Buy-Hold-Sell List Update August 2025

Earnings season brings volatility - and opportunities

👋 Howdy Partner,

There’s been lots of excitement in the markets lately because of earnings season.

Some earnings reports cause big swings in price.

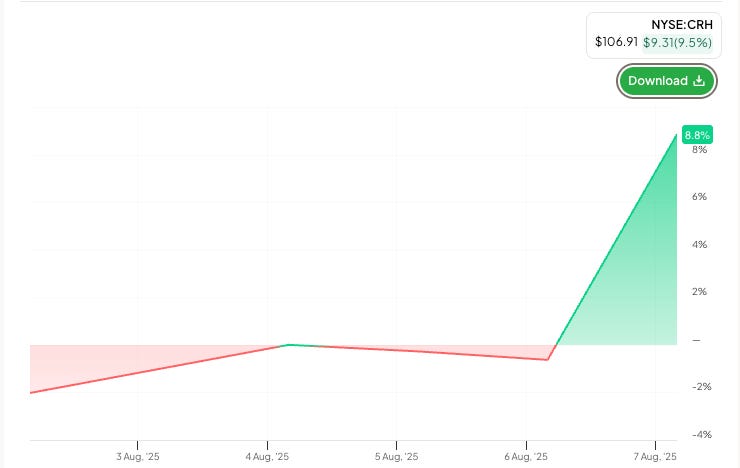

CRH plc is up nearly 10% over 5 days for example.

While Novo Nordisk A/S is down 30% over the past month.

Academics would tell you that price volatility is risk.

But we know better - we know that short-term volatility is just a popularity contest.

Sometimes Mr. Market gets too excited and sometimes he gets too depressed - which is what creates opportunities for long-term investors like us.

Let’s look at this month’s Buy-Hold-Sell list update and see what interesting opportunities he’s willing to serve up!

Buy-Hold-Sell List

The Buy-Hold-Sell List filters our very large Investable Universe.

You can see all of the details on how it works here:

We look for cheap Dividend Stocks based on three valuation methods:

The PEG Ratio

Current Yield vs Historical

Reverse Dividend Discount Model

Based on this, we give each company a Buy, Hold, or Sell recommendation.

Update July 2025

Some Interesting Stats:

209 companies total receive a ‘buy’ rating

That’s up from 148 last month

96 moved from 'hold’ to ‘buy’

43 have moved up from ‘sell’ to ‘hold’

6 made the jump from ‘sell’ directly to ‘buy’

Only 1 company did that last month.

Recommendation Changes

34 companies went from Buy to Hold due to increasing stock prices.

Here’s a sample of a few:

ASSA ABLOY (ASSA.B) designs and sells locks and security solutions for homes and businesses.

Healthcare Realty Trust (HR) invests in and manages properties leased to healthcare providers.

Norfolk Southern (NSC) provides freight transportation services across the eastern United States by rail.

You can download the entire Buy-Hold-Sell list here: