A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into this update and show you some of my favorite stocks.

May 2025

In May the S&P 500 increased by 6.4%

Source: Finchat

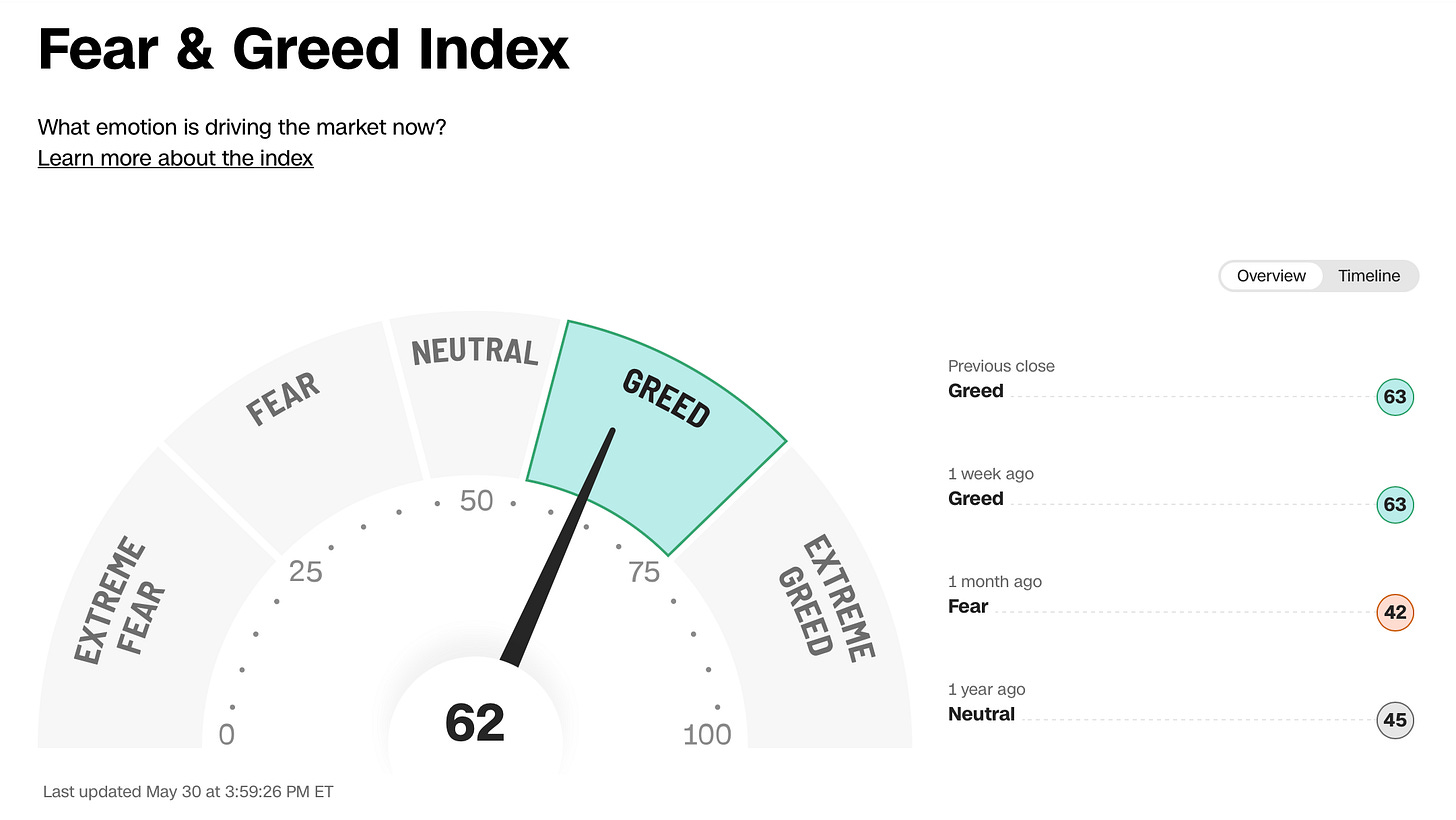

The Fear & Greed Index indicates that we ended May in ‘Greed’ Mode.

This is a big swing from the Extreme Fear we ended April in.

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

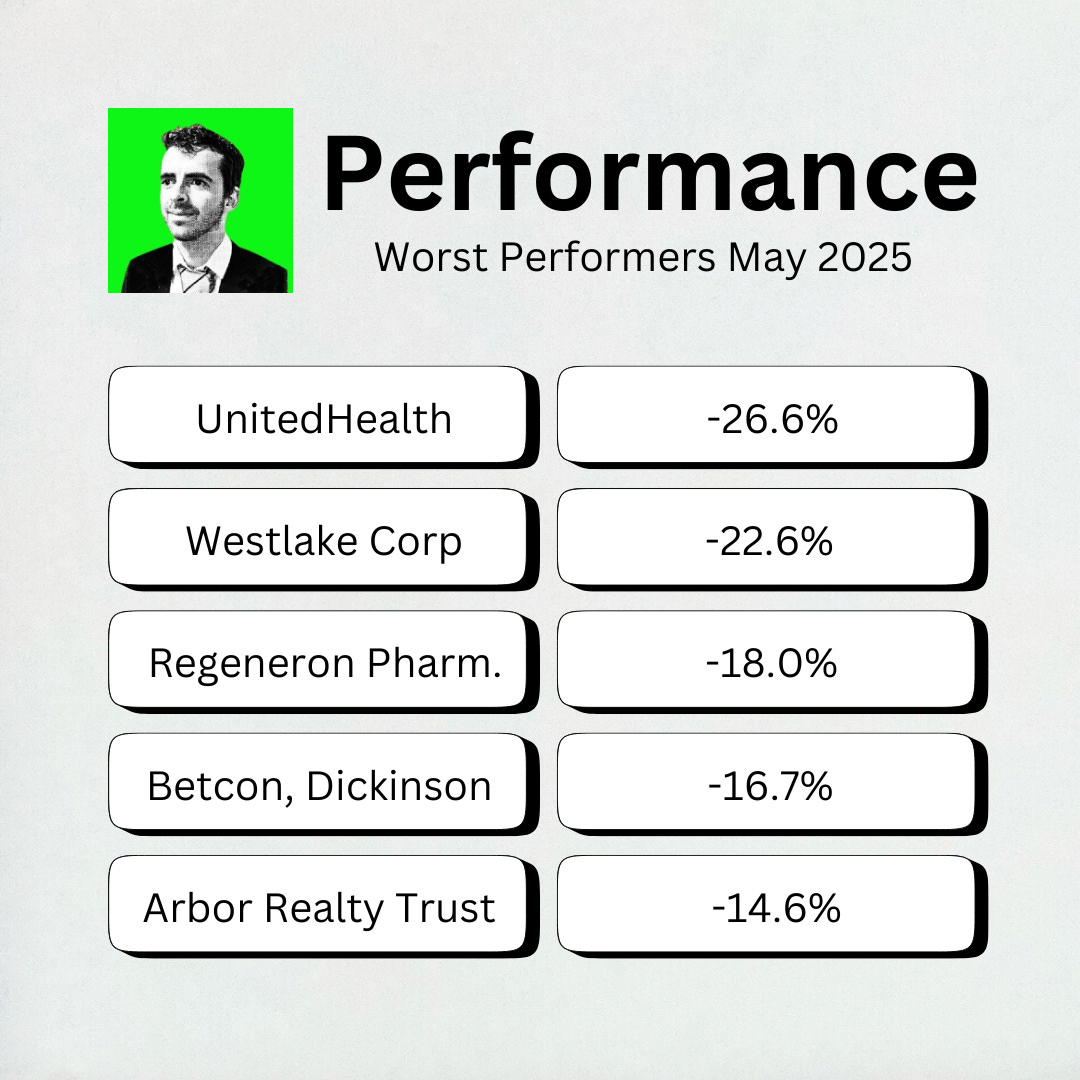

Worst performers

The cheaper we can buy great companies, the better.

