Here are 10 Dividend Stocks worth looking into:

Let’s dive into them and figure out which one is the most interesting.

Snacks & Packaged Foods

🥣 Genreal Mills

🍫 Mondelez

🥤 PepsiCo

Healthcare

🏥 Johnson & Johnson

😷 Medtronic PLC

💊 Merck

Oil & Gas

🛢️ Schlumberger

🛢️ ExxonMobil

🛢️ Chevron

Today we’ll look deeper into each of these companies and have a battle between the contenders in each industry to see who comes out on top.

Sound interesting?

Let’s dive in!

Snacks & Packaged Foods

Let’s meet the contenders:

General Mills

General Mills makes and sells food like cereal, snacks, and baking products.

The business is divided into categories like snacks, breakfast foods, and pet food.

Mondelez

Mondelez makes snacks like cookies, chocolate, and gum.

They have brands like Oreo, Cadbury, and Trident worldwide.

PepsiCo

PepsiCo sells soft drinks like Pepsi, Gatorade, and Rockstar as well as snacks like Lay’s chips.

They divide their business into drinks, snacks, and other foods.

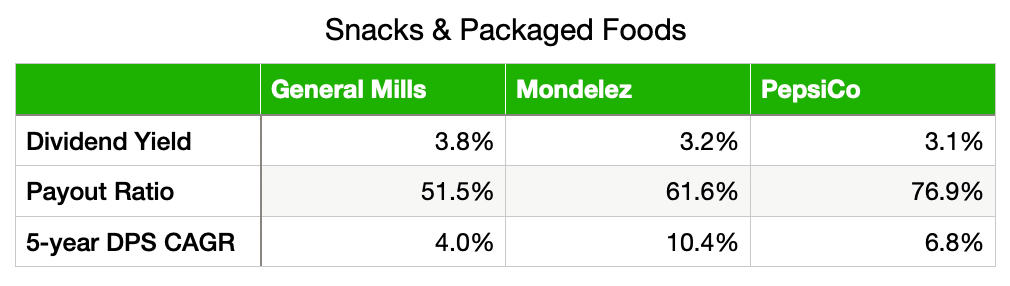

Dividend Info:

Source: Finchat

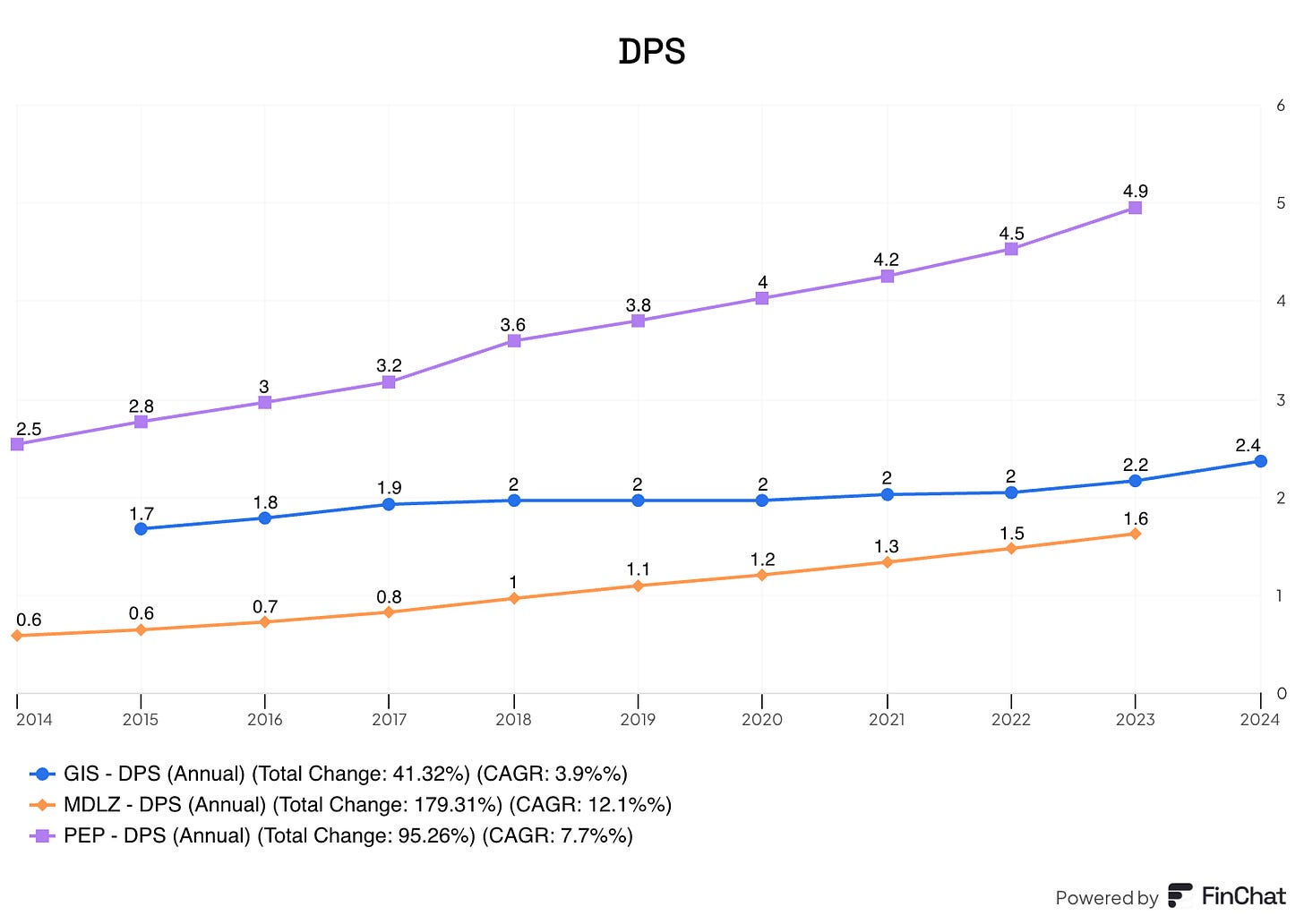

Revenue Growth

Source: Finchat

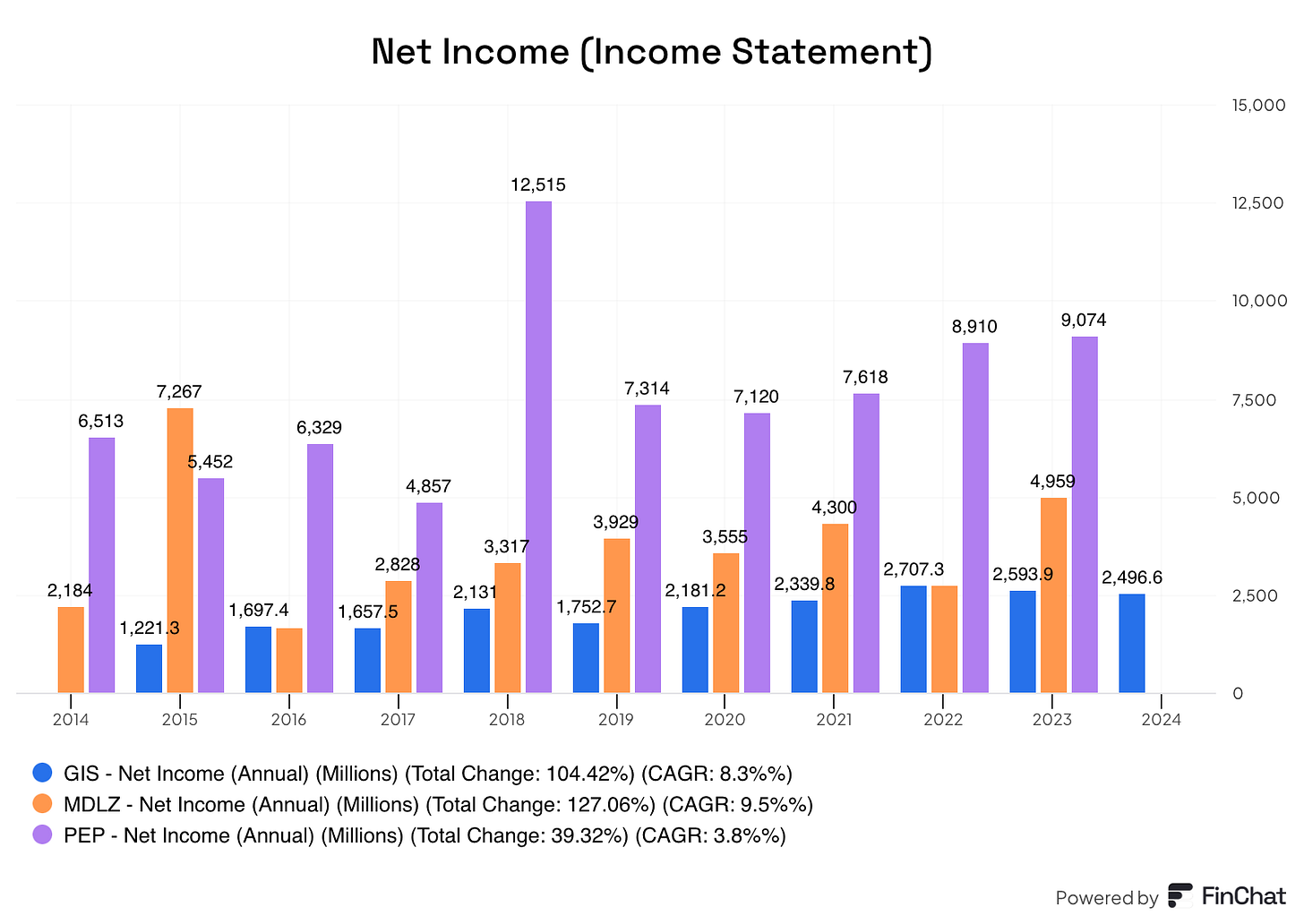

Income Growth

Source: Finchat

Let’s Battle

Right away I notice a few things:

The dividend yields are all around 3% - no company has a strong advantage there

None of the companies shows a steady trend in revenue and net income, but General Mills looks the most stable.

The First Elimination

The first company I’d eliminate from this group?

PepsiCo.

The payout ratio is significantly higher than the other two companies.

That means that unless PepsiCo can re-accelerate Net Income, it will be hard to keep growing the dividend at 6% per year.

