Best Buys December 2025

A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into this update and show you some of my favorite stocks.

November 2025

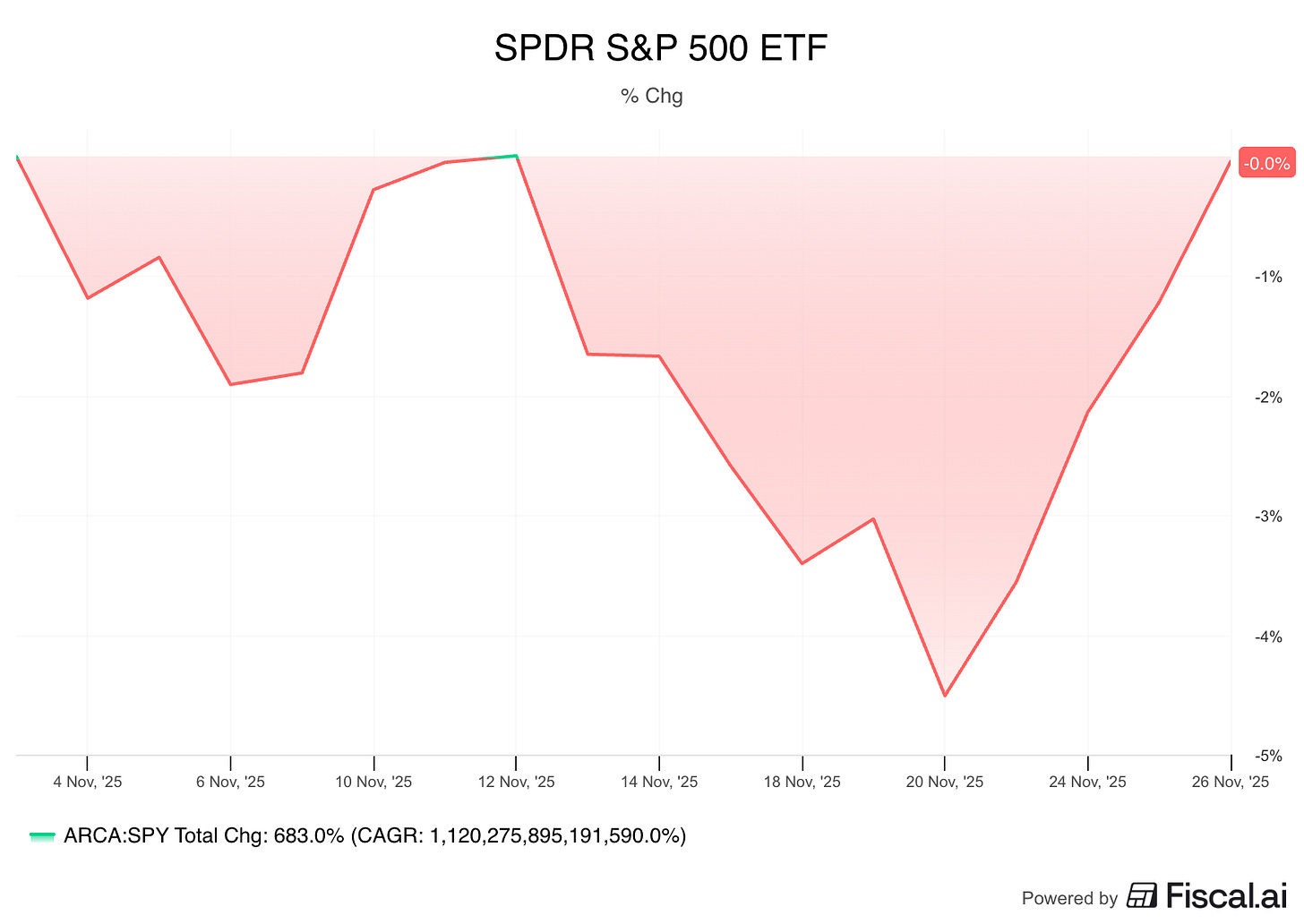

In November the S&P 500 decreased by 0.04%.

