👋 Howdy Partner,

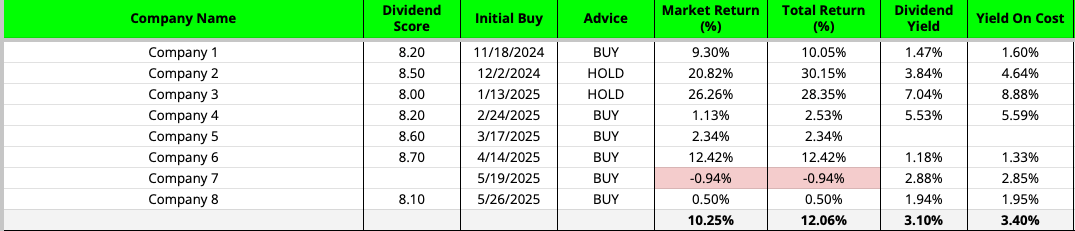

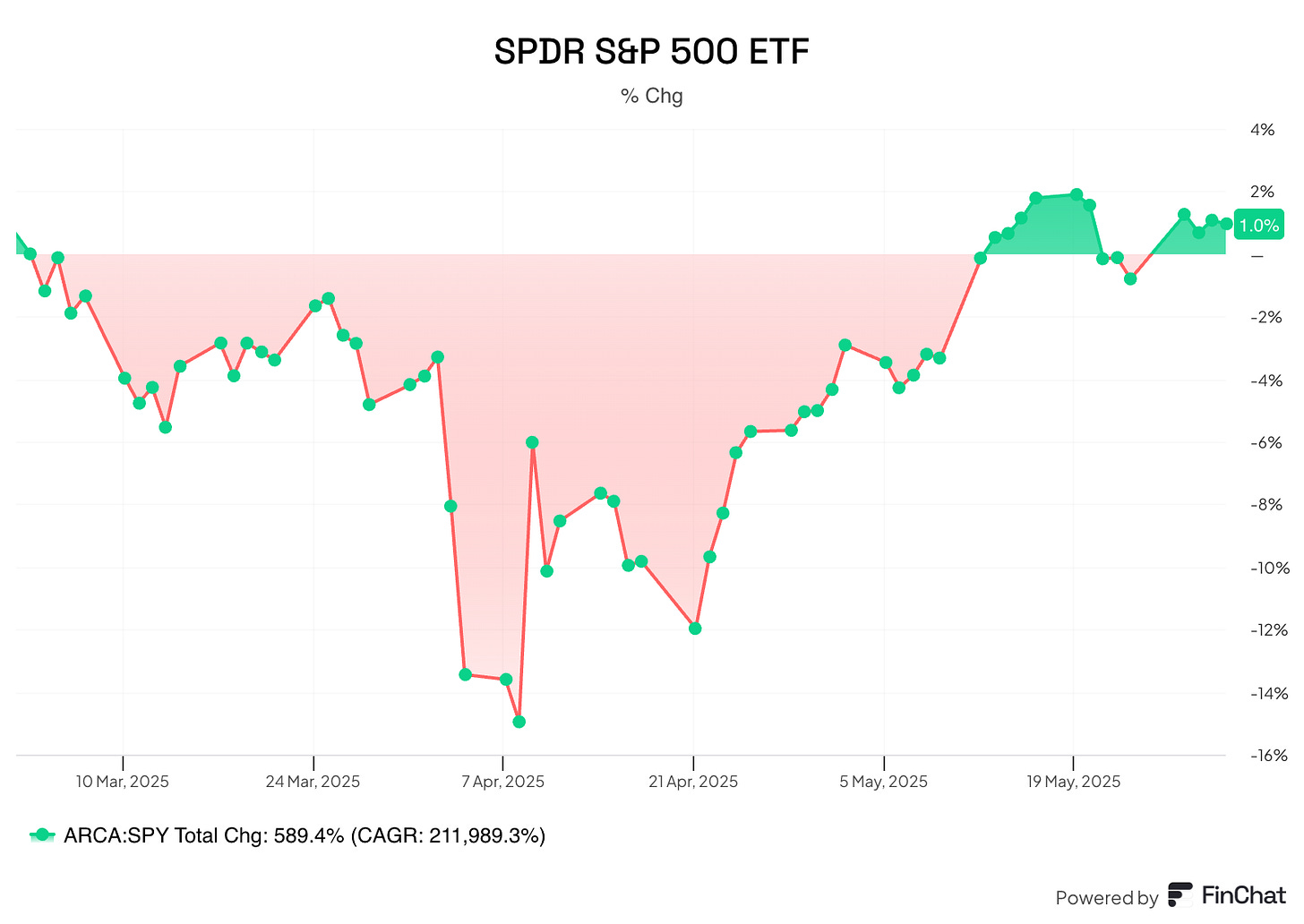

Since November, the Compounding Dividends Portfolio is up 12.06%.

