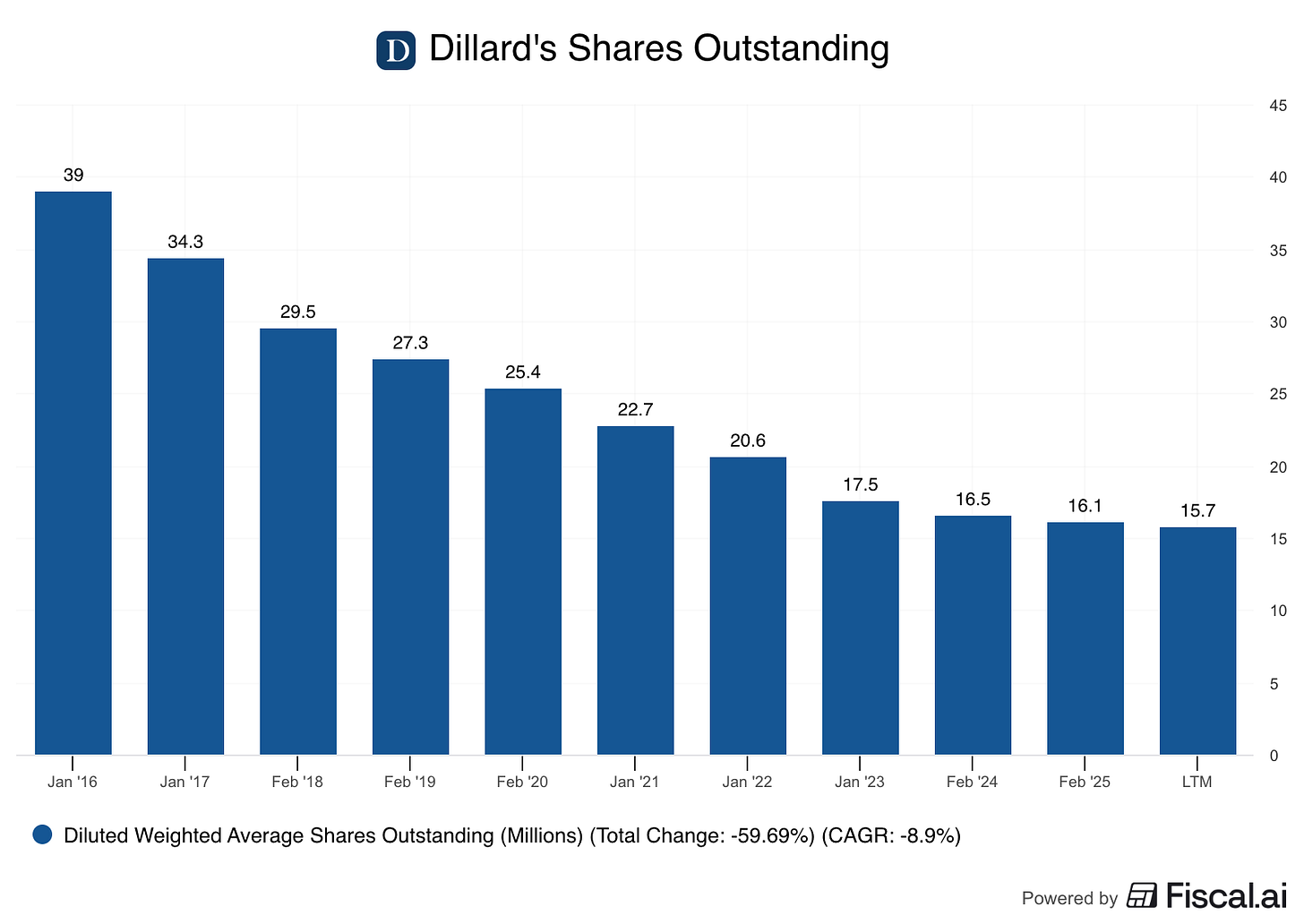

Dillard’s

Dillard’s is an upscale department store chain - it’s returned 28% per year over the past 9 years, but of course that’s not the whole story.

Dillards was the same price in January 2021 as it was in January 2016 - 5 years of no return.

Since then it’s a 10-bagger.

What’s Dillard’s have to do with PayPal?

It’s a cannibal stock.

It traded flat for a long time, and management bought back shares at low valuations.

By 2021, the share count was nearly cut in half.

Combine that with a shift in sentiment around the company and you get a long period where nothing happened, then everything happened at once.

PayPal Update

Back in March, we bought PayPal as a Cannibal Stock.

The price has declined, but has the business gotten worse?

Let’s take a good look at PayPal and see if our thesis was wrong, or if Mr. Market is just too distracted by AI to notice what PayPal is doing.

Original Investment Thesis:

Paid partners got a full 32 page investment case.

Here’s a summary:

PayPal operates a massive two-sided network (including both merchants and consumers) this gives it a major data advantage which means PayPal has conversion rates and services that other competitors cannot match

PayPal operates in the attractive digital payments market expected to grow by over 11% annually.

The company didn’t pay dividends (it does now!) instead, using all of its FCF (which grew over 15% annually in the past decade) for massive share buybacks.

With the $20 billion authorized at the time of the investment, PayPal could have bought back about one-third of its market cap at current prices.

The company’s valuation looked very cheap, with the market pricing in only a 1.2% FCF growth rate.

Things to Check On

Re-reading the investment case, I found a few things that we should check in on to make sure our thesis is still on track.

Fastlane Checkout

This product was only rolled out to 30% of the U.S. and wasn’t available internationally.

Let’s look at how it’s expanded and if it’s maintained its 50% improvement in guest checkout conversion rates.

How’s Fastlane Doing Today?

I would say very well.

As of June, 50% of small business cusotmers were using PayPal Complete Payments which includes Fastlane.

PayPal has also partnered with Adyen to offer Fastlane on their platform:

As well as Global Payments:

To me, this is solid proof of PayPal’s data advantage - these companies don’t have the data needed to build a competing product themselves, so they partnered with PayPal.

The Advertising Platform

New General Manager Mark Grether’s goal is to build a massive advertising business.

This is the guy that built Uber’s ad business, which today does well over $1 Billion in revenue.

I think PayPal gives him an even better platform to build an advertising business on.

Think about what he’s got to work with:

400 million global consumers

30 million merchants that accept the PayPal button

Covering 25% of all e-commerce transactions globally

With 26+ billion annual transactions

PayPal knows what you’re shopping for, where you’re shopping for it, what you’ve bought in the past, and who you bought it from.

This is still a massive opportunity, but we don’t have a lot of data on it yet.

One thing we do know that PayPal rolled out ads in the UK.

Venmo Monetization

Venmo has historically been undermonetized compared to PayPal. Alex Chriss and the new management team want to change that.

This is another big opportunity because Venmo users tend to be more affluent than the average PayPal user.

How’s Venmo Monetization Going?

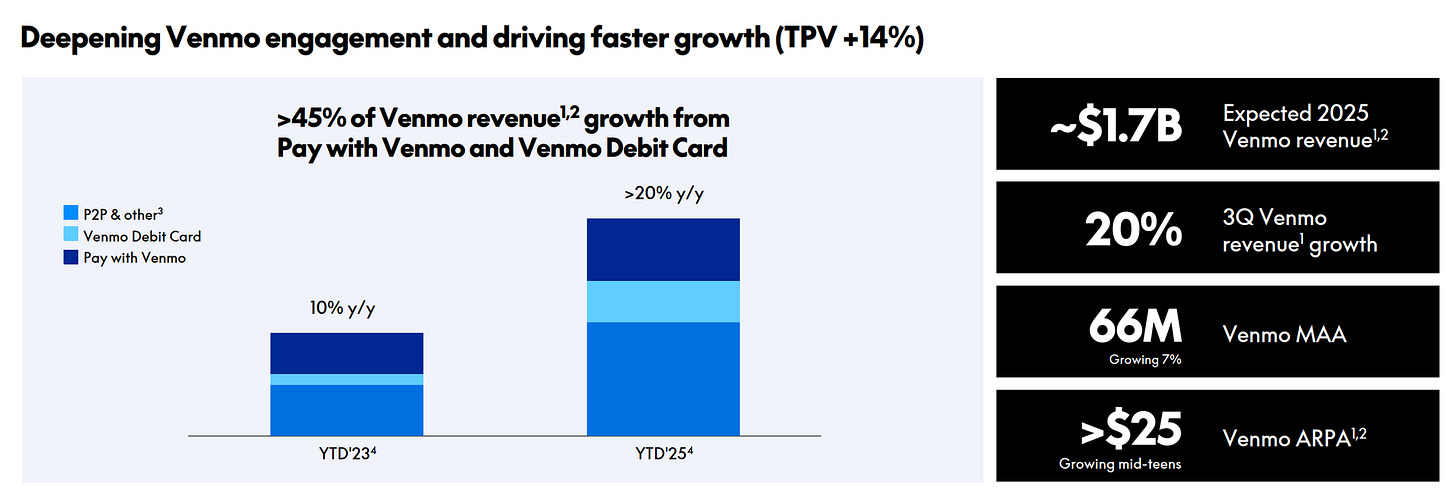

In the third quarter this year, Venmo revenue was up more than 20% and Total Payment Volume grew 14%.

Most of that revenue growth came from Pay with Venmo (which did $1 billion in payments in September 2025 alone) and the Venmo Debit Card (which attracted 1 million first-time users in Q3).

At a conference on Wednesday, Alex Chriss said that Pay with Venmo volume is growing 40%, and the debit card volume is up 65%. Venmo is on track for more than $2 billion in revenue in the near term and is estimated to have the potential for a long-term Average Revenue Per Account of 4-5x the current level.

Buybacks

This is the reason we bought PayPal in the first place - because it was returning a lot of capital through buybacks at very attractive valuations.

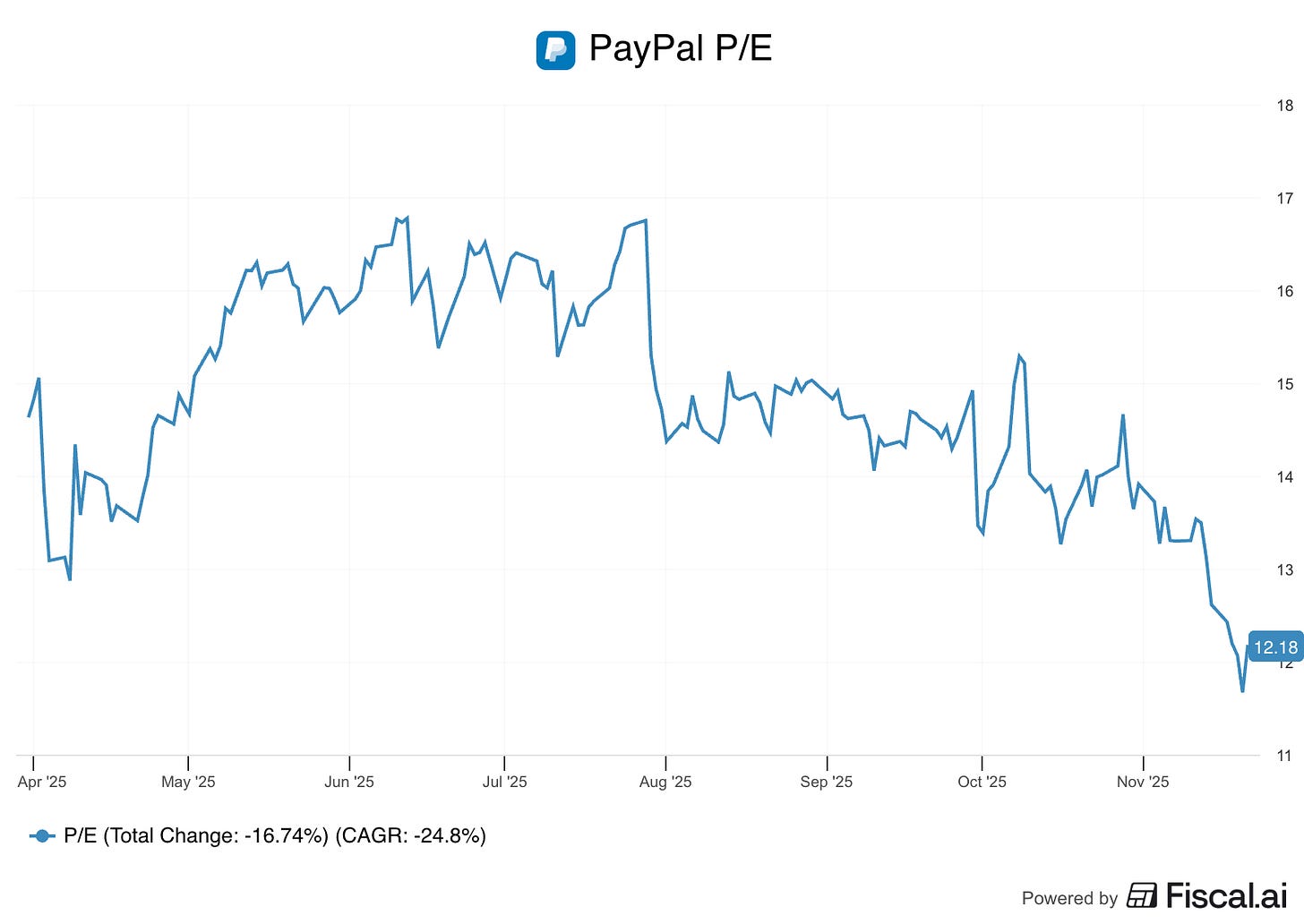

PayPal was at a P/E of 17 when we bought it.