The biggest decliner this month? UnitedHealth Group.

UnitedHealth Group is a large American company that helps people get the healthcare they need.

It does this through two main parts:

UnitedHealthcare, which provides health insurance, and

Optum, which offers medical care, manages pharmacy services, and uses data to improve healthcare.Best Performers

UnitedHealth has been hit by a perfect storm of issues including:

Rising medical costs squeezing profits

A criminal investigation into possible Medicare fraud

The unexpected departure of its CEO

A suspended 2025 financial outlook

We wrote an article about the company that you can read here.

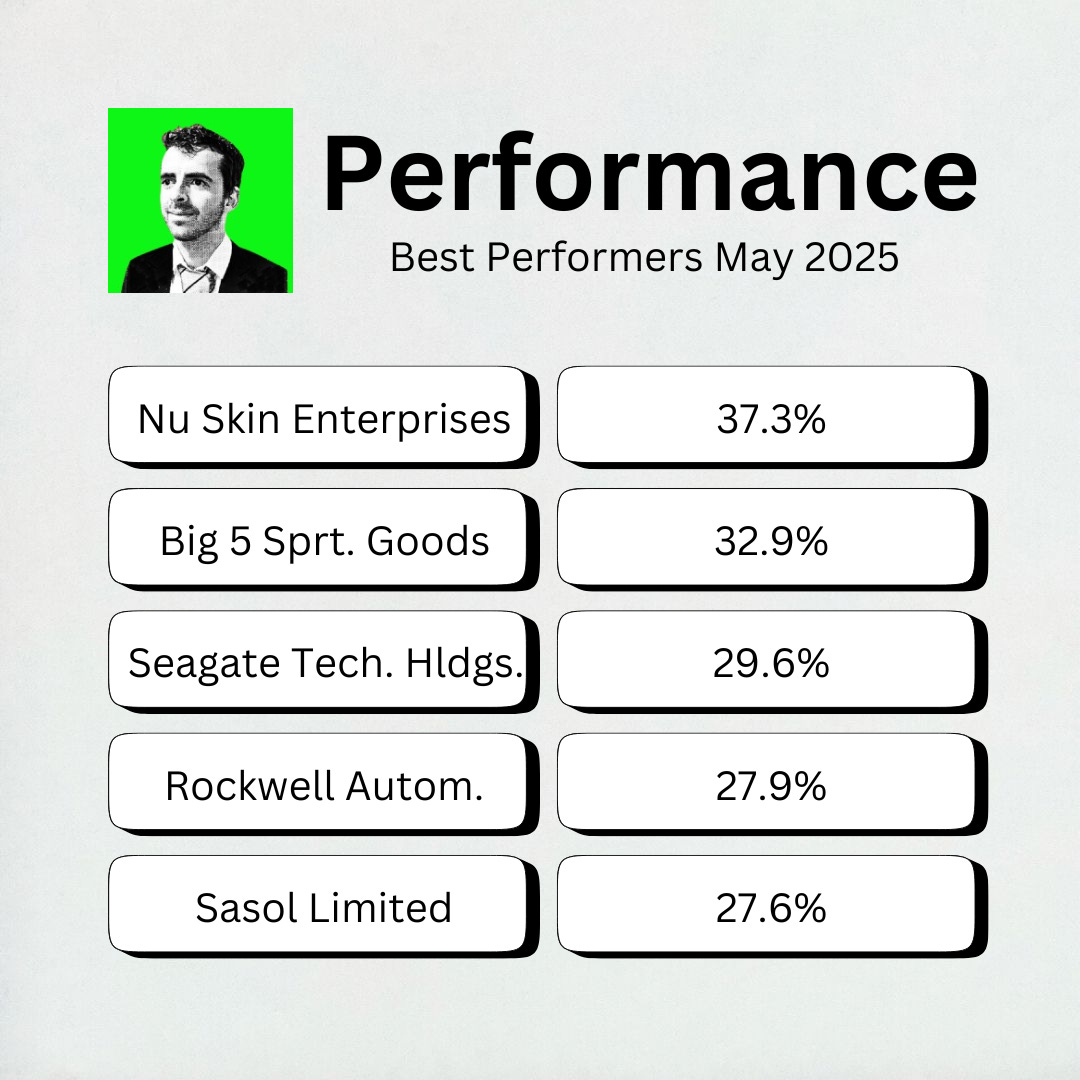

Best Performers

Nu Skin Enterprises was this month’s best performer, rising over 37%.

Nu Skin Enterprises is a global company that sells skincare products, anti-aging devices, and nutritional supplements.

They use a direct selling model, where independent distributors promote and sell products to customers.

Spotlight: The Clorox Company ($CLX)

How does the company make money?

Clorox makes money by selling cleaning supplies, trash bags, bleach, cat litter, and other everyday household products.

You’ll find Clorox brands in nearly every home:

Clorox bleach

Glad trash bags

Kingsford charcoal

Burt’s Bees personal care

Brita water filters

These are simple products people buy again and again. That makes Clorox a steady business with predictable cash flow.

Why do dividend investors like it?

Because Clorox pays a reliable dividend - and keeps raising it.

Clorox has increased its dividend for 47 straight years

It’s a Dividend Aristocrat

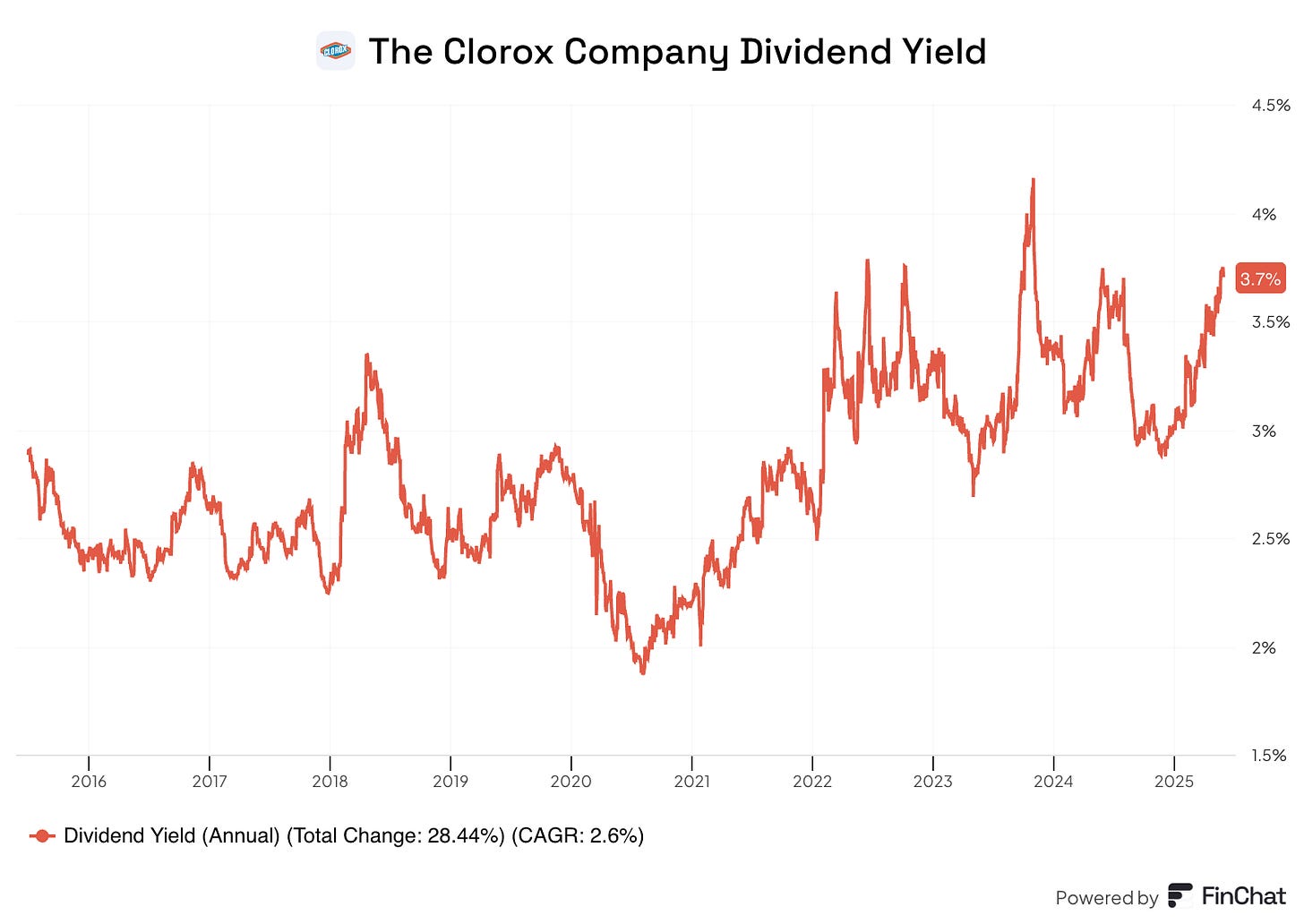

The current yield is around 3.5%

Its dividend is backed by stable cash flow and strong brands

Management plays the long game.

Clorox doesn’t grow fast - but it grows steadily. It invests in brand strength, pricing power, and small bolt-on acquisitions.

It focuses on high returns on capital and shareholder returns through dividends and buybacks.

It’s also available at a higher starting yield than usual.

Source: Finchat

The fundamentals look like this:

Dividend Yield: 3.6%

Payout Ratio: 87.1%

10-Year Dividend CAGR: 5.1%

Net Profit Margin: 9.9%

ROIC: 13.4%

Forward PE: 18.8x

Clorox isn’t flashy. But if you want a defensive, recession-resistant company that rewards long-term shareholders with consistent dividend growth - it’s worth a look.

June Best Buys

In May, another batch of 13-F filings came out.

These are quarterly reports that institutional investment managers must submit to the SEC, disclosing their equity holdings.

They’re interesting to look at because they give us a look at the investment strategies and stock choices of large, influential funds.

We can use these to spot trends and generate ideas.

With that in mind, June’s Best Buys all come from the holdings of professional investors.

Mohnish Pabrai would approve!

