👋 Howdy Partner,

Today we’re taking a look at Agree Realty Corporation.

It’s a U.S. real estate investment trust specializing in owning and developing retail properties leased to major national and regional tenants across necessity-based and e-commerce–resistant sectors.

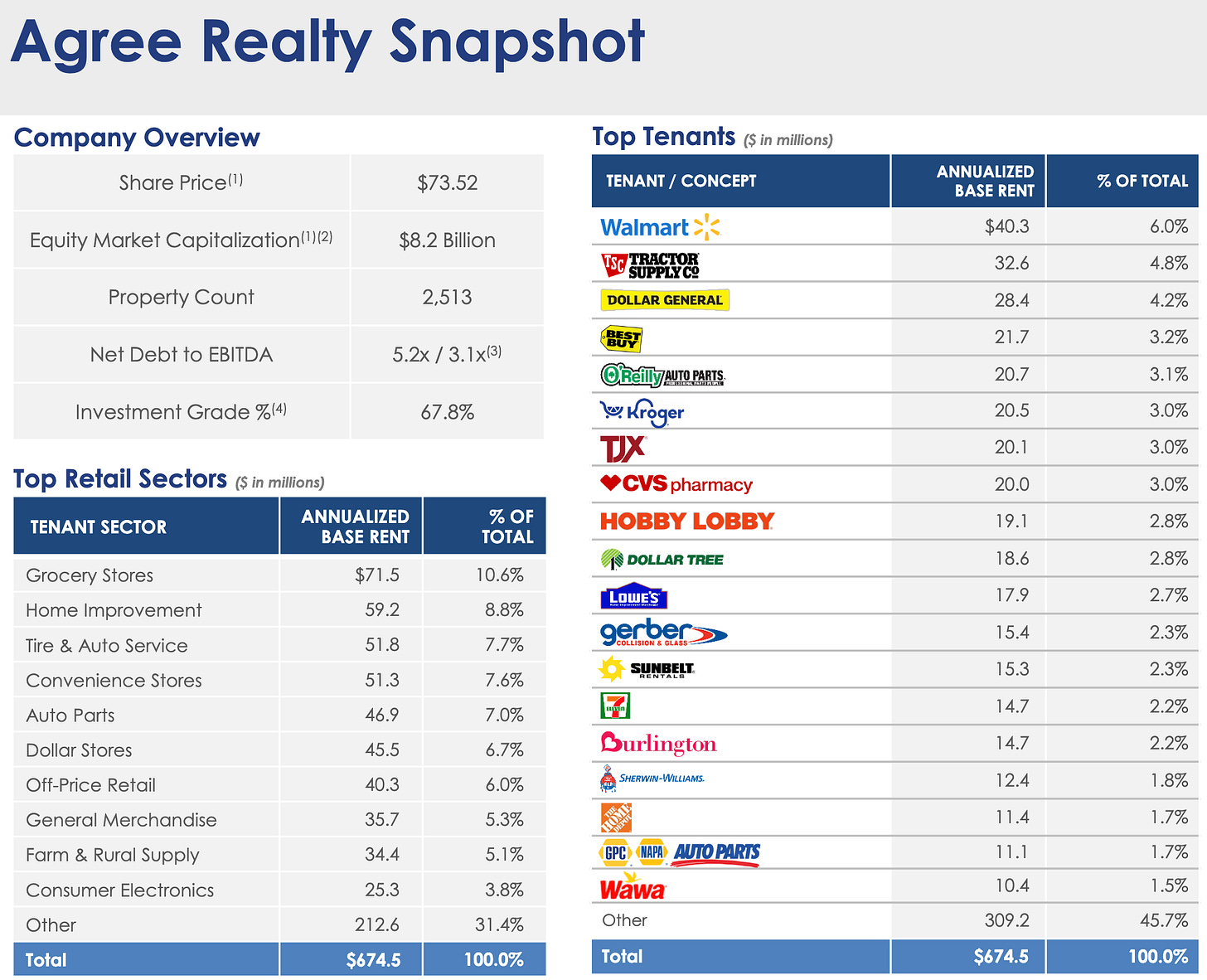

They focus on essential retailers like Walmart, Dollar General, and CVS.

Agree has grown steadily over the past decade, with strong management, reliable tenants, and a solid balance sheet. On top of that, it pays its dividend monthly, which is always a nice bonus for income investors.

General information:

🏪 Company name: Agree Realty Corporation

✍️ ISIN: US0084921008

🔎 Ticker: ADC 0.00%↑

📚 Type: Dividend Growth Stock

📈 Stock Price: $72

💵 Market cap: $7.9 billion

📊 Average daily volume: $78 million

Agree Realty is a REIT, and it’s been affected by the same dynamics NNN is. Those are described here.

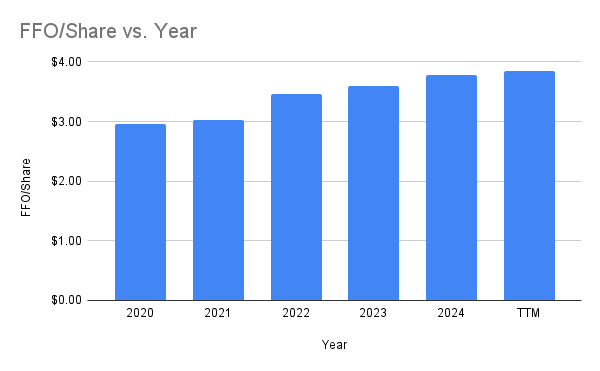

Over the past 3 years, the company has grown revenue by 20% per year and FFO per share by 7.7% each year.

Despite that, the share price is down close to 4%.

We’ll use the same modifications for Agree that we did with NNN. Let’s run our 10 steps and see if Agree is a good opportunity.

1. Do I understand the business model?

Agree Realty is a U.S. based Real Estate Investment Trust (REIT).

The company owns over 2,000 properties across the United States.

These are mostly free-standing retail buildings rented to big, well-known companies like Walmart, Dollar General, and CVS.

Agree doesn’t run any of the stores. Instead, it collects rent from the businesses that use its buildings.

Most of the leases are long-term (10–20 years) and “net leases.” That means the tenant pays for things like maintenance, insurance, and taxes - not Agree.

The goal is simple: buy strong retail properties, rent them to reliable tenants, and collect steady income.

Agree keeps growing by buying more properties and sometimes selling the ones that don’t fit its long-term plans.

Growth Platforms

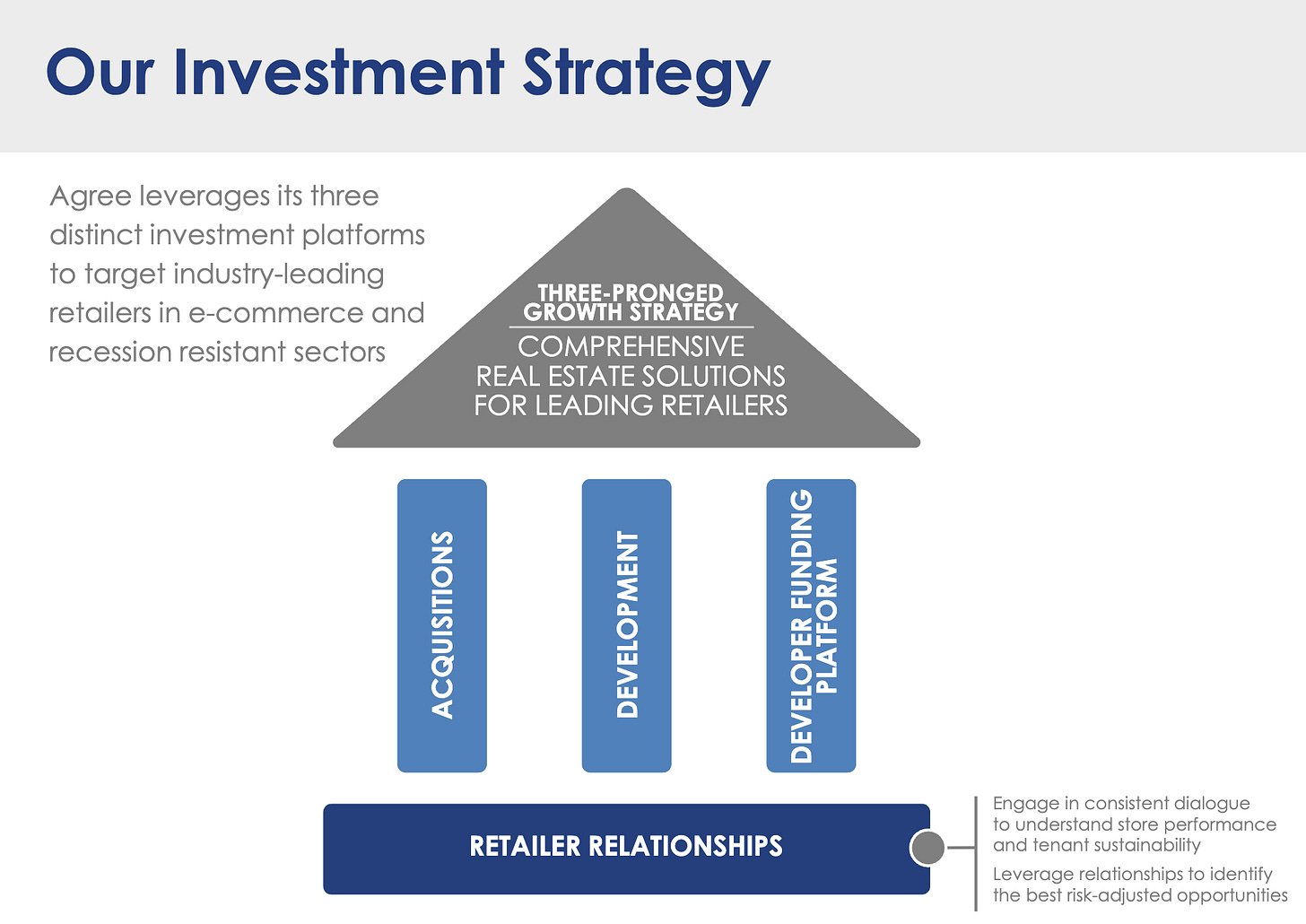

Agree Realty describes itself has having three main growth platforms.

These are the ways the company keeps growing and adding value.

1. Development

Agree Realty builds new stores for trusted tenants.

Advantages:

Agree has control over the property from the start

They can build in strong locations and tailor the lease terms

It builds long-term relationships with tenants

Example:

They might build a new Walgreens or Chick-fil-A store and then lease it out under a long-term deal.

2. Acquisition

Agree buys existing retail properties. Especially ones with strong tenants and long-term leases.

Advantages:

This is the biggest growth driver

They focus on essential retailers (like grocery stores, pharmacies, dollar stores)

They use data and strict rules to find high-quality deals

Example:

Buying a Dollar General or Walmart location with 10+ years left on the lease.

2a. Ground Lease

This is a different from of acquisition. In this situation, Agree buys the land under a building but not the building itself. The tenant owns the building but pays Agree rent for the land.

Advantages:

Very low-risk

Tenants are locked in for very long terms

If the lease ends, Agree still owns the land

Example:

A tenant builds a store on land owned by Agree and pays rent just to use the land.

3. Direct Funding Platform (DFP)

Agree works directly with developers by funding new retail projects before they are completed.

Advantages:

Gives developers quick access to capital

Secures high-quality properties early

Builds strong, long-term relationships with tenants and developers

Reduces risk for developers, since Agree commits to buying the property

Example:

Funding the construction of a new Walgreens or Chick-fil-A store, then owning it once it’s completed.

Competitive Advantages

You might think that having competitive advantages would be difficult in retail real estate, but Agree has several:

High-Quality Tenants

Agree works with some of the biggest and safest companies in the U.S. These businesses sell everyday items (think groceries, medicine, and fast food), so they usually do well even during recessions. This helps Agree keep getting rent, even when the economy is weak.

Simple and Safe Leases

Most of Agree’s leases are “net leases.” That means the tenant pays for almost everything, and Agree just owns the building and collects rent. It’s low risk and steady.

Conservative Management

Agree grows steadily, keeps debt low, and focuses on long-term value. They also tend to keep their rents slightly below market to keep buildings full and reduce tenant turnover.

Scale and Data

With thousands of properties, Agree has access to lots of data. This helps them make smart decisions about where to buy next and what to avoid.

2. Is management capable?

Joey Agree - CEO

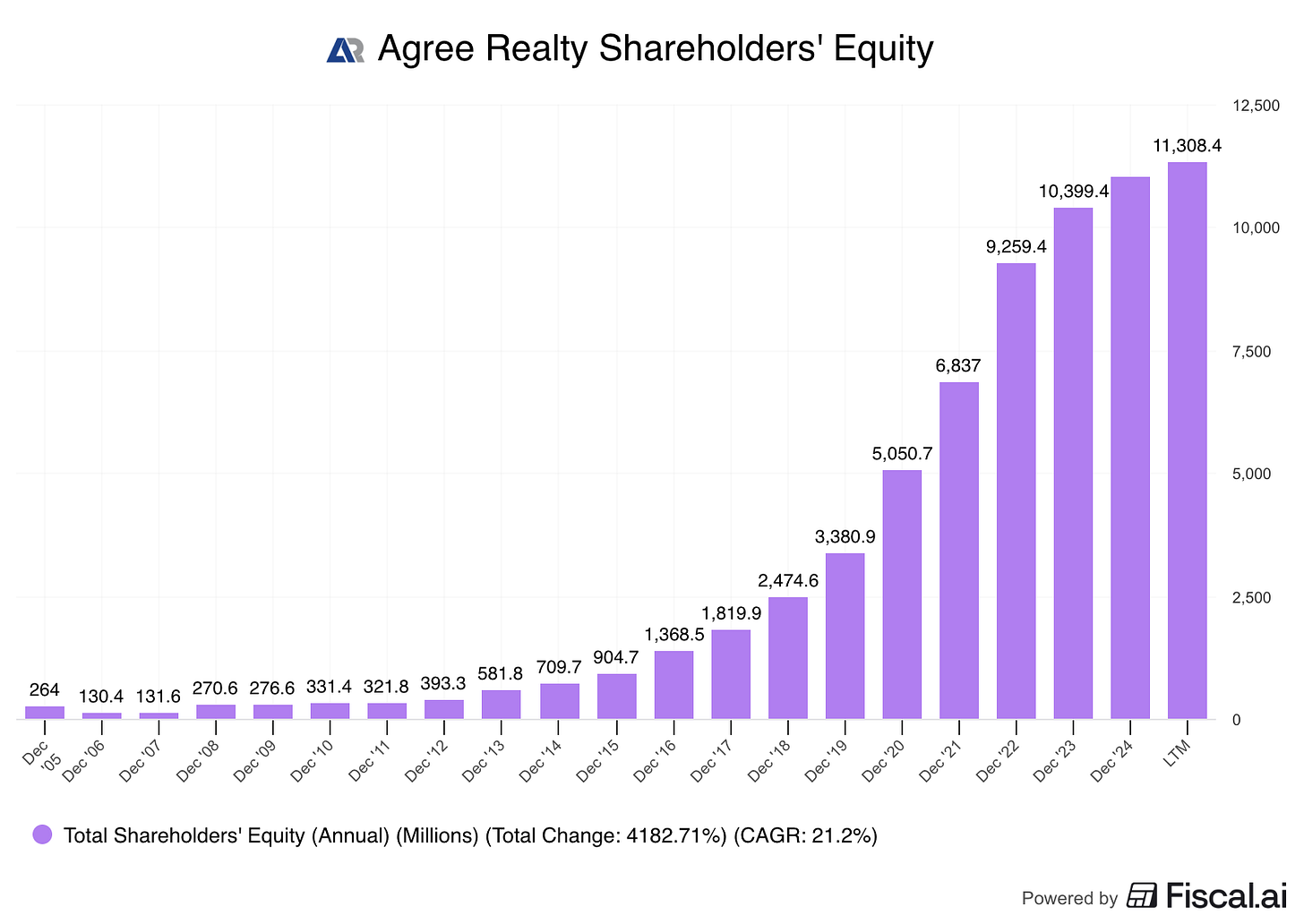

Joey has been the CEO of Agree since 2013.

Back then, it was a $300 million microcap stock focusing on property development.

He’s turned Agree Realty into the $8 billion company that it is today.

Peter Coughenour - CFO

Mr. Coughenour has been the CFO of Agree since 2015.

The management team at Agree has consistently grown the company’s equity:

They’ve also grown the FFO/Share consistently:

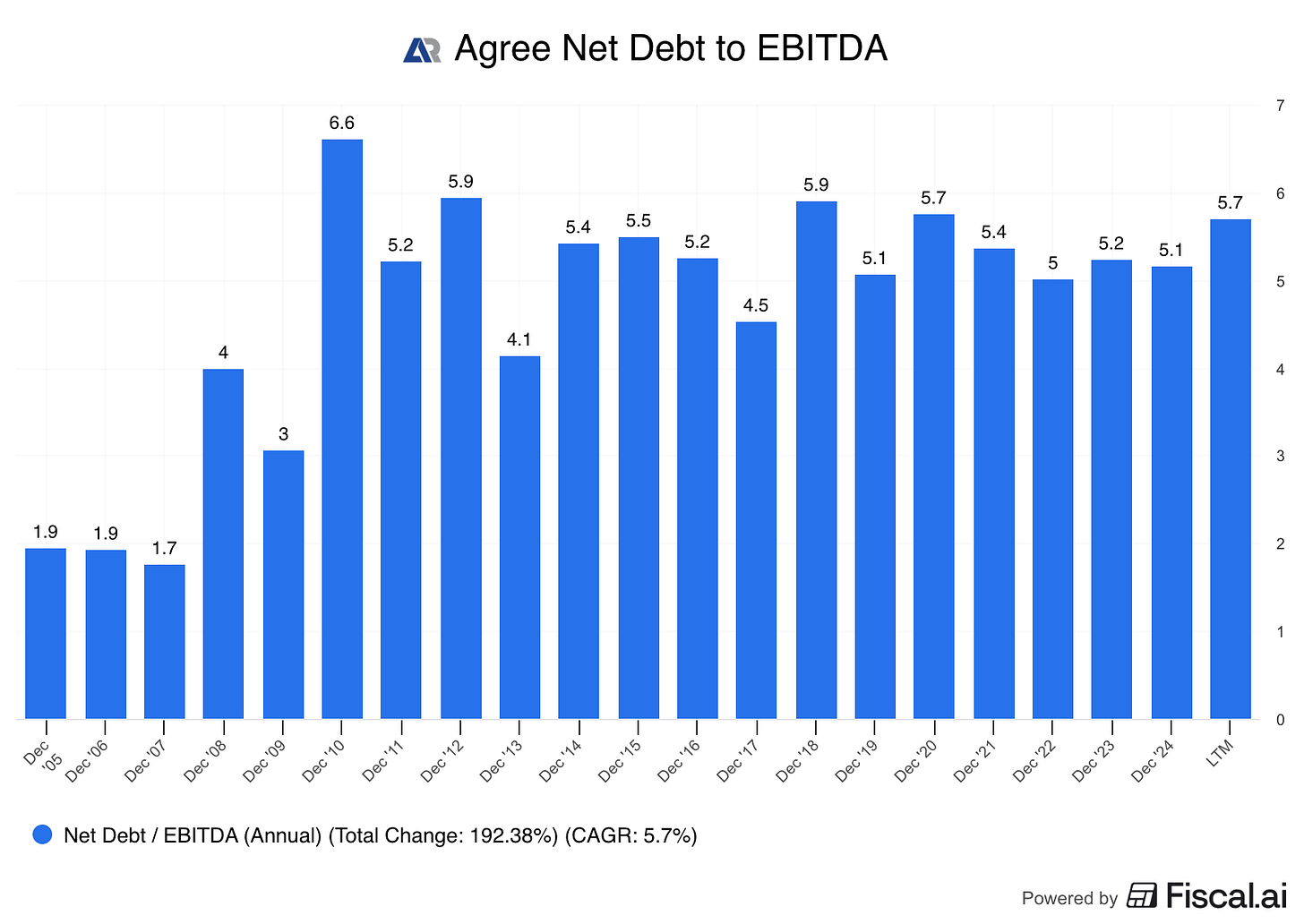

While maintaining reasonable debt levels:

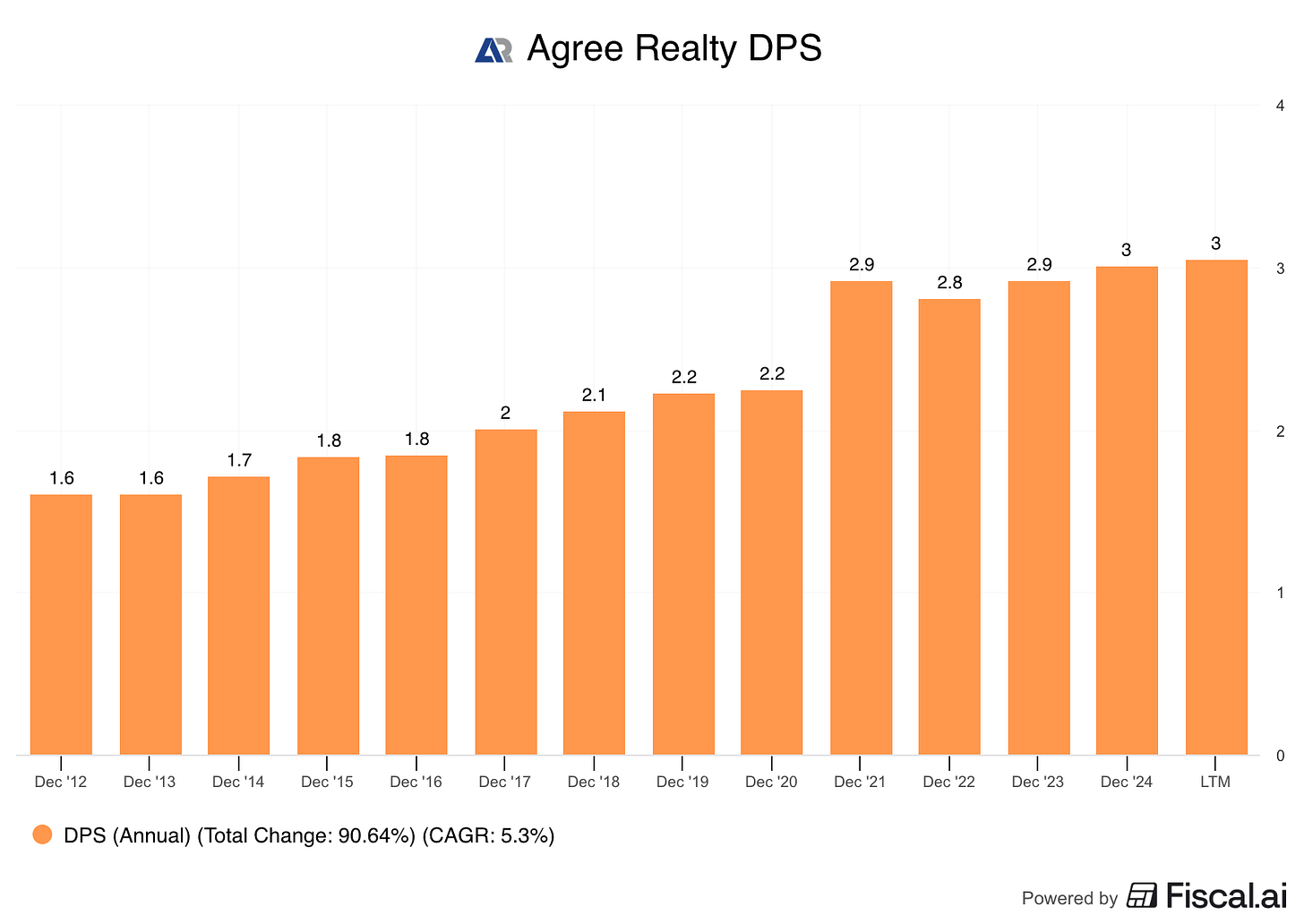

3. Has the company grown the dividend attractively?

We look for:

At least 10 years of dividend growth

5-year dividend growth >5%

Agree realty has consistently grown its dividend.

They have paid dividends monthly since 2021.

The last quarterly dividend was for Q4 of 2020, and was paid in January of 2021. That makes the dividend look like it took a big jump from ‘20 to ‘21, then got lowered in ‘22.

This isn’t the case, it’s due to the change from a quarterly dividend to a monthly one and the timing of the payouts.

