Are Booze Stocks Broken?

We compare six major players to find out if there’s any interesting opportunities

👋 Howdy Partner,

Sometimes a whole sector or industry presents interesting opportunities.

Alcohol stocks have been struggling as a group recently. Why?

People are becoming more conscious of the health effects of alcohol

Young people are drinking less

Non‑alcoholic drinks are trendy and popular

Appetite‑suppressing medications like GLP-1

Added macro pressures like tariffs, logistics, and rising costs

Together, these are causing lower sales, smaller volumes, tighter margins - and dropping stock prices.

Are any of these companies worth considering for Our Portfolio?

Let's figure it out together.

Step 1: Find a Starting Point

There are lots of ways to find interesting stocks - our Buy-Hold-Sell list is a good one.

But today we’re looking at alcohol stocks because the entire industry has seen declines in their stock prices.

And some superinvestors are buying or holding alcohol stocks

Berkshire has been buying Constellation Brands

Prem Watsa owns Molson Coors

Tom Gayner owns Brown-Forman

When I see the same kinds of stocks popping up over and over, I know it’s time to dig deeper.

Let’s do that today.

Step 2: Pick The Most Interesting

To find the best ideas, you should try to find reasons to say ‘no’ as fast as possible.

For each company, ask yourself:

Do I understand how the company makes money?

Does this company interest me?

Can I make an educated guess about where this company will be in 10 years?

If you say 'no' to any of those questions, move on to another company.

Our Companies

Alcohol stocks are pretty easy to understand, and there aren’t that many of them.

Here’s the list I came up with:

Brown-Forman

Constellation Brands

Diageo

AB InBev

Molson Coors

Pernod Ricard SA

Step 3: Compare What’s Left

Let’s compare them.

We’ll assign points in each category.

The best-scoring stock is the most attractive company - simple.

Capital Allocation

We’ll start by looking at how management allocates capital.

Using the average ROIC for the past 5 years, we’ll give one point to any company with an ROIC > 8% (the average return of the stock market).

Brown-Forman, and Diageo both get a point here.

1 Point = Brown-Forman (+1), Diageo (+1)

0 Points = Constellation,AB InBev, Molson Coors, Pernod Ricard SA

Dividend Growth

We want companies that will grow the dividend over time.

We’ll aware one point for companies with dividend growth rates >5% over both the 5 and 10 year time horizons.

The companies with the best dividend growth? Brown-Forman, Constellation, and Pernod Ricard SA

AB InBev and Molson Coors have both seen dividend cuts.

3 Points = Brown-Forman (+2)

2 Points = Constellation (+2), Pernod Ricard SA (+2)

1 Point = Diageo

0 Points = AB InBev, Molson Coors

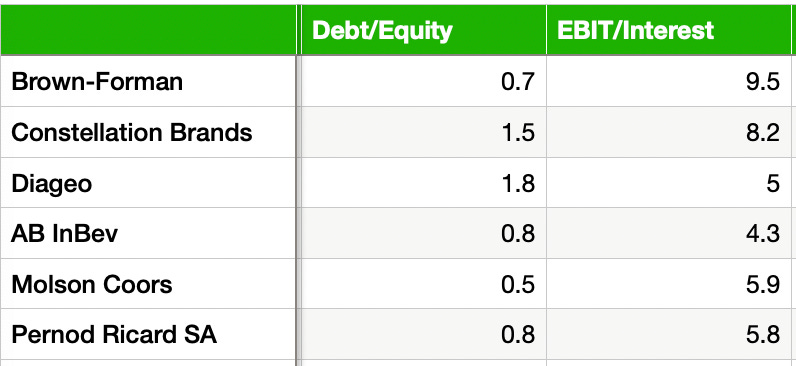

Balance Sheet

We also like strong balance sheets.

We’ll give one point for a Debt/Equity of 0.5 or less, and another point for Interest Coverage >10x.

Molson Coors is the only company to pick up a point here.

3 Points = Brown-Forman

2 Points = Constellation, Pernod Ricard SA

1 Point = Diageo, Molson Coors (+1)

0 Points = AB InBev

Next we’ll dive into how these companies return capital to shareholders, how they’ve grown in the past, and how they’re expected to grow into the future.

