A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into this update and show you some of my favorite stocks.

July 2025

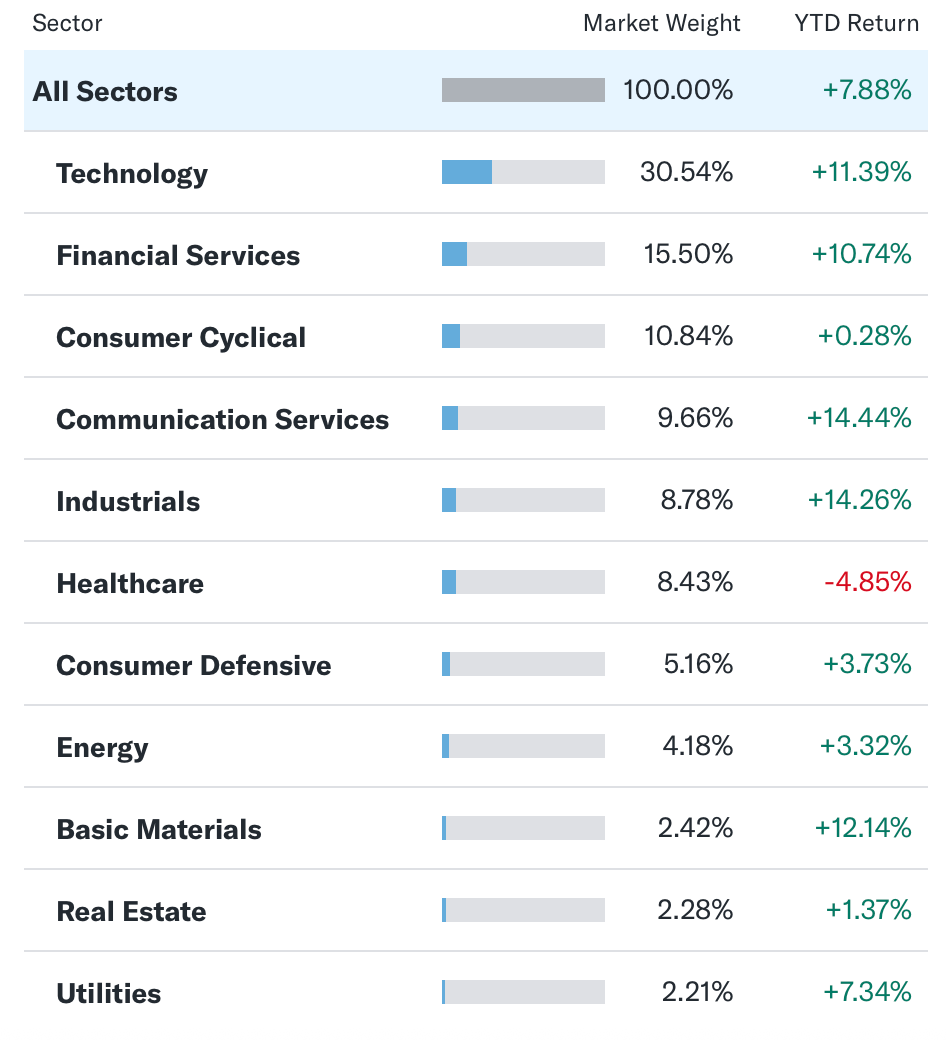

In July the S&P 500 increased by 2.3%

