A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into this update and show you my favorite stocks.

November 2024

In November the S&P 500 increased by 5.3%

The Fear & Greed Index indicates that we are currently in ‘Greed’ Mode.

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

Worst performers

The cheaper we can buy great companies, the better.

The biggest decliner this month? Celanese

Celanese produces specialty chemicals and advanced materials used in industries, like automotive and healthcare.

Best Performers

Landbridge was this month’s best performer, rising over 40%.

Landbridge owns and manages land for oil and natural gas development in the United States. It owns surface acres of oil and gas royalties in and around the Delaware Basin in Texas and New Mexico.

Celanese (CE)

Celanese is worth highlighting.

As we pointed out, it’s down more than 40% this month.

Source: Finchat

How does Celanese make money?

Celanese makes and sells a wide range of specialty chemicals and advanced materials. They serve various industries, including automotive, healthcare, and electronics.

Celanese has production plants around the world, which helps them reduce costs and increase efficiency. They typically build long-term relationships with clients, developing materials to meet their needs.

What happened?

Business conditions are weakening in Europe and China.

There are oversupplies of materials Cleanese makes, like nylon (acetyls), for example.

The company said it faced:

“Persistent demand weakness across key end-markets like paints, coatings, and construction, as well as rapid and acute downturns in Western Hemisphere automotive and industrial segments.”

At the last quarterly report Celanese:

Missed revenue and EPS targets

Said they expect the fourth quarter to be worse than the third

Announced cost-cutting measures including

Reducing production at facilities in every region

Raising $200 million through an inventory release

Temporarily cutting the dividend by 95% for Q1 of 2025

Could we have seen it coming?

Celanese is an interesting case study - let’s look to see what warning signs it gave off before cutting its dividend.

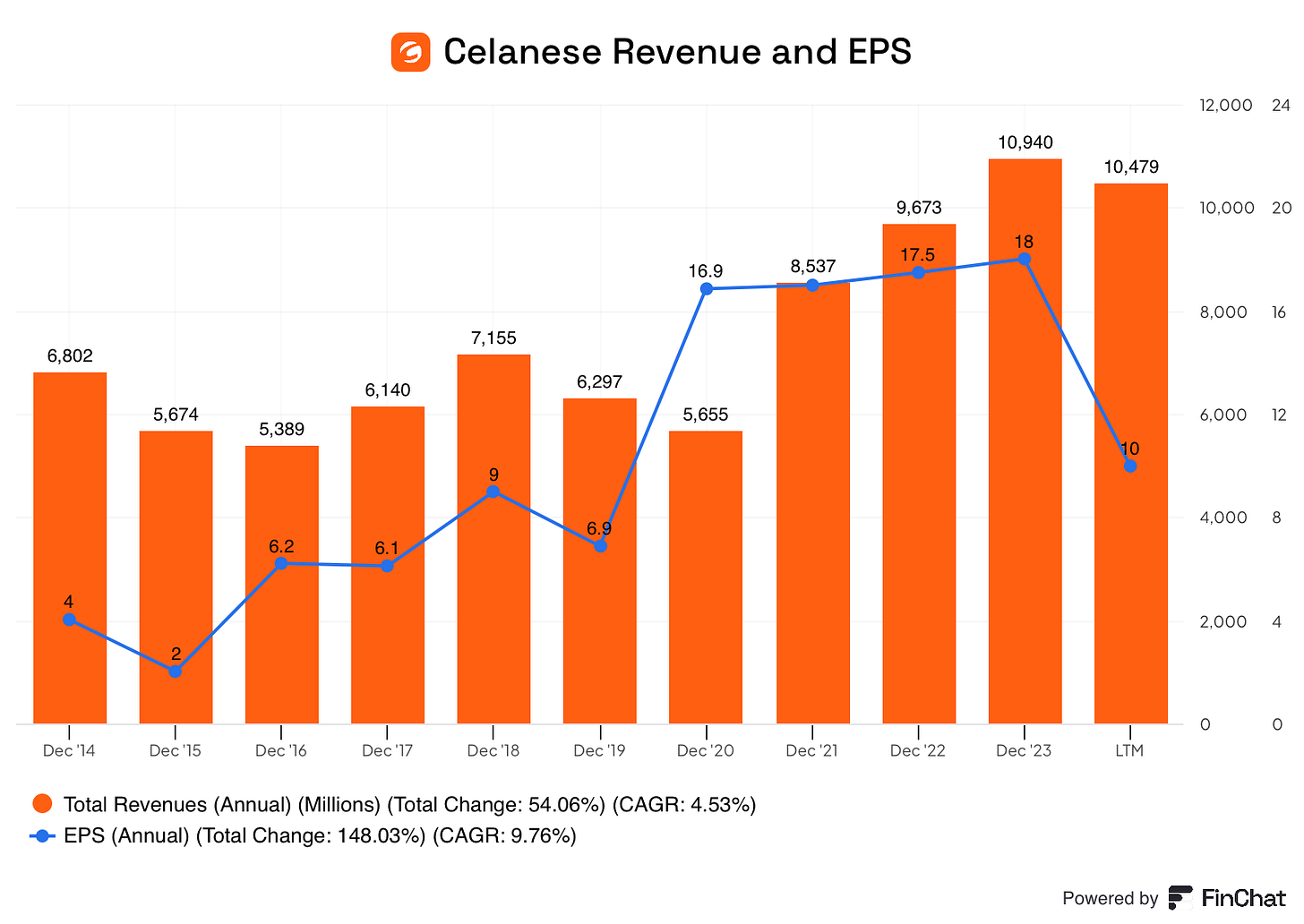

The revenue and EPS are lumpy, but as a chemical maker, Celanese has some cyclicality.

There was a significant decline in EPS in the last 12 months:

Source: Finchat

The dividend grew over the past decade, but there were very small increases in ‘22 and ‘23.

Source: Finchat

The payout ratio looks reasonable:

Source: Finchat

Were there any warning signs that could have kept us away from Celanese?

The small increases in the dividend payment recently, combined with the low payout ratio is a bit of clue.

But the biggest warning signs are in the balance sheet:

Source: Finchat

There were at least 2 major acquisitions in 2022, plus a business restructuring which increased the debt.

This significantly decreased the Cash Flow/Debt Ratio and the EBIT/Interest Ratio, while increasing the Debt/Equity ratio.

Some businesses can tolerate a higher level of debt.

Adding that much debt to a cyclical company isn’t usually a good idea.

Celanese increased its debt by 4x in 2022.

Go back and look at the 2023 revenue and EPS numbers. They didn’t significantly increase given the amount of debt the company took on.

What we can learn

Dividend investing isn’t all about yields, growth, and payout ratios.

The small increases in the dividend in 2022 and 2023 were because the company took on a lot of debt and didn’t significantly increase its income.

As soon as business conditions declined, this led to the dividend being cut.

It’s important to look at the decisions management is making and the underlying health of the business, including the balance sheet.

Best Buys December 2024

Now let’s dive into 5 of the most interesting stocks for December 2024.

5. Bank of Ireland Group plc (BIRG)

How does Bank of Ireland Group make money?

Bank of Ireland makes most of its revenue through interest from loans it provides to individuals and businesses.

The bank also collects fees for services, like account maintenance, transaction processing, and financial advice.

Furthermore, they earn income from investments and managing assets.

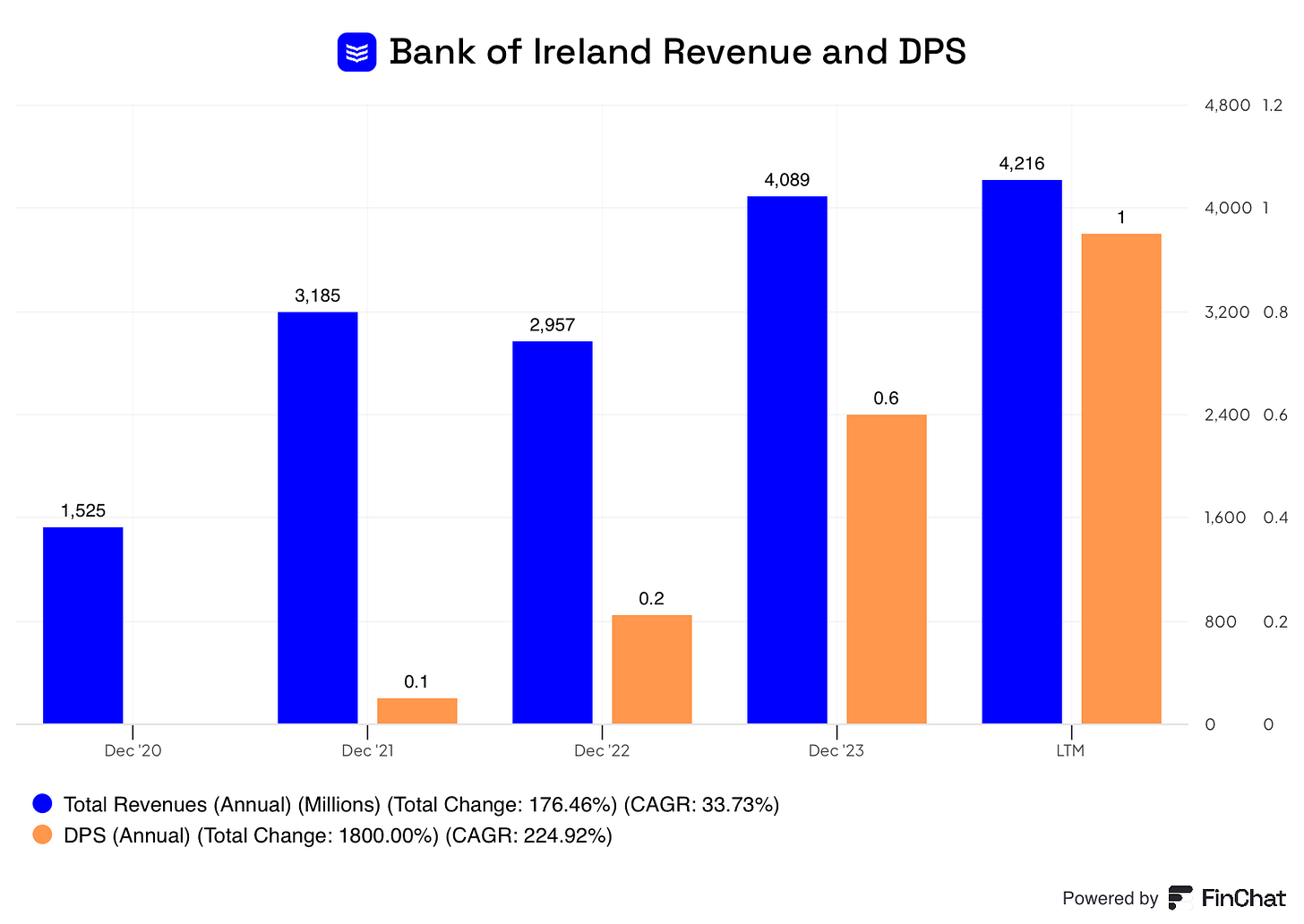

Why we think Bank of Ireland is interesting

European stocks are trading at much lower valuations than US stocks

Bank of Ireland operates in an oligopoly, with AIB Group, and Permanent TSB being the other large banks in Ireland

The current price offers a 6.8% dividend yield (payout ratio 65%), the company has been buying back shares at an increasing rate, and earnings are expected to grow modestly

Source: Finchat

4. American Tower Corporation (AMT)

How does American Tower Corporation make money?

American Tower owns and leases cellphone towers to companies.

They’re a major player in the growing field of wireless communication.

Why we think American Tower is interesting

AMT operates over 200,000 towers globally, giving them significant scale and reach in a growing market

American Tower typically has long-term leases in place with customers, allowing steady dividend growth

The current dividend yield of 3.2% is more than 30% higher than the 5-year average

Source: Finchat

Bank of Ireland and American Tower both offer attractive dividend yields.

The next 3 not only offer a strong starting yield, but strong potential for dividend growth and capital appreciation.

Ready to see what they are?