A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into this update and show you some of my favorite stocks.

Want this post as a YouTube video? Go here.

October 2025

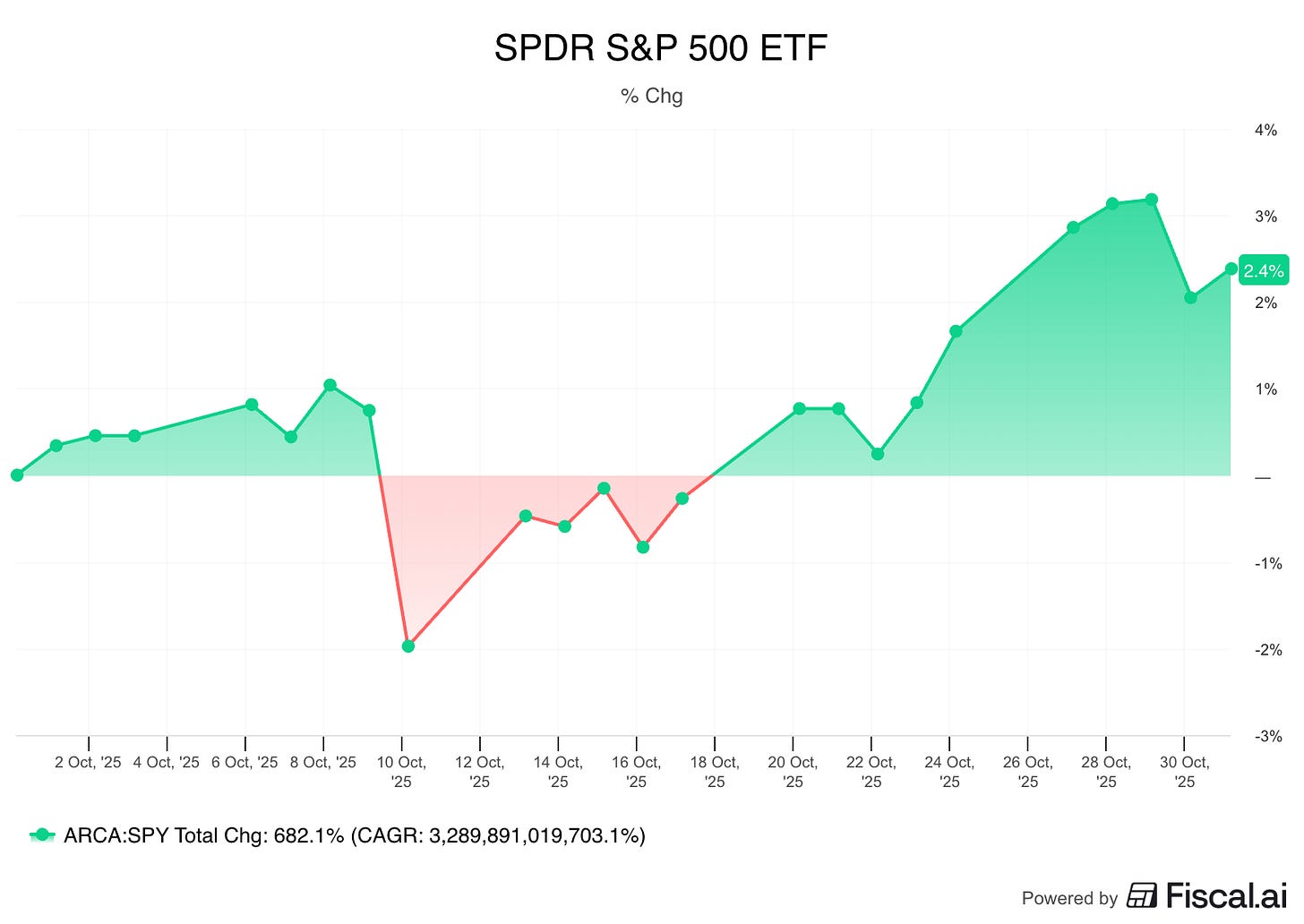

In October the S&P 500 increased by 2.4%.

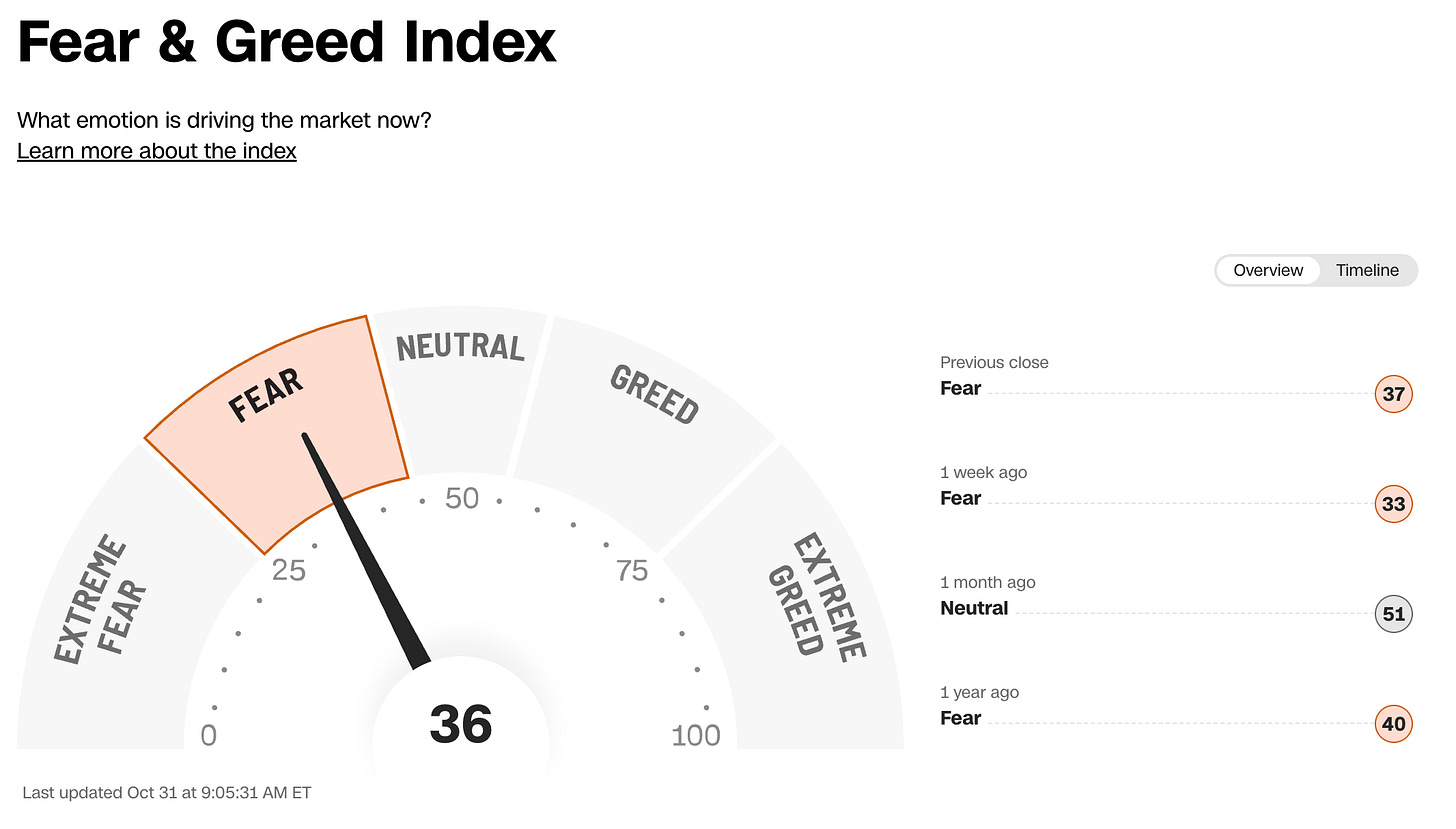

The Fear & Greed Index indicates that we’re currently in ‘Fear’ Mode.

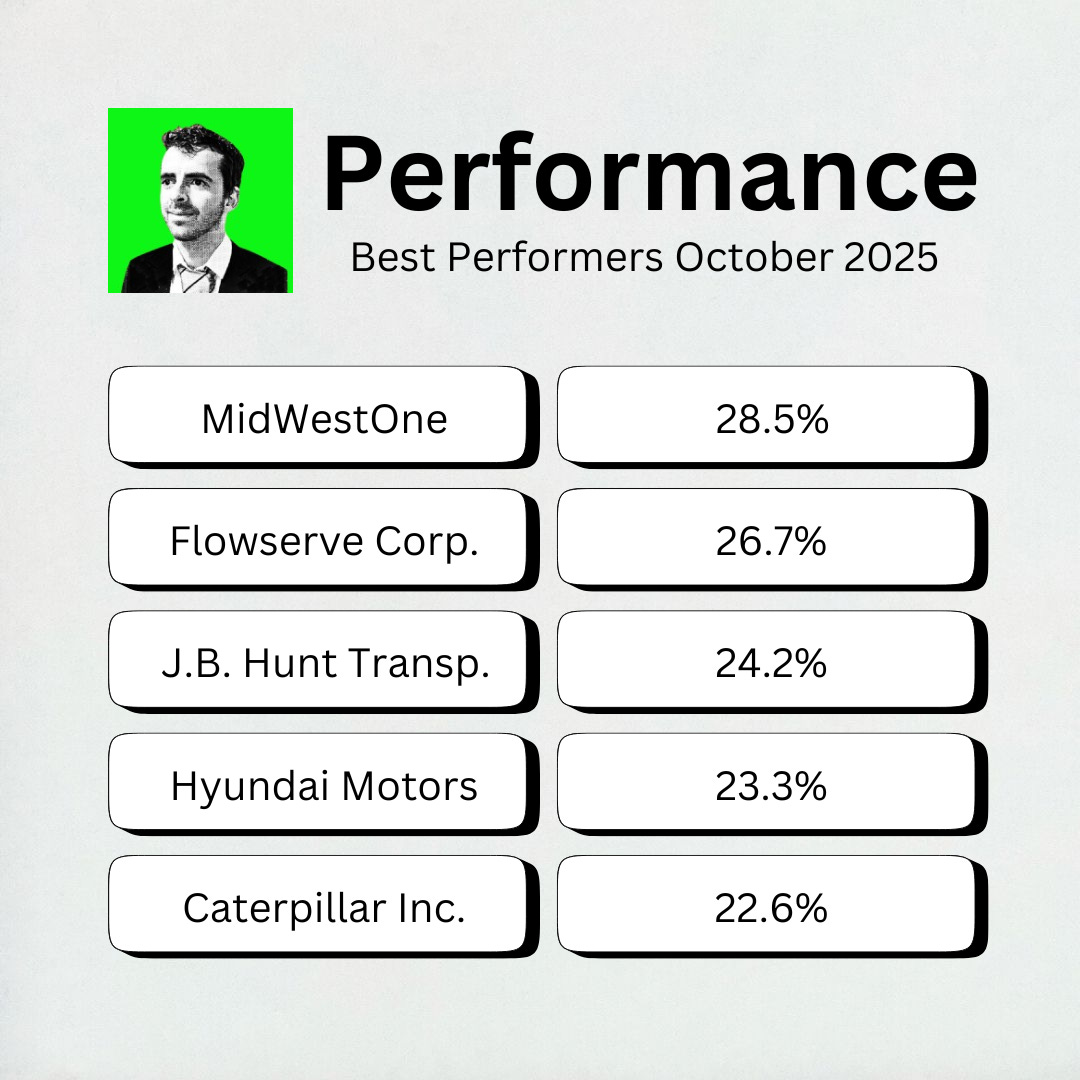

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

Worst performers

The cheaper we can buy great companies, the better.

The biggest decliner this month? Fiserv Inc. falling by nearly 50%!

Fiserv is a fintech company that provides payments and banking tech for banks, shops, and online businesses.

It helps people move money, swipe cards, use banking apps, and manage financial accounts.

The stock dropped hard because:

Quarterly growth slowed to just 1%

Merchant business grew 5%, but financial services fell 3%

Margins fell 320 bps

New CEO said past growth and margins weren’t sustainable

Company will spend more, meaning margins will go down

Management expects more weak quarters as they reset and rebuild

In short: the new CEO reset expectations for lower growth and lower margins for now, to build a stronger base later.

Best Performers

MidWestOne Financial Group was this month’s best performer, rising 28%.

MidWestOne Financial Group is a regional bank that offers commercial banking, retail banking, loans and deposits across several Midwestern states.

This month the stock jumped because it’s being acquired by Nicolet Bankshares in an $864 million stock merger.

Spotlight: FactSet Research ($FDS)

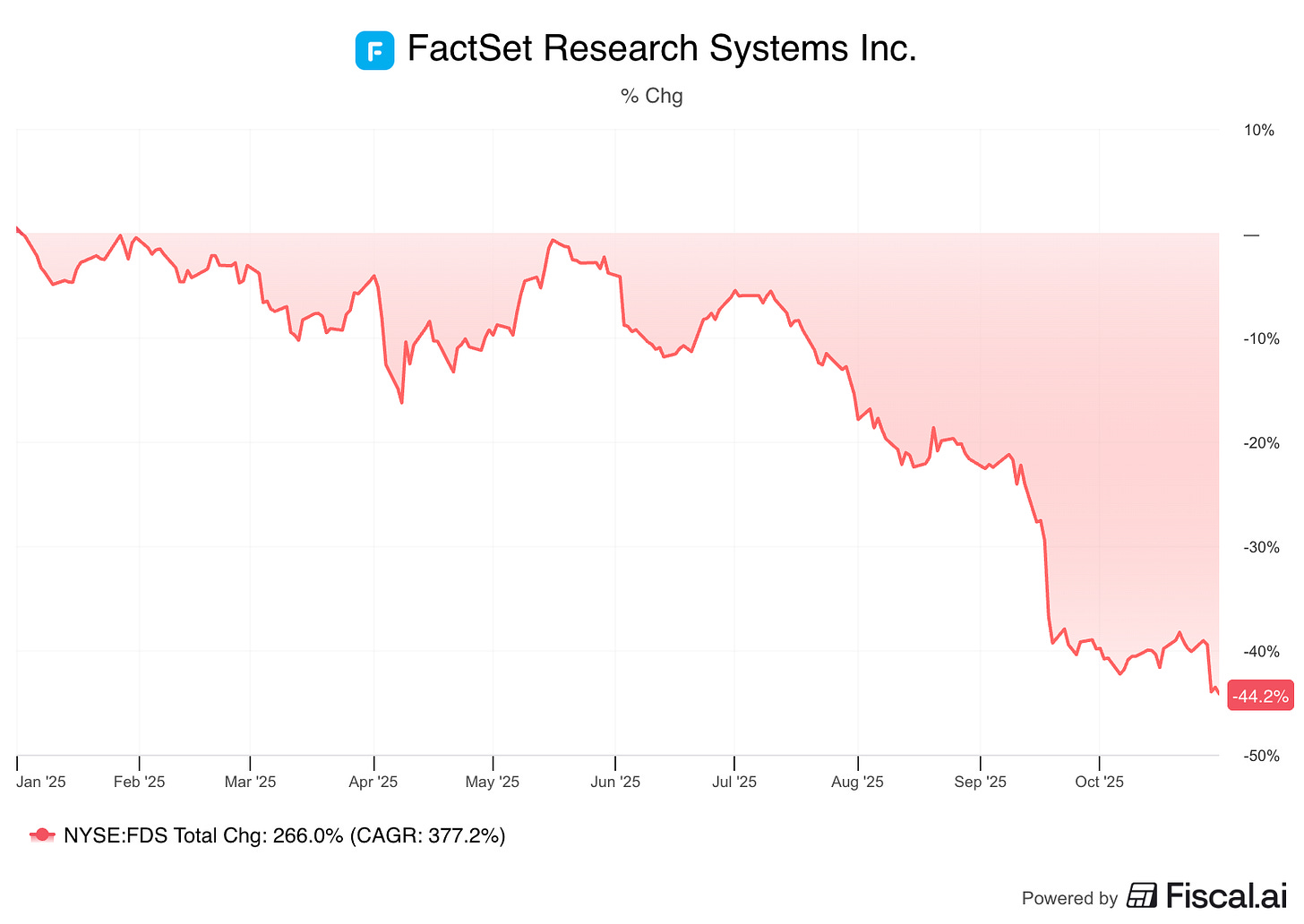

FactSet was the worst performer in Our Investable Universe last month.

Let’s look deeper into the company this month.

How does the company make money?

FactSet sells financial data and tools to big money managers, like BlackRock, Fidelity, and investment banks.

These people make huge money decisions every day, and they need fast and accurate info. FactSet gives it to them.

Factset sells subscriptions, meaning clients pay every year to use FactSet’s data and software.

They have nearly 9,000 clients with over 237,000 individual users.

Their renewal rate is very high at 95%+, meaning that clients almost never leave.

This makes sense, once a firm trains all its people on FactSet and builds tools with it, switching is very hard.

FactSet serves:

