All Dividend Aristocrats + 5 of Our Favorites

Hi Partner 👋

Welcome to this week’s 🔒 exclusive edition 🔒 of Compounding Dividends. Each week we talk about the financial markets and give an update on our Portfolio.

In case you missed it:

Subscribe to get access to these posts, and every post.

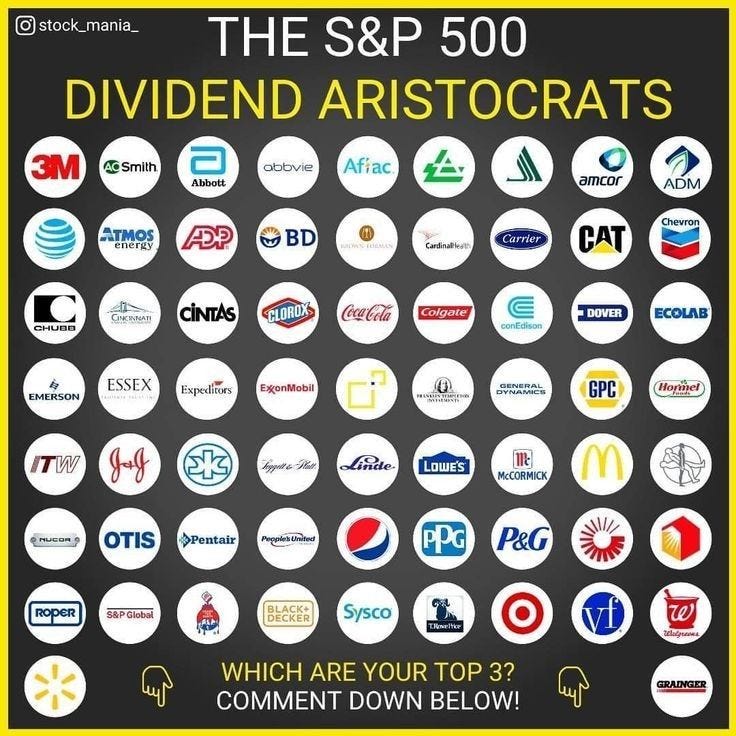

Dividend Aristocrats are companies that have raised their dividends for at least 25 consecutive years.

There are only 66 of them.

They’re a great place for Dividend Investors to look at for ideas!

In this article, we’ll rank the Aristocrats using different metrics.

At the end, I’ll share my 5 favorite ones.

Download all the Dividend Aristocrats here:

I created a spreadsheet for you with all the Aristocrats.

The spreadsheet has the following data:

Dividend Yield

Debt/Equity Ratio

5-Year Dividend CAGR

EPS CAGR

Forward PE

A short description of the business

Highest Yields

The 5 Dividend Aristocrats with the highest Dividend Yields are:

Franklin Resources: 6.1%

Realty Income: 5.2%

Amcor plc: 4.6%

T. Rowe Price: 4.5%

Chevron: 4.3%

Highest Dividend Growth Rate

Cintas: 20.5%

Lowe’s Companies: 19.3%

Sherwin-Williams: 16.1%

Nordson Corporation: 16.0%

Abbott Laboratories: 12.7%

Highest EPS Growth Rate

Ecolab: 16.6%

Stanley Black & Decker: 15.8%

C.H. Robinson Worldwide: 15.3%

S&P Global: 14.6%

Pentair plc: 14.4%

Starting with yields and growth rates is a good approach.

But I took it further.

I analyzed all 66 companies using an Earnings Growth Model and Reverse DDM.

I also considered the starting yield, historical dividend growth rate, and expected EPS growth rate for each one.

Using these criteria and the quality of the businesses, I selected 5 of my favorites.

The Aristocrats are a good starting point for dividend investors.

But I think these 5 companies offer some of the best opportunities.

The Earnings Growth Model says that these companies have an expected return of more than 10% per year.

The dividend growth rate from the Reverse DDM is also lower than the growth rate from the past five years for each company.

Ready to see what they are?

Let’s dive in!