5-year dividend growth rate: 5.3% annually

10-year dividend growth rate: 5.4% annually

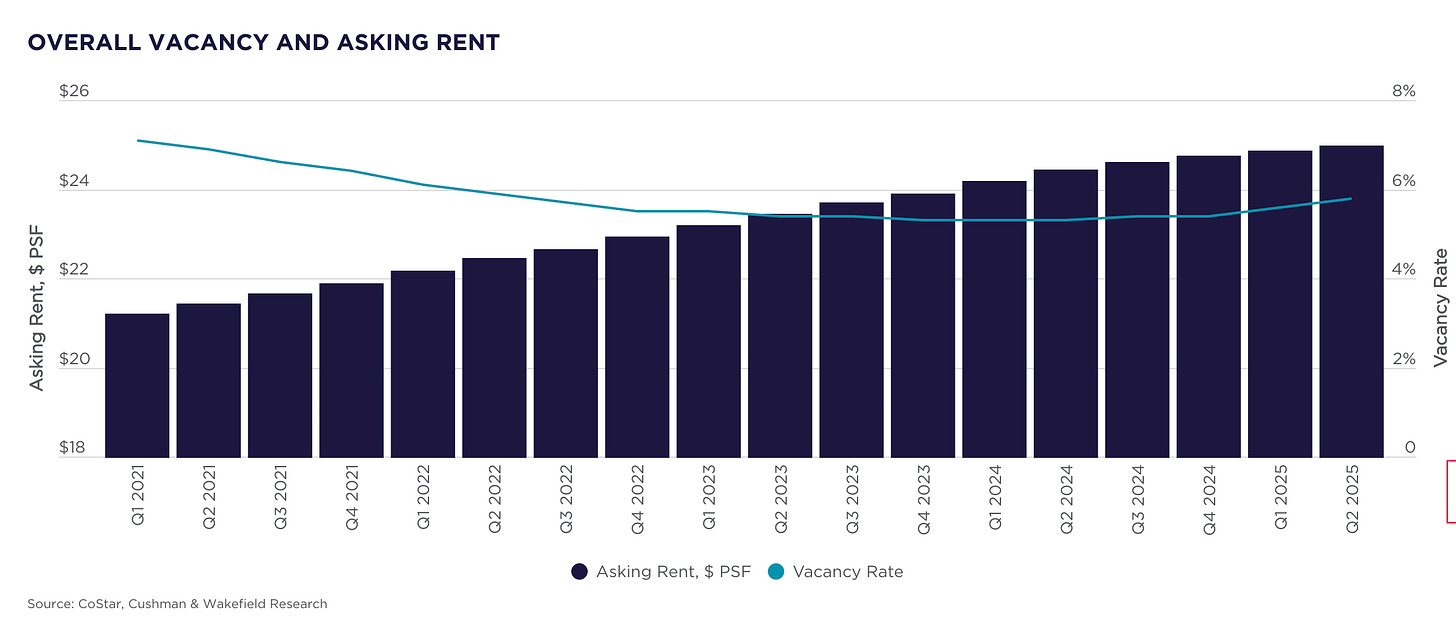

4. Is the company active in an attractive end market?

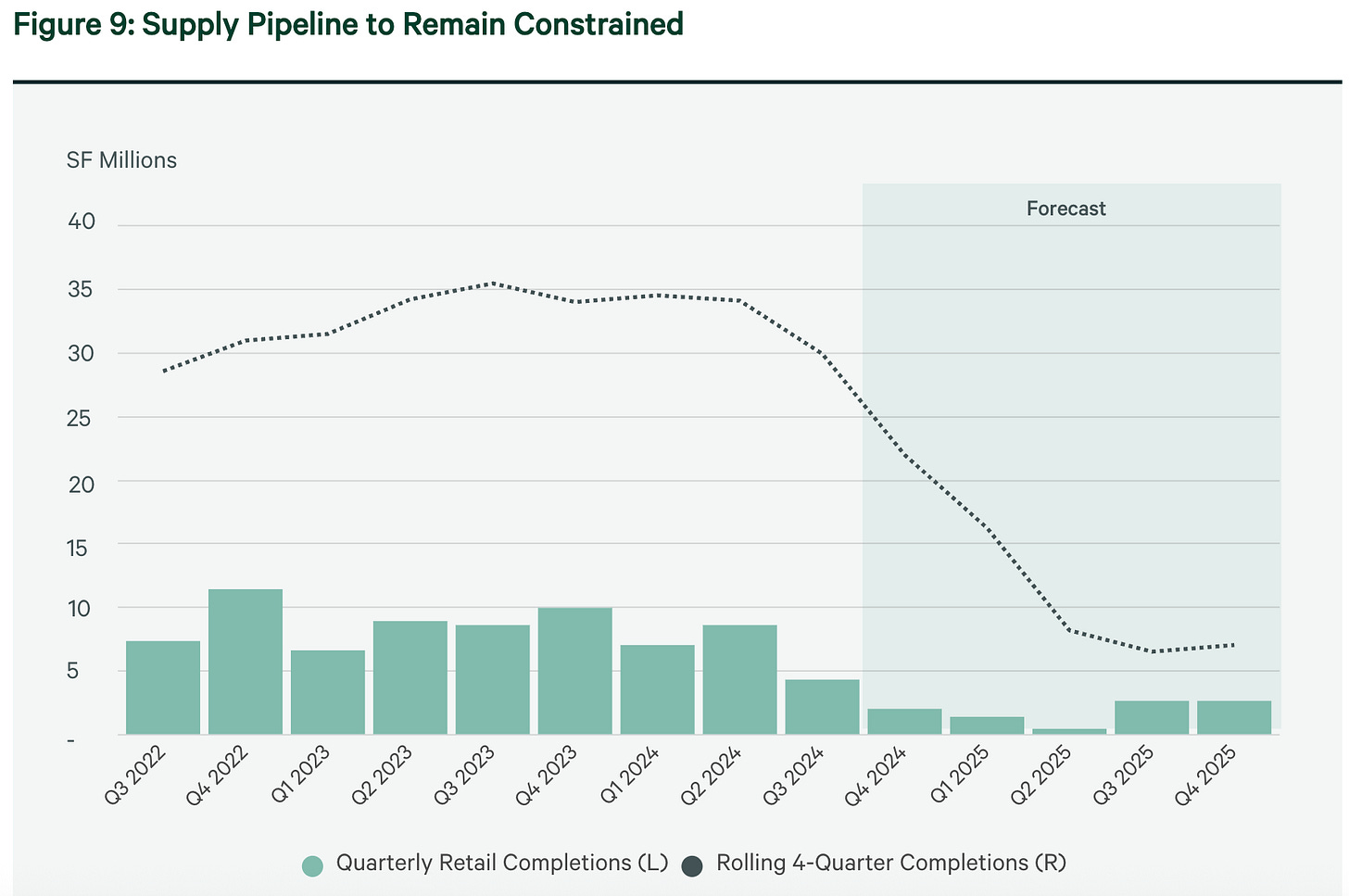

The retail real estate market is fairly mature.

However, vacancies have been trending down, and rent prices have been trending up.

Construction is also sluggish, which means the demand for Agree’s properties should remain strong and support continual rent increases.

5. What are the main risks for the company?

Tenant Risk

Agree relies on tenants (like Walmart, Dollar General, Walgreens) to pay rent. If a tenant goes bankrupt or leaves, Agree could lose income.

Mitigation:

Agree’s tenants are mostly essential retailers (grocery, pharmacy, dollar stores) that do well in both good and bad economies. They also spread risk by having over 2,000 properties with more than 400 tenants — no single tenant dominates.

Interest Rate Risk

Agree borrows money to buy new properties. If interest rates go up, borrowing becomes more expensive and could hurt profits.

Mitigation:

Agree keeps a conservative balance sheet (low debt compared to peers). Much of its debt is fixed-rate, which protects against rising interest costs. Management has a track record of careful financial discipline.

Retail Industry Changes

Shopping habits are changing, with more people buying online. If tenants can’t adapt, they might close stores.

Mitigation:

Agree focuses on retailers that are essential and resistant to e-commerce - like dollar stores, pharmacies, auto parts, and quick-service restaurants. These are businesses people still visit in person.

Property Concentration Risk

If too many properties are in one area or industry, local downturns could hurt results.

Mitigation:

Agree is geographically diverse, with properties across all 48 mainland U.S. states. They also keep a balanced mix across industries, so one weak sector won’t sink the portfolio.

Development / Construction Risk

Projects funded under the Direct Funding Platform or development program could face delays, cost overruns, or tenant pullouts.

Mitigation:

Agree works only with trusted, creditworthy developers and tenants. Deals are structured so that tenants often sign leases before projects are finished, lowering the risk of empty properties.

6. Does the company have a healthy balance sheet?

The real estate industry runs on debt. That means that we need to look at the balance sheet of a REIT slightly differently than we do for a typical company.