Big investment firms

Investment banks

Wealth advisors

Other software partners

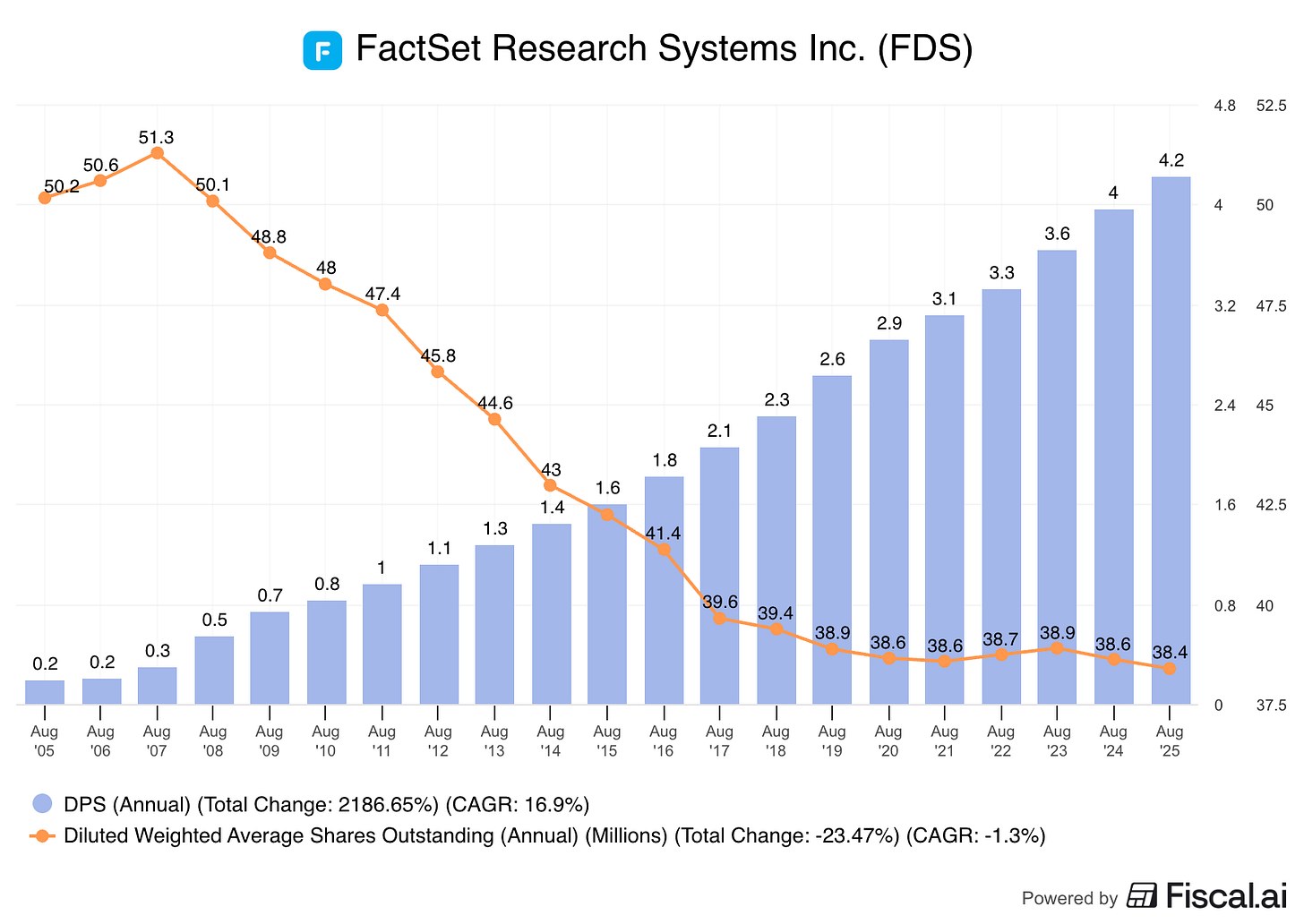

Why do dividend investors like it?

Dividend investors like steady, safe companies and FactSet fits that bill.

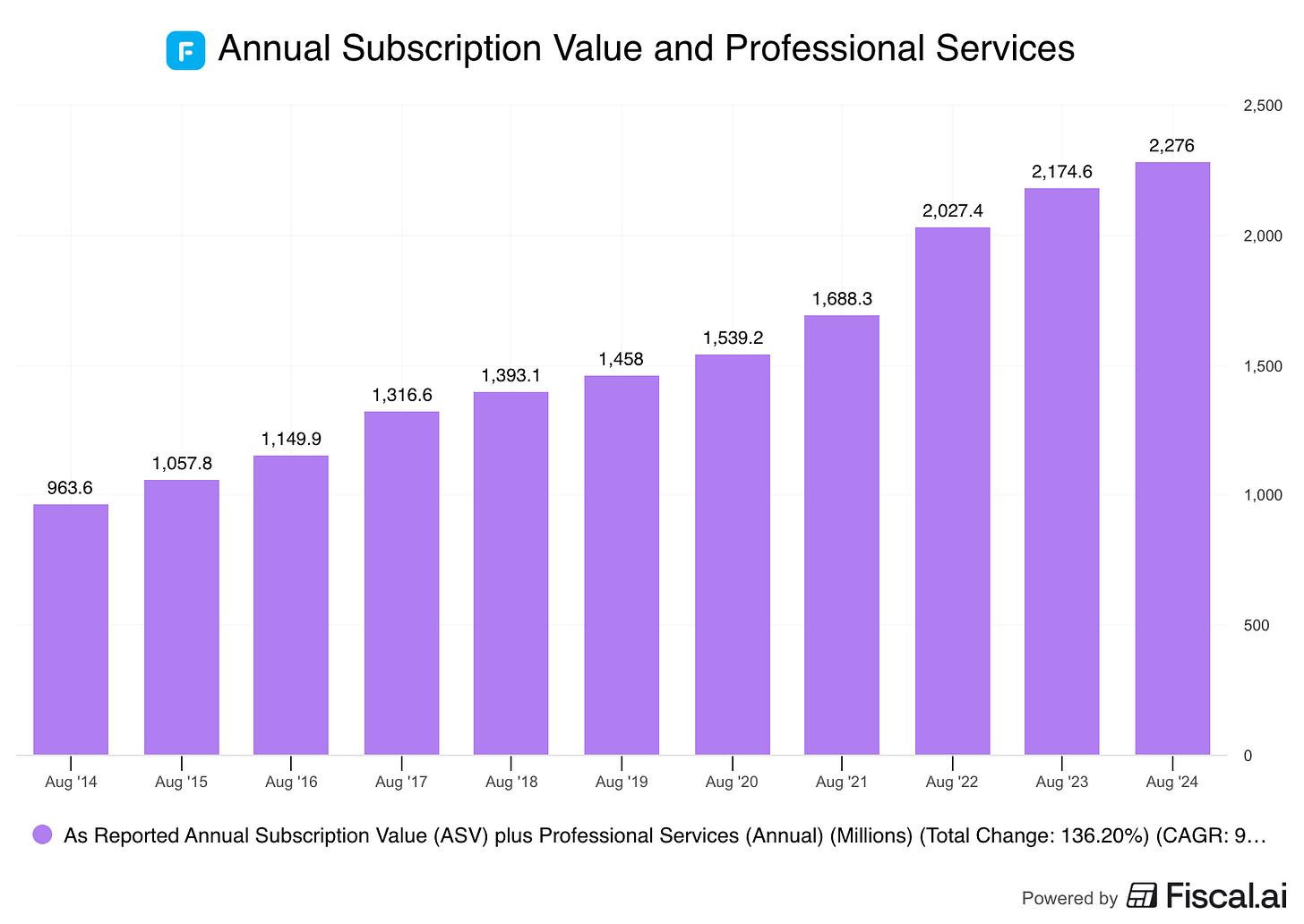

Just look at the steady growth of the Annual Subscription Value and Services they sell each year.

