Best Buys February 2026

A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into this update and show you some of my favorite stocks.

January 2026

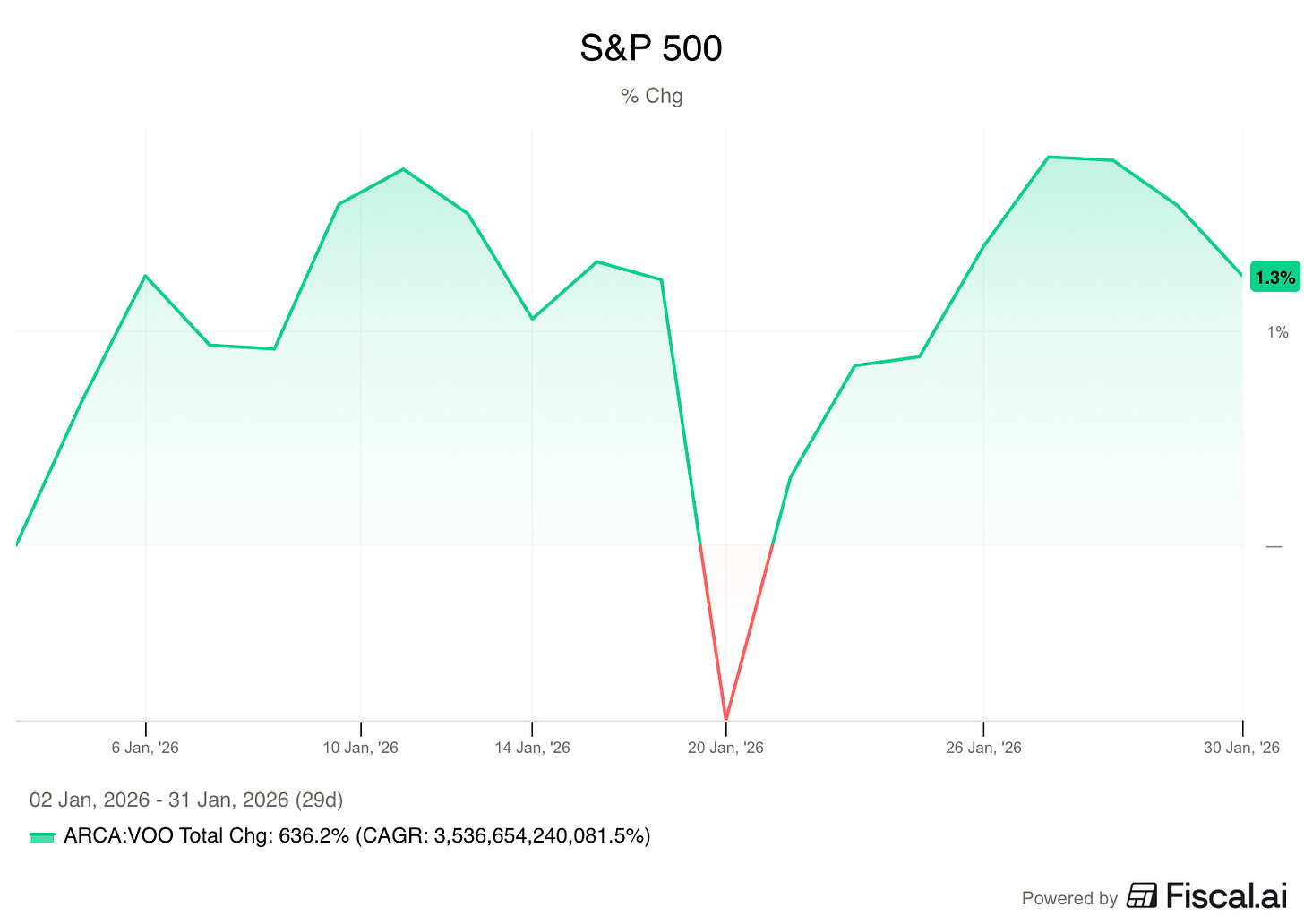

The S&P 500 was up 1.3% in January

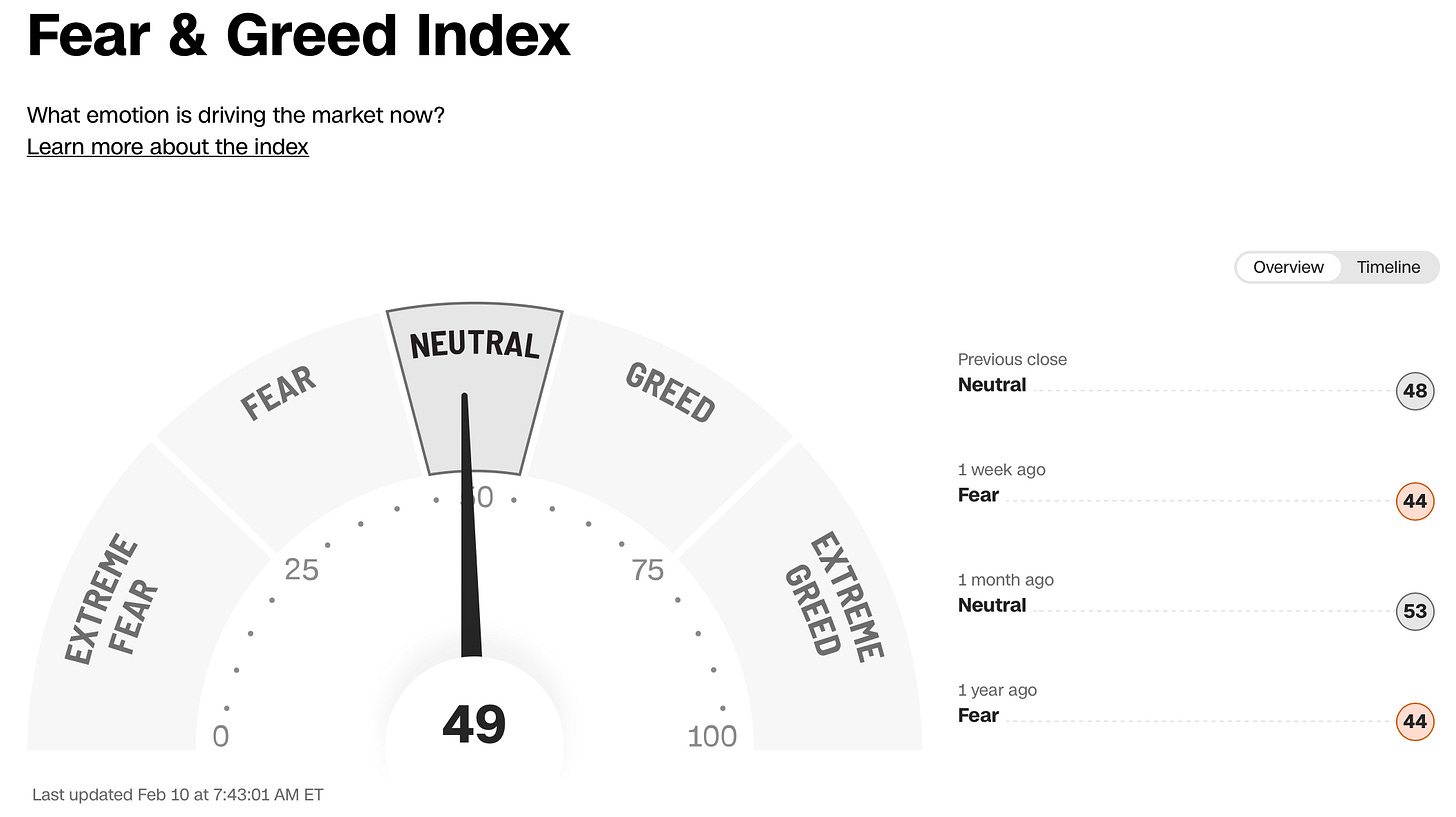

