A new month, a new Best Buys List.

Each month, I’ll give an overview of my favorite stocks of the month.

Let’s dive into this update and show you some of my favorite stocks.

August 2025

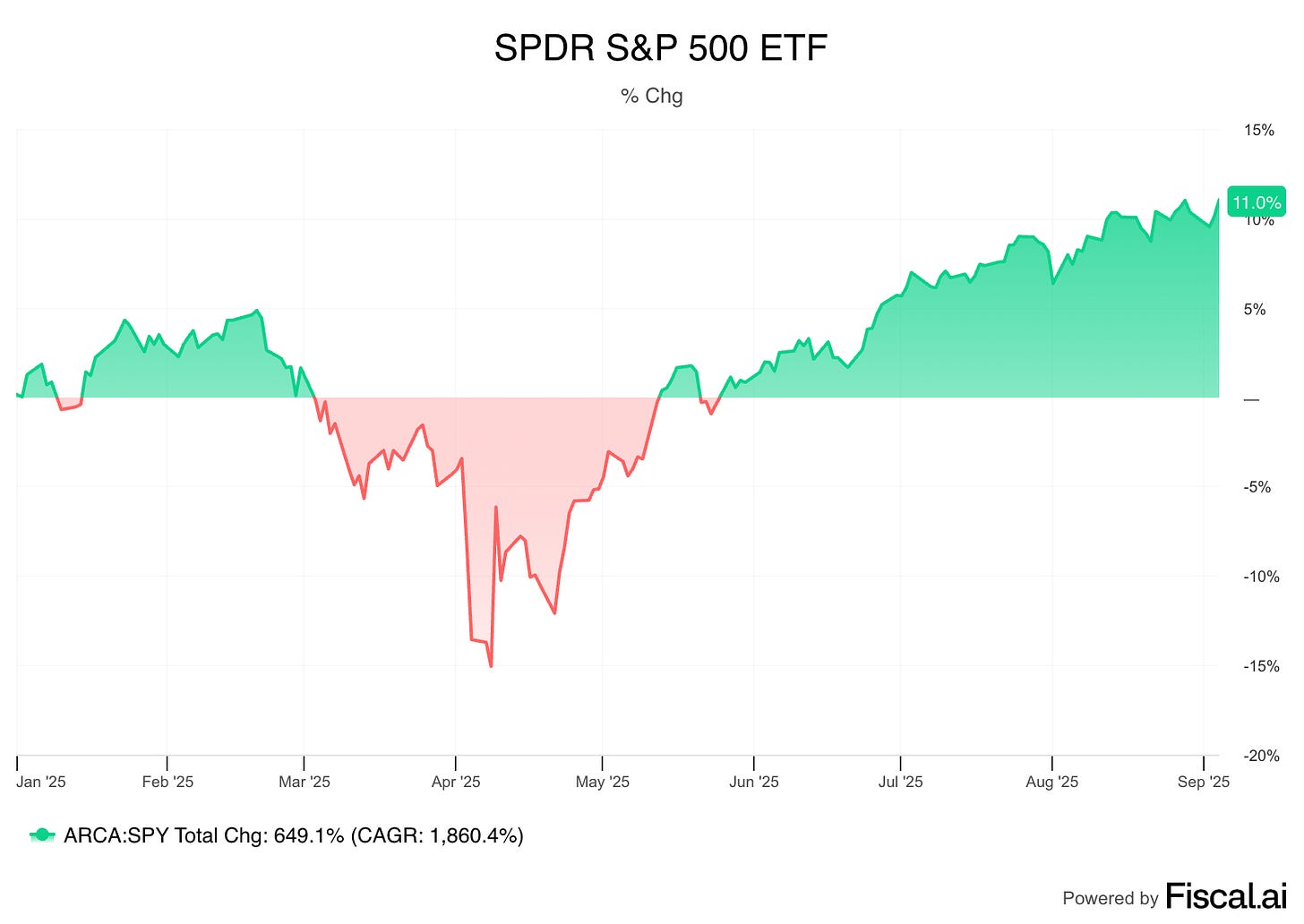

In August the S&P 500 increased by 1.9%

So far the S&P is up 11% for the year.

