A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into this update and show you some of my favorite stocks.

April 2025

In April the S&P 500 decreased by 0.9%

Source: Finchat

The Fear & Greed Index indicates that we ended April in ‘Extreme Fear’ Mode.

Best & Worst Performers

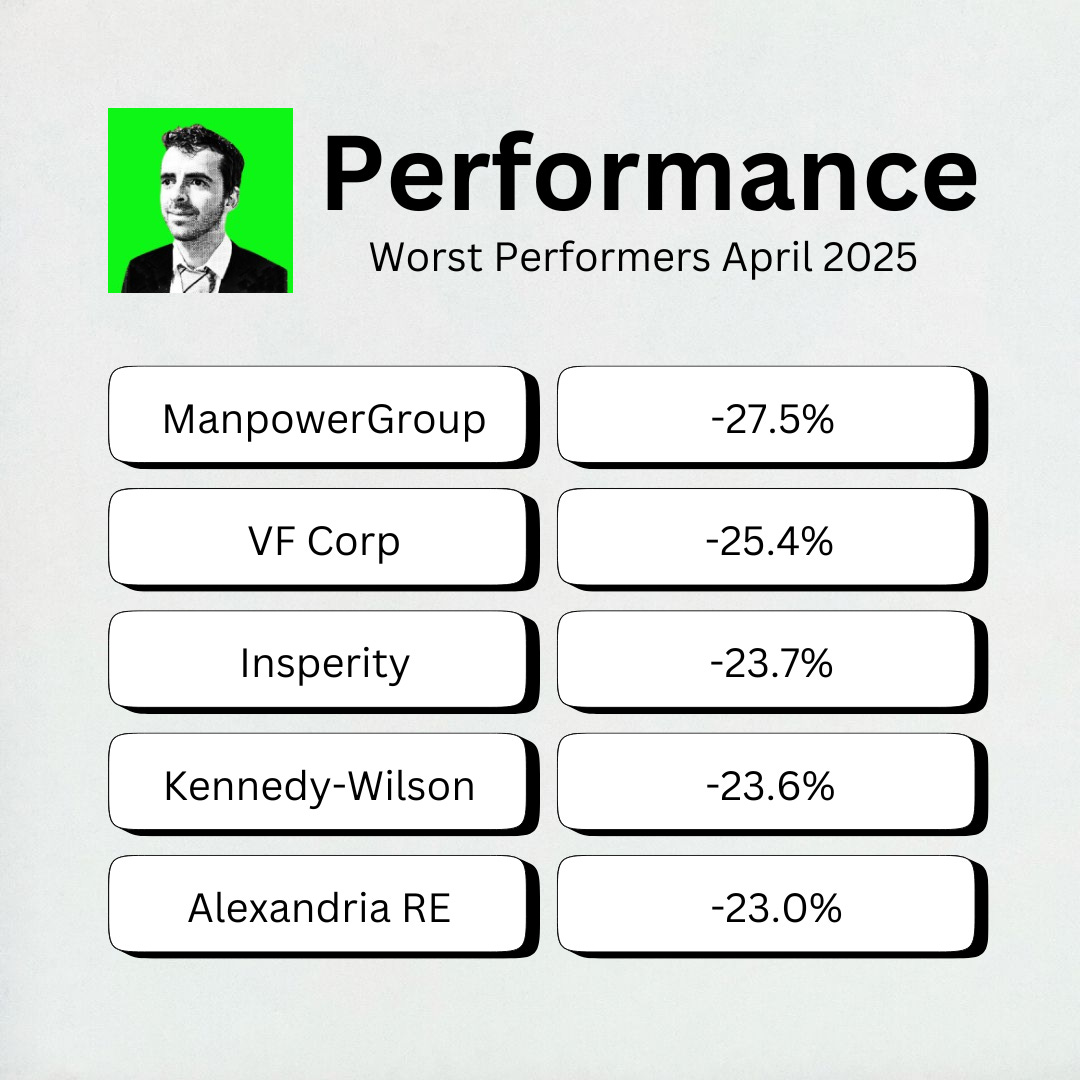

This overview shows you the best and worst performers in our investable universe.

Worst performers

The cheaper we can buy great companies, the better.

The biggest decliner this month? ManpowerGroup.

ManpowerGroup helps companies find the right people to fill their jobs.

They connect businesses with workers for temporary assignments, permanent roles, and even help manage their workforce with things like outsourced Human Resources services.

Best Performers

Sensient Technologies was this month’s best performer, rising over 27%.

Sensient makes the colors, flavors, and scents that go into many products.

Think of the colors in your food or makeup, the flavors in your drinks, or the smell of your soap – Sensient often plays a part in making those.

A Company Highlight:

Pool Corporation ($POOL)

What does Pool Corp do?

Exactly what the name says.

They’re the largest wholesale distributor of swimming pool supplies and equipment in the world.

Think pumps, filters, heaters, liners, pool chemicals, and even hot tubs. They also serve contractors who build and maintain pools — residential and commercial.

Here’s what makes Pool Corp special:

They don’t build pools. They sell everything else.

That means they make money whether the pool is brand new… or 20 years old and needs repairs.

And when a heat wave hits or everyone’s stuck at home during a lockdown?

Business booms.

After explosive growth during the pandemic, Pool Corp’s sales have cooled slightly - but margins remain strong, and long-term fundamentals are solid.

Why?

There are more pools in the U.S. now than ever. And every single one of them needs maintenance, cleaning, and parts.

That’s recurring revenue.

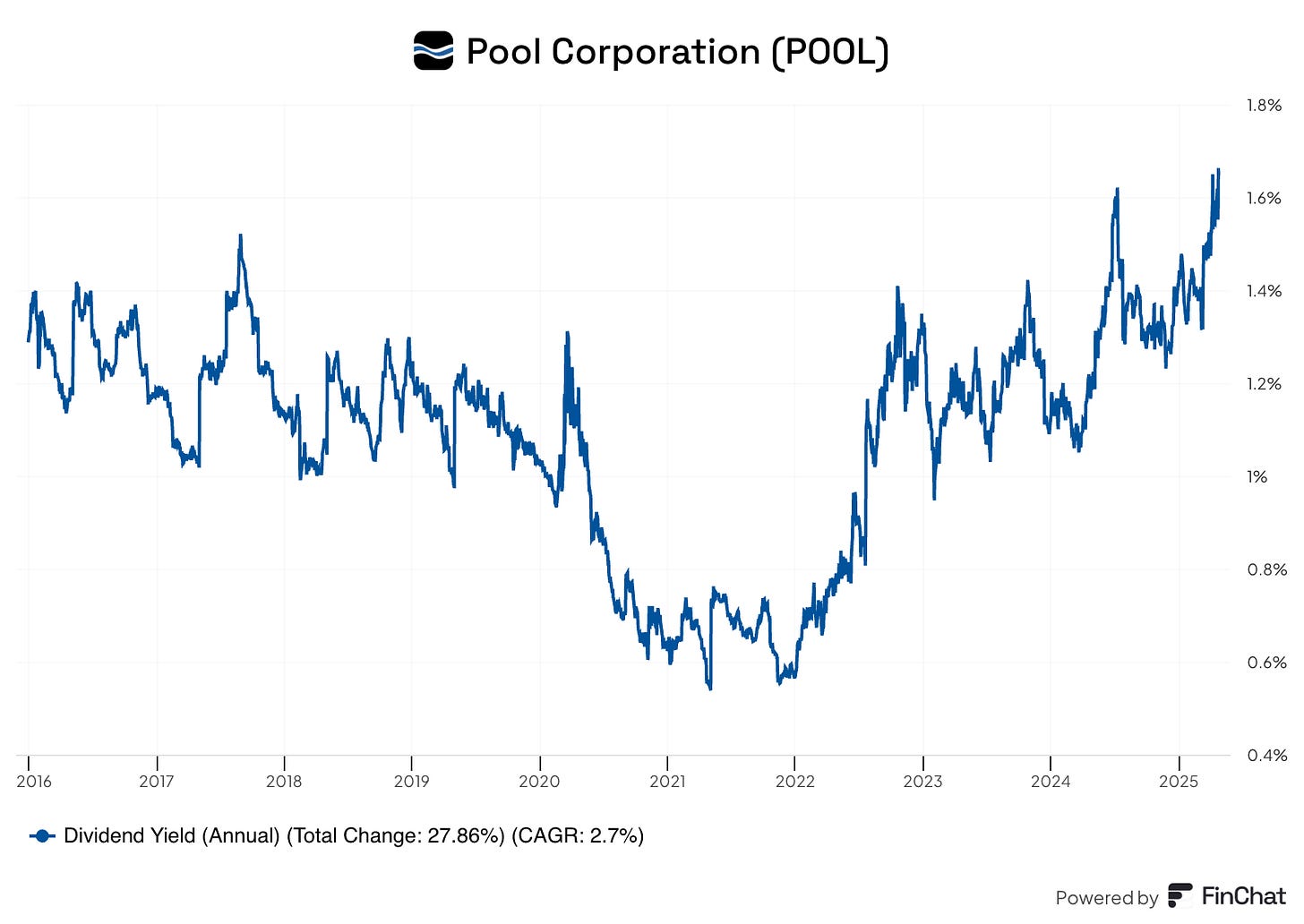

The dividend yield sits at about 1.6%, which is well above the company’s 10-year average of 0.9%.

And dividend growth?

Over the last 10 years, the dividend has grown by 18.5% per year on average.

Pool Corp isn’t cheap on traditional metrics. But it rarely is - and for good reason.

It’s a capital-light business with strong pricing power, wide moats, and very little competition.

If you want a shareholder-friendly company with durable growth and a rising income stream…

Pool is worth diving into.

May Best Buys

With markets fluctuating and quality companies starting to trade at attractive valuations, May presents an excellent opportunity for dividend growth investors.

This month’s selections emphasize high-quality businesses with strong dividend growth, sustainable payout ratios, and solid revenue and earnings prospects.

The focus is on total return - combining dividend income with capital appreciation - by investing in companies with:

Attractive current yields (relative to their historical averages)

Consistent dividend growth

Strong revenue and earnings outlooks

Let’s dive into the five best buys for May!