A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into this update and show you some of my favorite stocks.

September 2025

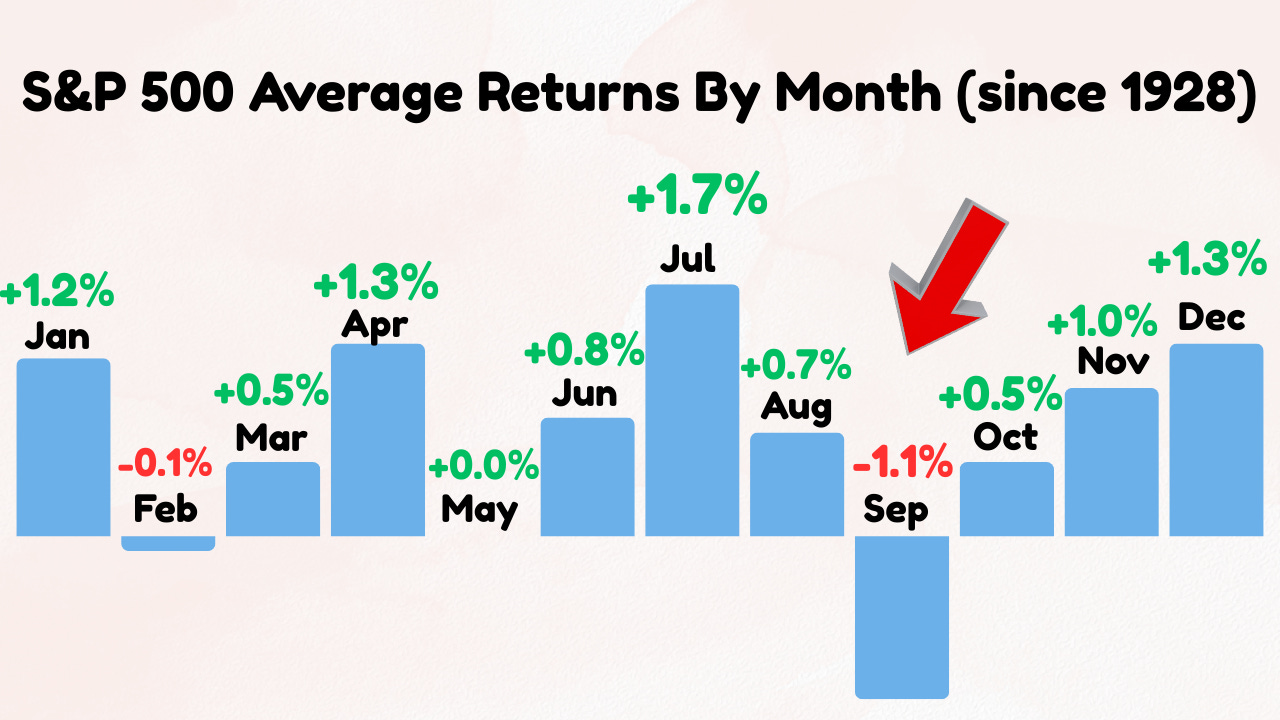

In September the S&P 500 increased by 4.1%.

This breaks the typical pattern - September is historically the worst month for the S&P 500.

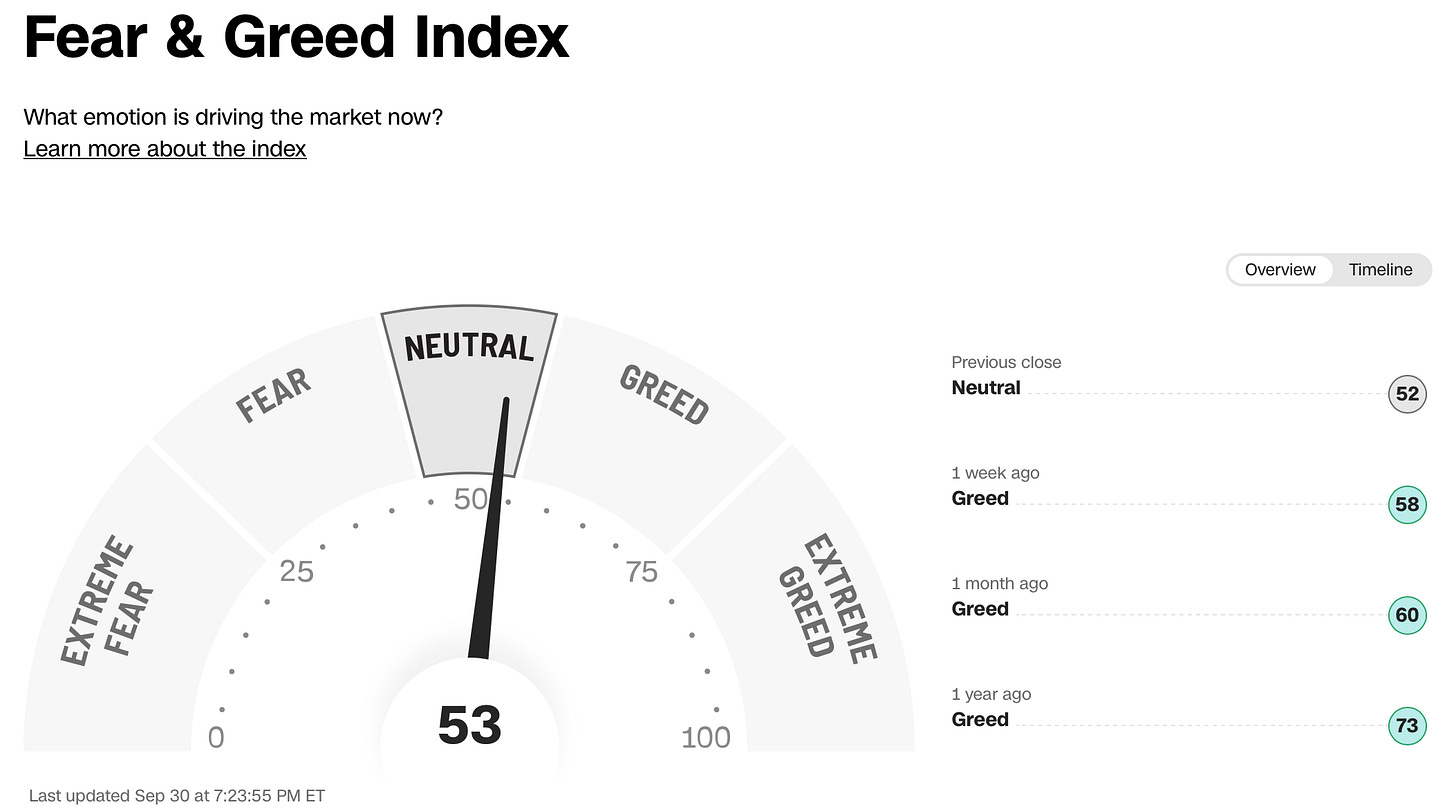

The Fear & Greed Index indicates that we’re currently in ‘Neutral’ Mode.

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

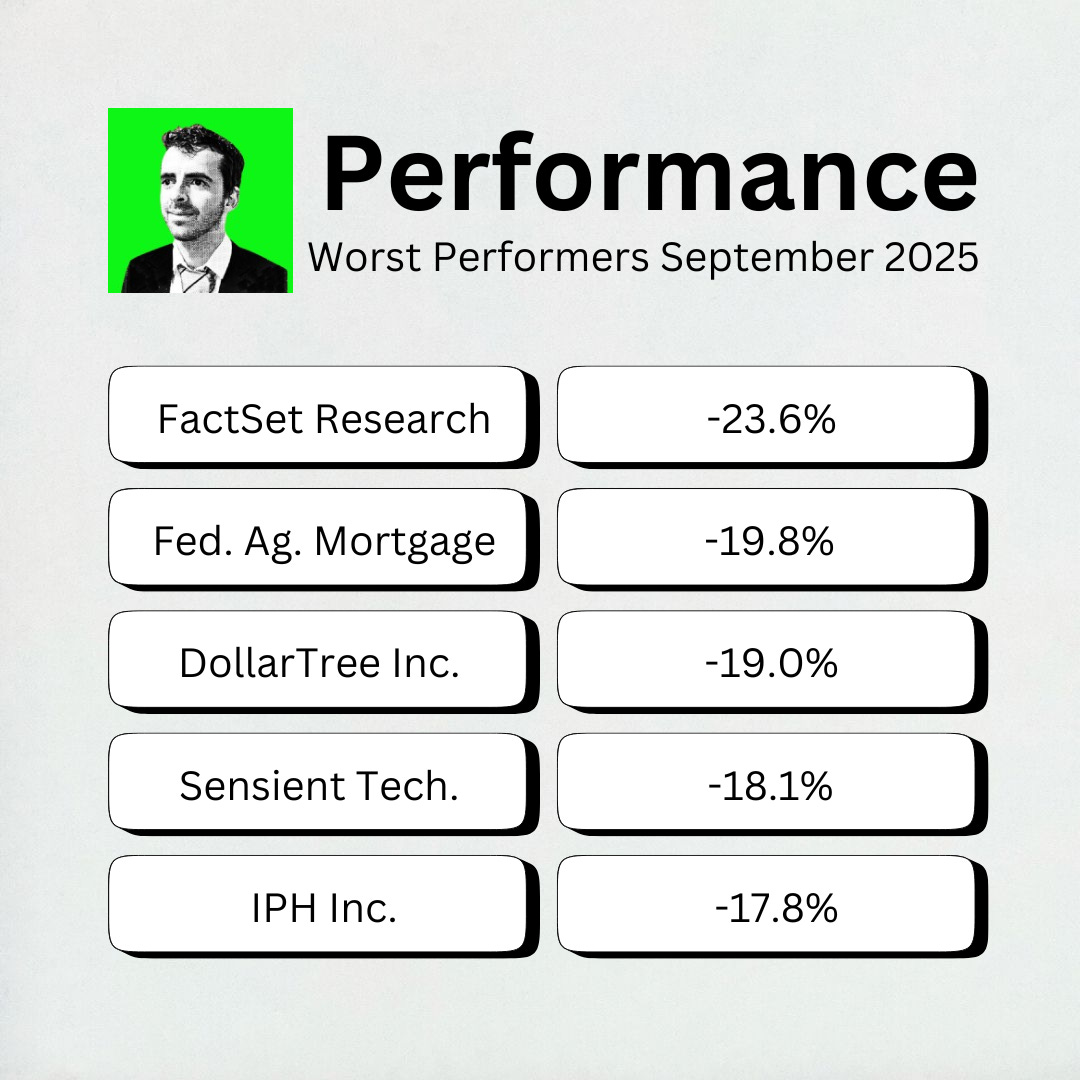

Worst performers

The cheaper we can buy great companies, the better.

The biggest decliner this month? FactSet Research.

FactSet Research Systems provides financial data and tools for investors, asset managers, and banks.

Its software helps professionals track markets, analyze companies, and manage portfolios. The business runs on sticky subscriptions, since once clients use it, switching is hard.

The stock fell in September because of:

Earnings that missed expectations

Weaker guidance for the year ahead

Rising costs in technology and operating costs hurt profit margins

Valuation coming down after a strong run

Best Performers

KLA Corp. was this month’s best performer, rising over 42%.

KLA Corporation builds high-tech equipment used in semiconductor manufacturing.

Their tools inspect wafers, measure layers, detect defects, and help chip makers get better yields.

In September, KLA’s stock jumped because of:

Strong earnings that beat expectations

Upward revisions to revenue guidance

Surge in chip demand tied to AI, data centers, and next-gen nodes

Market enthusiasm for semiconductor equipment names

Spotlight: Accenture plc ($ACN)

How does the company make money?

Accenture is one of the world’s largest IT services and consulting firms. It helps businesses with everything from strategy and digital transformation to cloud migration, cybersecurity, and outsourcing.

Its big advantage is being able to handle everything end-to-end.

Instead of juggling multiple vendors, companies can rely on Accenture as a single partner. Once Accenture is embedded, the switching costs are high, clients don’t want to rip out and replace a provider that’s running their critical systems.

Accenture works across industries, with large clients in government, finance, health care, tech, and more.

Why do dividend investors like it?

Accenture combines a global client base with steady cash flows and a long record of dividend growth.

It has raised its dividend for 21 straight years

Accenture’s dividend growth has been strong - more than 13% per year over the past 5 years

The balance sheet is rock solid in a net cash position

The company is a cash-generating machine with 15% FCF margins

The fundamentals look like this:

Dividend Yield: 2.8%

Payout Ratio: 49.4%

10-Year Dividend CAGR: 11.1%

Revenue CAGR (10-Year): 8.4%

Forward P/E: 17.6x

What’s the story today?

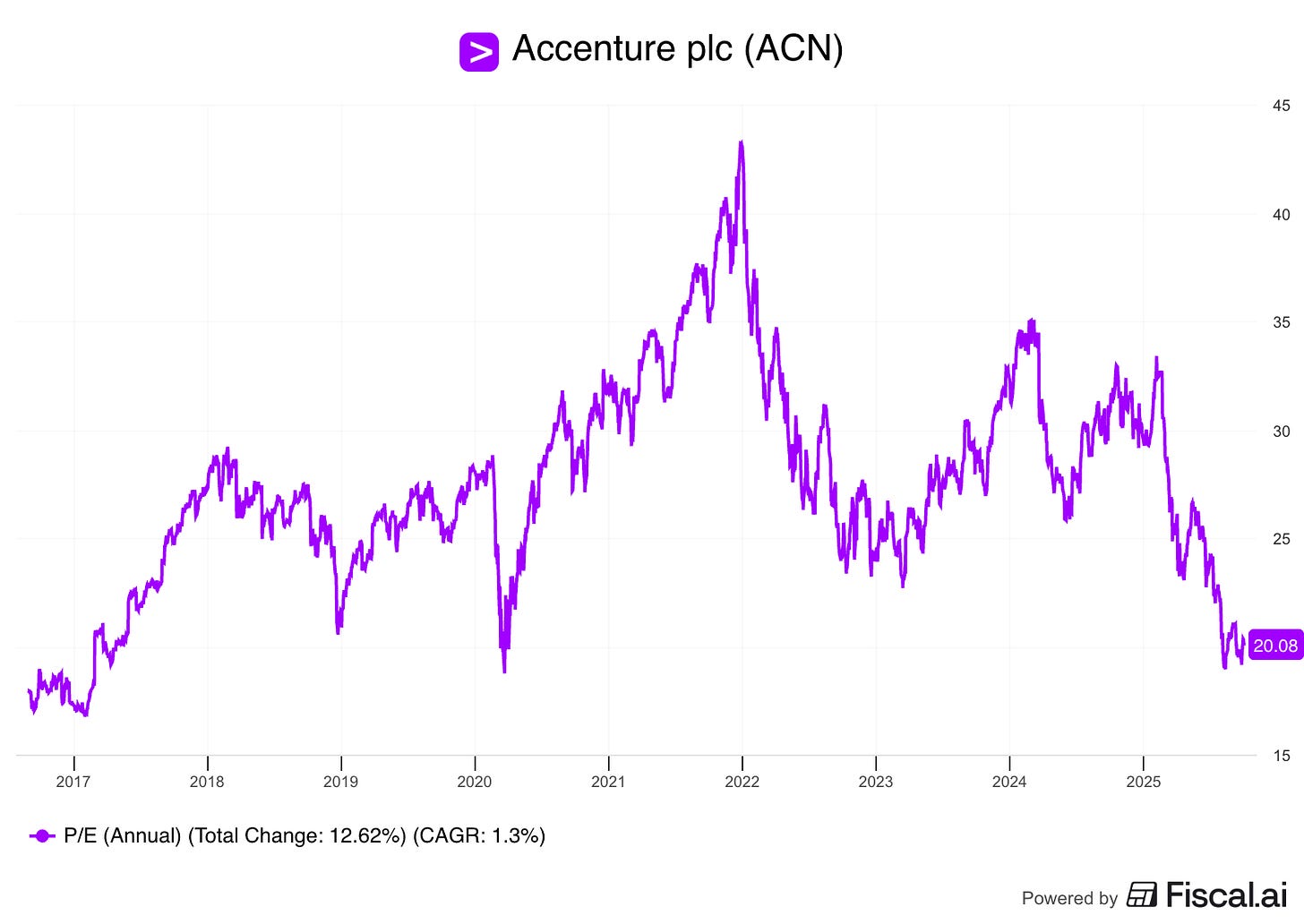

Accenture’s growth has slowed.

Revenue growth has slowed to ~4% per year over the past 3 years, and margins haven’t expanded, so earnings growth has followed the same trend.