How Are the Buybacks Going?

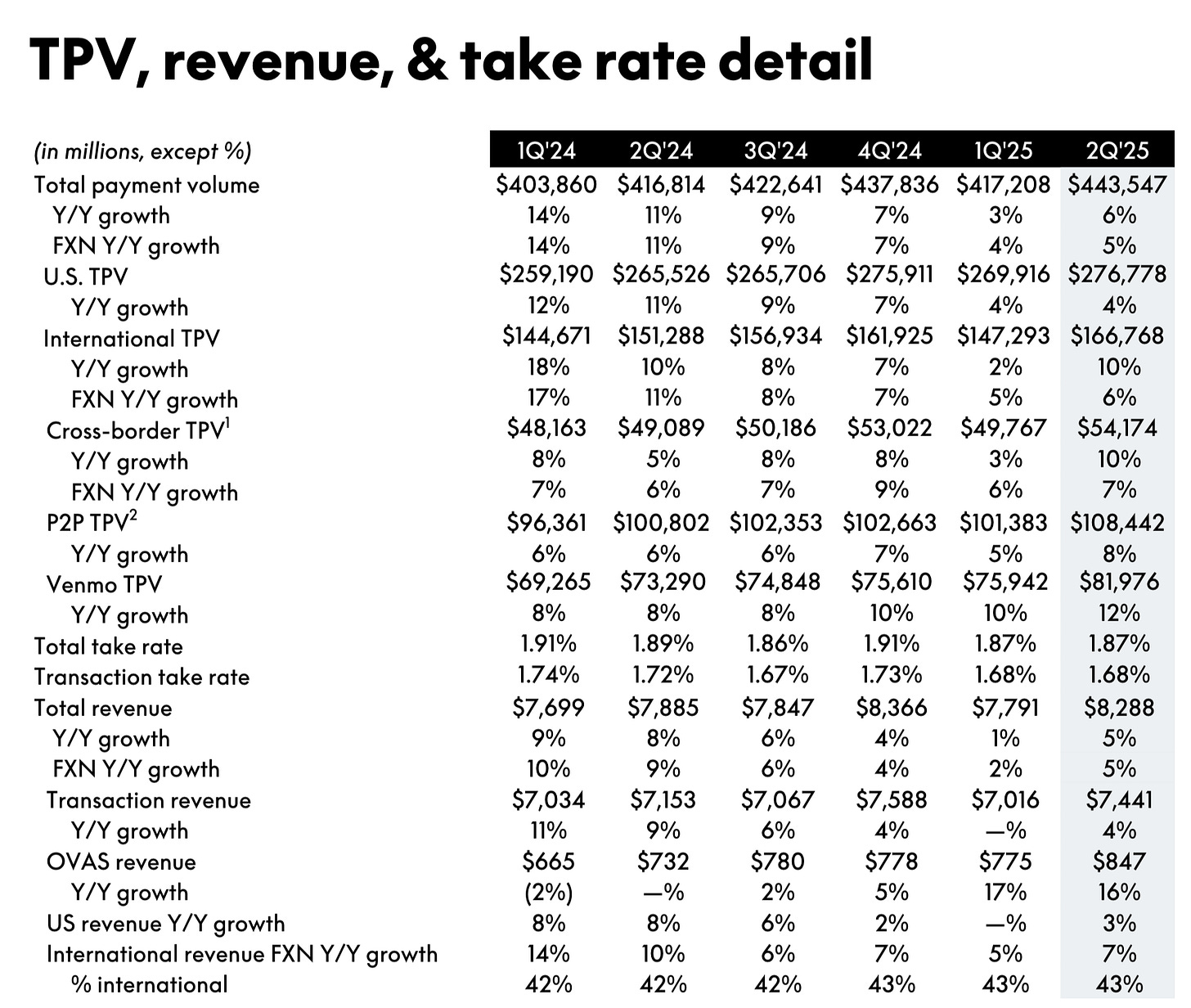

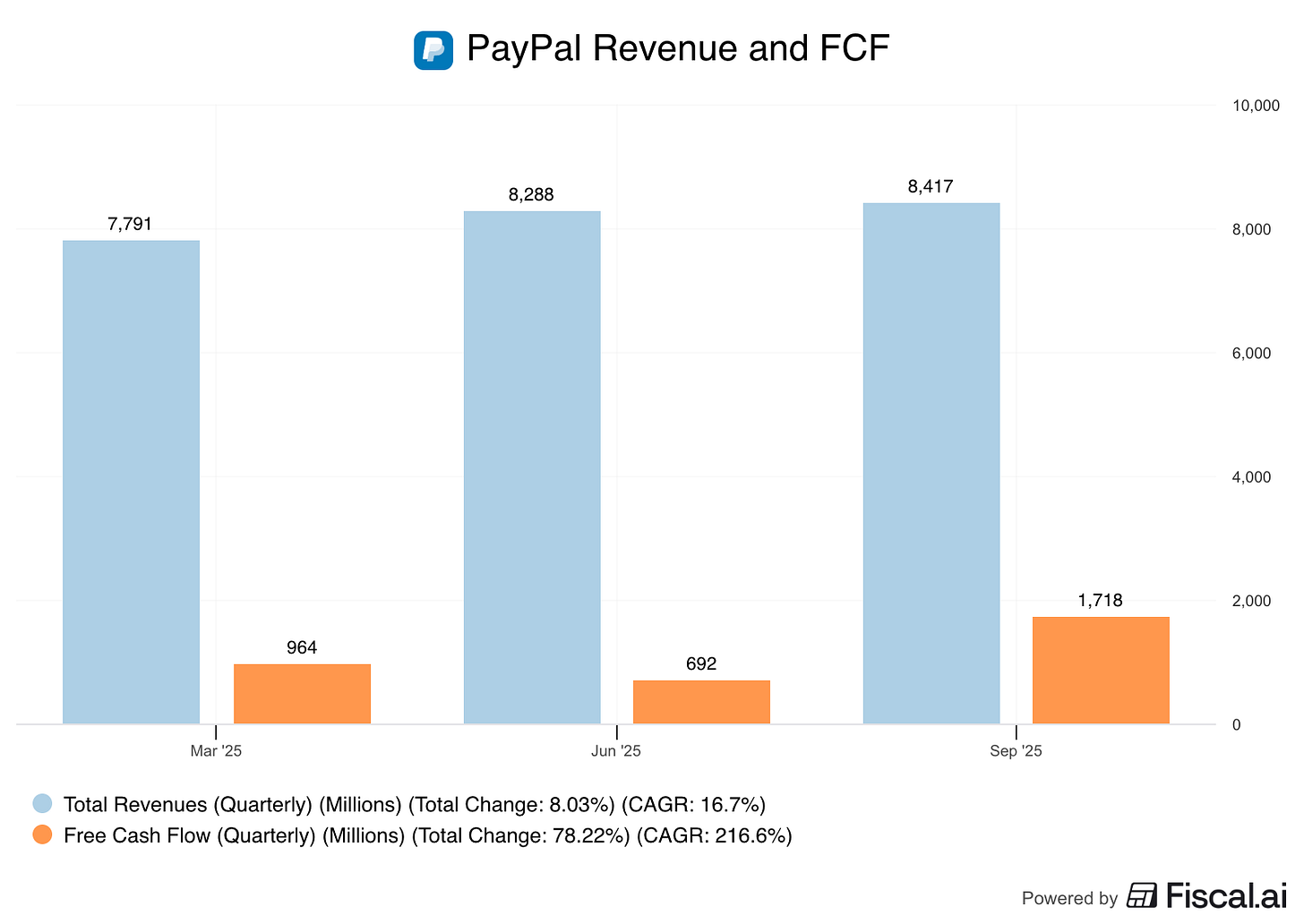

Since we bought PayPal it has continued to grow Revenue and Free Cash Flow.

But it’s even cheaper now.