Source: Fiscal.ai

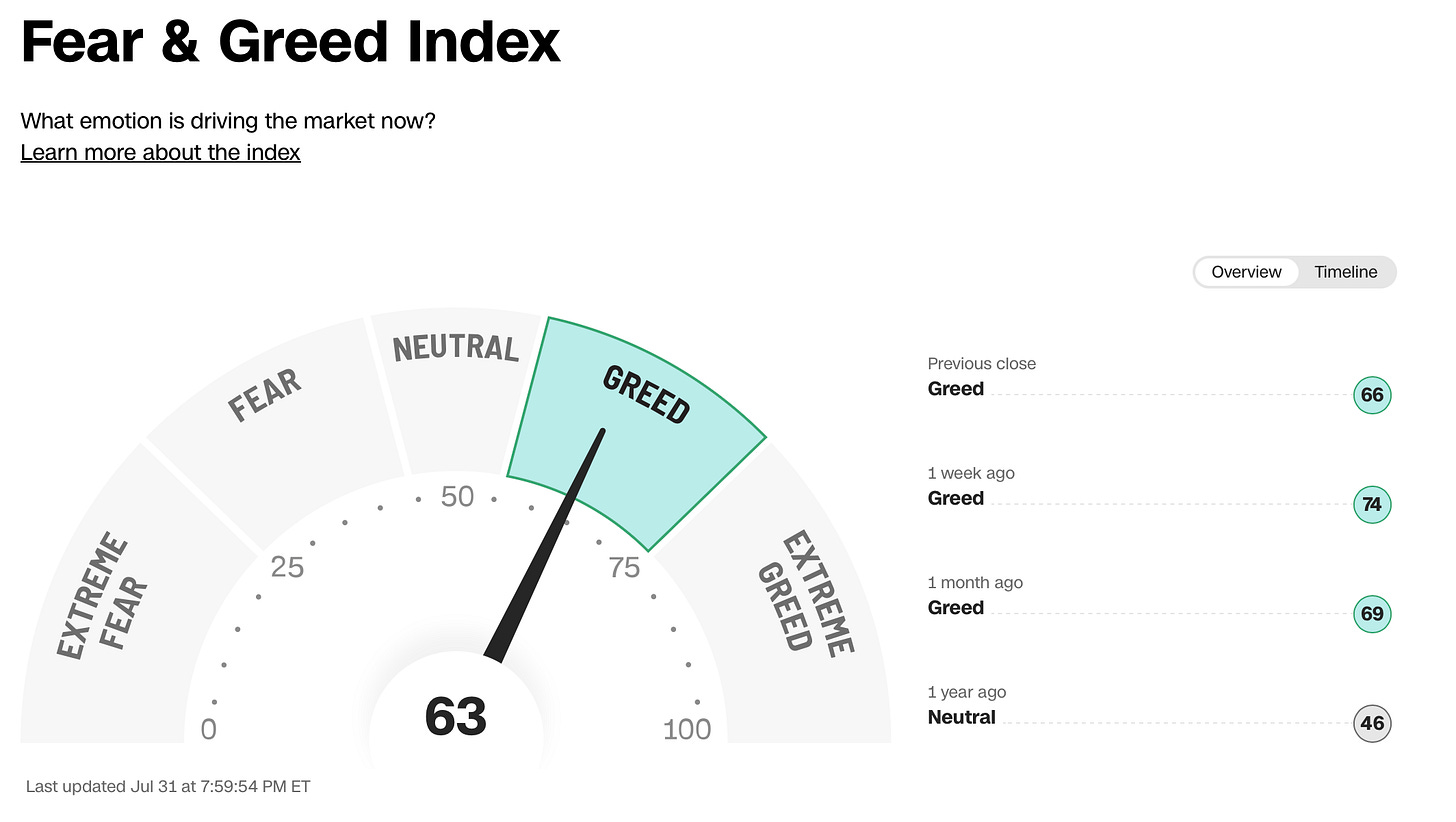

The Fear & Greed Index indicates that we ended July in ‘Greed’ Mode.

This is remains unchanged from the end of May.

Best & Worst Performers

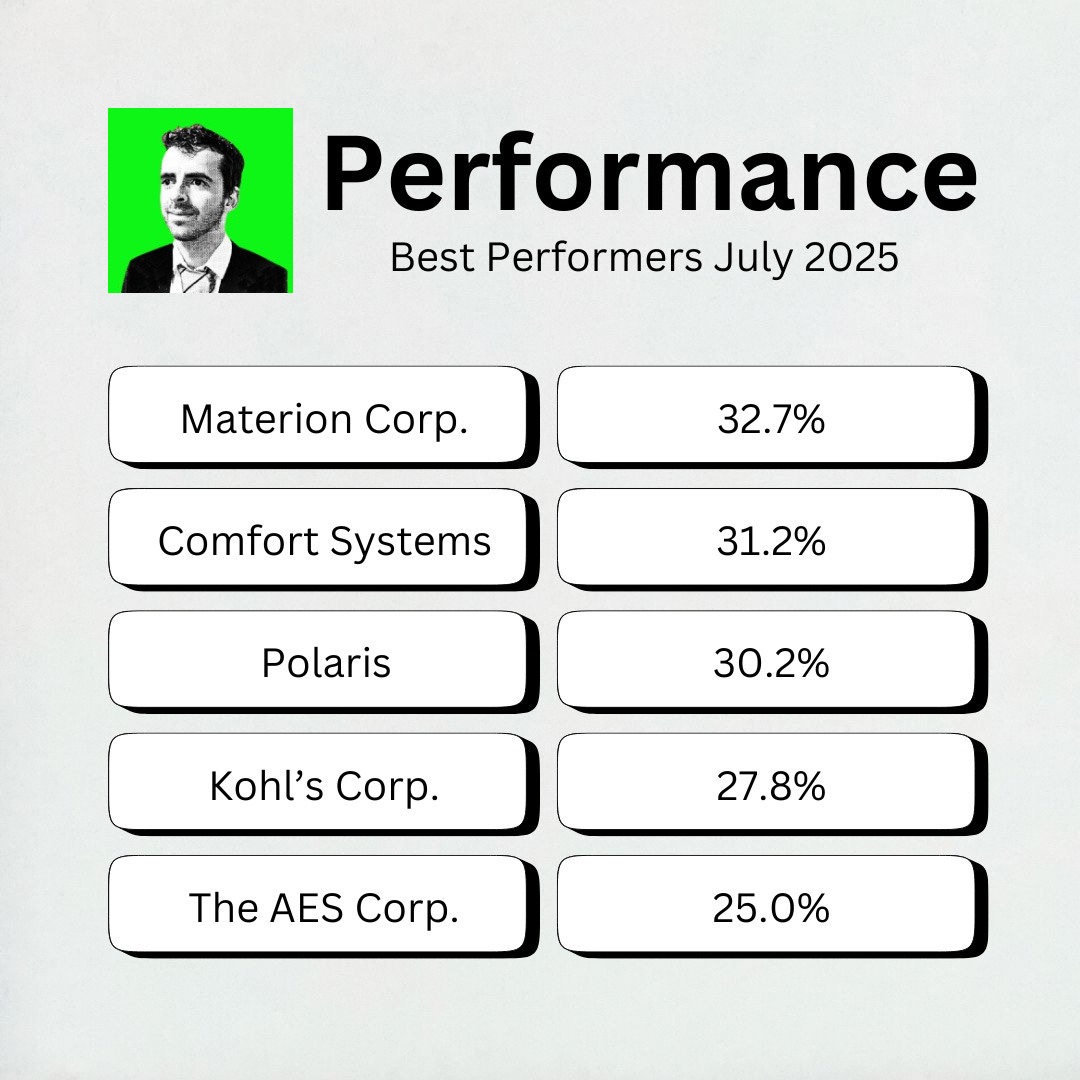

This overview shows you the best and worst performers in our investable universe.

Worst performers

The cheaper we can buy great companies, the better.

The biggest decliner this month? Centene Corporation.

Centene Corporation is one of the largest U.S. healthcare insurers, primarily focused on government-sponsored programs.

The company serves tens of millions across Medicaid, Medicare, and Affordable Care Act (ACA) marketplace plans.

Centene declined this month for several reasons

Withdrawal of 2025 earnings guidance

Surprise loss in Q2 earnings

Rising medical costs

Poor sector performance and analyst downgrades

The entire healthcare sector is performing poorly as of late, and many other insurers like Elevance Health, UnitedHealth, and Molina Healthcare are seeing many of the same issues.

Best Performers

Materion Corporation was this month’s best performer, rising nearly 33%.

Materion Corporation is a global materials technology company headquartered in Ohio, specializing in advanced engineered materials.

Its products serve industries such as aerospace & defense, semiconductors, energy, industrial, automotive, and telecommunications.

Its core businesses include:

Performance Materials: specialty alloys and engineered metals

Electronic Materials: semiconductor and microelectronics materials

Precision Optics: coatings and components for optics

Materion’s stock rallied in July, driven by a strong Q2 earnings beat and improved financial outlook

The company also completed an acquisition of tantalum manufacturing assets in Asia, growing its footprint and support for tier‑1 semiconductor customers.

Spotlight: Healthcare Sector

Health care has had a rough start in 2025.

It’s the only sector with a negative performance year-to-date.

Political and regulatory uncertainty - especially around drug pricing and tariffs under the Trump administration - has weighed heavily on pharmaceutical companies.

Managed care companies have struggled too as I pointed out above with Centene, Elveance, UnitedHealth, and Molina.

Life sciences tools and services have also lagged, hurt by ongoing weakness in Chinese demand impacting leaders like Thermo Fisher and Danaher.

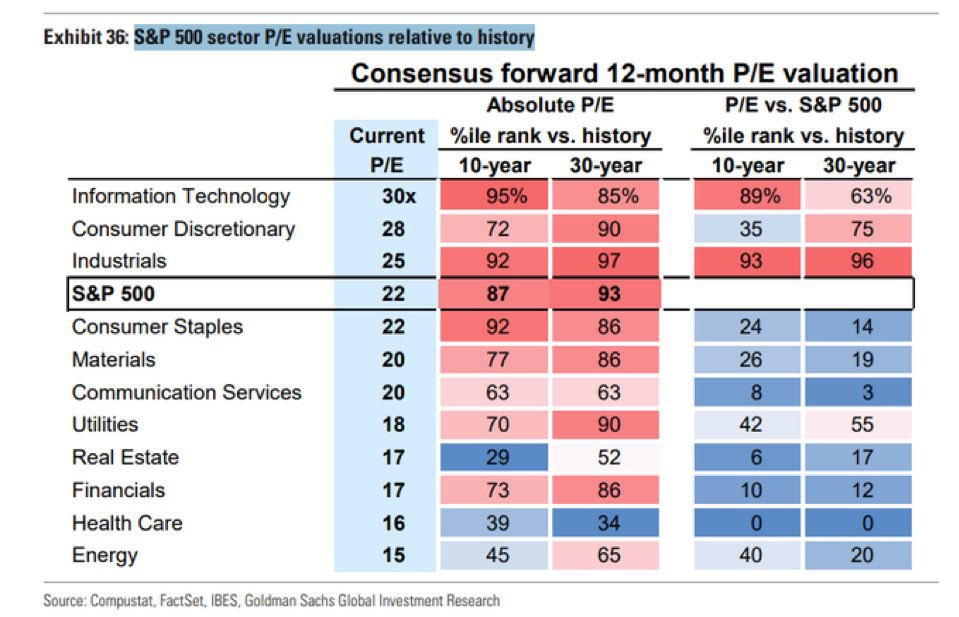

The entire sector is currently trading at a discount to both its average 10-year P/E and 30-year P/E.

It’s also looks very cheap relative to the S&P 500.