Source: Fiscal.ai

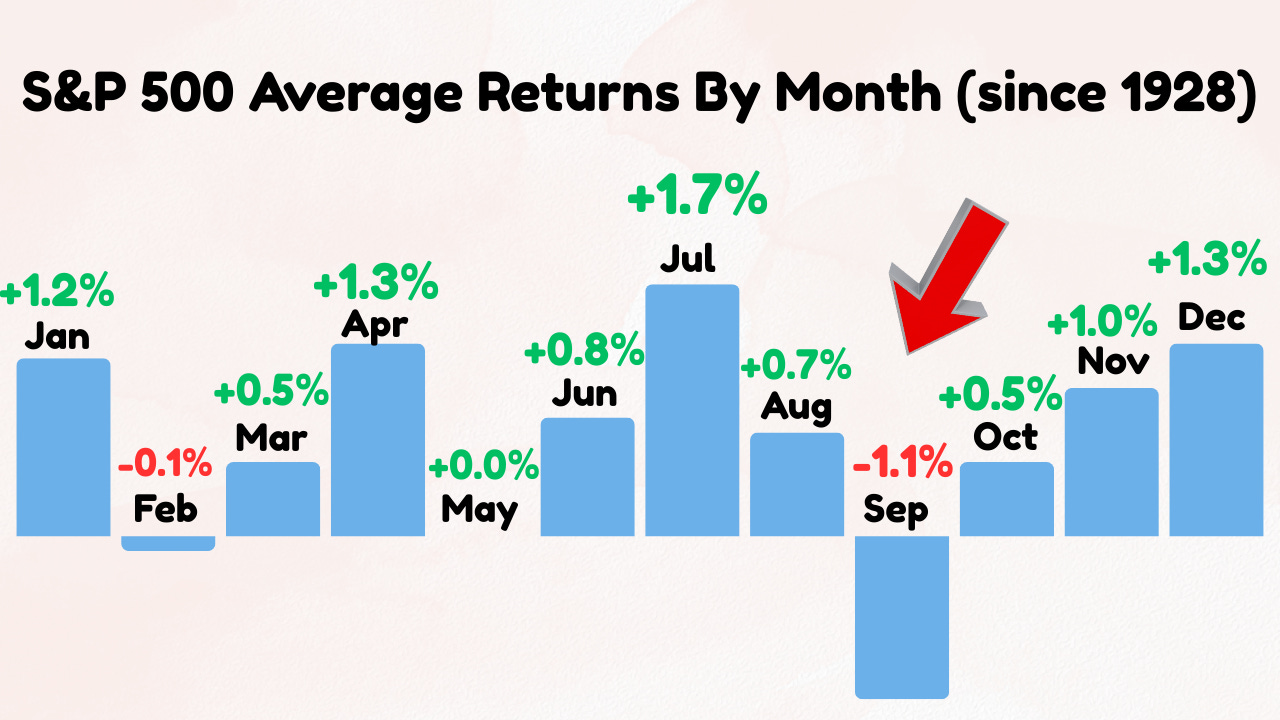

September is historically the worst month for the S&P 500.