Here’s what makes it so steady:

Very loyal customers

Strong profit margins

Good cash flow

Capital-light business

And it returns money to shareholders through both dividends and buybacks.

The fundamentals look like this:

Dividend Yield: 1.5%

Payout Ratio: 27.2%

10-Year Dividend CAGR: 9.9%

Revenue CAGR (10-Year): 8.7%

Forward P/E: 15.5x

What’s the story today?

FactSet is still a strong business, but it’s hitting a rough patch.

What’s slowing down:

Growth has cooled (around 5% expected ahead)

Margins dipped a bit, due to rising tech spending (to keep up with AI)

Uncertainty around the new CEO

For these reasons, the stock dropped a lot this year - more than 40%.

The good news:

FactSet is still very profitable

Strong ROIC (19% 5-year average)

Recurring, sticky revenue

Cash flow is still strong

And the valuation looks low.

Here’s the current Dividend Yield compared to the historical yield:

Investor Takeaway

FactSet is an important data provider to Wall Street, with long-term sticky customers and strong profits.

Right now, it’s selling at a lower than normal valuation because of a short-term growth slowdown, a new CEO, increasing competition, and unknowns around AI.

If you believe FactSet will adapt to AI and keep its Wall Street grip, this could be a solid long-term buy at a lower price.

November Best Buys

I usually scan the Buy-Hold-Sell List for great dividend payers at attractive prices to highlight for you.

But this month, I looked somewhere else...

On Monday we talked about Chuck Akre’s 3-legged stool, so for November I looked at Akre’s portfolio for ideas.

And guess what?

I found some great ones!

We’ll look at understanding the business, why it can keep compounding, and have a quick look at valuation by comparing the current dividend yield to the historical one.

Let’s dive into 5 of the most interesting stocks Chuck Akre owns!