Despite the current headwinds, the long-term story remains interesting. The sector benefits from powerful tailwinds:

Aging demographics driving demand for medicine, procedures, and hospital services

Breakthrough innovation, from GLP-1 weight-loss drugs to AI-driven drug discovery and robotic surgery

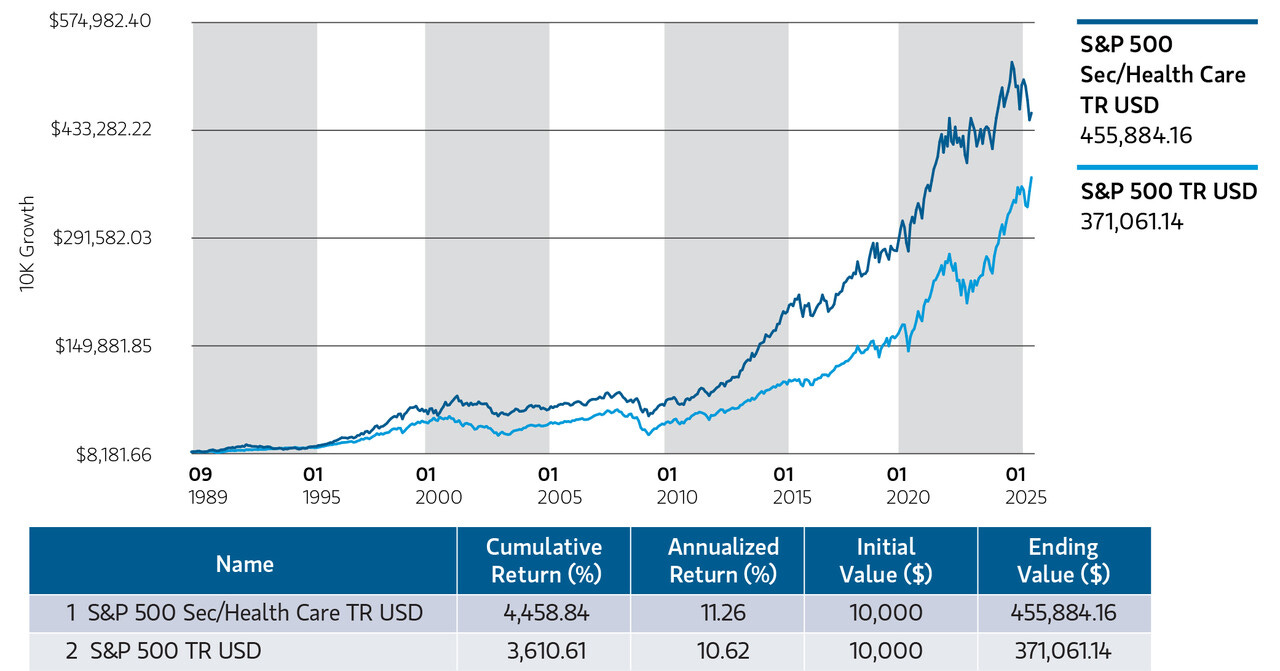

Since 1989, the S&P 500 Health Care Index has delivered 11.3% annualized returns, outpacing the broader market.

For dividend investors, temporary weakness can present opportunity. Health care remains a defensive sector with secular growth drivers, making it worth watching for long-term portfolio additions.

August Best Buys

Because the healthcare sector is so out of favor at the moment, I scanned the Buy-Hold-Sell List for healthcare stocks.

Let’s dive into 5 of the most interesting ones I found!

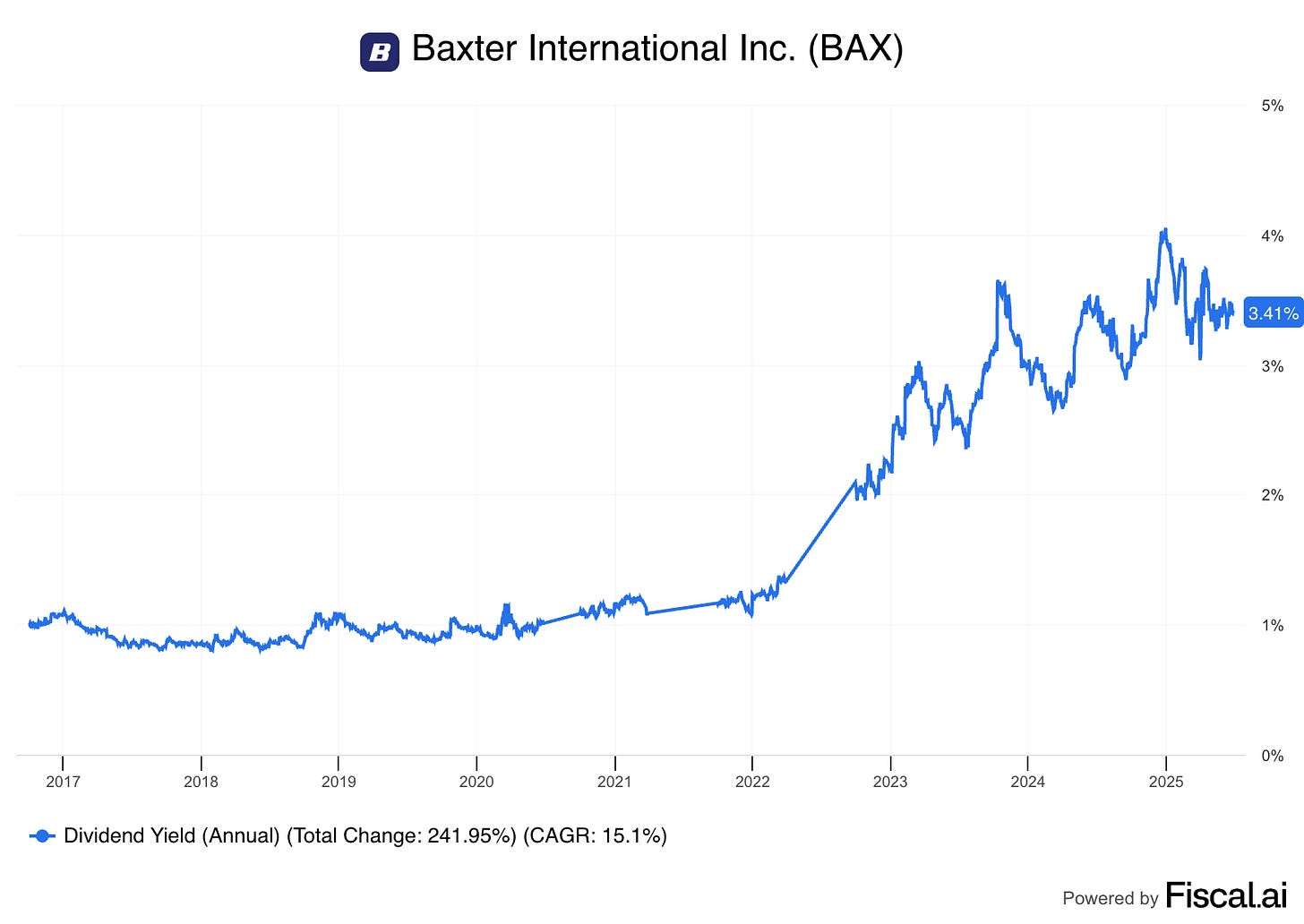

5. Baxter International (BAX)

Hospitals and care settings depend on Baxter’s kidney care, infusion, and critical care products. Baxter is interesting because its offerings sit at the intersection of life-saving and repeat use.

Recent strategic pruning (e.g., the kidney-care deal) and a focus on operational effectiveness have been about simplifying the business and strengthening the balance sheet while keeping cash flowing.

Baxter currently offers a high dividend yield relative to history:

Current yield: 3.1%

Payout ratio: -95.3%

Forward P/E: 11.2

It’s a legacy medtech that supplies the backbones of healthcare and funnels cash back to investors.