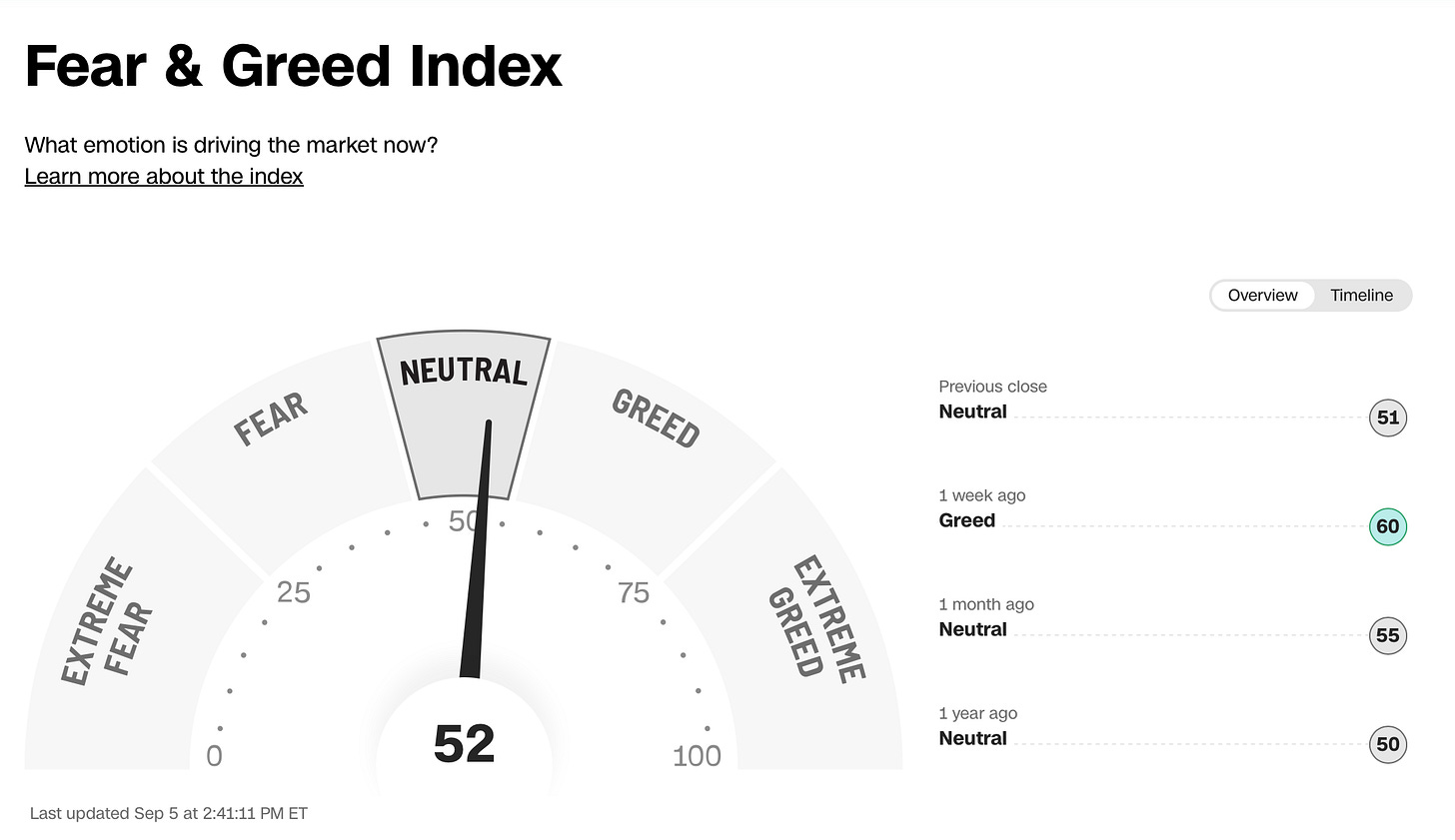

The Fear & Greed Index indicates that we’re currently in ‘Neutral’ Mode.

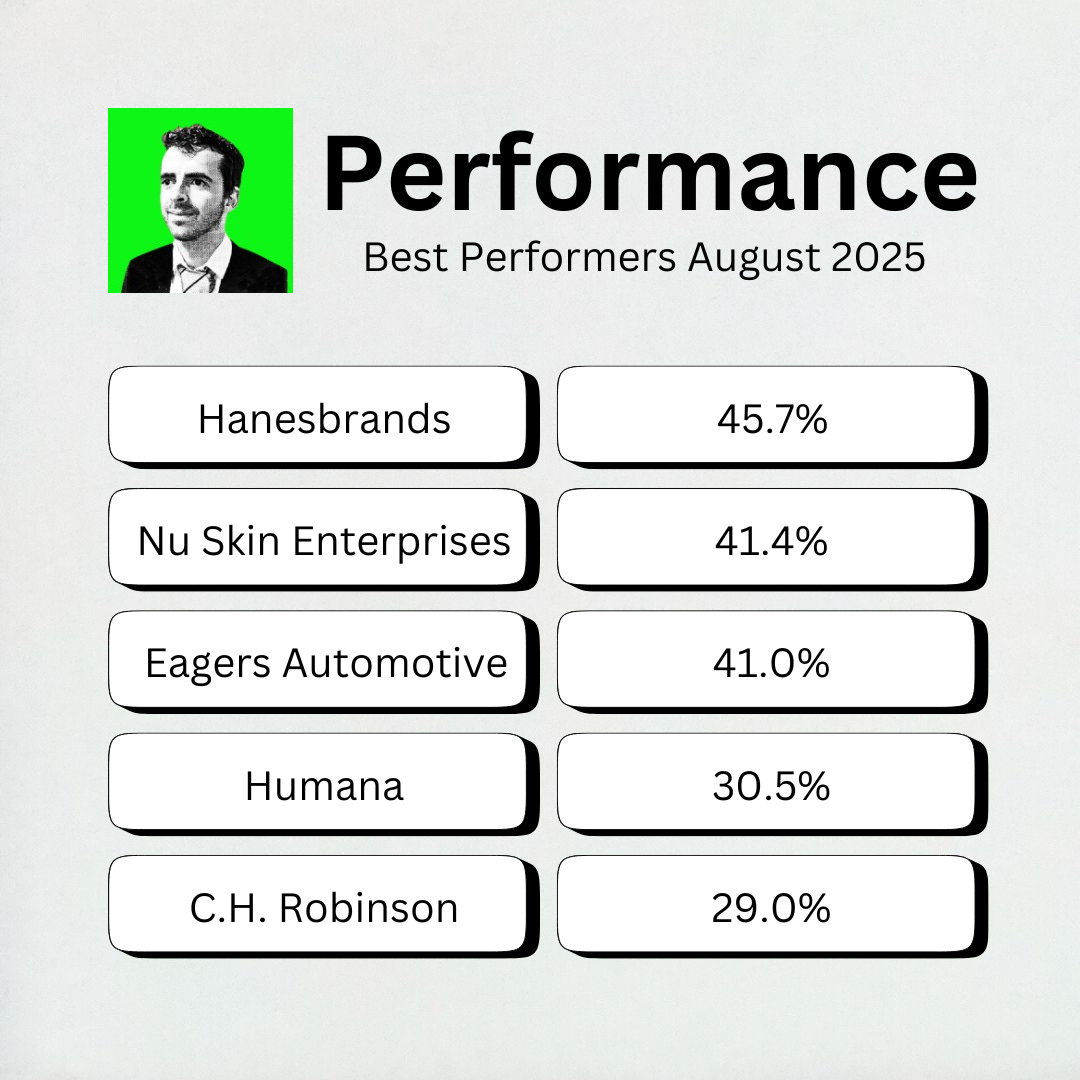

Best & Worst Performers

This overview shows you the best and worst performers in our investable universe.

Worst performers

The cheaper we can buy great companies, the better.

The biggest decliner this month? Align Technologies.

Align Technology is a medical device company best known for its Invisalign clear aligners, which provide an alternative to traditional metal braces.

Its business also includes iTero scanners and digital orthodontic tools that help dentists and orthodontists design and monitor treatments.

Align is down because of:

Slower demand in North America as consumers delay elective dental procedures

Pricing pressure from new competitors in the clear aligner market

Weaker growth in China due to economic uncertainty

Higher costs tied to manufacturing and marketing investments

Best Performers

Hanesbrands Inc. was this month’s best performer, rising over 42%.

Hanesbrands is a major U.S.-based apparel company focused on everyday basics: innerwear, T-shirts, socks, activewear and so on.

Brands include Hanes, Playtex, Maidenform, Bonds, Barely There, L’eggs, Just My Size, and Berlei

Hanesbrands stock shot up after it was announced that Gildan Activewear was buying the company for about $2.2 billion.

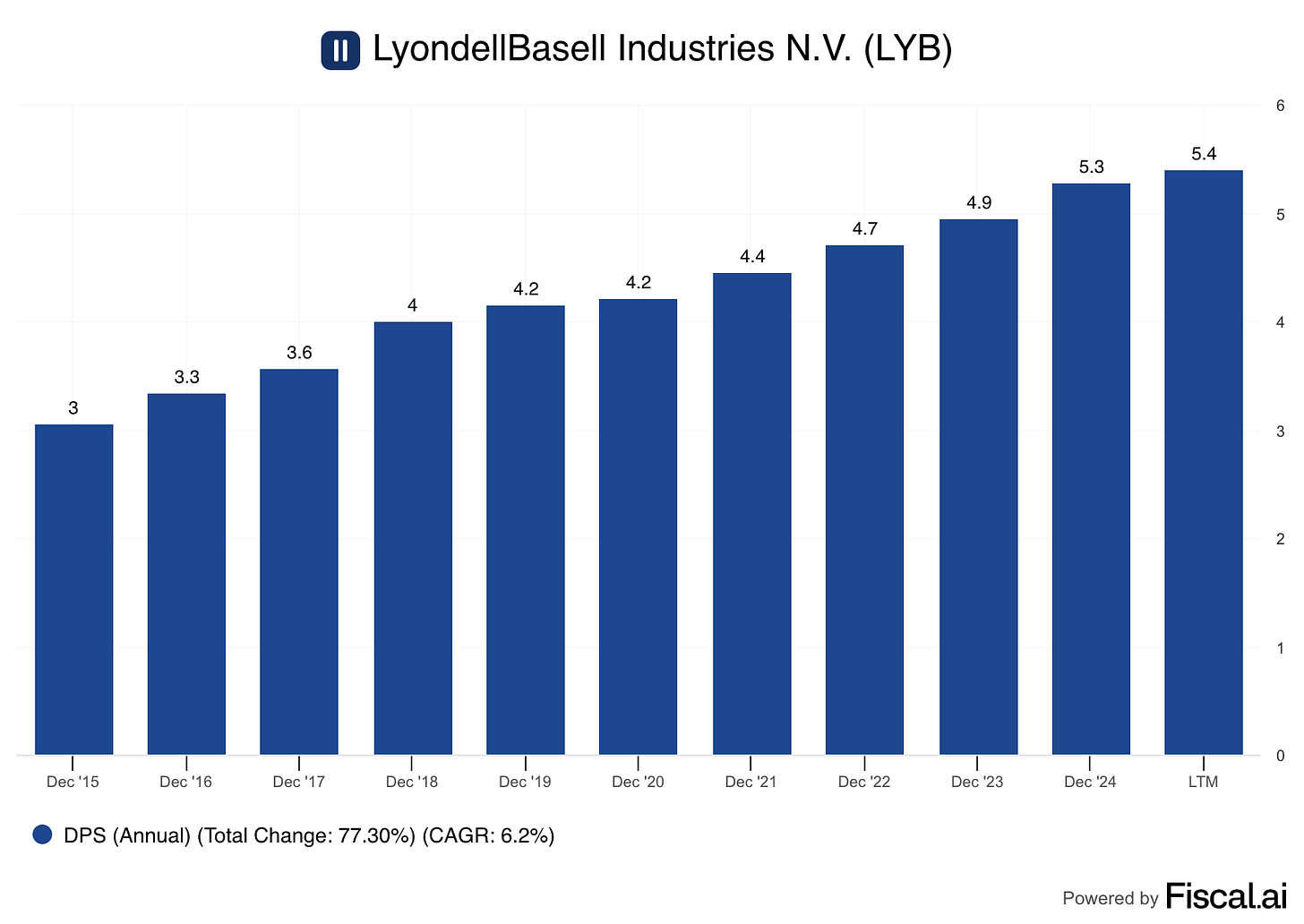

Spotlight: LyondellBasell Industries:

LyondellBasell makes money by producing plastics, polymers, and basic chemicals.

They’re one of the world’s largest petrochemical companies, making ethylene, propylene, polyethylene, polypropylene, and various downstream derivatives.

These products end up in everyday applications:

Food packaging

Automotive parts and lightweight transportation

Clean water, healthcare disposables, and hygiene products

Infrastructure, building materials, and advanced insulation

This is a capital-intensive, cyclical chemical business

Much of LyondellBasell’s advantage comes from low-cost North American feedstock (natural gas–derived ethane/propane) for cracking into ethylene and propylene.

It also operates globally, with plants in Europe and Asia - but those regions face tougher feedstock economics and regulatory headwinds. That’s why the company has sold some of these plants - a move I like.

They have kept their plants focused on sustainability and plastic circularity, aiming to pair its polymer production with recycling technologies and lower-carbon materials, which may help insulate it from future regulatory and raw-material risks.

All of that means that their earnings and cash flow are highly cyclical. They’re tied to raw material spreads, global demand, and macroeconomic swings.

Why’s it interesting to dividend investors?

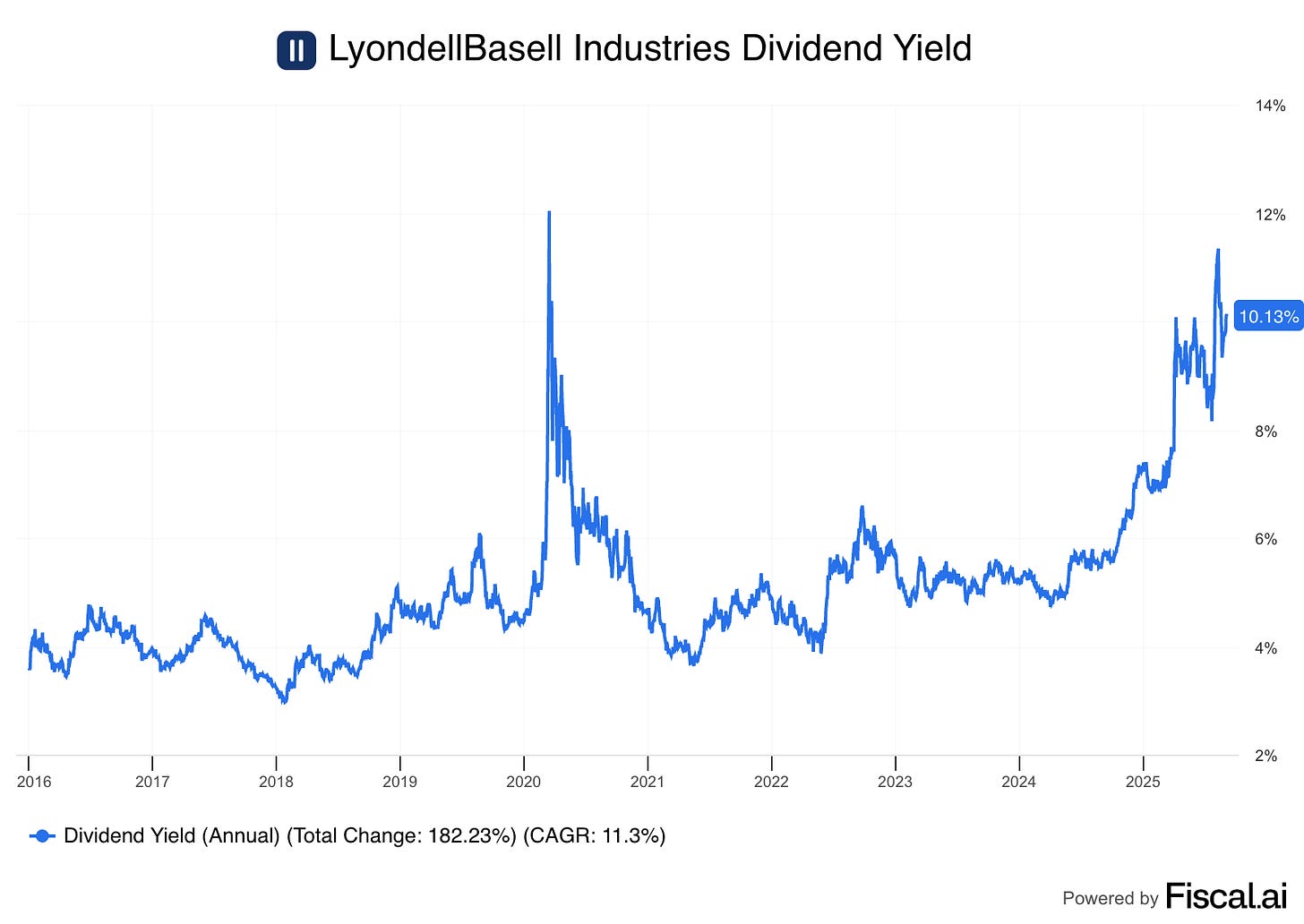

At current prices, LYB yields over 10%.

The company has increased its dividend for 14 years

However, there’s a big red flag: payout ratios are extremely high relative to earnings and cash flow.

Payout ratio (EPS): 130.5%

Payout ratio (FCF): 86.9%

That makes the dividend potentially vulnerable if commodity spreads stay weak or if the currently low demand doesn’t recover.

The fundamentals look like this:

Dividend Yield: 10.1%

Payout Ratio: 130.5%

10-Year Dividend CAGR: 6.5%

Net Profit Margin: 0.7%

ROIC: 12.8%

Forward PE: 15.0x

If you believe global plastic demand (especially packaging, transportation, and medical/high hygiene applications) recovers and feedstock spreads remain favorable, the high dividend yield might look very attractive.

On the other hand, if chemical margins stay depressed or deteriorate further, LyondellBasell could struggle to support the dividend without raising debt.

September Best Buys

There were big swings in price both up and down in August.

I scanned the Buy-Hold-Sell List for great dividend payers at attractive prices to highlight for you this month.

Let’s dive into 5 of the most interesting ones I found!

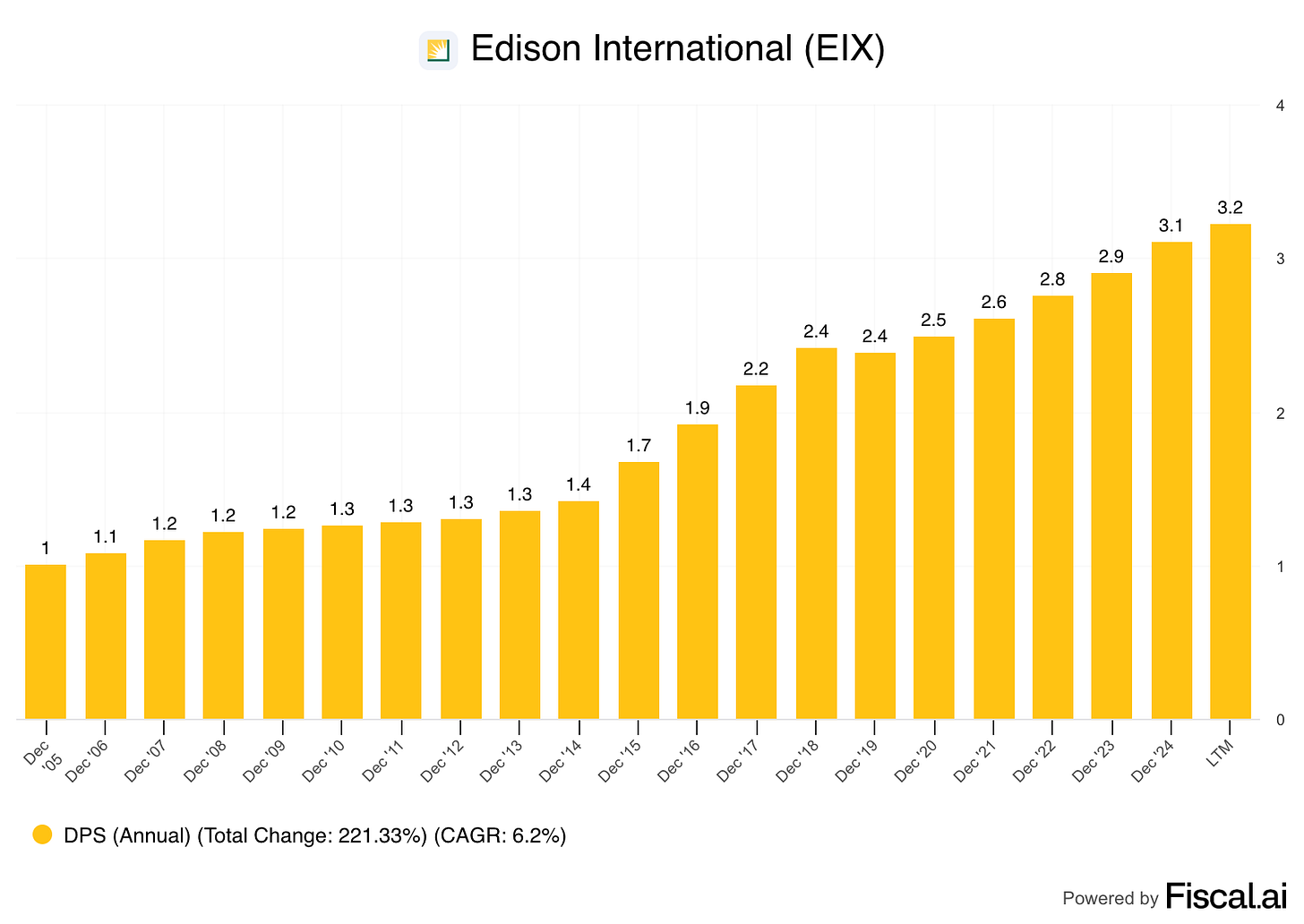

5. Edison International (EIX)

Edison powers California with regulated electric utilities, focusing on infrastructure, clean energy, and grid modernization.

Its steady cash flows come from essential services, and the long-term tailwind is the state’s growing electricity demand combined with an aggressive renewable energy push.

The utility structure provides stability, while management balances reinvestment in the grid with paying dividends.

Edison has raised its dividend for 21 years in a row with an attractive 10-year DPS CAGR of 7.3%.

