A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into this update and show you some of my favorite stocks.

February 2025

In February the S&P 500 decreased by 2.9%

Source: Finchat

The Fear & Greed Index indicates that we ended February in ‘Extreme Fear’ Mode.

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

Worst performers

The cheaper we can buy great companies, the better.

The biggest decliner this month? Newell Brands.

Newell Brands is a consumer goods company.

They are the owners of brands like Rubbermaid, Sharpie, Mr. Coffee, Ball, and Graco.

Best Performers

TBC Bank Group PLC was this month’s best performer, rising over 32%.

They operate banks in Georgia, Azerbaijan, and Uzbekistan.

5 Cannibal Companies Worth Your Attention

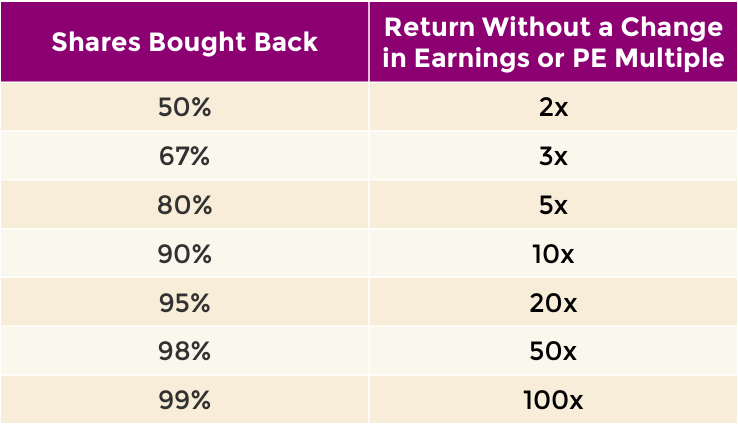

Stock buybacks are a quiet way for companies to return value to shareholders.

Instead of paying dividends, they reduce their share count. Fewer shares mean higher earnings per share (EPS) and often a rising stock price.

The best companies - true capital allocators - use this strategy aggressively.

They’re known as cannibal companies. These firms shrink their share count year after year, concentrating ownership for those who stick around.

Here are five major cannibals worth researching. Let’s start with number five.

5. Comcast (CMCSA)

Comcast is a media and telecom powerhouse.

It owns NBCUniversal, the Xfinity brand, and the wildly profitable broadband business. The company has aggressively repurchased shares, cutting its count by over 30% in the last decade.

Why is it interesting? While cable TV is dying, broadband is a cash machine. Comcast controls infrastructure that competitors can’t easily replicate. And it’s cheap - trading at a a single digit P/E ratio. Combine cheap shares with a strong buyback history, and you get an interesting share cannibal

4. Adobe (ADBE)

You know Adobe. It owns Photoshop, Acrobat, and Premiere Pro. More importantly, it controls the subscription software model that keeps customers locked in.

Adobe is a buyback monster. Since 2010, it has slashed shares outstanding by over 20%. The company generates huge free cash flow - over $7 billion annually - and pours it back into repurchases.

Why should investors care? Digital content is growing, AI is enhancing creative tools, and Adobe is raising prices. Combine that with steady buybacks, and long-term investors could see substantial returns.