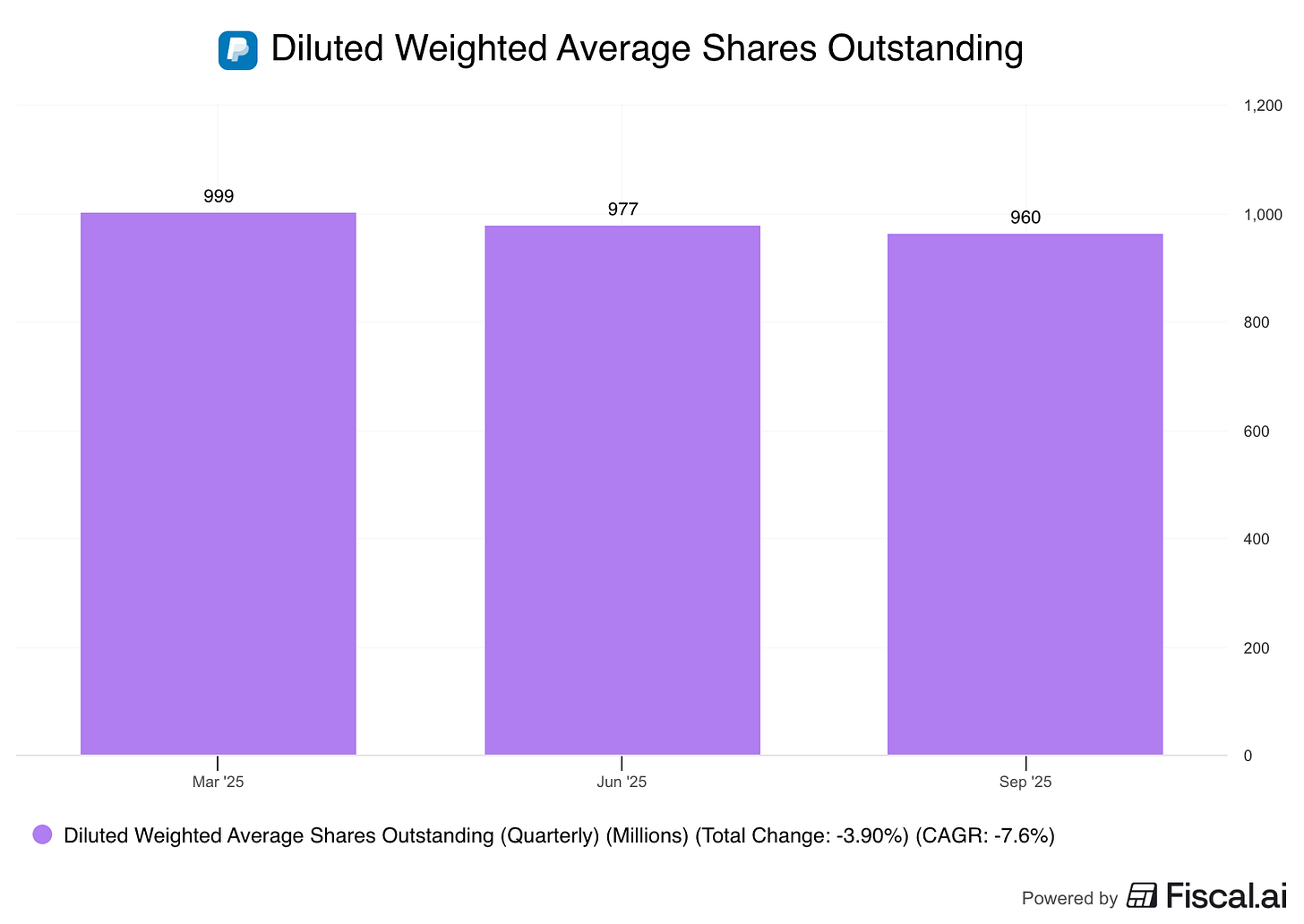

The company continues to buy back shares at an impressive rate.

Since March, they’ve shrunk the share count by nearly 4%.

That means we now own 4% more of PayPal than we did when we first invested in the company.

Risks

Let’s check on PayPal’s risks - the main things concerning the market are competition and user growth.

Let’s look at PayPal’s user metrics and activity first.