Ready to see which company comes out on top?

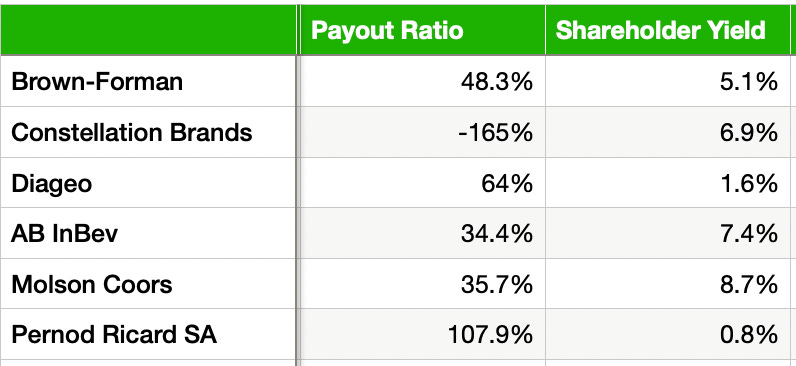

Capital Returns

We want companies that return capital to us, but in a smart way.

We’ll award one point for a Payout Ratio of less than 60%, and another point for a Shareholder Yield of 8% or more.

The best capital allocator? Molson Coors

The worst? Pernod Richard SA with a payout ratio over 100% and a very low shareholder yield.

4 Points = Brown-Forman (+1)

3 Points = Molson Coors (+2)

2 Points = Constellation, Pernod Ricard SA

1 Point = Diageo, AB InBev (+1)

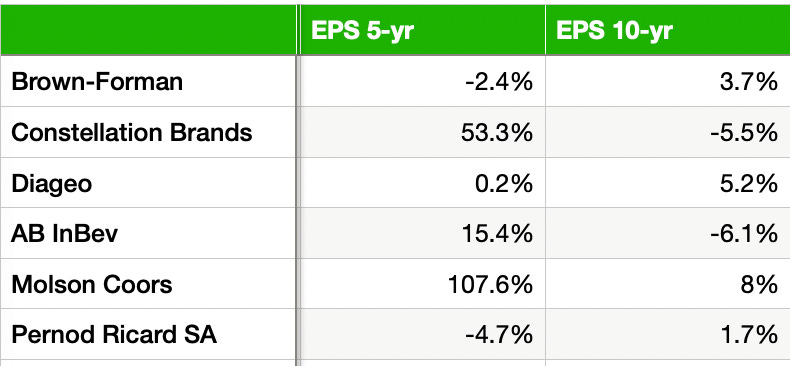

Past Growth

To grow the dividend, the company needs to grow its profits.

We’ll give one point for:

5-year EPS growth >5%

10-year EPS growth >5%

We’ll also give one point for:

5-year Revenue growth >5%

10-year Revenue growth >5%

The companies that score the most points here? Brown-Forman, Constellation, and Molson Coors.

6 Points = Molson Coors (+3)

4 Points = Brown-Forman, Constellation (+2)

2 Points = Pernod Ricard SA, Diageo (+1), AB InBev (+1)

Future Growth

We also want companies that will continue growing.

We’ll give a point to any company expected to grow its EPS by 5% or more.

In addition, we’ll give a bonus point to companies expected to grow by at least 8%.

Totals:

6 Points = Molson Coors

4 Points = Brown-Forman, Constellation, Diageo (+2), AB InBev (+2)

2 Points = Pernod Ricard SA

Conclusion

To determine which stock to buy, you can follow these steps:

Step 1: Find a starting point

Step 2: Pick your interesting companies

Step 3: Compare them

Molson Coors came out on top in our comparison - but that doesn't mean it's a buy.

The alcohol industry is facing long-term challenges: changing drinking habits, health concerns, and rising demand for non-alcoholic options.

None of these companies show steady growth in sales, earnings, or dividends. Even the "best" one lacks the consistency we look for.

Sometimes the smartest move is to wait. This sector might recover, but right now, there are likely better places to invest.

Great investments come from strong businesses in strong industries - not weak ones on sale.

PS…

Our YouTube Channel is still young - subscribing and interacting with some likes, comments, or shares helps a lot. Find it here.

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data