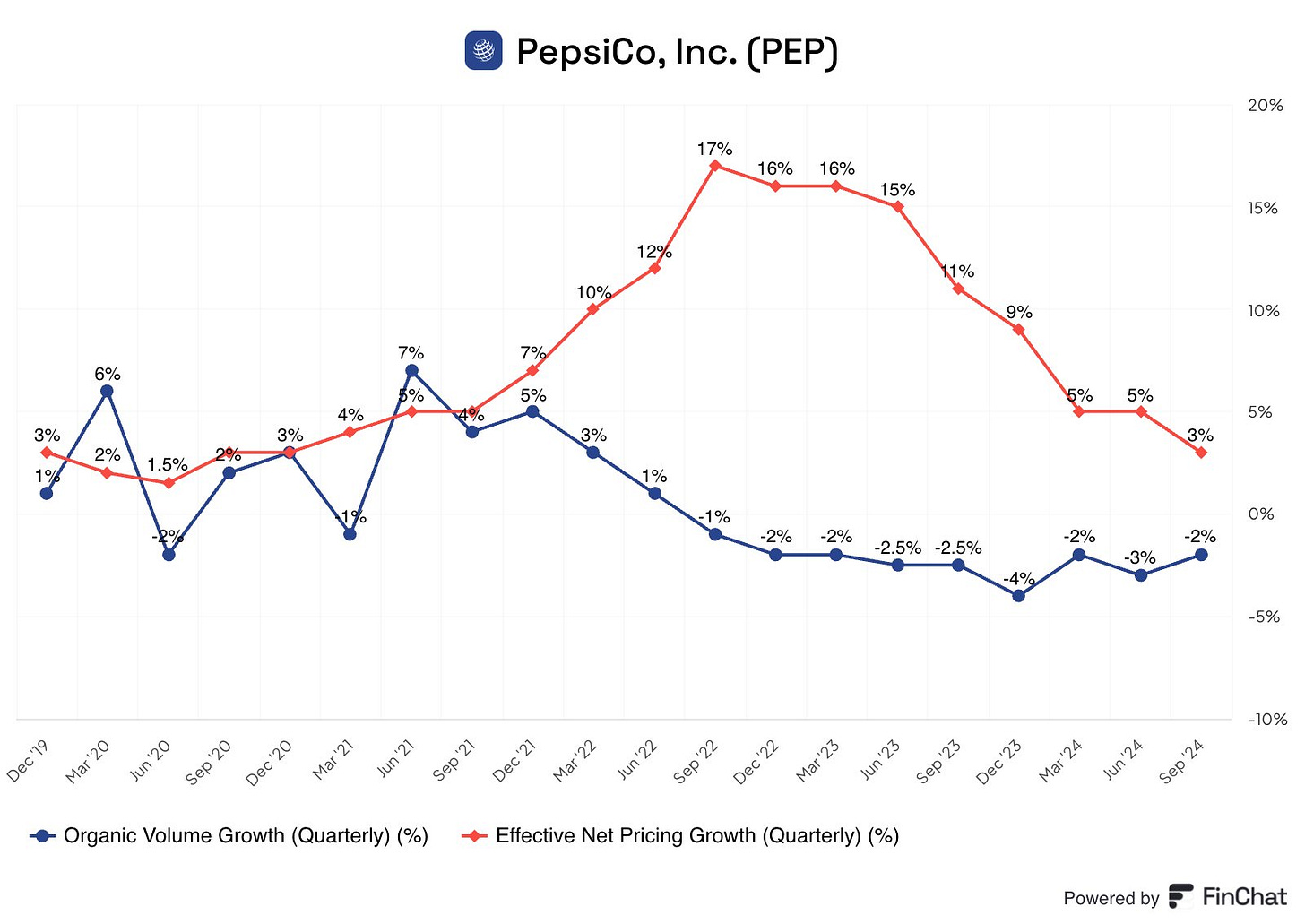

Pepsi’s biggest challenge:

Pepsi has seen falling sales volumes and has been making up for it with price increases.

Source: Finchat

General Mills VS Mondelez

Which stock will win?

General Mills

Strengths

Strong brands like Cheerios (11% of U.S. cereal market) and Nature Valley (26% of cereal bars)

Diverse revenue streams lead to more stable income compared to PepsiCo and Mondelez

Weaknesses

Vulnerable to health trends, with 52% of sales in cereal, snacks, and convenient foods

Cereal sales are declining ~2% per year

Premium brands may struggle if consumers trade down due to inflation or a weak economy

Dividend growth is less consistent than Mondelez or PepsiCo

Mondelez International

Strengths

Strong brands like Oreo, Cadbury, and Toblerone face less competition from store brands

Strong management simplifies operations, cuts unprofitable brands, and upgrades facilities

Shareholder-friendly policies

$9 billion buyback (announced December)

11% dividend increase (July)

Clear capital priorities: reinvestment, acquisitions, and returning cash to shareholders

Weaknesses

Vulnerable to health trends

Chocolate brands face pressure from rising cocoa prices

Winner: Mondelez

While General Mills offers more stable revenue, Mondelez stands out with:

A stronger balance sheet (Debt/Equity: 0.7 vs. 1.5)

Consistent dividend growth

Better management with a focus on efficiency and shareholder returns

We have one winner so far, but that’s just the warm up match.

The Healthcare and Oil & Gas matchups have some giant companies:

ExxonMobil had over $300 billion in revenue last year

More than all 3 snack companies’ revenues combined

Chevron paid out more than $11 billion in dividends last year

That’s more than the net incomes of all 3 snack companies

Johnson & Johnson spent $16 billion on R&D last year

Nearly double PepsiCo’s net income

Ready for the matchups between some epic contenders?

Let’s go!