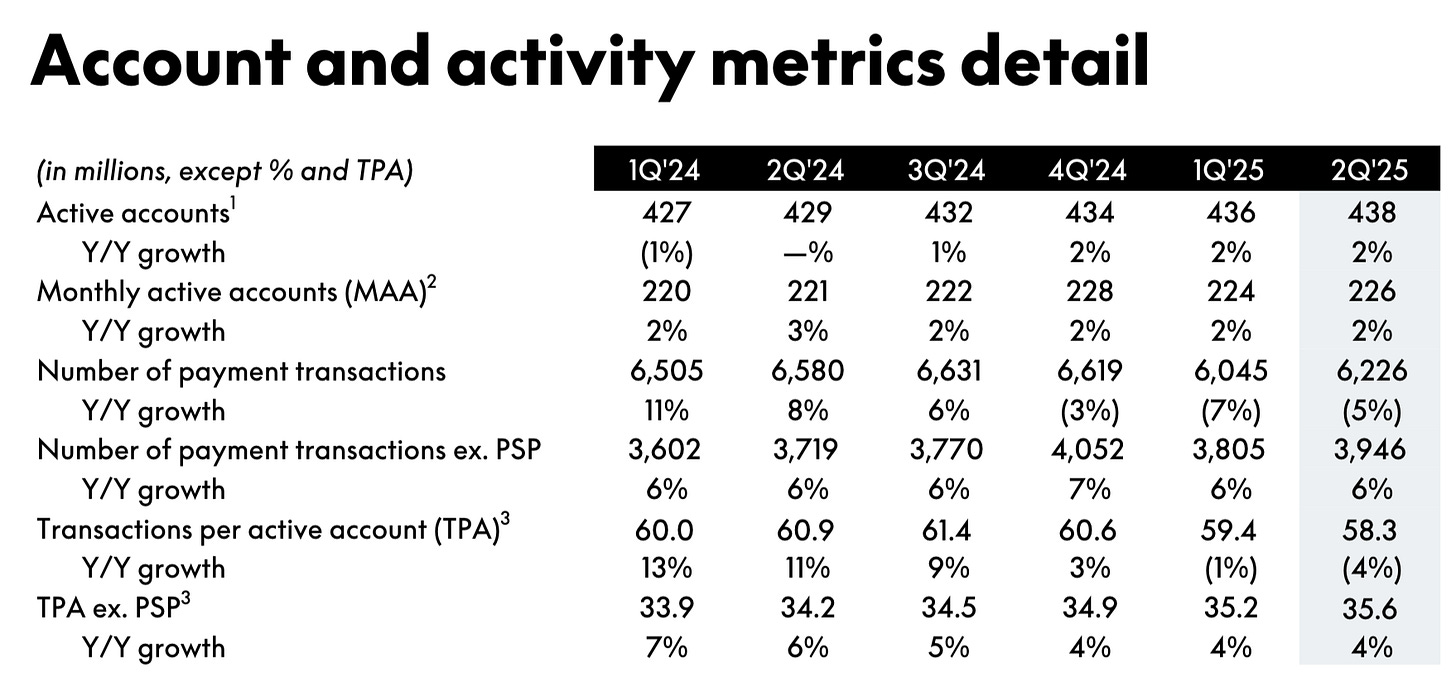

Active accounts are growing - that’s a good sign!

But payment transactions and transactions per active account are down, does this mean people are using PayPal less?

Looking at the ex. PSP lines tells us that the answer is no.

PSP stands for Payment Service Provider - which is mainly PayPal’s Braintree business. Previous management was targeting payment volume growth here, and got some of it by charging very low prices.

The new management team is intentionally reducing the unprofitable accounts, and raising prices.

That focus on profitability is what’s lowering transactions and TPA numbers.

Other good news?

Total payment volume continues to grow and PayPal’s take rates look to be stabilizing.

Other New Programs

PYUSD Loyalty Program (April 2025)

PayPal and Venmo users who hold the PayPal USD digital dollar (PYUSD) are getting a new rewards program to encourage them to use digital currency for shopping and sending money.

PayPal World (July 2025)

This is another initiative that I think has a lot of potential, and something only PayPal could have done. This is a worldwide platform connecting huge payment systems and digital wallets (like Mercado Pago, UPI, and WeChat Pay) to serve nearly 2 billion people. This lets users send money internationally and shop without paying currency conversion fees. In addition, it instantly opens up the entire PayPal merchant ecosystem to every Venmo user.

Partnership with Google for Agentic Commerce (September 2025):

PayPal is partnering with Google to let merchants use a personalized AI sales associate to help customers find what they want, then check out using PayPal.

Partnership with OpenAI for Payments in ChatGPT (October 2025):

PayPal is integrating with OpenAI to allow users to make purchases and payments directly within the ChatGPT platform.

PayPal Relaunch in the UK with PayPal+ (November 2025):

The UK will be the first country to get the completely new PayPal experience.

Management says this combines online and in-store payments and includes PayPal’s first free loyalty program (PayPal+) with rewards and greater shopping flexibility.

This includes 10x rewards points for using PayPal’s Debit Card, and gives people Buy Now Pay Later access to in-store purchases.

This just rolled out so we’ll have to see how it develops.