“I'm a shameless copycat. Everything in my life is cloned … I have no original ideas.”

-Mohnish Pabrai

Let’s see if we can clone some great ideas!

5. Visa (V)

Owned by: Chuck Akre, Francois Rochon

How does the company make money?

Visa runs the toll booth on the world’s biggest payment highway.

Every time someone swipes, taps, or clicks to pay - Visa gets a slice.

That’s tens of billions of transactions... across every continent.

Why invest?

It’s a toll booth business - high margin, zero credit risk

Global tailwind as cash dies and digital payments grow

Dividend growth of over 10% per year

Visa’s network is almost impossible to replicate

Dividend Data

Current Yield: 0.7%

5-Year Average Yield: 0.7%

4. Old Dominion Freight Line (ODFL)

Owned by: Francois Rochon, Tom Gayner

How does the company make money?

Old Dominion moves freight - doesn’t sound that hard, lots of companies do that.

But Old Dominion specializes in less-than-truckload (LTL) shipping, meaning they transport smaller shipments that don’t fill an entire truck.

And they do it better, faster, and more precisely than anyone else. Which gives them margins their competitors dream about.

Why invest?

Industry leader with best-in-class efficiency

Net cash balance sheet

Growing dividend with plenty of room to keep rising

Dividend Data

Current Yield: 0.7%

5-Year Average Yield: 0.4%