Investors are ‘Neutral’ today according to the Fear & Greed Index:

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

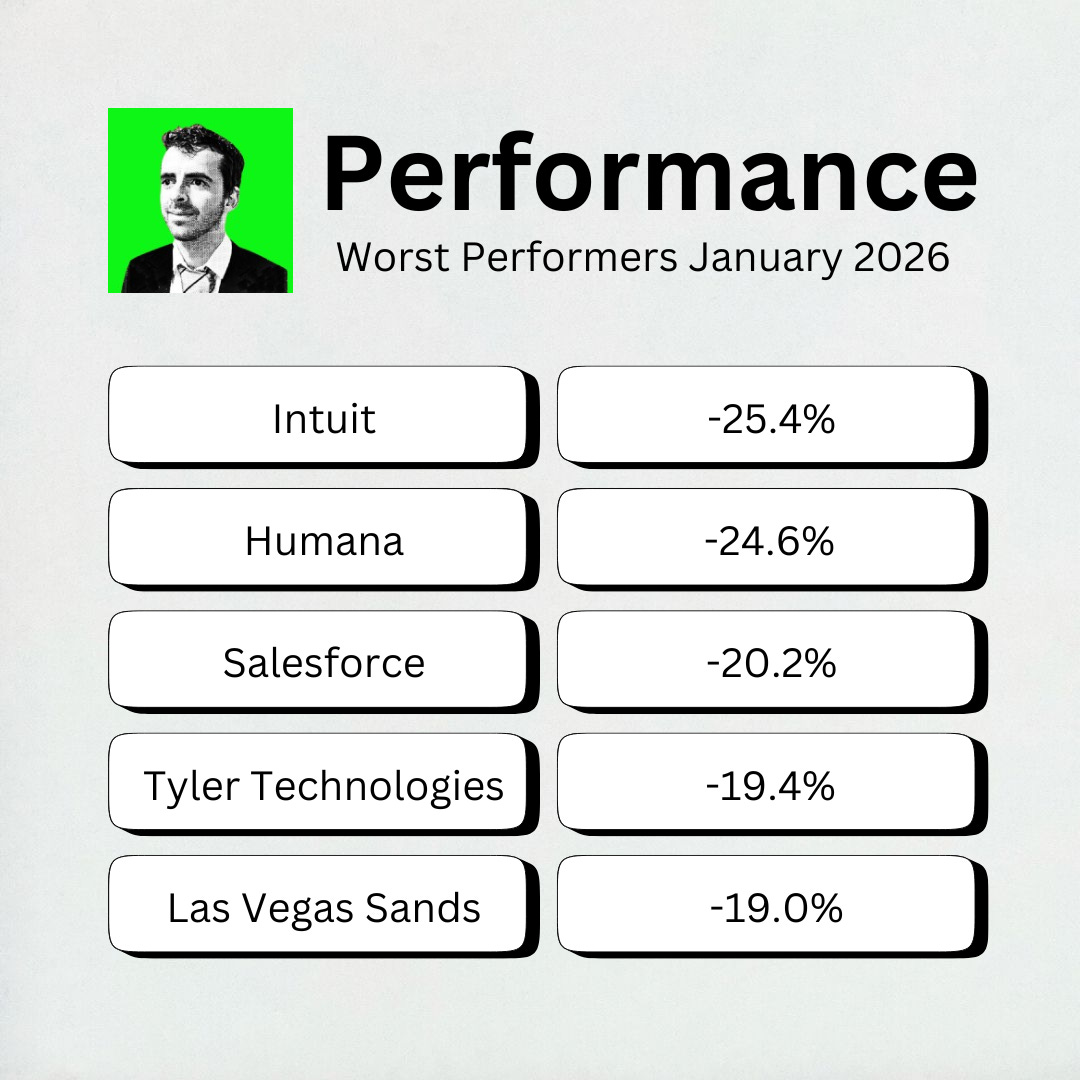

Worst performers

The cheaper we can buy great companies, the better.

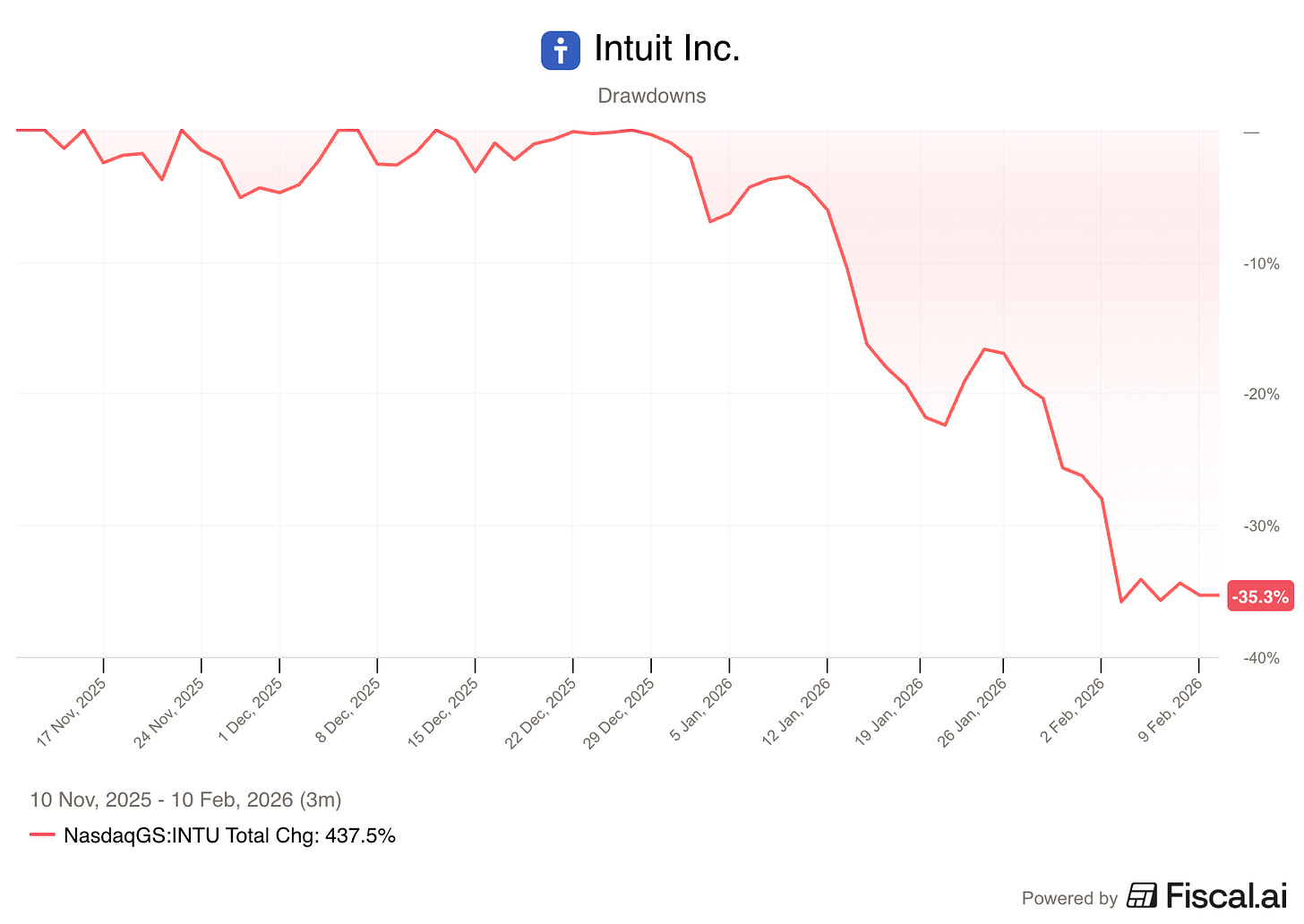

The biggest decliner this month? Intuit, losing 25% of its value.

Intuit provides tax, accounting, and personal finance software.

We’ll talk more about it and why the stock is down in the ‘Spotlight’ section.

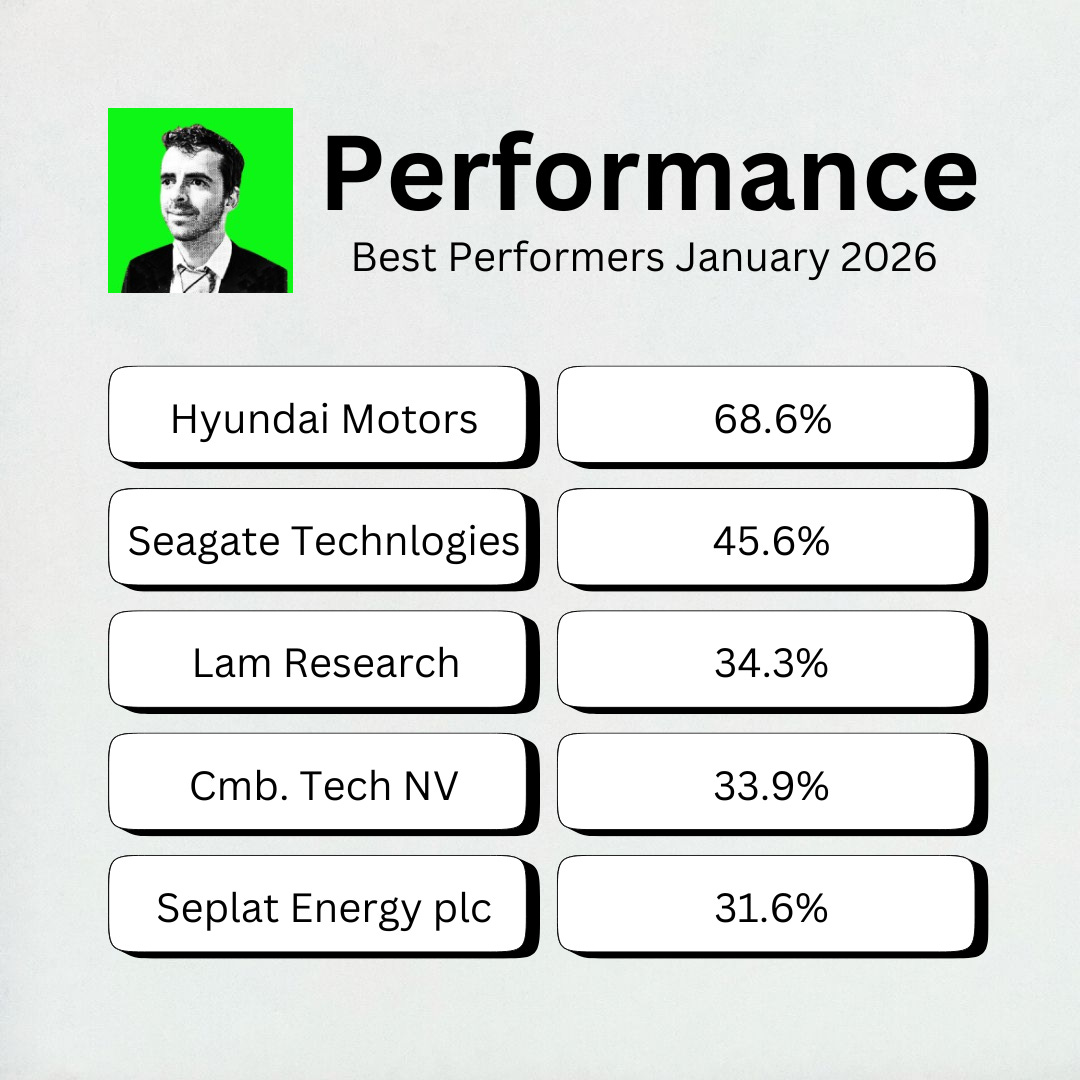

Best Performers

Hyundai Motors was this month’s best performer, rising more than 68%!

Hyundai Motor Group manufactures vehicles under the Hyundai, Kia, and Genesis brands.

It’s trying to pivot from a traditional automaker into ‘physical AI’ through robotics, autonomous driving, and hydrogen technology.

The January performance was due to:

The Atlas Robot: At CES 2026, Hyundai unveiled a production-ready version of the Atlas humanoid robot (via Boston Dynamics).

NVIDIA Partnership Speculation: News of a private meeting between Hyundai’s Chairman and NVIDIA’s CEO started rumors of a deeper collaboration on AI chips for robotics, leading to a 15% gain in a single day.

Shareholder Returns: Management announced a 400.7 billion won share buyback and a commitment to return over 35% of profits to shareholders through 2027.

Record US Sales: Hyundai reported its best-ever January sales in North America.

Tech Investment: The company pledged to spend 17.8 trillion won ($12.5 billion) in 2026 on new-growth areas.

In other words, Hyundai’s stock jumped because investors now see it as a robotics and tech company instead of a car maker.