That’s a big change from earlier years when growth was closer to 8%.

That explains why the stock de-rated from a 40x P/E in 2021 to closer to 20x today.

Dividend growth has been very strong, but with revenue and earnings growth slowing, it may not keep compounding at the same pace unless revenue and earnings re-accelerate.

AI is also a wild card - it could either drive new demand for Accenture’s services or pressure its traditional consulting model.

Investor Takeaway

If you believe that businesses will continue to rely on Accenture as an all-in-one technology partner, and that AI will create more opportunities than risks, then Accenture offers a high-quality, financially strong business at a more reasonable valuation than in years past.

But investors should expect slower growth, and potentially slower dividend hikes, compared to the past decade.

October Best Buys

There were big swings in price both up and down in August.

I scanned the Buy-Hold-Sell List for great dividend payers at attractive prices to highlight for you this month.

Let’s dive into 5 of the most interesting ones I found!

5. Coloplast ($COLO-B.CO)

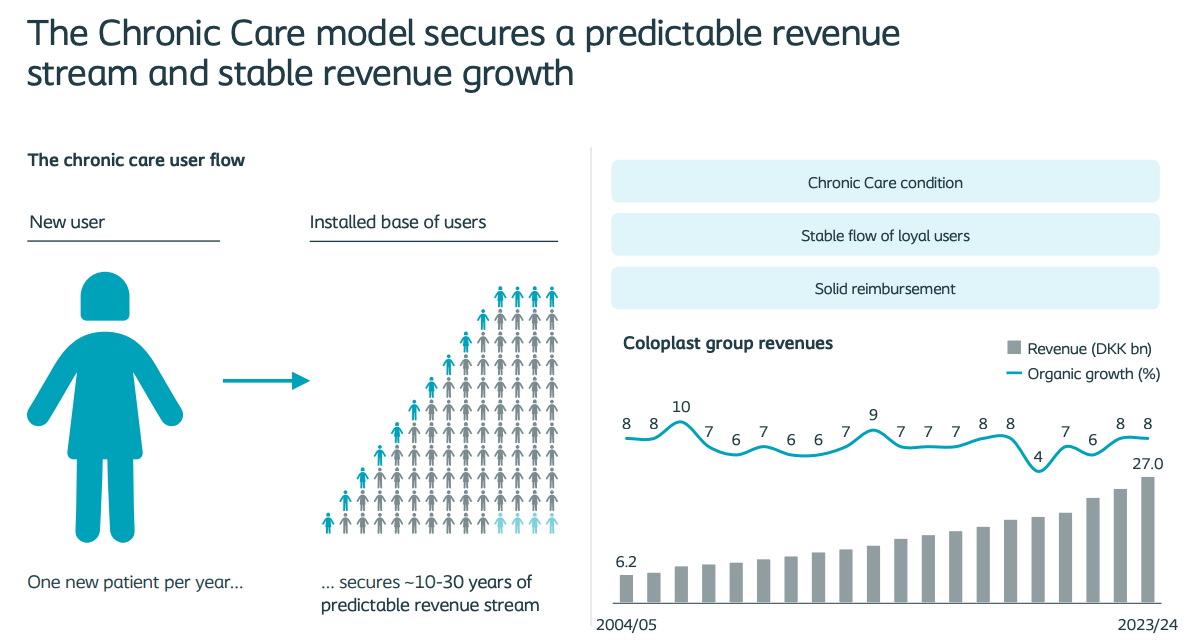

How does Coloplast make money?

Coloplast is a Danish healthcare company specializing in ostomy care, continence care, wound care, and interventional urology.

These are niche but essential medical products used by patients for long periods, which creates recurring demand.

Why is this business strong?

Sticky customer relationships: once a patient uses Coloplast’s products, switching is difficult.

Strong global market share in ostomy and continence care.

Healthcare demand is stable and aging populations drive long-term growth.

Dividend profile:

Coloplast has one of the best dividend track records in Europe, raising its dividend 35 years in a row. The revenues are recurring, with the trend of growing healthcare spending driving

For dividend investors, Coloplast offers both defensiveness and growth, making it a hidden gem outside the U.S. The only concern with this business is the high payout ratio.

Current yield: 3.8%

Payout ratio: 97.7%

Forward P/E: 23.1

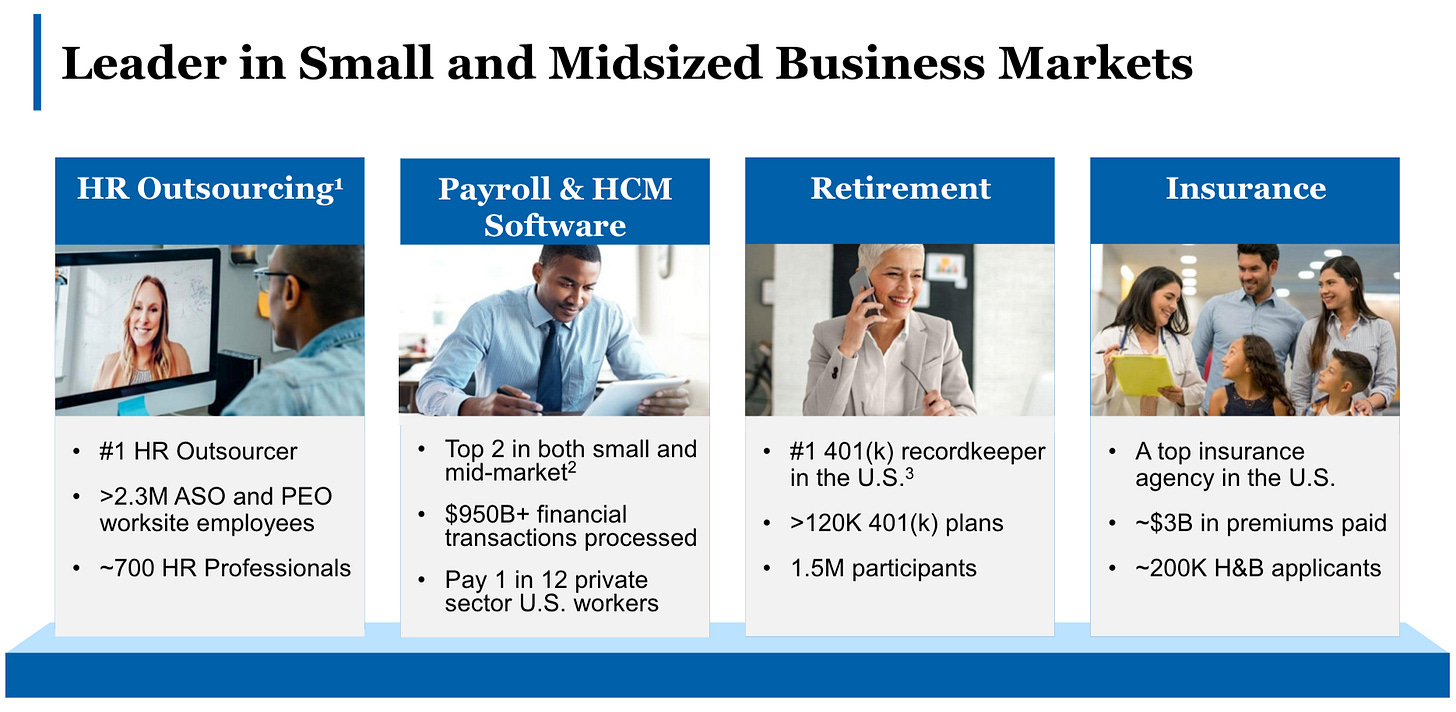

4. Paychex ($PAYX)

How does Paychex make money?

Paychex provides payroll, HR, and benefits outsourcing to over 740,000 small and medium-sized businesses in the U.S.

It earns revenue from subscription fees and payroll processing charges.

Why is this business strong?

Recurring revenue from sticky, long-term client relationships.

Switching payroll providers is costly and risky, creating high retention rates.

Paychex earns float income from holding client funds temporarily, so they benefit from higher interest rates

Dividend profile:

Paychex doesn’t raise the dividend every year, but it does have 5 and 10-year dividend CAGRs >10%.

For income investors, Paychex offers a reliable yield plus long-term exposure to the growth of small businesses.

Current yield: 3.5%

Payout ratio: 92%

Forward P/E: 22.3

Now let’s look at the top 3.