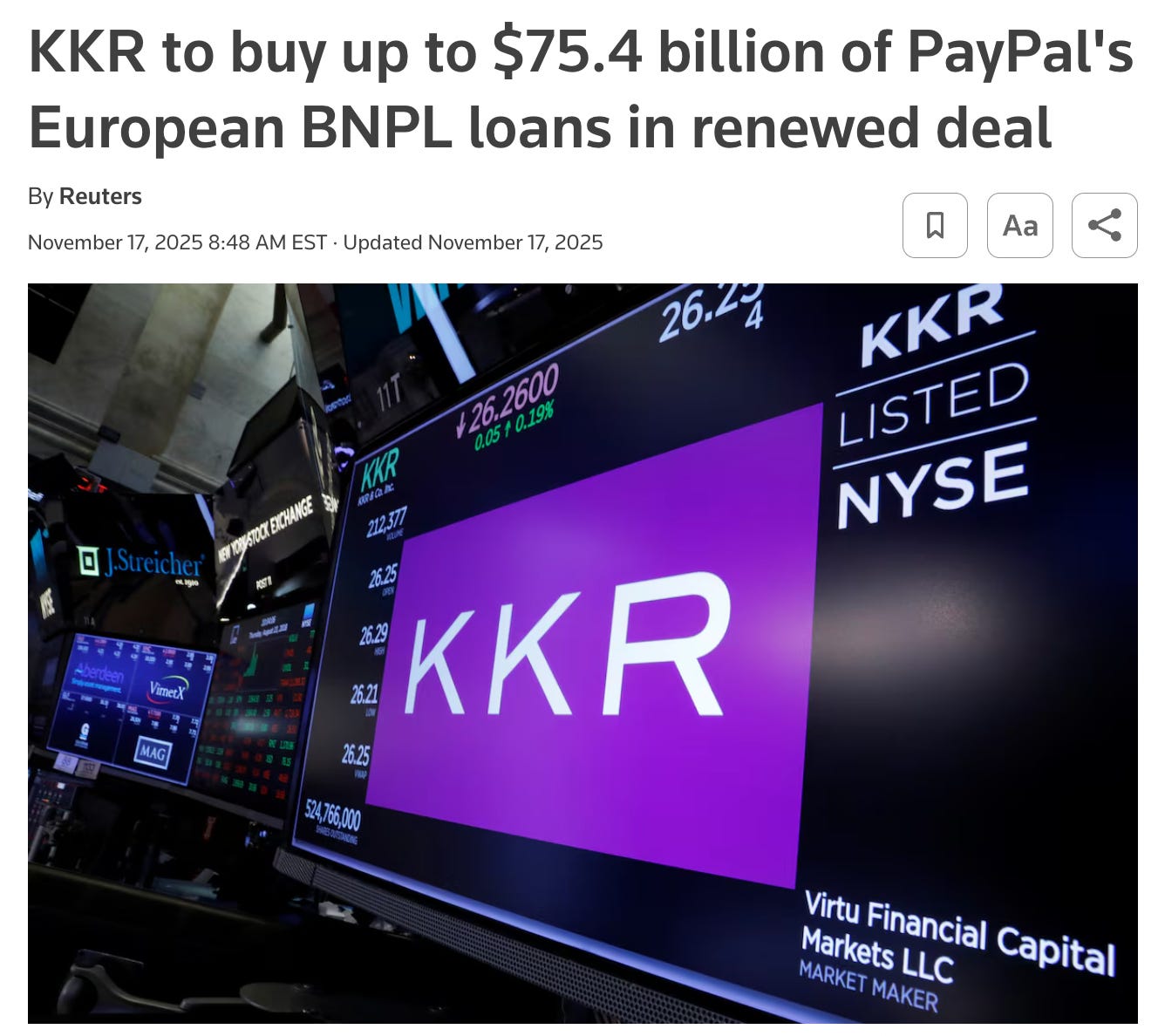

Buy Now Pay Later:

CEO Alex Chriss said that PayPal is seeing a generational shift with younger customers preferring it over credit cards. PayPal’s BNPL product has a high Net Promoter Score (NPS) of over 80 and is on track for a $40 billion volume business this year. They’re also moving the BNPL option upstream to the product page, which is expected to increase conversion by 10%.

In other news, KKR has agreed to buy $75 billion of PayPal’s European loans. Which means PayPal gets to originate the loans, then sell them to KKR getting them off PayPal’s books and converting them immediately into cash.

Recent Concerns

At the same conference Alex Chriss made the remarks about Venmo’s growth, a few new concerns came up as well.

Slow Branded Checkout Upgrades: Upgrading the core PayPal button (branded checkout) is taking much longer than expected. This is due to many years of complex, inconsistent merchant integrations. The delay means a slower recovery in the company’s core online business.

Macroeconomic Weakness: The company is seeing a slowdown in consumer discretionary spending across the U.S. and Europe. This weakness is most pronounced in the middle-to-lower income brackets.

Growth Investments: Management is choosing to invest heavily in growth areas (Agentic Commerce, BNPL) in 2026. This spending is a direct headwind to transaction margin dollar growth in the short term, prioritizing future wins over immediate bottom-line results.

Normally growth investments are something we like to see, but Chriss admitted that he has “no idea” when Agentic AI volume will scale up to translate to revenue.

Is PayPal Still a Great Investment?

Paid partners get a full update of the PayPal investment case, including updated valuations and expected returns.

Don’t miss out.

Become a partner here.

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.