💸 Buffett's Latest Moves

What Dividend Investors Need to Know

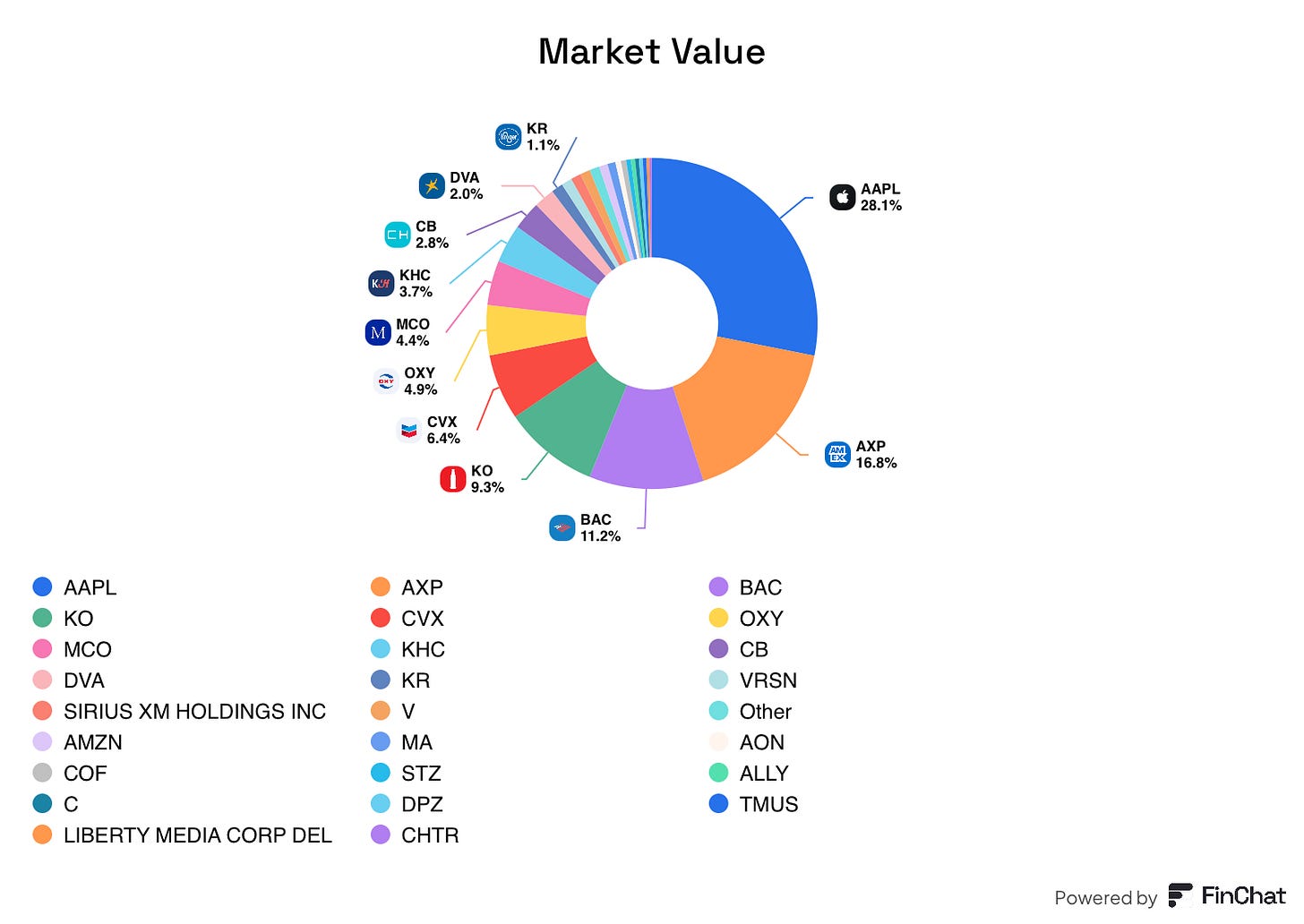

Warren Buffett’s latest 13-F filing was released Friday.

Here’s how the portfolio currently looks.

Now let’s look at some of his recent moves.

Bank of America

Buffett trimmed his stake in Bank of America.

He’s owned BofA since 2011, investing $5 billion in preferred shares with a 6% dividend and warrants to buy 700M common shares at $7.14 each. He later exercised the warrants in 2017, securing a massive stake at a bargain price.

The shares have appreciated massively from where Buffett bought them:

Occidental Petroleum

He piled more money into Occidental Petroleum (OXY).

Buffett has been loading up on OXY since 2019, backing its $38 billion acquisition of Anadarko with a $10 billion preferred stock investment paying an 8% annual dividend.

He added more shares this quarter. Why?

They return capital to investors. Here’s their shareholder yield:

Buffett has praised OXY’s CEO, low debt, and strong cash flow, but says he’s not looking to acquire the whole company - he just likes the business and its capital returns.

VeriSign and SiriusXM

Buffett also added to his positions in VeriSign and SiriusXM. These aren’t traditional dividend plays, but they generate strong free cash flow.

And they’re both Cannibal Companies.

Here are the shares outstanding for VeriSign:

And for SiriusXM:

Constellation Brands

Buffett initiated a new position in Constellation Brands.

This is the force behind Modelo and Corona, two of the best-selling beers in America.

It has pricing power, steady demand, and they’ve been growing the dividend.

Domino’s Pizza

Buffett almost doubled his position in Domino’s. Think about that.

A man known for buying slow-and-steady businesses just went all-in on pizza delivery. What does that tell us?

That Buffett sees Domino’s as a cash machine.

He’s right - Domino’s has quietly become one of the most successful fast-food chains on the planet, with relentless expansion and an aggressive stock buyback program.

What’s the takeaway?

Buffett is positioning himself for cash flow, pricing power, and resilient consumer demand.

He’s doubling down on energy, and betting on brands that dominate their markets.

It’s always worth paying attention to what Buffett is doing.

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data