Current yield: 6.2%

Payout ratio: 47.8%

Forward P/E: 9.2

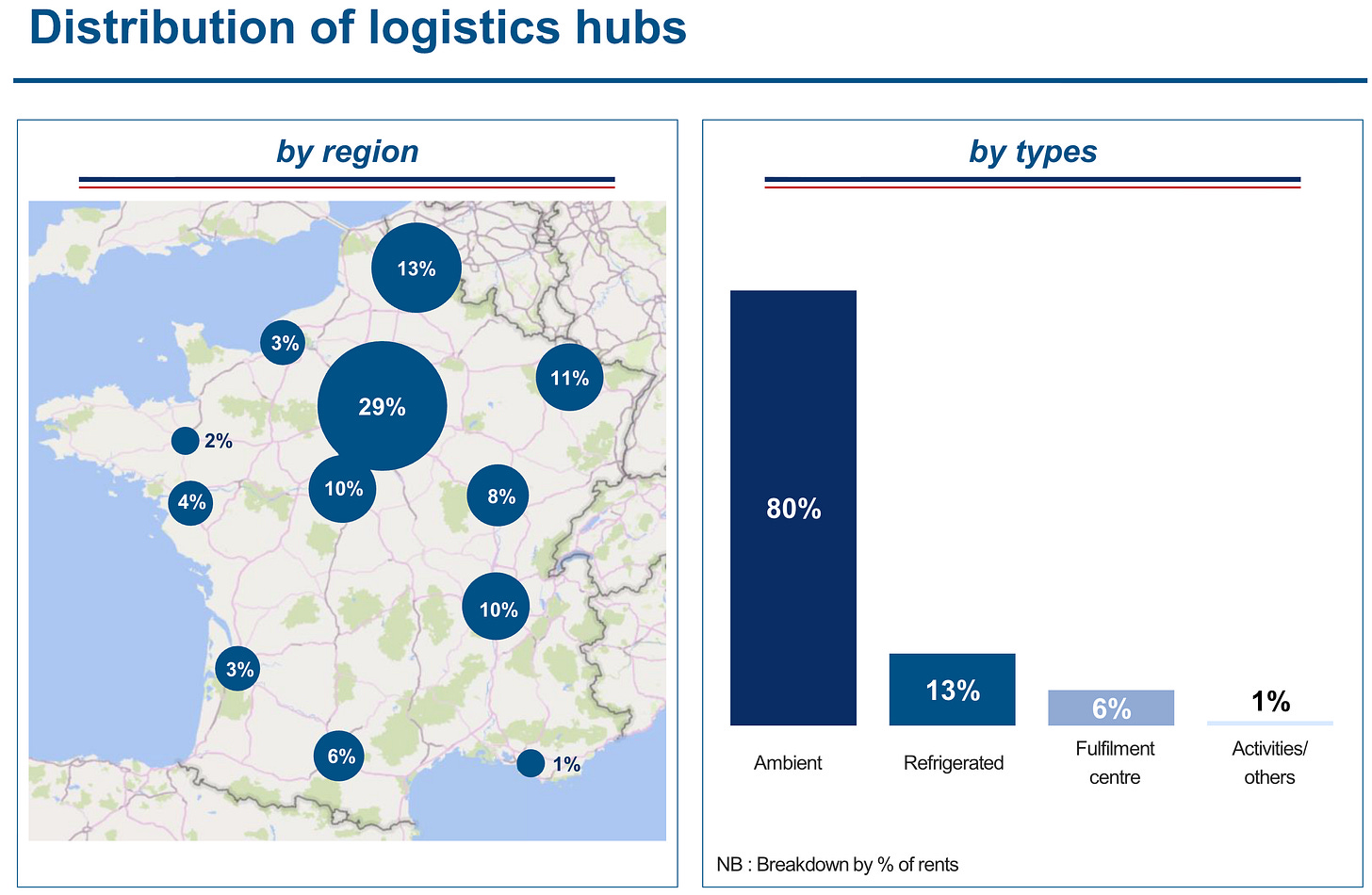

4. Argan SA (ARG)

Argan is France’s only listed real estate company dedicated entirely to logistics warehouses.

It benefits from the rise of e-commerce and demand for efficient supply chains, with long-term tenants like major retailers and distributors.

Its “develop and hold” model creates steady rental income, and the company pairs growth with disciplined financial management.

Argan has raised its dividend for 12 years in a row, with a 10-year DPS CAGR of 14.5%.

Current yield: 4.8%

Payout ratio: 28.9%

Forward P/FFO: 10.5