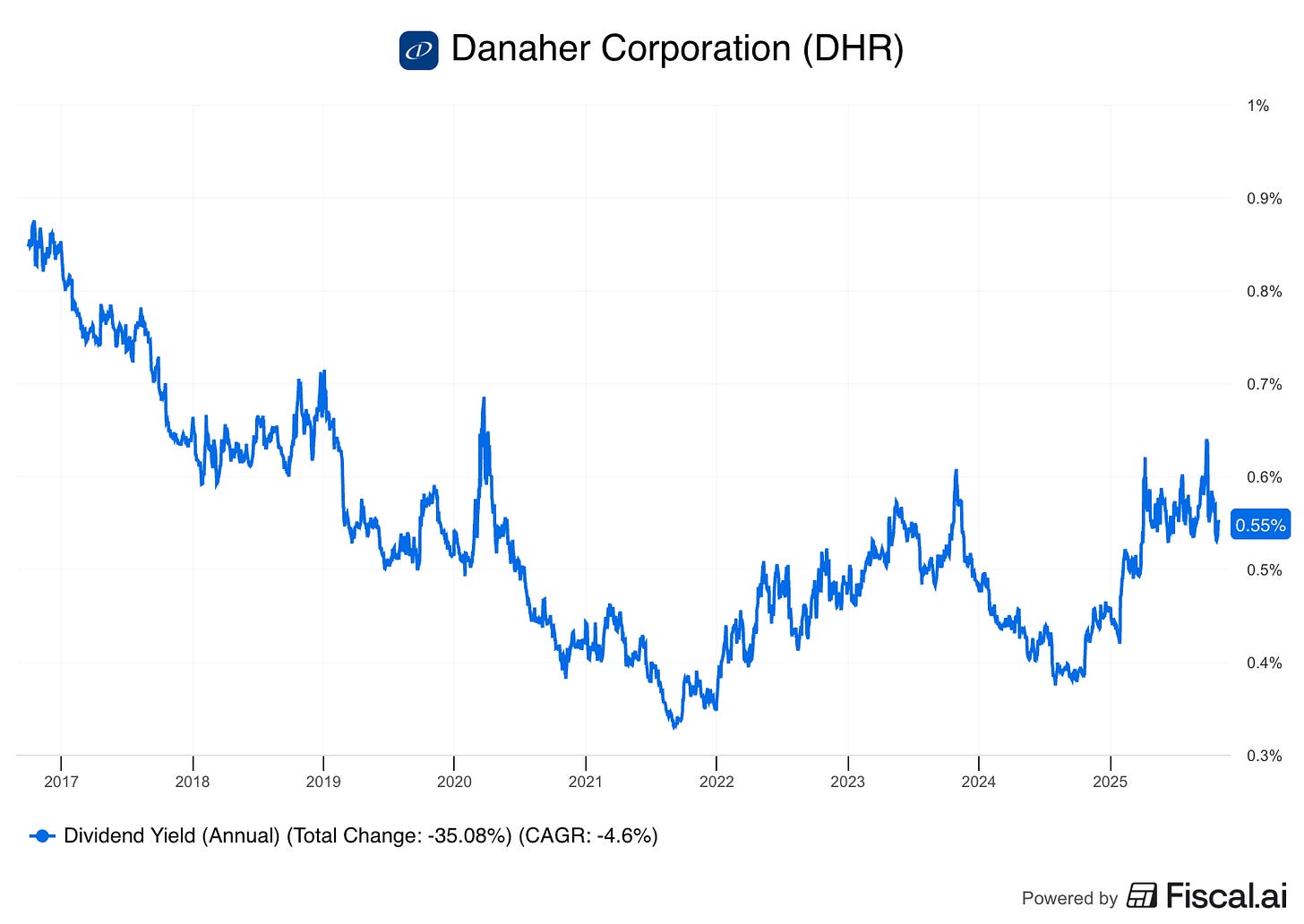

5. Danaher ($DHR)

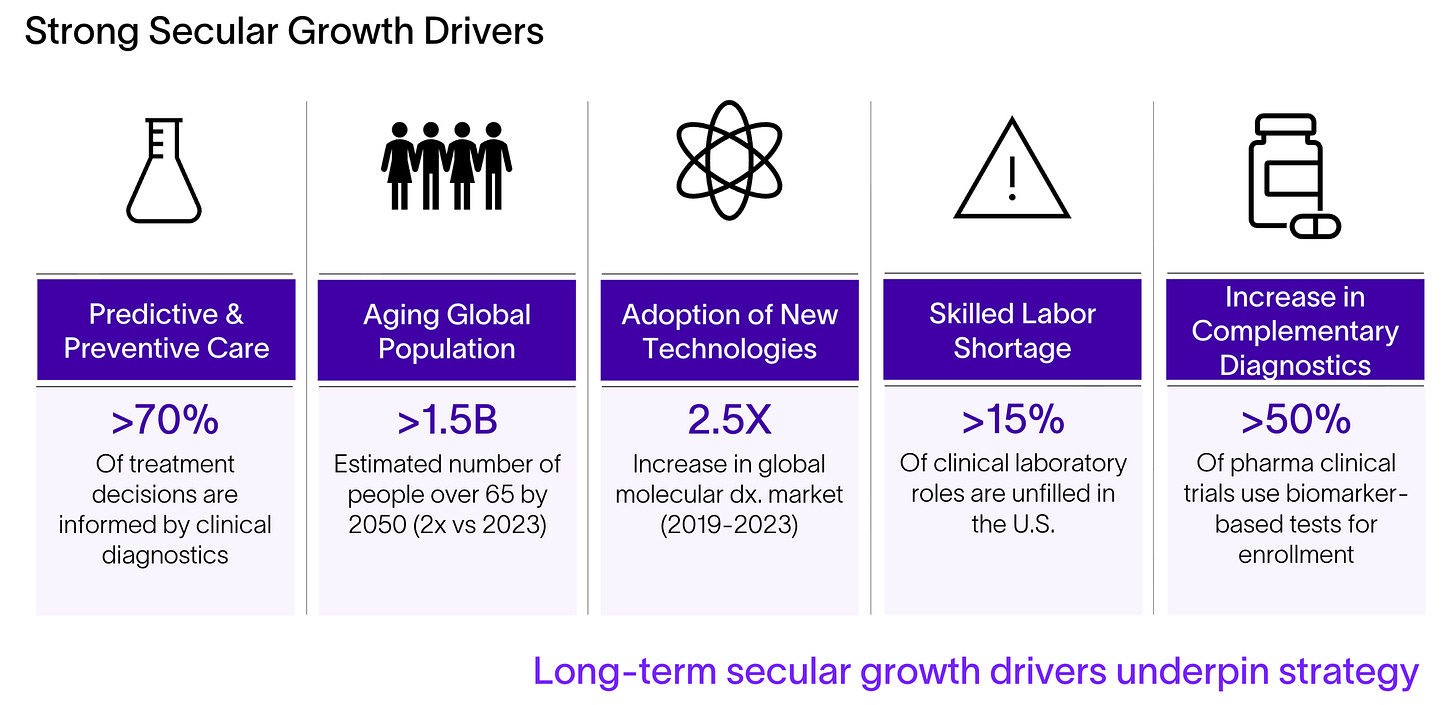

How does Danaher make money?

Danaher makes tools and equipment for science and medicine, like lab tools for research, diagnostic machines, and biotech equipment.

Scientists, hospitals, and labs need Danaher’s products for research and testing.

Why can this business keep compounding?

Danaher has a huge role in science and healthcare, which has a steady demand

The “Danaher Business System” to keep improving the business

It’s a serial acquirer, buying high-quality life-science companies, then growing them

Healthcare spending grows as the world ages and needs more treatment

Danaher grows by helping the world innovate, discover, and cure diseases.

Science and healthcare keep moving forward , and Danaher keeps growing.

How’s the valuation?

It looks reasonable based on the past few years:

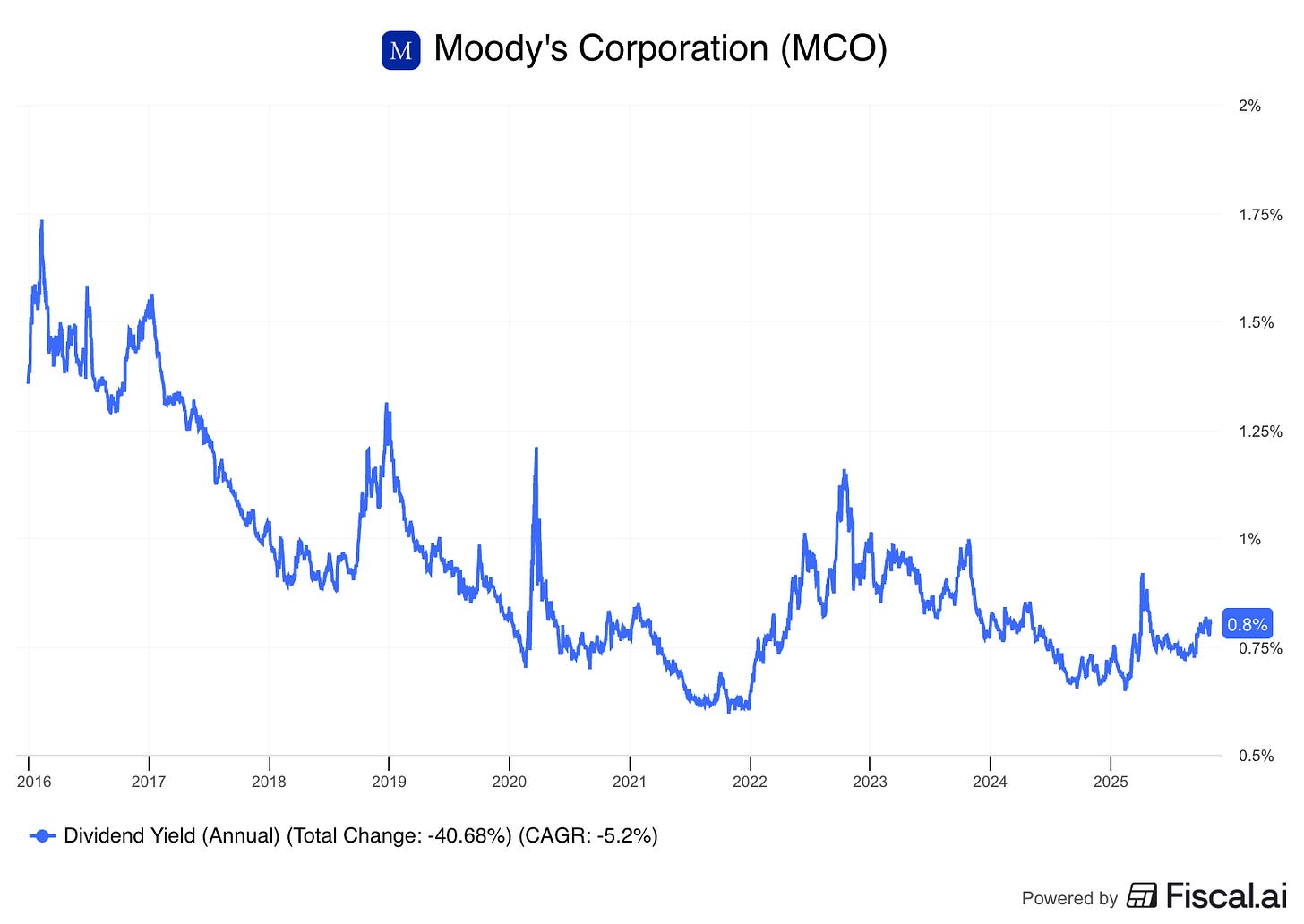

4. Moody’s ($MCO)

How does Moody’s make money?

Moody’s rates the credit of companies and governments.

When a company wants to borrow money, Moody’s gives a rating and gets paid.

They also sell financial data and software through Moody’s Analytics.

Why can this business keep compounding?

Moody’s is almost impossible to replace, the credit rating business is an Oligopoly with Standard & Poor’s and Fitch being the other participants

Moody’s provides a necessary service - banks and investors rely on ratings

High-margin subscription data business is growing fast

Moody’s can raise prices over time because demand is steady

As long as borrowing exists, Moody’s gets paid, and borrowing isn’t stopping any time soon.

How’s the valuation?

Like Danaher, Moody’s valuation looks reasonable:

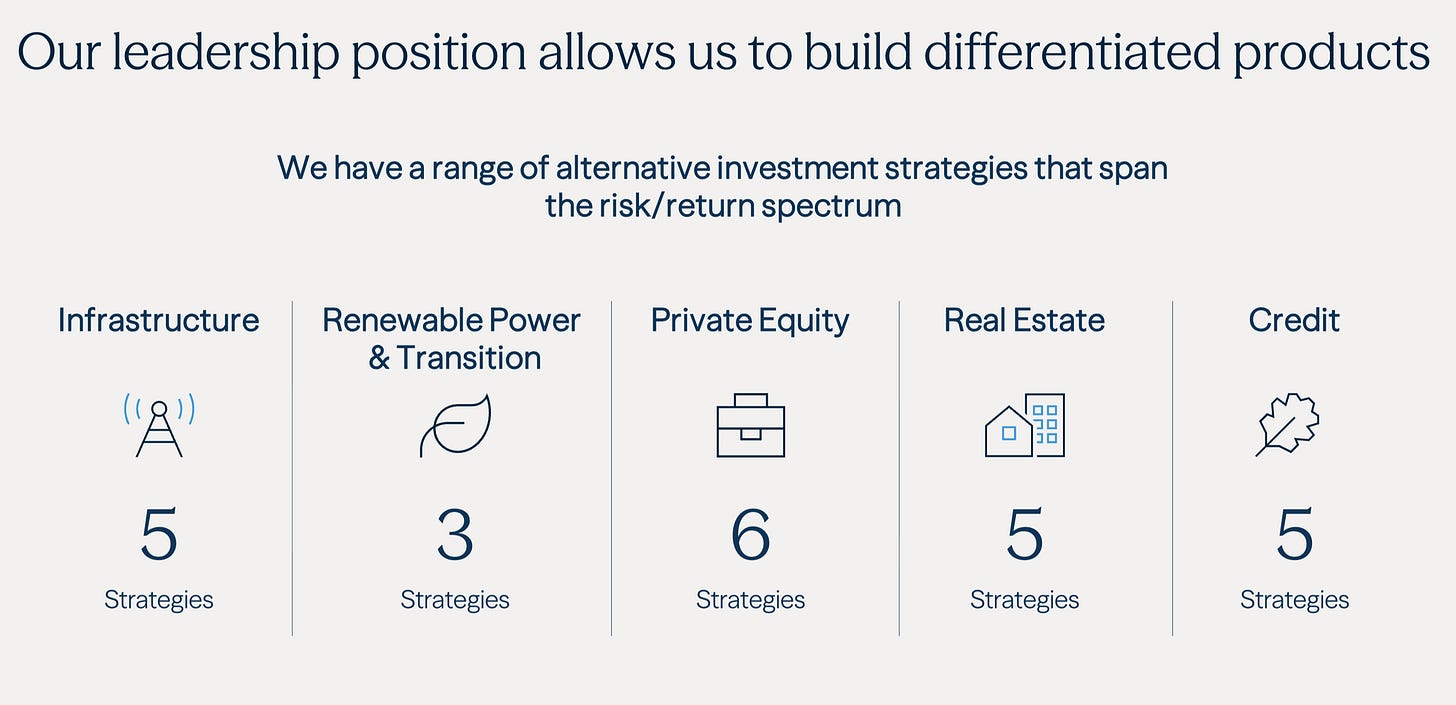

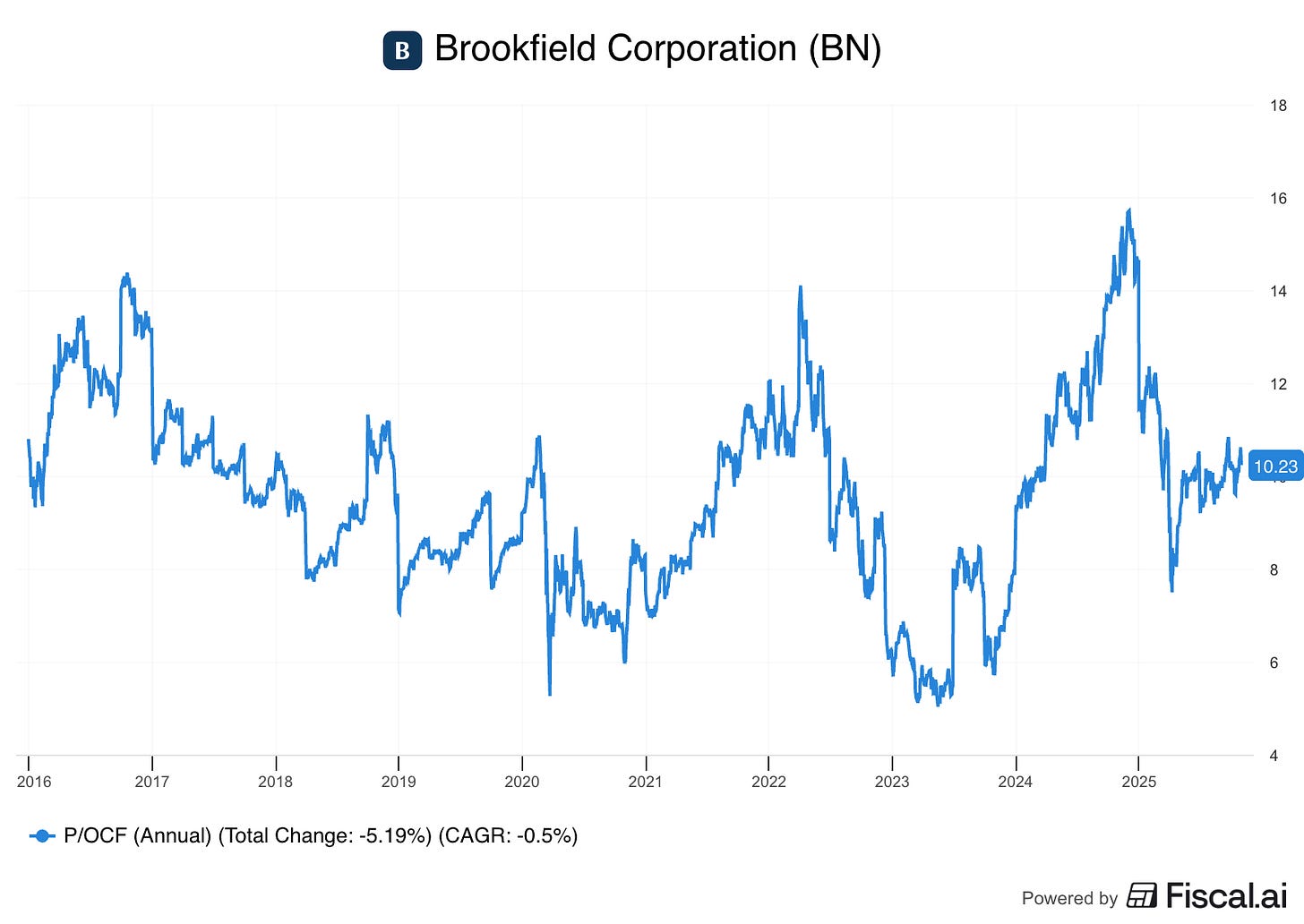

3. Brookfield Corporation ($BN)

How does Brookfield make money?

Brookfield invests in and manages real assets like real estate, renewable energy, and infrastructure (like bridges and fiber networks).

They also manage assets like private equity and credit.

They earn money from owning these assets AND from managing money for other investors.

Why can this business keep compounding?

Brookfield has a massive global investment platform

More governments and companies need private money for big projects

Strong history of smart deals and value creation

Lots of room to reinvest profits into long-term assets that grow and cash flow

The real projects that Brookfield builds and buys are necessary, with growing demand into the future.

How’s the valuation?

Valuing Brookfield using dividend yield wouldn’t be fair because the main company has spun-off several divisions, like the asset management business (BAM). That makes it look like BN has cut the dividend, when that’s not the case.

So here, we’ll use a Price to Operating Cash Flow:

10x cash flow for a business of Brookfield’s quality looks reasonable.

✋ Wait - Before You Go!

If you’ve made it this far, you’ve already seen 3 of the 5 companies that legendary investor Chuck Akre owns.

But here’s the thing…

The next two might be the most interesting of them all.

One of them has beaten the market for more than two decades, with a business so durable it barely flinched during 2008.

The other? It’s an under-the-radar serial acquirer hiding in plain sight, growing earnings year after year, even when the headlines scream “recession.”

These are the kinds of stocks that don’t just go up for a season… they build wealth for generations.

👉 Free readers get a sneak peek at the first three ideas.

👉 Paid members unlock the full list, including the final two Akre compounders I’m most excited about right now.

Don’t miss them.

These are the names I believe could quietly make long-term investors very happy over the next decade.

Conclusion

That’s it for this month!

Here are the five companies we covered from Chuck Akre’s portfolio, all steady compounders that can keep growing for years:

Danaher ($DHR): A science and healthcare powerhouse. Buys great life-science companies, improves them, and keeps growing as the world spends more on health.

Moody’s ($MCO): A key player in global credit ratings and financial data. Moody’s is hard to replace, and as long as people borrow money, Moody’s earns money.

Brookfield Corporation ($BN): A global leader in real assets like infrastructure and renewable power. Smart investors in big global projects with lots of ways to reinvest and grow.

????

????

For this month’s theme, we didn’t just look for good dividend stocks.

Instead, we focused on Akre-style compounders, great businesses that:

✅ Are easy to understand

✅ Can reinvest for long periods

✅ Keep getting stronger over time

We checked how they make money, why they can keep compounding, and how today’s valuation compares to history (using dividend yield where it makes sense).

These 5 companies are slow, steady, powerful wealth builders.

One Dividend At A Time

-TJ

P.S…

Can you guess the final two companies?

✅ One of them owns brands you probably use every single day...

✅ The other is a digital toll road with recurring revenue and sky-high returns on capital.

Join the full membership to see both, along with why they’re still strong buys in November 2025.

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data