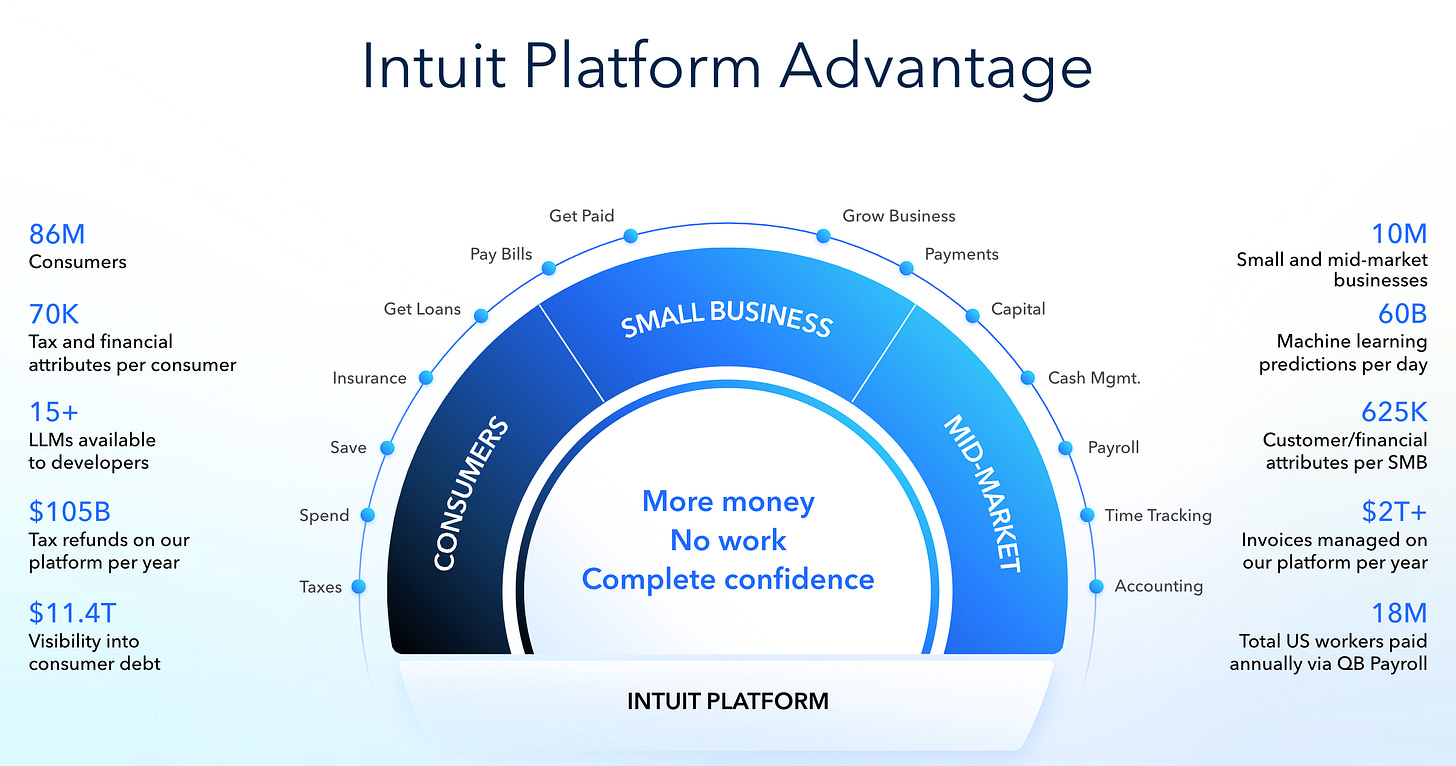

Spotlight: Intuit ($INTU)

Intuit has had a tough start to 2026, dropping nearly 34% from its November highs.

How does the company make money?

Intuit provides financial software to small businesses and consumers.

They own four of the most recognizable brands in finance:

QuickBooks: Accounting and payroll for small businesses

TurboTax: DIY tax filing.

Credit Karma: Credit scores, personal loans, and insurance recommendations

Mailchimp: Marketing and email automation for small businesses

Intuit makes money primarily through subscriptions (recurring monthly fees for QuickBooks and Mailchimp) and transactional fees (Credit Karma leads and payroll processing).

Over 80% of their revenue is recurring.

Why is it interesting?

Intuit has a very strong moat.

Once a small business is on QuickBooks, they almost never leave because the switching costs are too high.

Other interesting things about the company?

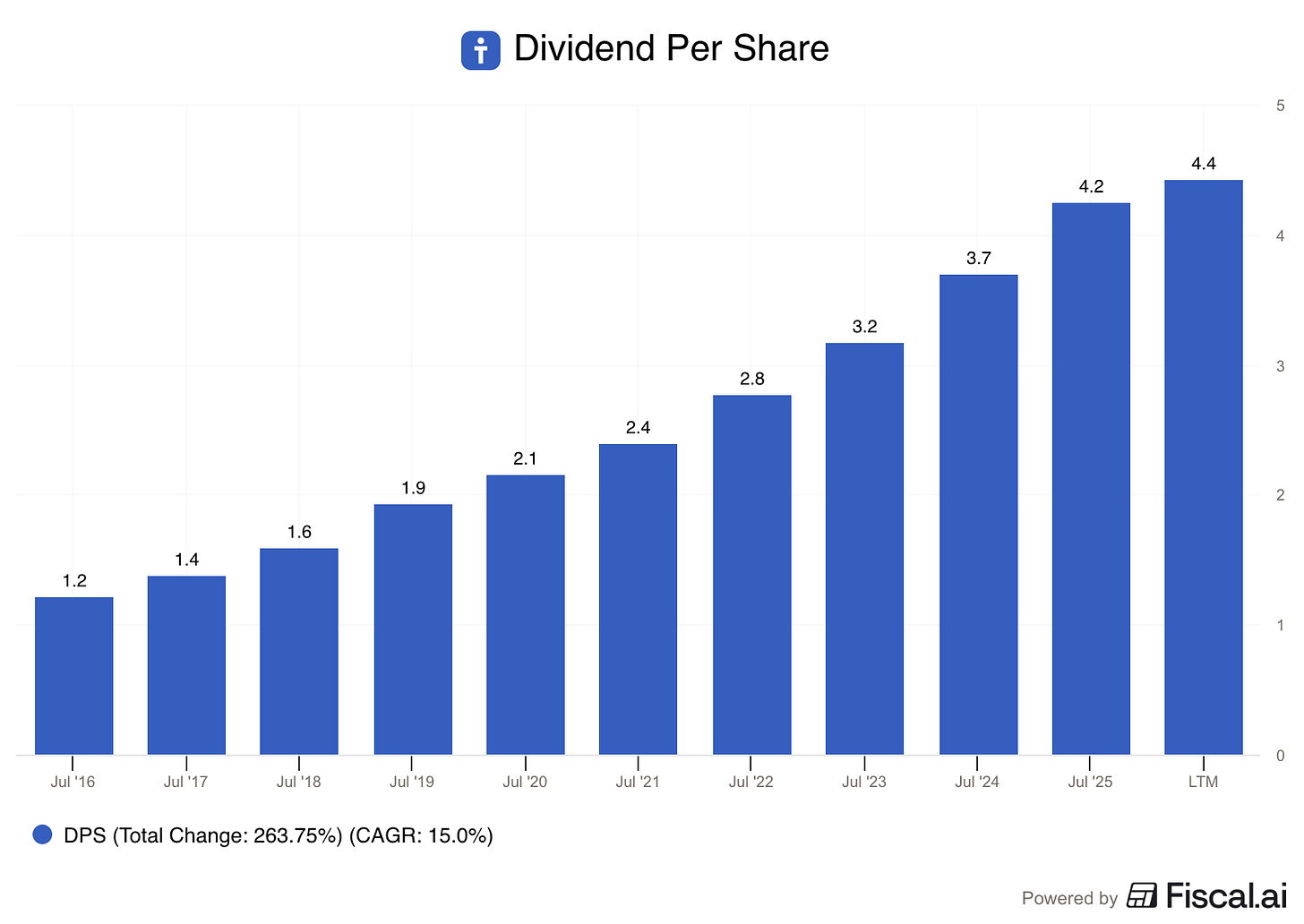

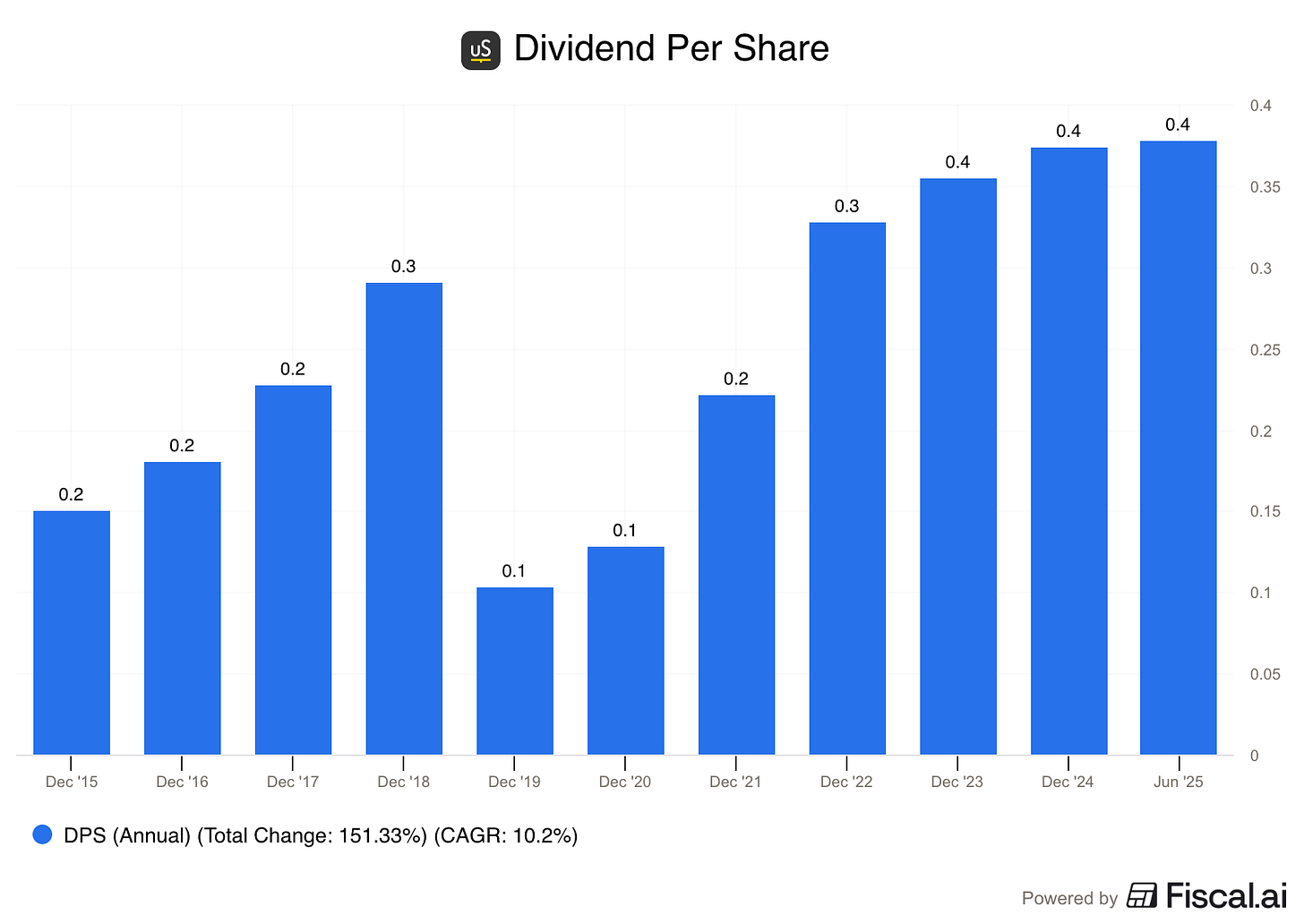

Dividends: Intuit is a dividend grower, with a 15% per year dividend growth rate over the past decade.

Buybacks: The board recently authorized a $3.2 billion share repurchase program

Pricing Power: Intuit has a history of successfully raising prices on its software without seeing significant customer churn.

High Margins: The company consistently maintains operating margins above 35%

Why’s the stock down?

Intuit is down for several reasons:

Guidance: Management guided for 12–13% revenue growth for 2026, down from 16% in 2025

Small Businesses: Data from January showed fewer small business formations, which limits the pool of new QuickBooks subscribers.

AI Worries: There is a growing fear that AI agents might eventually automate tax filing and bookkeeping

High Valuation: The stock’s P/E ratio was very high at 50x and has come down to 30x

Investor Takeaway

The market is worried that Intuit’s best days are behind it and that AI will disrupt its moat.

However, if you believe that small businesses will always need software for their books and that tax laws are too complex for a chatbot to handle, you are looking at a market-leading monopoly, with a higher yield than normal.

February Best Buys

There were some big moves in stock prices in January.

I scanned the Buy-Hold-Sell List for great dividend payers at attractive prices to highlight for you this month.

Let’s dive into 5 of the most interesting ones I found!

Unite Group PLC ($UTG)

How does Unite Group Make Money?

Unite Group is the UK’s largest owner, manager, and developer of purpose-built student accommodation.

They house over 70,000 students across the UK.

Unite Group partners directly with top-tier universities that nominate students straight to Unite properties.

When a university sends students directly to you, you don’t have to worry about occupancy.

Here are a few of their other advantages:

Scale: They are the undisputed market leader in the UK.

Moat: It is nearly impossible to get planning permission to build high-density housing in prime UK university cities.

Predictability: Between limited supply and the Universities nominating students, occupancy stays near 100%.

In addition they have a £1 billion development pipeline that will add over 6,600 new beds over the next three years.

For dividend investors, Unite could be very attractive right now:

Dividend Yield: 6.4%

Payout Ratio: 53%

5—Year DPS CAGR: 29.5%

Equifax ($EFX)

How does Equifax make money?

Equifax is one of the Big Three US credit bureaus.

But it’s way more than that.

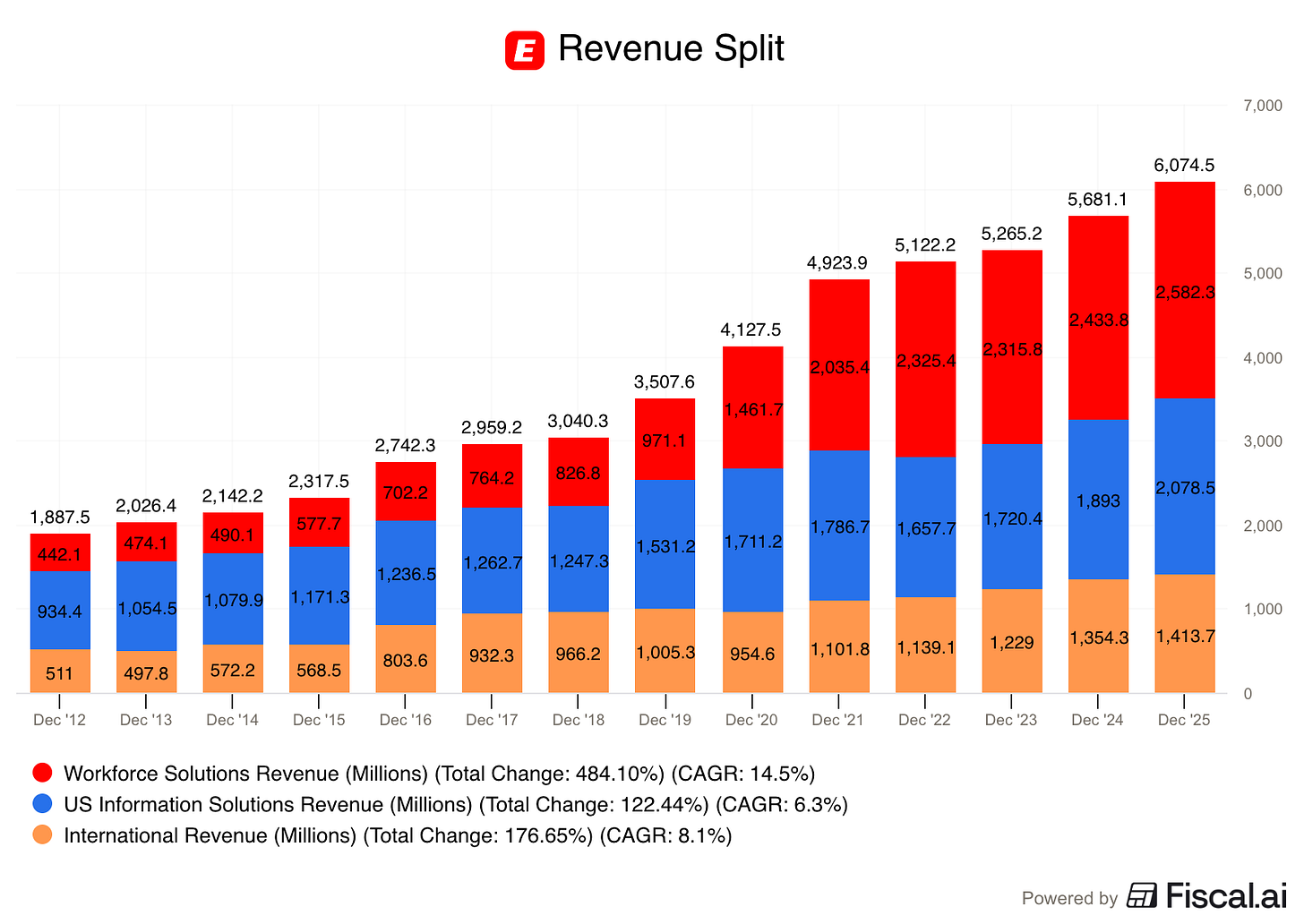

Over 40% of its revenue now comes from its Workforce Solutions segment - a business that verifies income and employment for lenders, landlords, and employers.