The S&P 500? It’s still down about 1%.

Now, I’ll be the first to tell you - this isn’t a race.

I’m not trying to “beat the market.”

What I am trying to do is build $5,000 in reliable, recurring, passive income. Every month. Rain or shine.

That’s it. That’s the goal.

And you know what I love about dividend stocks?

They don’t care how the market feels.

It’s swung from ‘Extreme Fear’ in April to ‘Greed’ in May.

But the total change in the past 3 months?

Only 1%.

If you were on social media, or read the financial headlines, you know there was painc.

To be honest, I hardly worried about it.

Why?

Because I own real businesses. With real cash flow. That send me money.

Every. Single. Month.

Remember that volatility is opportunity - even though the market has recovered, some Dividend Stocks are still beaten down.

Let’s update our Buy-Hold-Sell List to see what looks attractive right now.

Have you ever heard about The Walnut Fund?

With The Walnut Fund, you invest in real walnut trees that produce nuts (and cash) every year, for over 40 years.

It's a simple way to earn passive income and help the environment. Plus, for every 10 trees you buy, you get 1 free. Be fast, there are only 5,400 trees available.

Cold Beer, Warm Sun, and Passive Income

I love the summertime - unfortunately our weather hasn’t been very nice lately.

It’s been unseasonably cold, wet, and miserable.

But I know the heat and sun are coming, so last week I opened our pool.

One of my favorite things to do is to float around on the water, paperback (or 10-K) in hand, with a cold, crisp beer sweating in the can.

I don’t need much more than that.

And here’s the best part…

While I’m floating? Those cash flowing companies we talked about earlier are still working to produce income for me.

Even though I’ll be doing my part to support the breweries through the summer, the beer business has taken a hit lately.

Alcohol consumption is down. Some of the biggest names have seen their stocks slide.

One of them is Constellation Brands ($STZ).

They sell popular alcoholic drinks like Corona, Modelo, and Robert Mondavi wines. Constellation leads the market for imported beer in the U.S. and also sell many spirits and wines.

A few reasons they’re interesting:

Berkshire Hathaway has been buying

They’re divesting lower-end wine brands to focus on premium wines

The stock is down nearly 33% over the past year

It looks undervalued on the Buy-Hold-Sell list

62% undervalued on Historical Dividend Yield

15% undervalued on the Reverse DDM

Buy-Hold-Sell List

The Buy-Hold-Sell List is a way to filter our very large Investable Universe.

You can see all of the details on how it works here:

We look for cheap Dividend Stocks based on three valuation methods:

The PEG Ratio

Current Yield vs Historical

Reverse Dividend Discount Model

Based on this, we give each company a Buy, Hold, or Sell recommendation.

Update May 2025

One company will be removed from the Buy-Hold-Sell List:

Discover Financial Services ($DFS): Capital One Financial Corporation acquired the company on May 19, 2025

Some Interesting Stats:

148 companies total receive a ‘buy’ rating

43 moved from 'hold’ to ‘buy’

38 have moved up from ‘sell’ to ‘hold’

5 made the jump from ‘sell’ directly to ‘buy’

Recommendation Changes

52 companies went from Buy to Hold due to increasing stock prices.

Here’s a sample of a few:

CME Group ($CME): Runs one of the world’s largest derivatives exchanges

CSX Corporation ($CSX): Provides freight rail and intermodal transportation services across the eastern US

L'Oreal ($OR): Develops, manufactures, and sells a wide range of cosmetics and beauty products

Baxter International ($BAX): Develops, manufactures, and sells medical products and therapies for hospitals and home use

Wabtec ($WAB): Provides equipment, systems, digital solutions, and services for the freight and transit rail industries

You can download the entire Buy-Hold-Sell list here: