💸 Boring Is Beautiful

Today is Dividend Day.

The series where I teach you 5 things about dividend investing in less than 5 minutes.

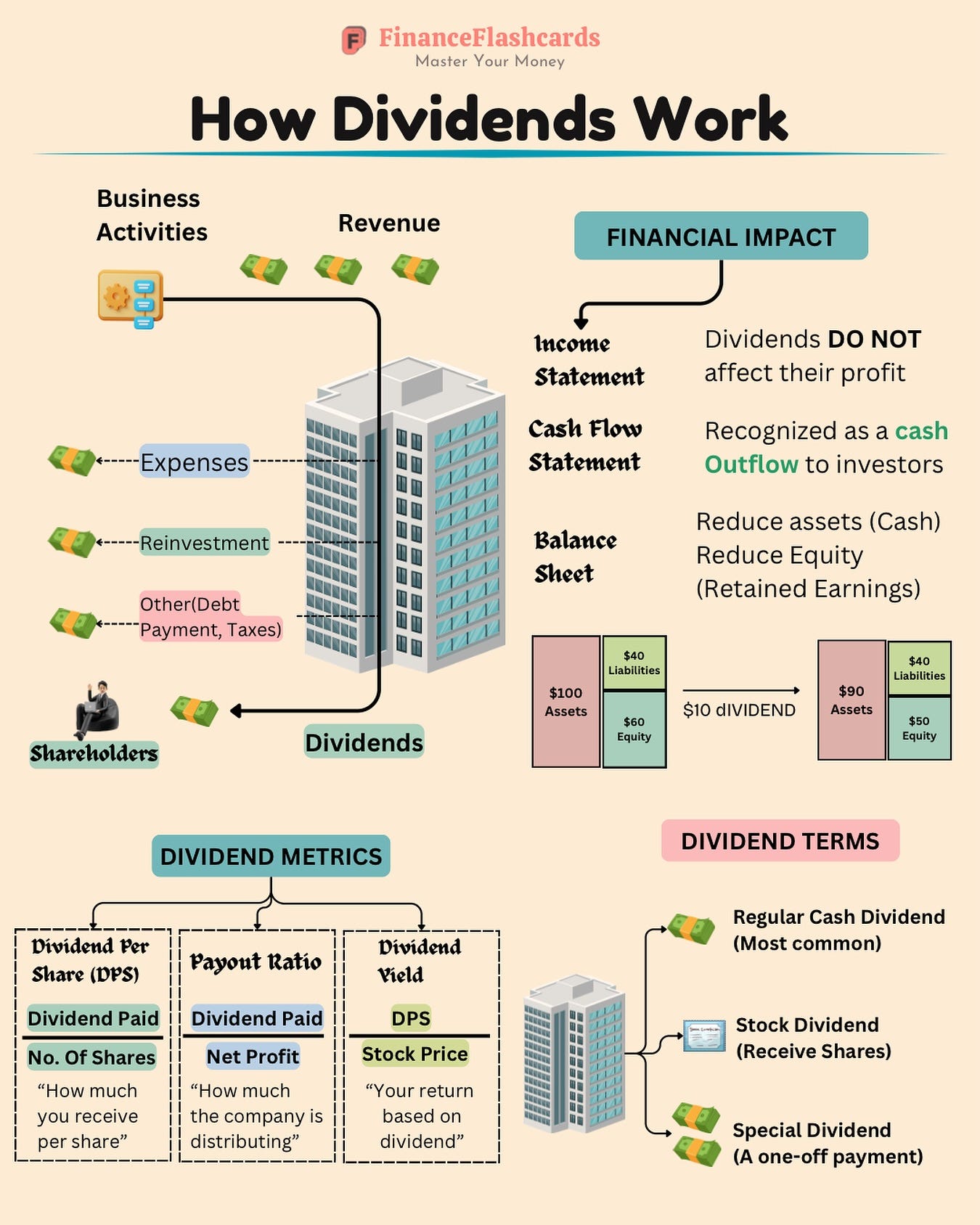

1️⃣ How Dividends Work

Ever wonder exactly how a payout moves from a company's bank account to yours?

This visual shows how the cash flows through the company, and the financial statements.

Income Statement: unaffected

Cash Flow Statement: Shows the outflow of cash

Balance Sheet: Cash and Retained Earnings are reduced

It also shows 3 important metrics, and the 3 ways you can receive a dividend:

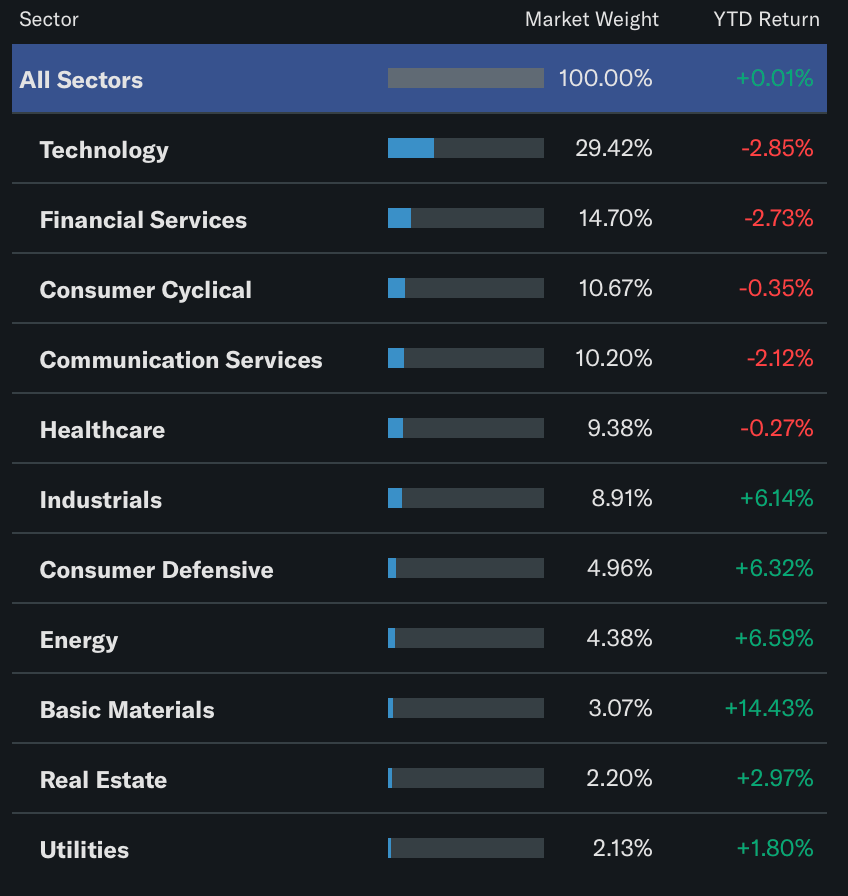

2️⃣ Boring Is Beautiful

AI and tech may be in the headlines, but boring dividend paying sectors are leading 2026 so far.

Basic Materials is the leading sector, mainly due to the strong performance of metals like gold, silver, and copper.

Industrials, Consumer Defensive, and Energy are all showing solid gains so far.

3️⃣ An Investing Quote

Warren Buffett would approve of investing in the boring sectors.

In his 2008 letter to shareholders, he reminded us that the goal of investing isn’t to impress other investors, or chase the hot trade.

It’s to compound your money over the long term.

The investments might not be exciting, but the returns will be.

"Beware the investment activity that produces applause; the great moves are usually greeted by yawns."

— Warren Buffett

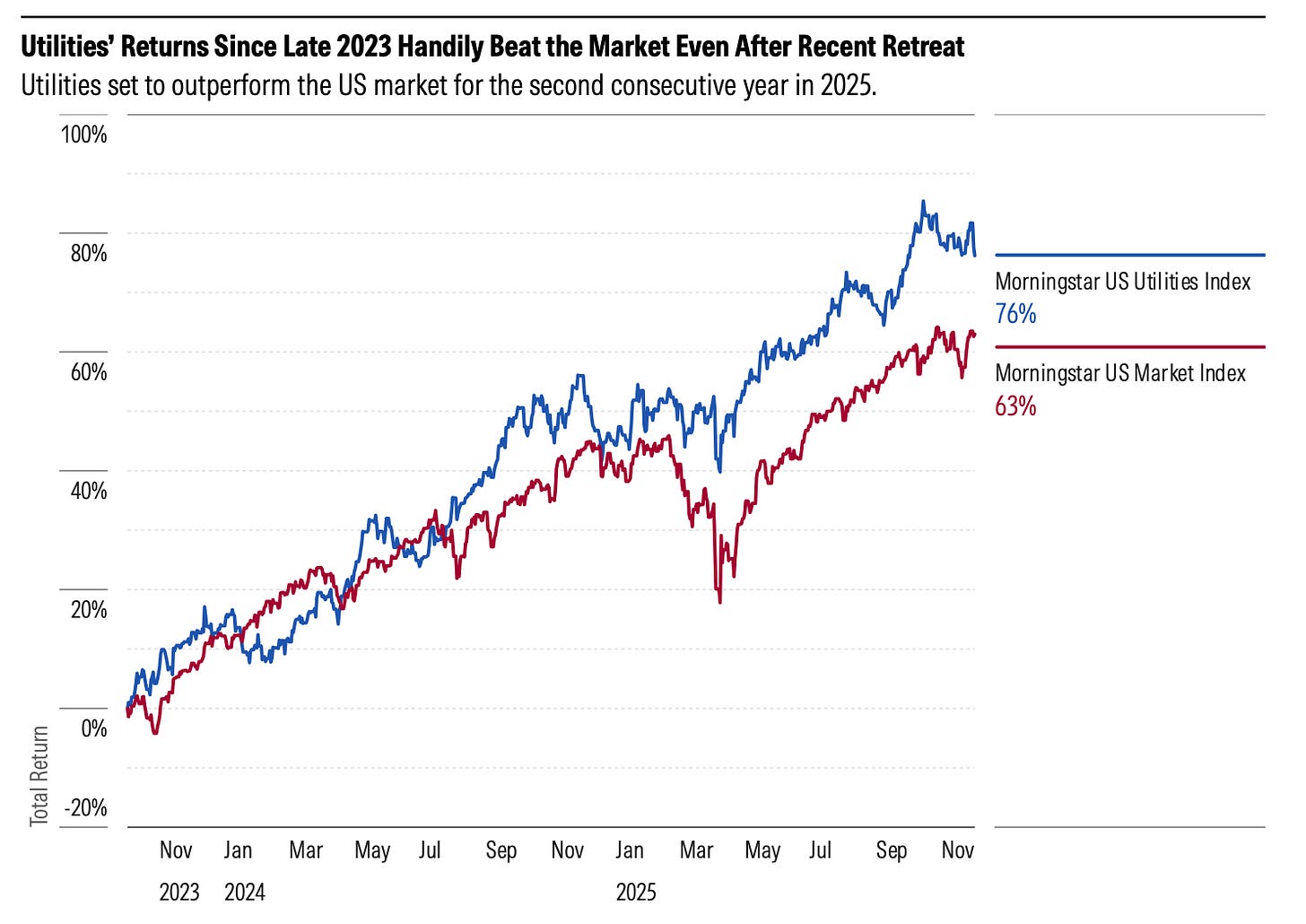

4️⃣ Utilities Have Outperformed

Utilities are another boring sector, but they’ve outperformed the broader market since 2024.

The energy demands of AI and data centers are pushing growth in this typically slow-growing sector.

Historical Highs: This surge represents the sector’s strongest two-year performance in more than 20 years.

The AI Tailwind: Energy demand from data centers is expected to triple by 2030, creating the best growth environment in decades for power providers.

Modernizing the Grid: To meet this need, utilities are projected to invest $1.1 trillion into infrastructure through 2029.

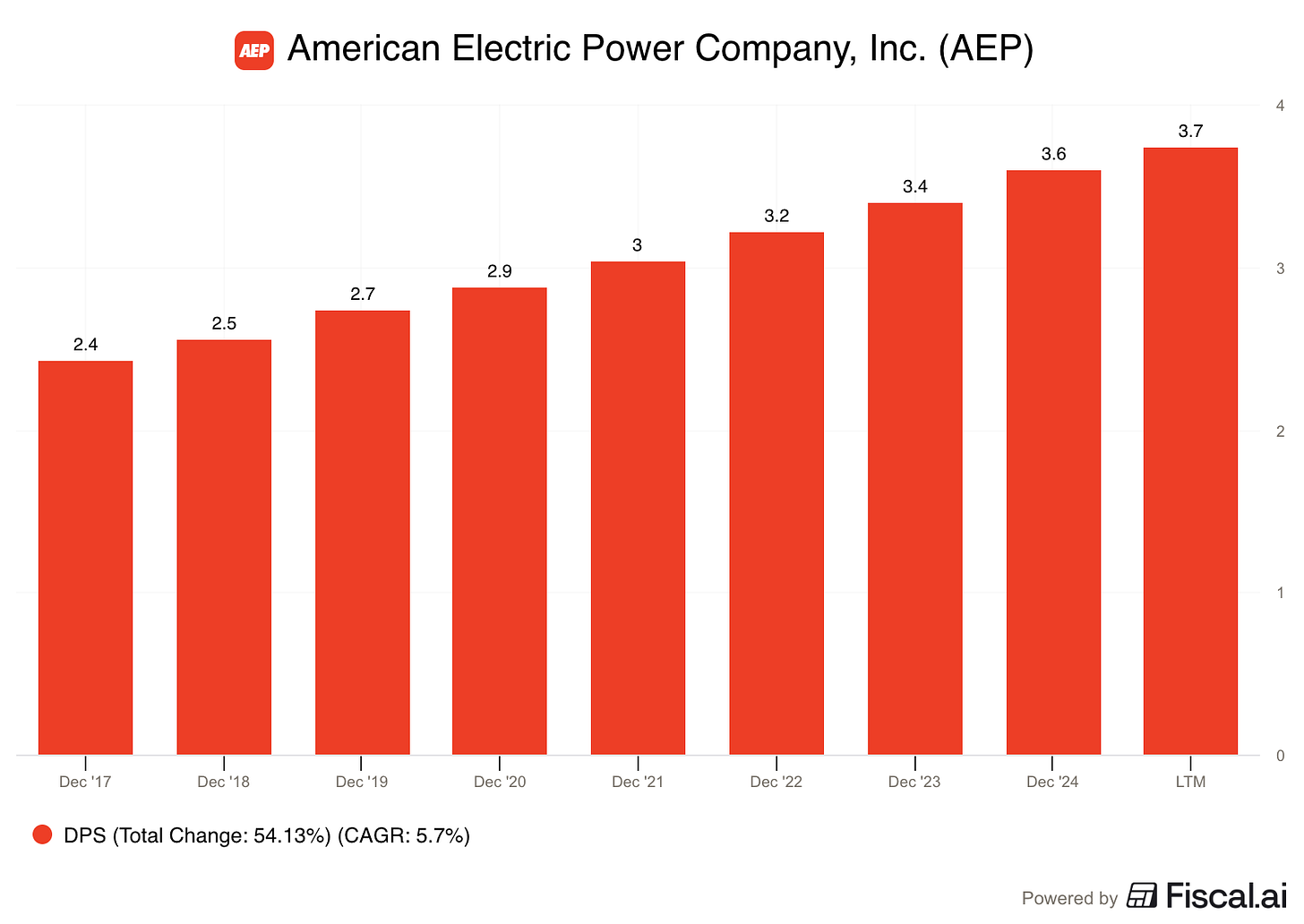

5️⃣ Example of a Dividend Stock

For our example of a dividend stock, we’ll use a utility company.

American Electric Power has the largest power distribution and transmission network in the U.S.

Profit Margin: 17.2%

Forward P/E: 19.1x

Dividend Yield: 3.2%

Payout Ratio: 54.2%

Source: Fiscal.ai

Whenever you’re ready

Whenever you’re ready, here’s how I can help you:

✍️ Three articles per week (Monday, Wednesday, and Saturday)

📚 Full access to our entire library of data-driven articles

📈 An insight into our Portfolio full of interesting Dividend Stocks

🔎 Full investment cases about interesting companies

The doors for Compounding Dividends will reopen to a limited of people on the 24th of February.

You don’t want to miss it? And you also want to receive all the exclusive bonuses?

You’ll also immediately get a copy of my 10 favorite cannibal stocks when you do.

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.