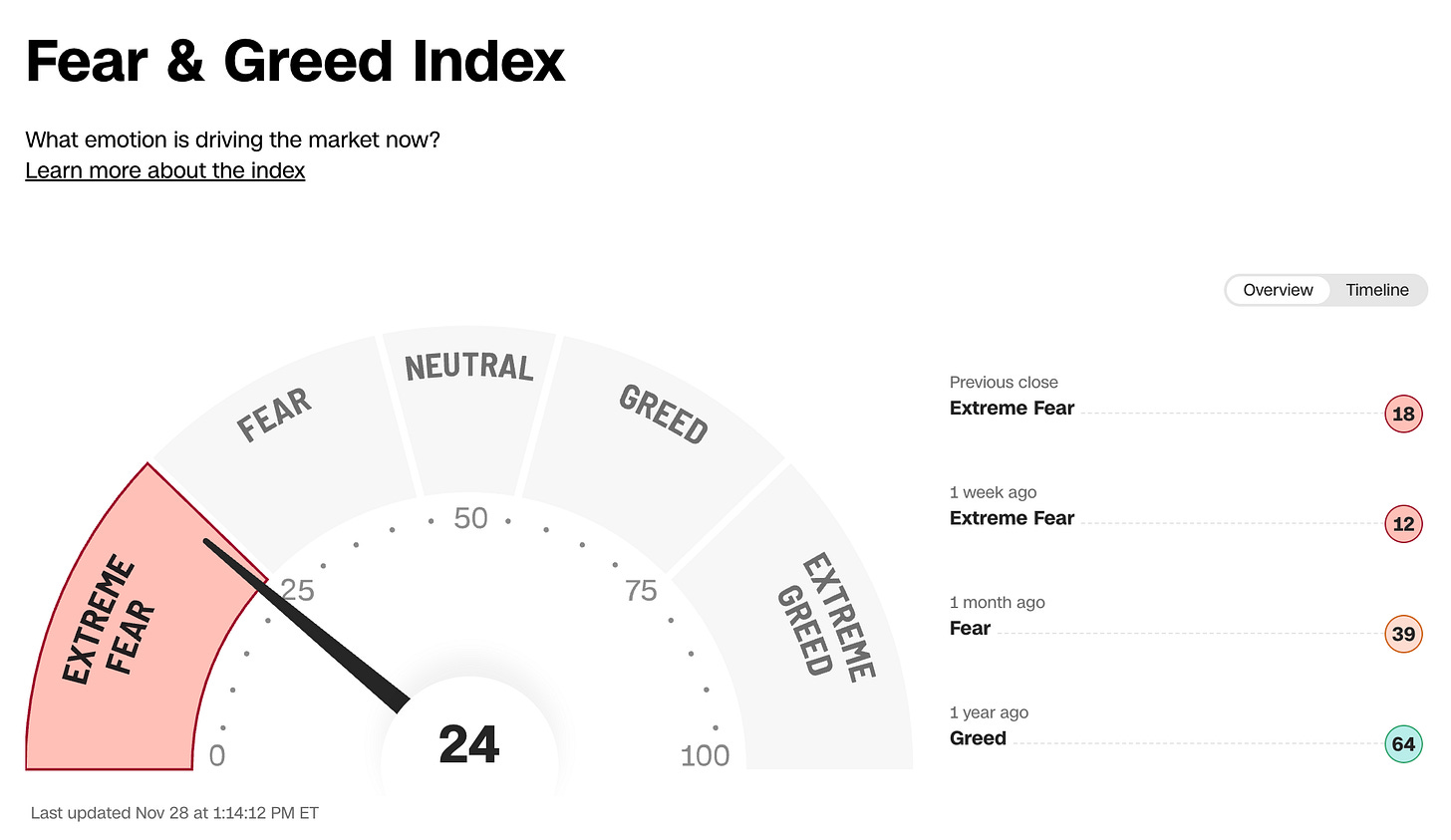

The Fear & Greed Index indicates that we’re in ‘Extreme Fear’.

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

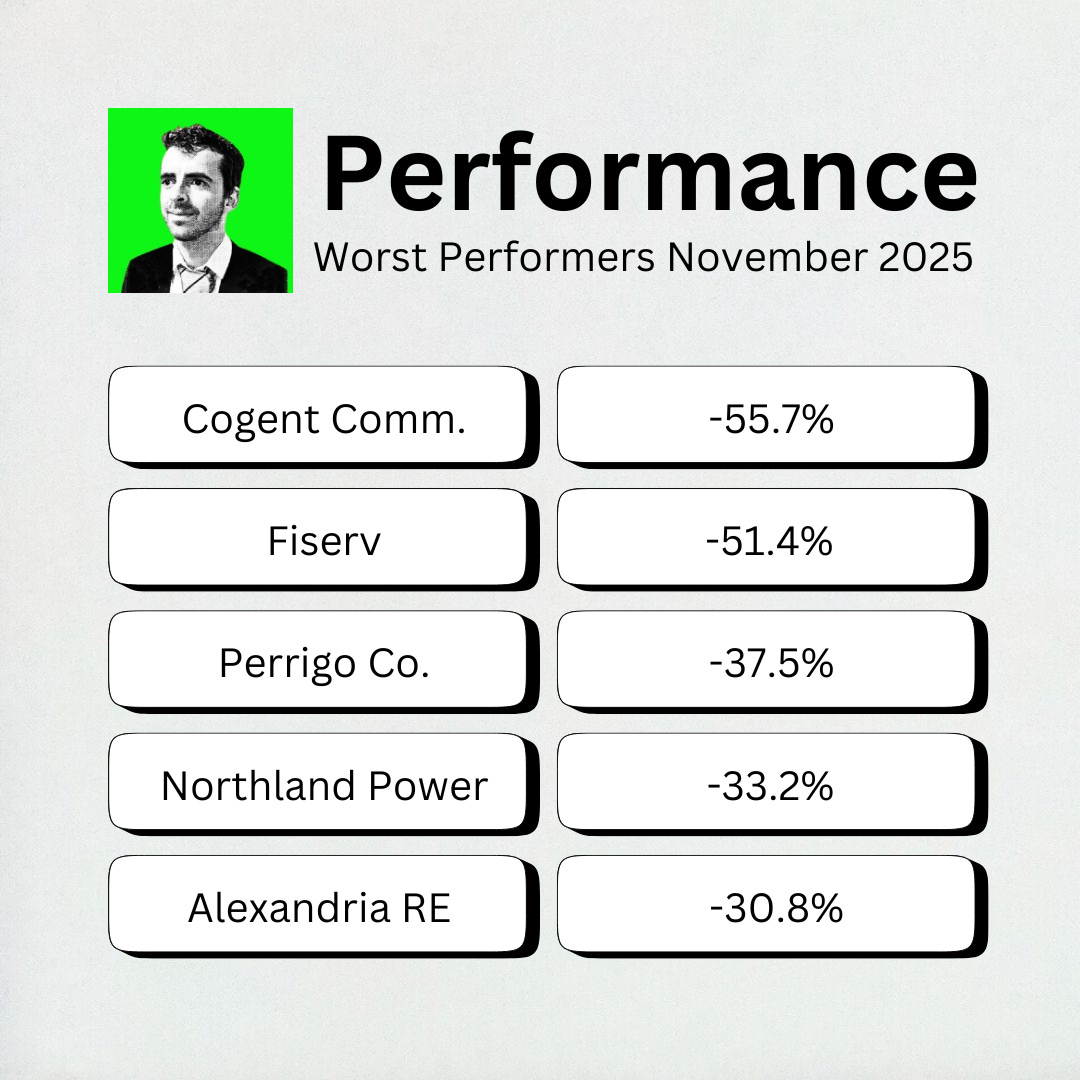

Worst performers

The cheaper we can buy great companies, the better.

The biggest decliner this month? Cogent Communications falling by over 50%!

Cogent Communications is an internet service provider that delivers high-speed internet access and data transport over a fiber-optic network.

It serves small and medium-sized businesses, communications service providers, and other bandwidth-intensive organizations in North America, Europe, and Asia.

The stock dropped hard because:

Quarterly revenue fell: Revenue declined 5.9% year-over-year, missing analyst estimates.

Dividend was slashed: The quarterly dividend was cut drastically from $0.995 to just $0.02 per share to preserve cash.

Corporate business is shrinking: Revenue from the corporate segment dropped significantly as the company sheds unprofitable connections.

Management is intentially shrinking the business: They are actively exiting low-margin contracts inherited from an acquisition, causing near-term pain for long-term health.

In short: Management executed a painful reset by slashing the dividend and shedding unprofitable revenue now to lower debt and return to growth.

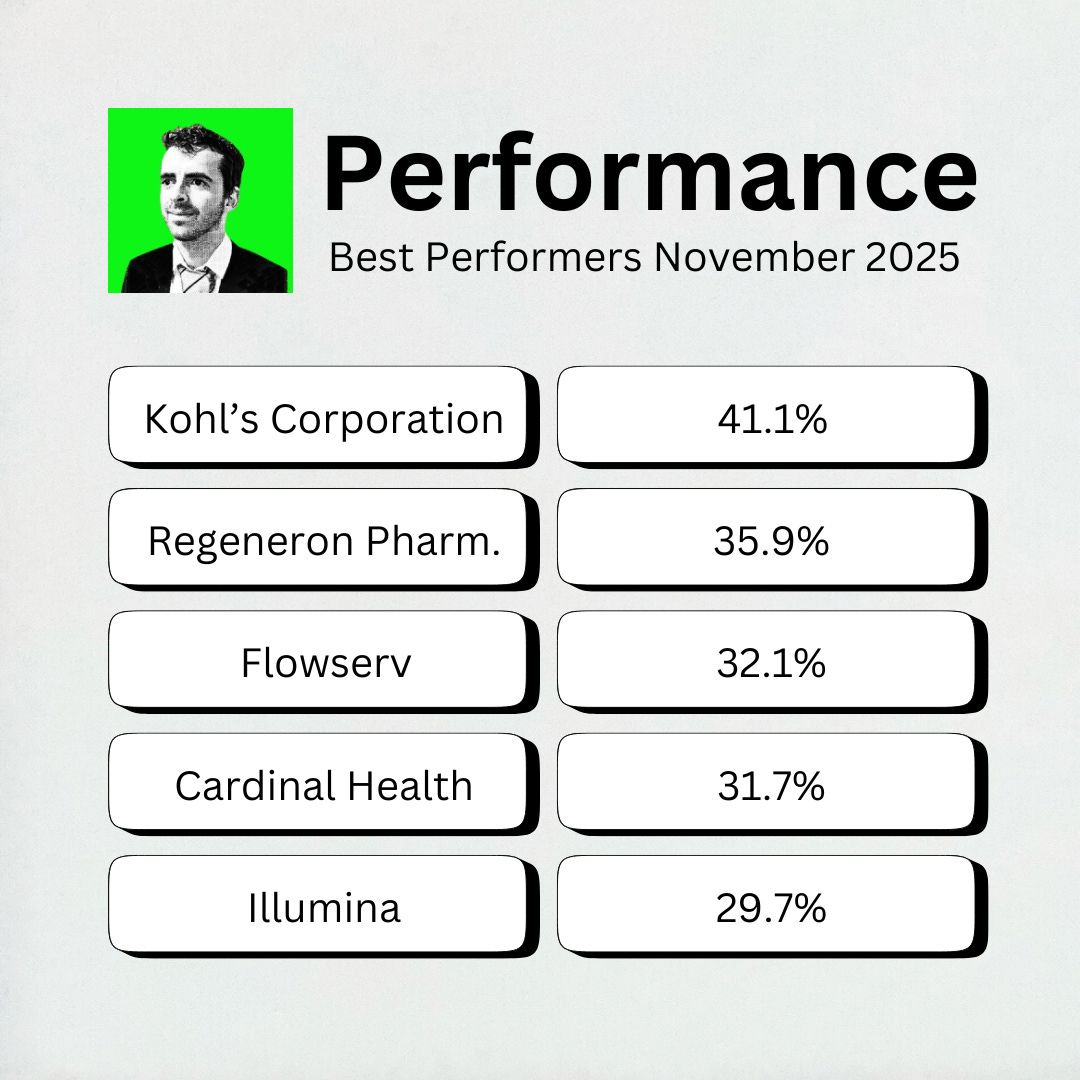

Best Performers

Kohl’s Corporation was this month’s best performer, rising more than 40%!

Kohl’s is a leading American department store retail chain that operates over 1,100 stores and a large digital platform.

It sells clothing, shoes, home goods, and accessories for families, often featuring partnerships with major brands like Sephora and utilizing a heavy promotional strategy with “Kohl’s Cash.”

The stock rose sharply because:

Earnings and revenue beat expectations: The company reported a surprise profit of $0.10 per share for the third quarter, and brought in more revenue than Wall Street anticipated.

Guidance was raised: Management increased their full-year financial outlook, forecasting better sales and higher earnings per share ($1.25–$1.45) than previously expected.

CEO uncertainty ended: The board officially named interim leader Michael Bender as the permanent CEO, stabilizing leadership after a period of turmoil.

Short squeeze effect: With a high percentage of shares being shorted (betting against the stock), the positive news forced short-sellers to buy back shares rapidly, fueling the rally.

In short: The new permanent CEO delivered a surprise profit and raised future guidance, proving that the company’s turnaround plan is gaining traction faster than skeptics expected.

Spotlight: Fiserv ($FI)

Fiserv was the worst performer in the S&P 500 recently, losing half its value in a single month, and 75% so far this year!

Let’s look deeper into the company this month.

How does the company make money?

Fiserv provides the “plumbing” for the global financial system.

If you swipe a card, check your bank balance, or pay a bill online, Fiserv likely processed it. They serve two main groups:

Merchants (shops & businesses): They provide payment terminals (like the ubiquitous Clover systems in coffee shops) and software to accept payments.

Financial Institutions: They run the core banking software for thousands of community banks and credit unions.

Fiserv makes money on transactions (taking a tiny fee every time money moves) and subscriptions (banks paying to use their software).

Why do long-term investors like it?

While Fiserv doesn’t pay a dividend, it has historically been a favorite of “compounder” investors who love steady cash flow and massive share buybacks.

It was heavily bought by large funds last quarter.

Here’s what usually makes it steady:

High Switching Costs: Banks almost never switch their core software (it’s too risky).

Inflation Hedge: As prices go up, transaction volumes (and fees) go up.

Recurring Revenue: ~80% of revenue is recurring.

Fiserv doesn’t pay a dividend, but has historically generated, and returned a lot of cash to shareholders through buybacks.

What’s the story today?

Fiserv crashed in November because the new CEO, Mike Lyons, decided to “kitchen sink” the quarter, meaning he revealed all the bad news at once to reset the baseline.

What went wrong:

Growth Disappeared: Organic revenue growth guidance was slashed from 10% down to just 3.5%–4%.

Margins Collapsed: Margins fell significantly as the company admitted past targets were unsustainable.

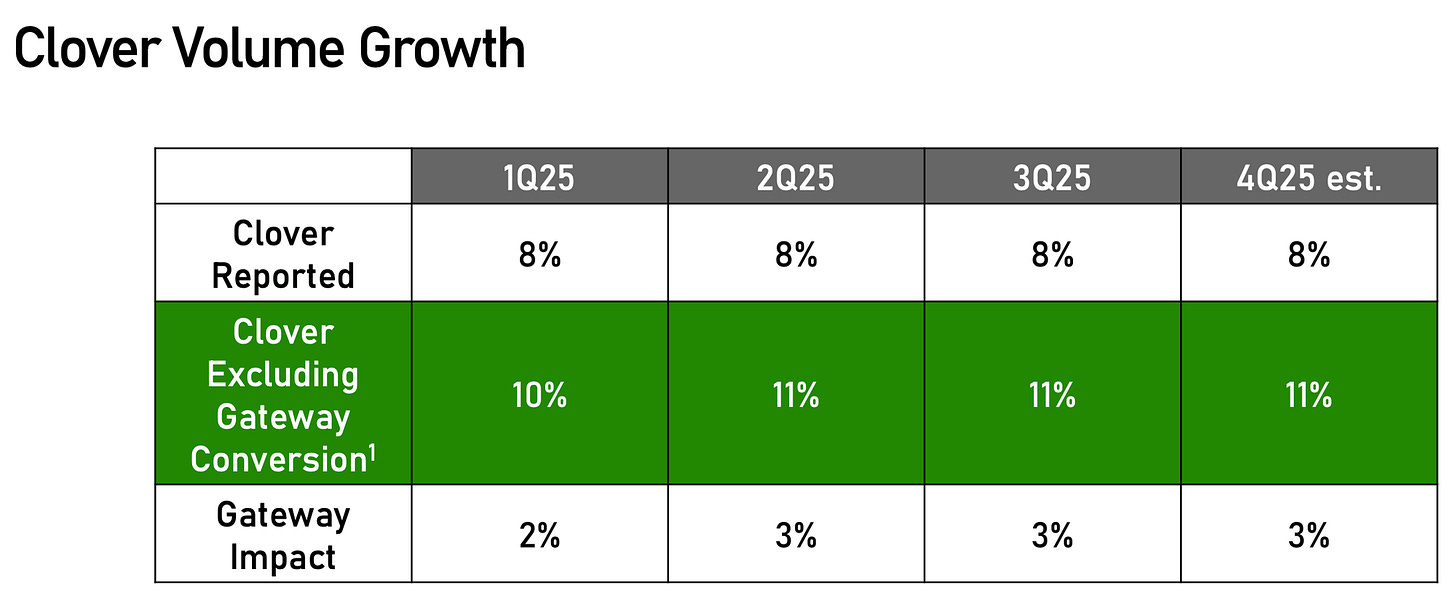

Merchant Slowdown: The “Clover” growth engine slowed, and the Financial Services segment actually shrank by 3%.

“Cleaning House”: The new management is exiting bad contracts (like low-margin deals in Argentina) which hurts numbers now but might help later.

The Good News:

Valuation is Rock Bottom: It is trading at a single-digit P/E ratio (9.4x), which is extremely rare for a high-quality fintech.

Cash Flow Machine: Even with the slowdown, the company generates massive free cash flow.

Clover is still a Leader: It remains the dominant Point-of-Sale system for SMBs.

Investor Takeaway

The new CEO has reset expectations drastically lower to clear the decks.

The market hates the uncertainty, and slower growth which is why the stock was punished so severely.

However, if you believe the new CEO can stabilize the ship, you are buying a market-leading monopoly at a bargain-basement price.

Fiserv has moved from a steady compounder to a turnaround story.

December Best Buys

I usually scan the Buy-Hold-Sell List for great dividend payers at attractive prices to highlight for you.

But because big investors have had to report their current holdings and portfolio changes through 13-F filings, I figured we’d cheat off of the best investors in the world to see what they’re buying.

A 13-F filing is a quarterly report submitted to the SEC by investment managers who control over $100 million in U.S. stocks. It’s a snapshot of their long holdings at the end of each quarter.

Let’s dive into 5 of the most interesting stocks bought by superinvestors last quarter!

💳 Visa (V)

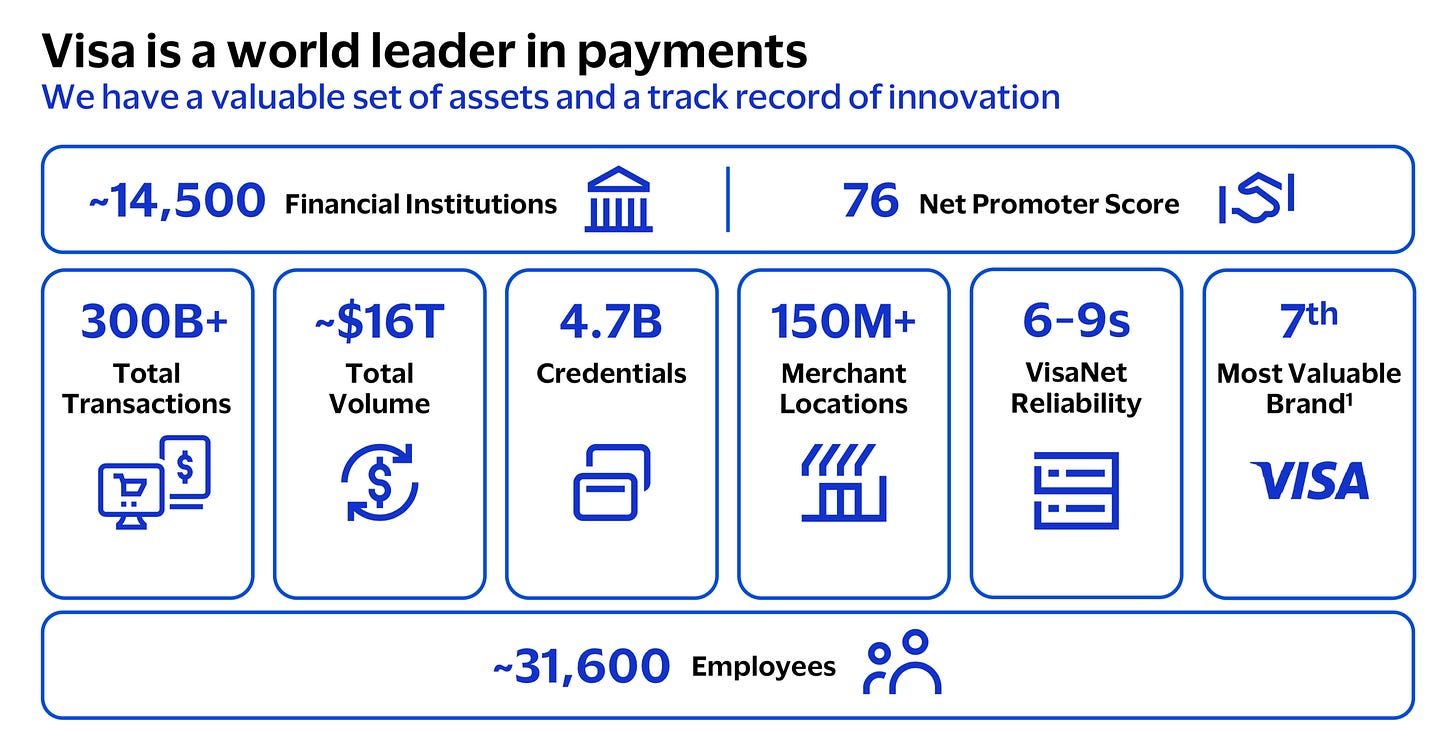

Visa makes money by charging fees on payment volumes and transactions across its vast, global network.

It’s a toll road for digital commerce, benefiting from every swipe, tap, or click.

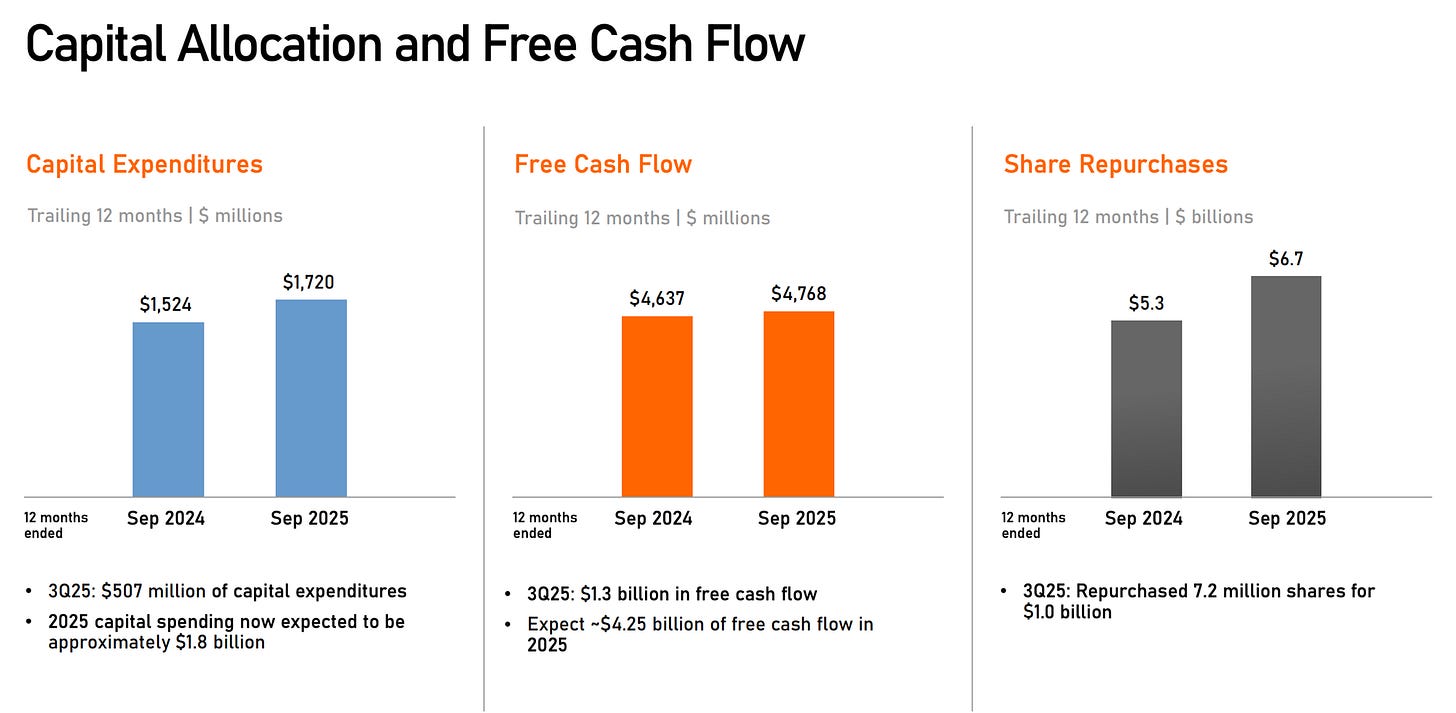

The secular trend toward a cashless society and the sheer volume growth in global consumer spending provide an enormous, long-term tailwind. Its business model requires very little capital expenditure to scale, resulting in high margins and exceptional free cash flow.

Visa has increased its dividend for 16 consecutive years, demonstrating a strong commitment to growing shareholder returns, with a 5-year dividend growth rate (CAGR) near 15%. Its low payout ratio signals plenty of room for future hikes.

Current Yield: 0.83%

Payout Ratio: 21.3%

Years of Dividend Growth: 16

🚂 Railroads: Union Pacific (UNP) and Canadian Pacific Kansas City (CPKC)

Railroads generate dependable cash flow by offering essential freight transport services for a wide range of goods, from grain and automobiles to chemicals and intermodal containers.

They have a strong moat due to their vast, difficult-to-replicate rail networks.

The industry benefits from being the most fuel-efficient way to move bulk freight over land, creating a long-term cost advantage over trucking.

The ongoing focus on Precision Scheduled Railroading (PSR) helps boost operating efficiency and profit margins, ensuring reliable cash flow for shareholders.

Union Pacific has an incredible dividend history, having paid a dividend on its common stock for 126 consecutive years.

The interesting thing about these two railroads?

How big they have built their networks through mergers.

Canadian Pacific merged with Kansas City Southern in 2023 , creating the first single-line rail network connecting the U.S., Mexico, and Canada.

Union Pacific is proposing a merger with Norfolk Southern which would create the first transcontinental railroad in the U.S.

I hope you got a lot of value from this article so far.

And trust me…

I wish I could show you the Top 3 Best Buys.

But those picks are for paid subscribers only.

The free version has to end here.

One Dividend At A Time

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data