Think about that for a second.

Every time someone applies for a mortgage, a car loan, or a new job…

there’s a good chance Equifax is in the background, providing the data to make that decision.

Revenue has grown around 8% per year for the past decade.

But the share price is down more than 20% in the last 6 months.

The reason? The market is terrified that AI will disrupt Equifax’s data business.

I think they’re wrong - here’s why:

Proprietary Data: Equifax owns exclusive payroll and utility data. You can’t just scrape this from the web.

High Barriers to Entry: Convincing thousands of banks to share sensitive data with a startup is nearly impossible.

I think Equifax’s unique datasets actually make it an asset in an AI world — not a victim of it.

That’s a very interesting setup.

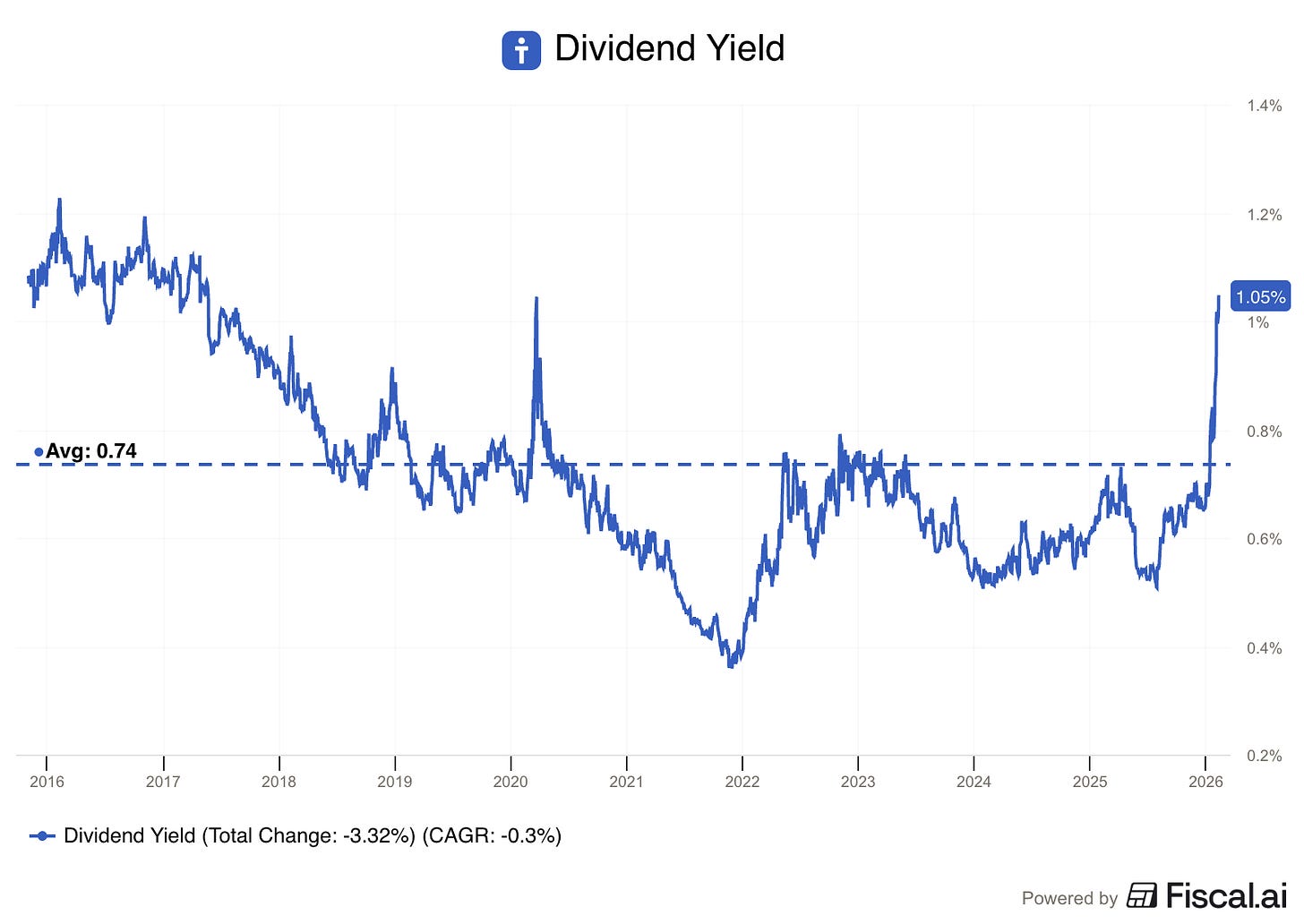

Dividend Yield: 1%

Payout Ratio: 35.3%

5-Year DPS CAGR: 3.9%

You’ve just seen two of my favorite stocks for February, but paid Partners get three more.

Whenever you’re ready

Whenever you’re ready, here’s how I can help you:

✍️ Three articles per week (Monday, Wednesday, and Saturday)

📚 Full access to our entire library of data-driven articles

📈 An insight into our Portfolio full of interesting Dividend Stocks

🔎 Full investment cases about interesting companies

The doors for Compounding Dividends will reopen to a limited of people on the 24th of February.

You don’t want to miss it? And you also want to receive all the exclusive bonuses?

You’ll also immediately get a copy of my 10 favorite cannibal stocks when you do.

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.