Bored? Good. You’re Probably Getting Rich.

👋 Howdy Partner,

It seems to me that most new (and a lot of old) investors want excitement.

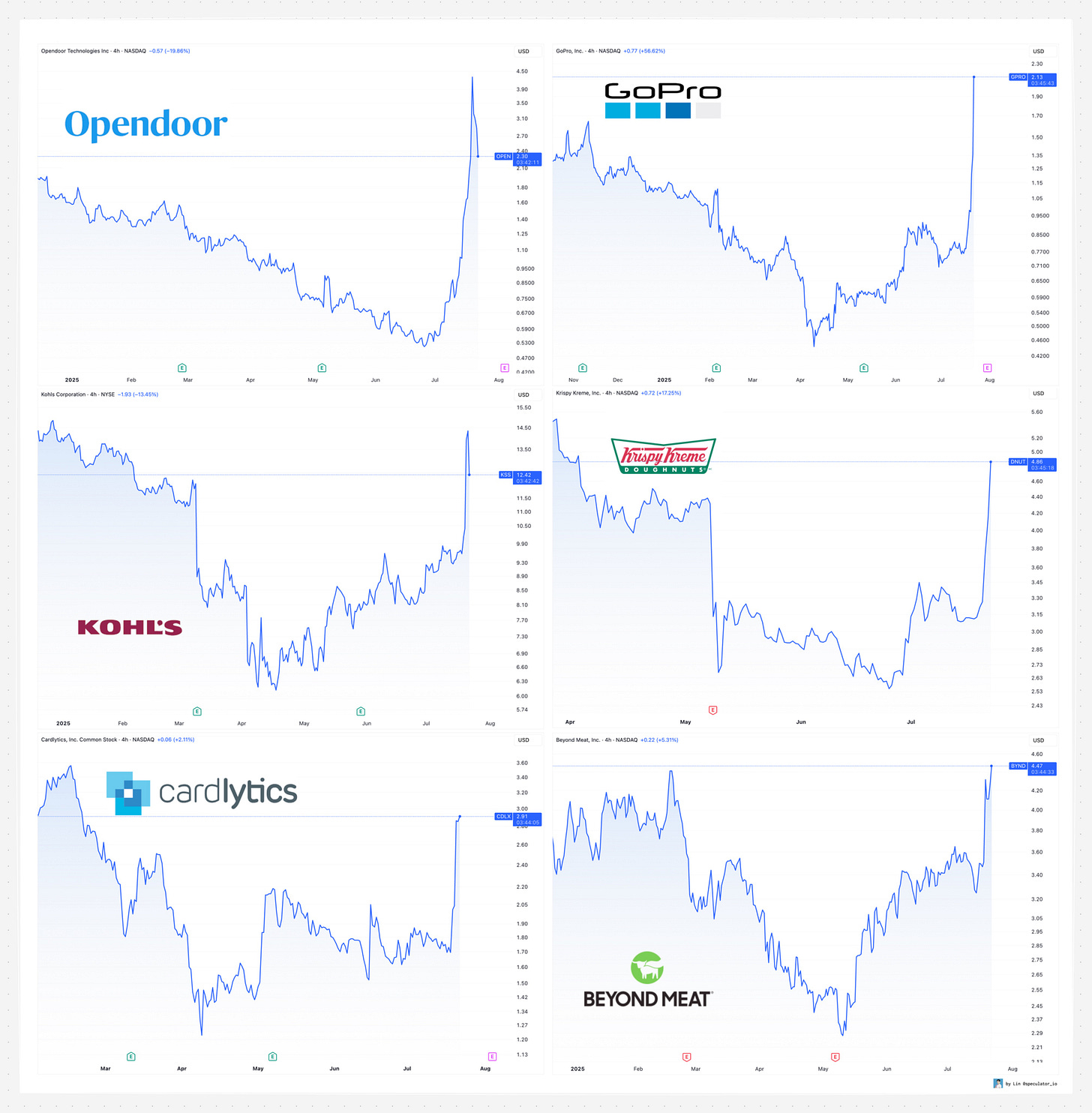

Meme stocks are back:

So are SPACs:

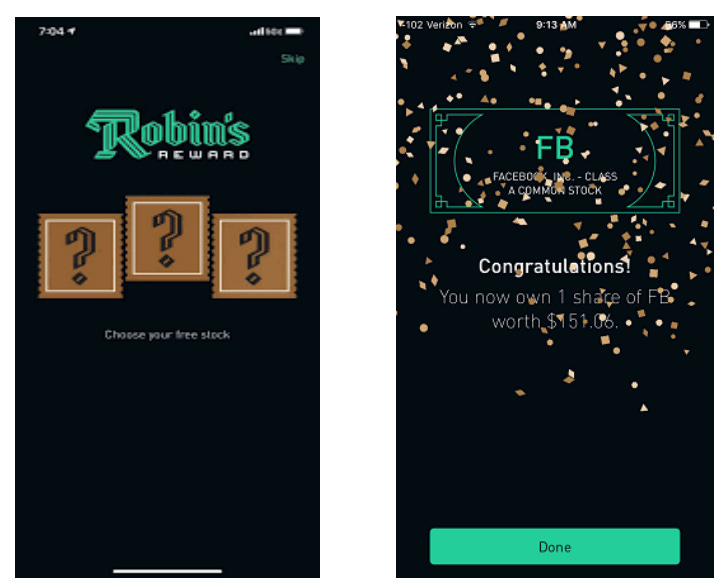

Robinhood even managed to turn investing into a video game, with mystery rewards and digital confetti to celebrate your trades:

And for a while… it’s fun.

Until it’s not.

The music stops. Prices fall. And that fun turns into regret.

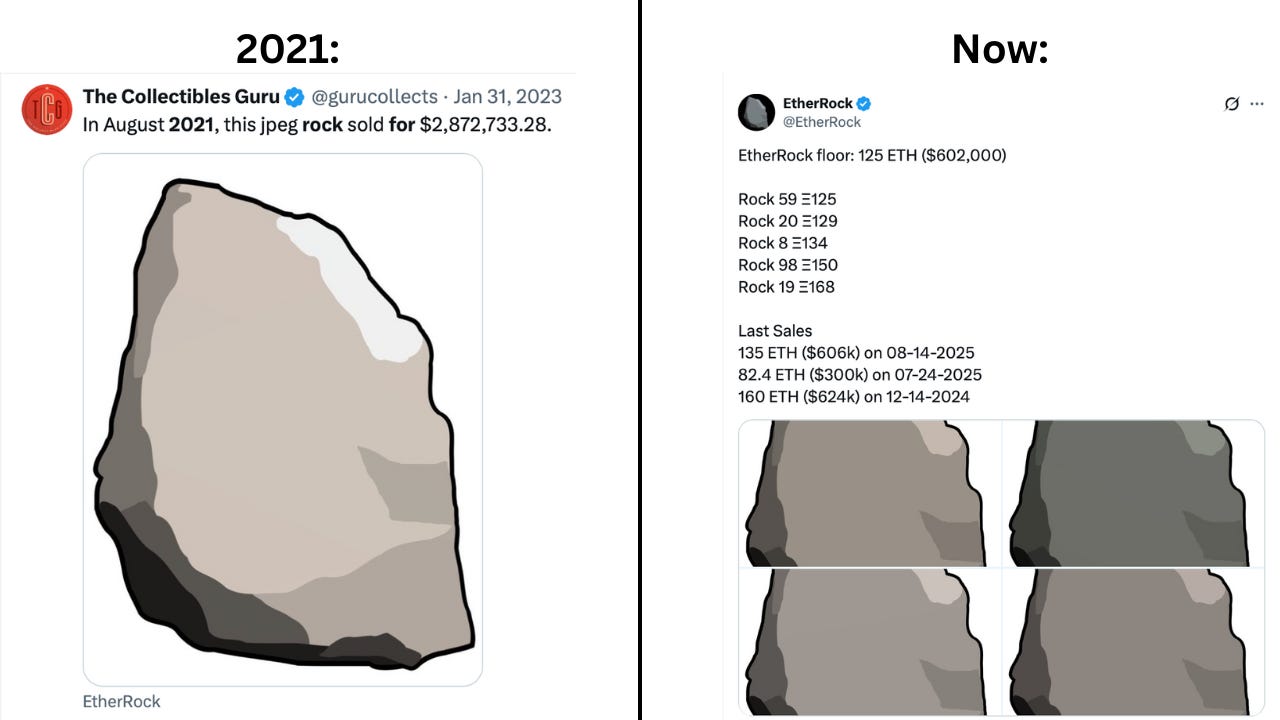

Remember NFTs in 2021? When people were paying millions of dollars for clipart rocks?

Prices have crashed nearly 90%, and the digital rock market is much less active.

Robinhood got fined for the digital confetti:

And boring investors keep winning, without the ups and downs.

How Boring Investing Makes You Rich

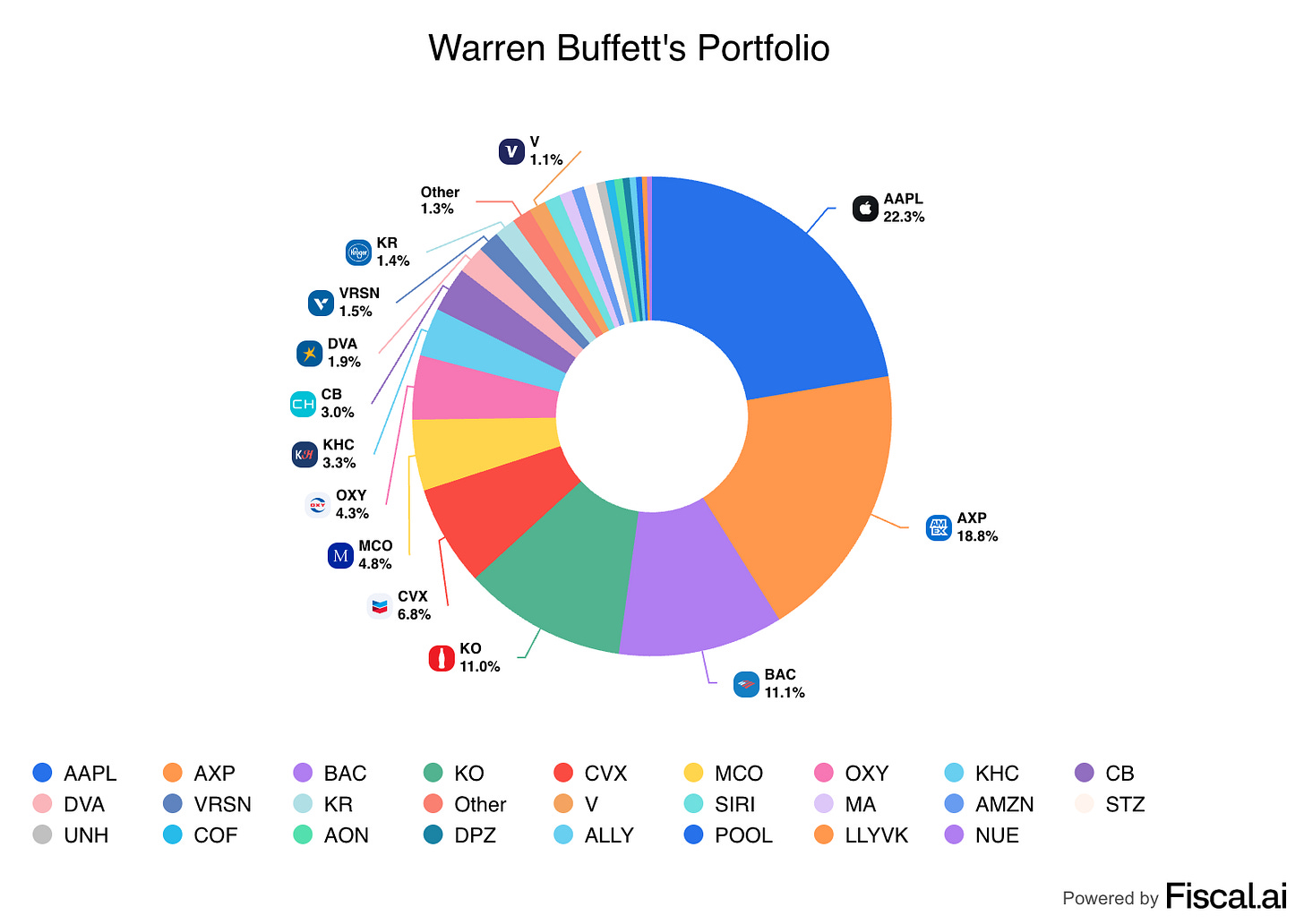

Take Warren Buffett.

His best investments aren’t new tech, or AI.

They’re Coca-Cola, railroads, credit cards, and Apple - which he bought 10 years after the iPhone came out.

He’ll make nearly $4.5 billion in dividends. Every single year. Whether the market went up or down.

That’s the power of Dividend Growth Investing.

It’s not exciting, but it works.

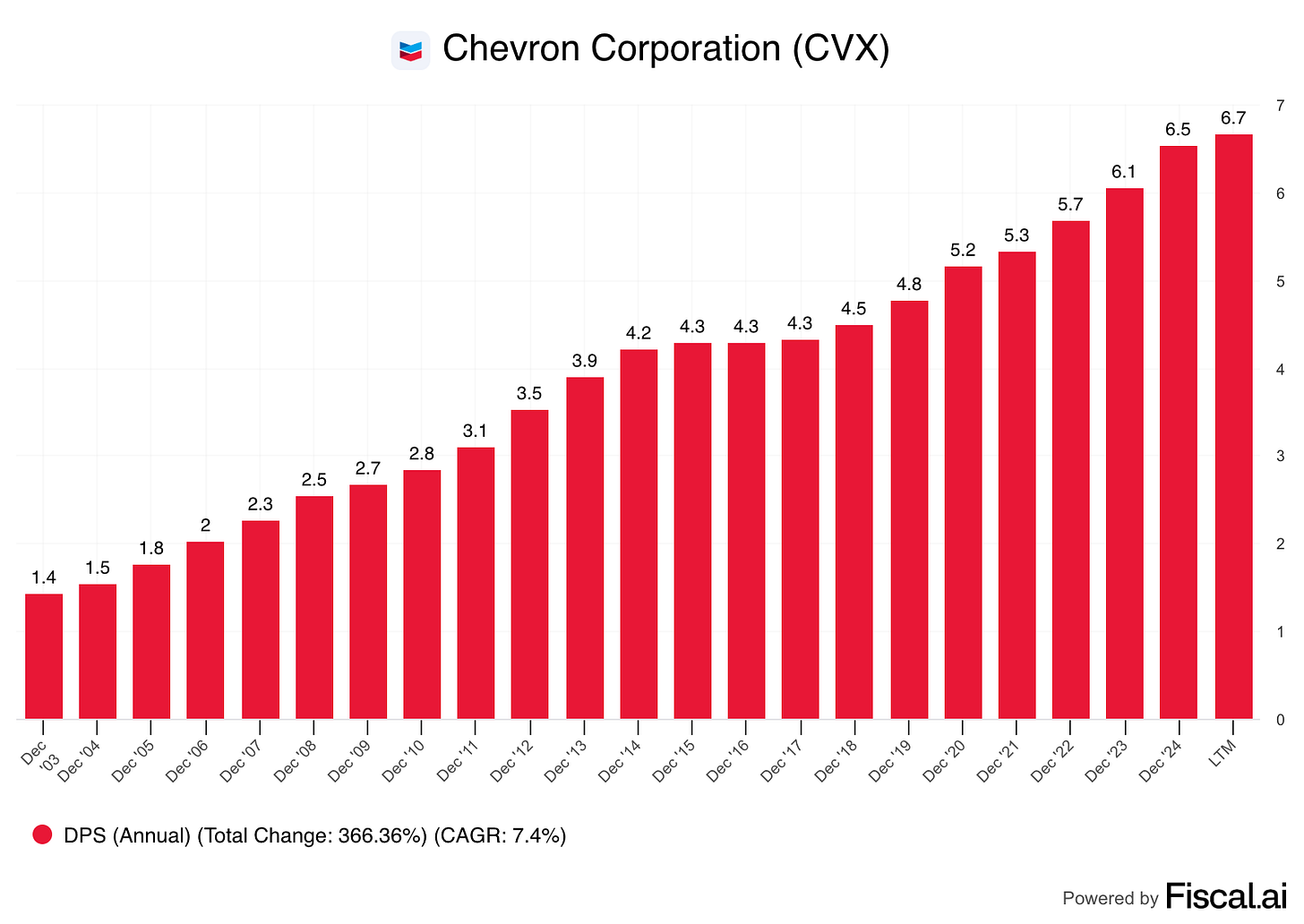

Johnson & Johnson. Procter & Gamble. Chevron.

These companies won’t double next month.

But they’ve paid and increased their dividend for decades.

Every 3 months, they pay you. And every year, they increase that payment.

Small steps. But over time… they compound into freedom.

Exciting investing is expensive

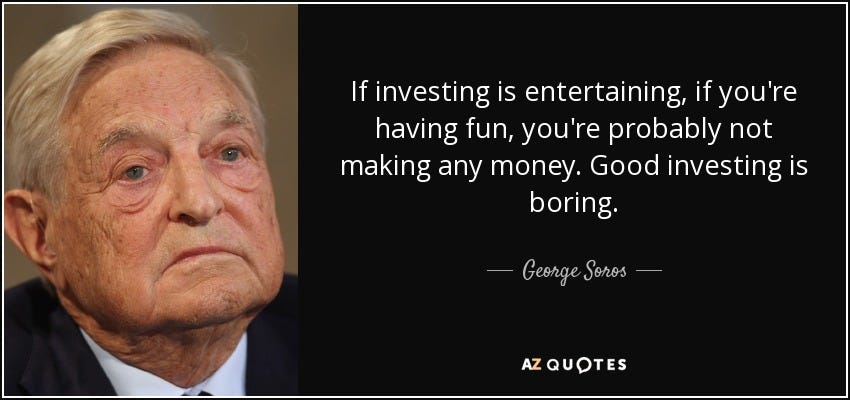

George Soros knows that you pay for excitement in investing:

He’s right.

NFTs, crypto, meme stocks…

Most of them crashed.

Dividend growth stocks just keep paying you.

Boring is Beautiful

Dividend investing doesn’t just grow your wealth, it also protects your peace of mind.

When the market crashes, you don’t have to panic.

You don’t need to watch your portfolio or the news 24/7.

You know those dividend checks are still coming in, because people will still buy toilet paper, Coke, gasoline, and groceries, and they’ll use their credit cards to do it.

You can sleep at night.

Boring works

So if your portfolio feels boring?

Good.

It means you’re doing something right.

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

What?! Boring?! No way ... my portfolio is exciting because it is filled with high quality compounders and dividend payers that grind out cash and returns. 🥳 I can literally hear the company's gears grind and the money drop into my piggy bank. 🐖 There's always an annual report or a press release to read about and use to learn more about the company. I can look for interviews on YouTube. Insiders and institutions are buying and selling shares. Oh, and don't forget the proxy statements! 😄

Boring? Hardly! I think the word "satisfying" is in order. 😉 👍