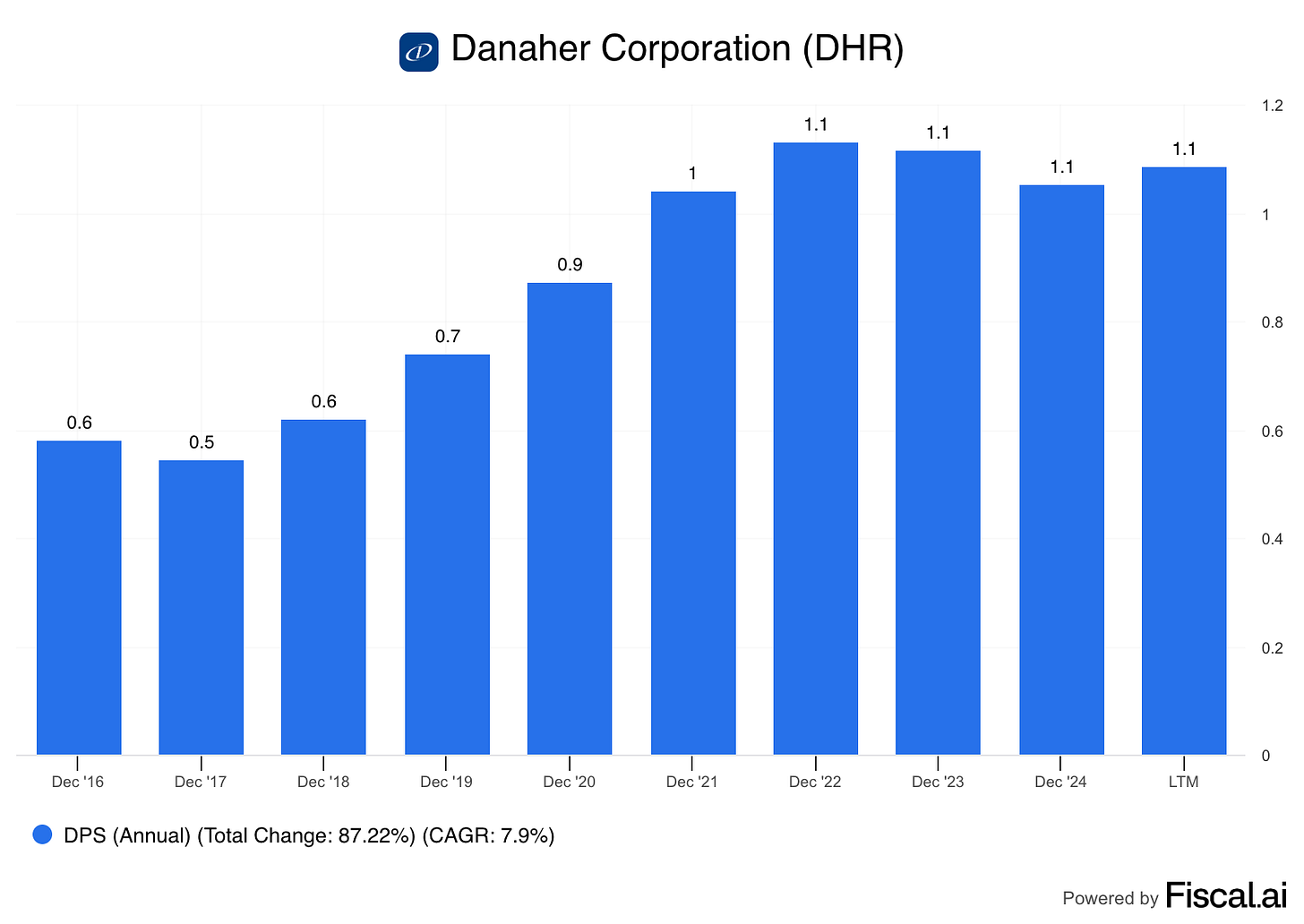

4. Danaher (DHR)

Danaher is the engine behind diagnostics, life sciences tools, and environmental solutions.

It has a famous business system based on continuous improvement that has expanded margins and free cash flow over years.

The portfolio is diversified across end markets that matter for health and industry, and the culture keeps reinvesting while still sharing profits with shareholders.

Current yield: 0.6%

Payout ratio: 24.9%

Forward P/E: 25.1

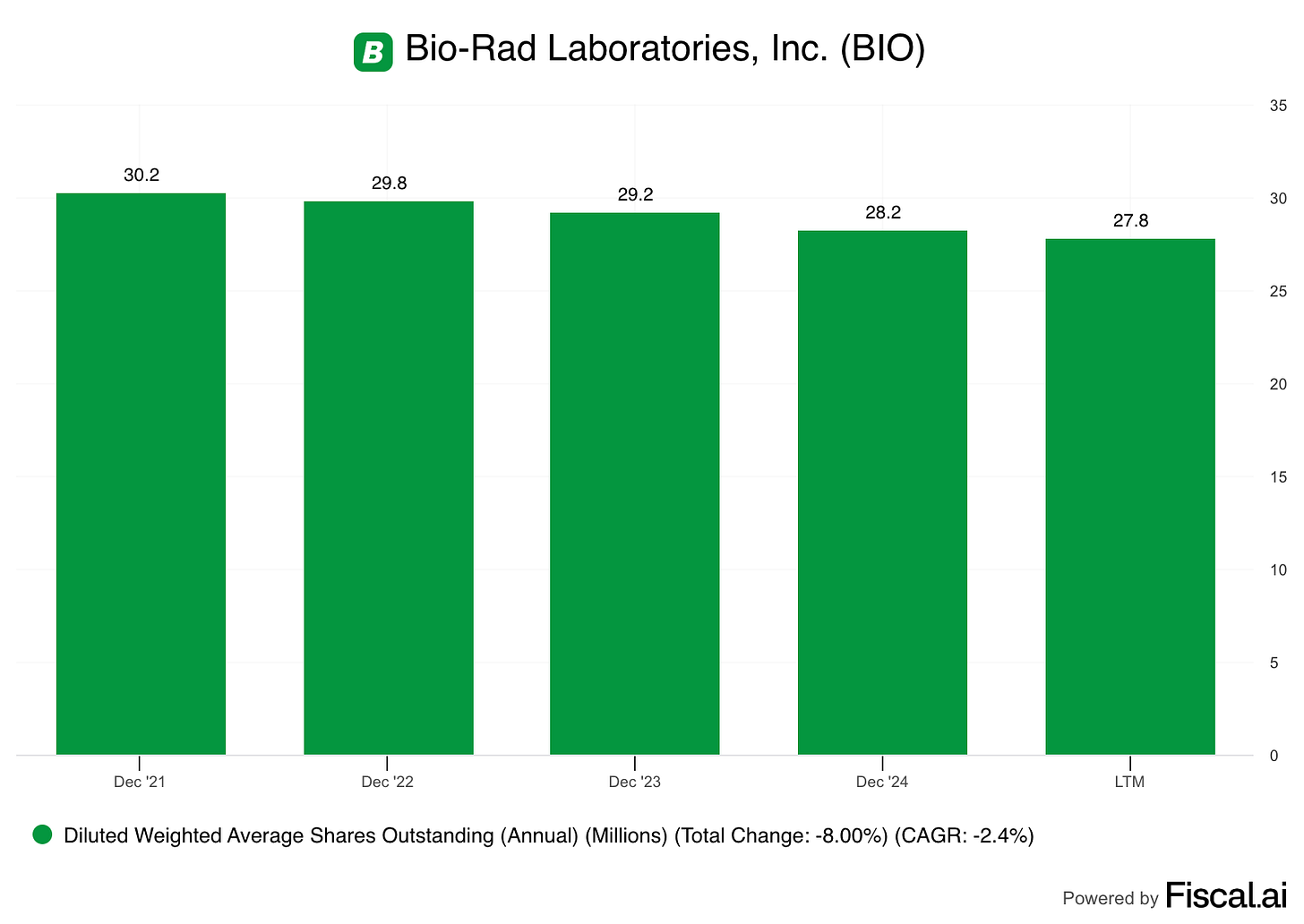

3. Bio-Rad Laboratories (BIO)

Researchers and clinical labs depend on Bio-Rad’s tools to understand biology and diagnose disease. It benefits from recurring demand from institutions that don’t cut corners on quality.

Despite some cyclicality in revenue, the business generates real free cash flow and it’s been spending that cash flow on buying back shares recently: