Buying More of This Stock.

In the short run, the market is a voting machine, but in the long run, it is a weighing machine.

Right now, the market is panicking and voting very negatively against anything it think AI might disrupt.

It’s getting ridiculous if you ask me, but it creates great opportunities!

The Selling Is Overdone

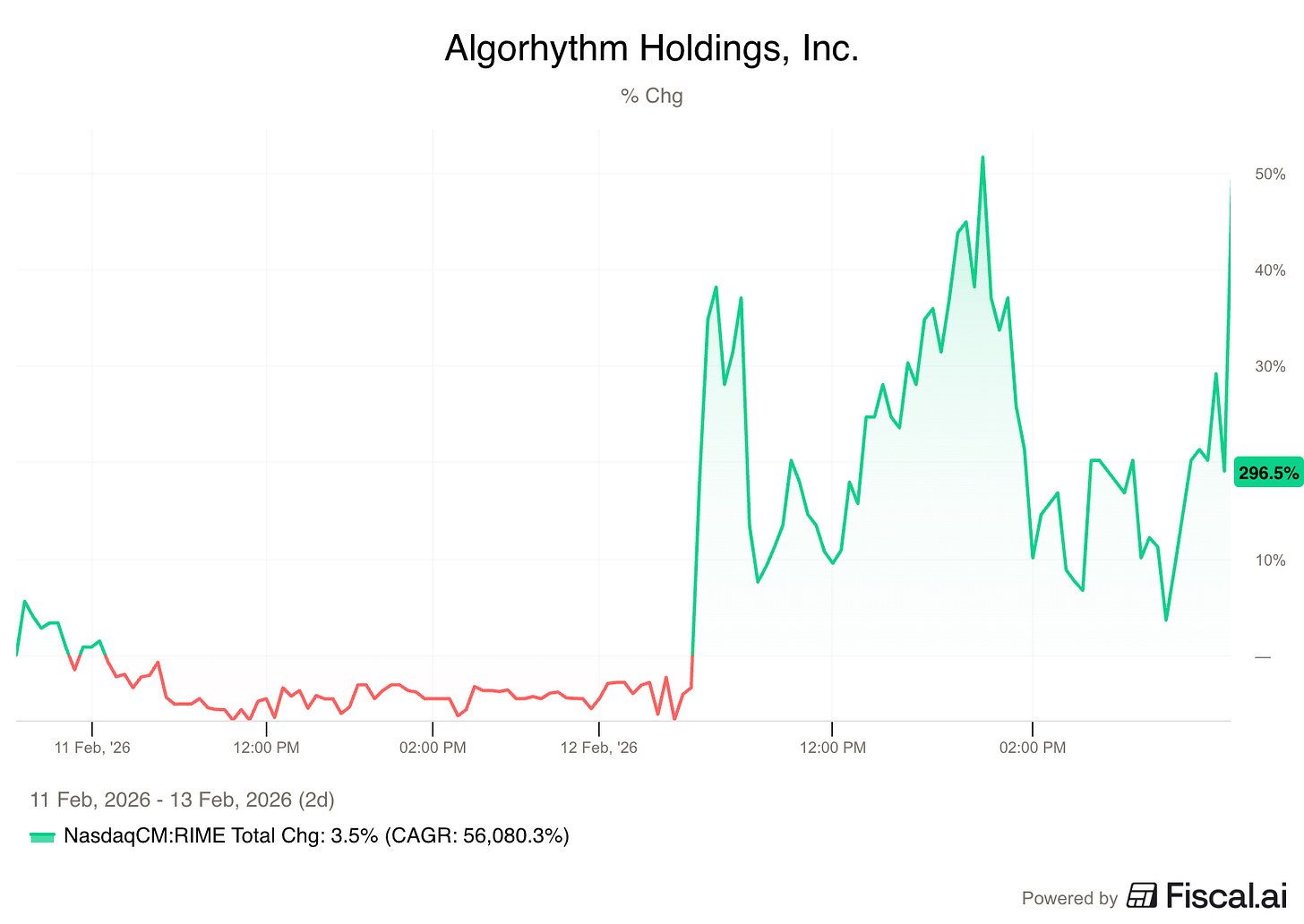

Last week, a a penny stock called Algorhythm Holdings (market cap: about $5M) made a claim.

Until recently, they sold karaoke machines.

They put out a press release about a new AI tool for logistics.

It claims to let fright companies handle 400% more volume without hiring more staff.

What Happened Next Was Total Irrationality

Algorhythm Holdings stock went from $0.85 a share to over $3.50.

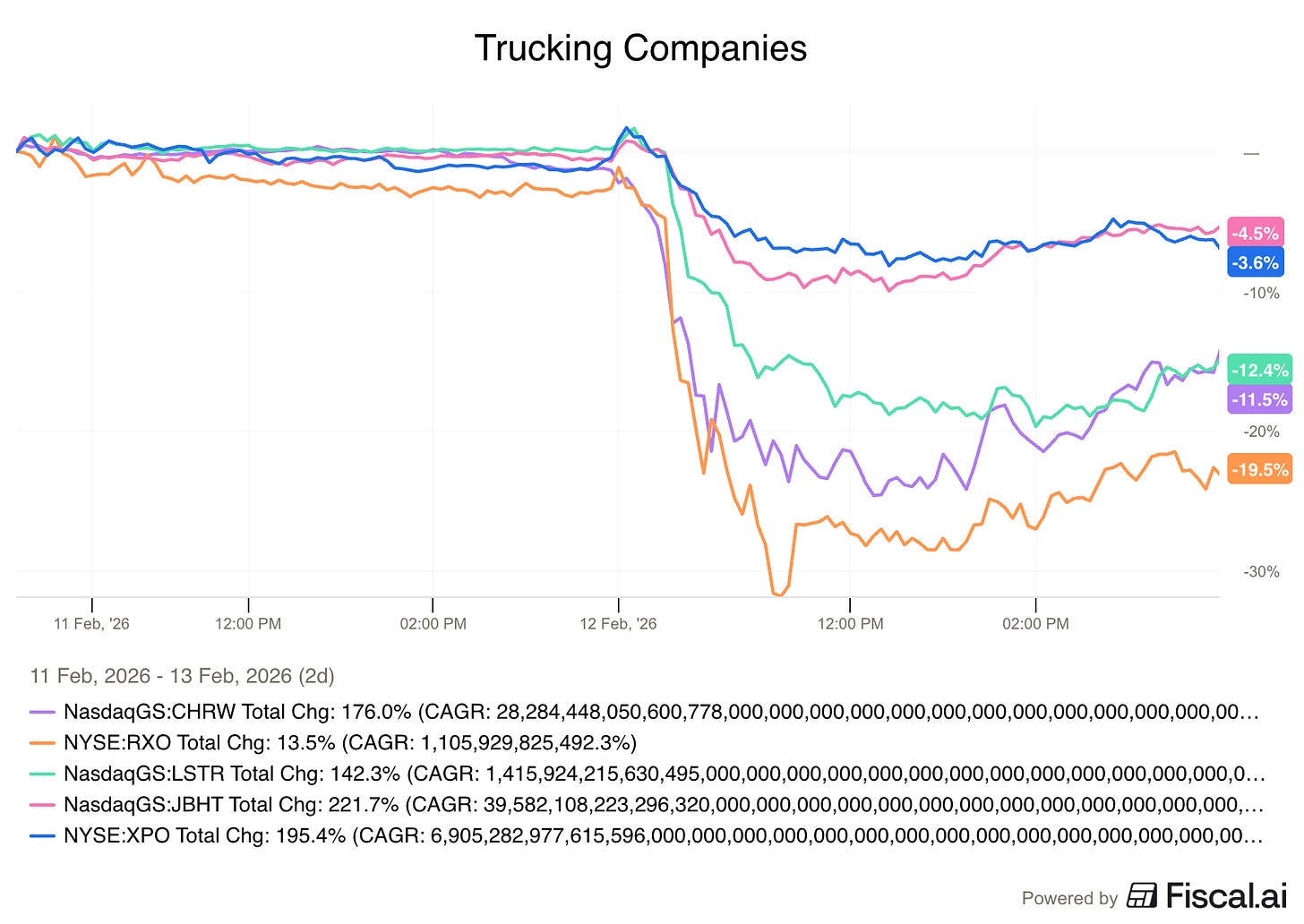

Meanwhile, billion dollar trucking companies had their stocks sell off.

C.H. Robinson: down as much as 24% on the day

Landstar Systems: dropped 16%

RXO: 20.5%

JB Hunt Transportation Services and XPO: both about 5%

Billions gone in market cap because the company that formerly made ‘The Singing Machine’ put out a press release about an AI software tool.

Taking Advantage Of Market Irrationality

Panic selling is a great thing for a long-term investor.

It’s gives us the opportunity to buy great businesses at lower prices.

These are the kinds of times Warren Buffett had in mind when he said this:

We’re not buying a trucking company, but we are buying more of a stock that the market thinks AI will disrupt.

It’s down nearly 30% this year alone.

Just recently, the price was hammered another 13% in a single day after Anthropic released a plug-in for Claude.

Here is why the market is wrong, and why we are adding to our position in this Wide Moat compounder.

Paid Partners find out exactly what company we’re adding to.

But I’ll give you some more stats about it:

The current dividend yield is more than double the average of the past 10 years

Without multiple expansion, we can expect a return of +12% per year

If the multiple re-rates to a very conservative level, our return would be +16%

Whenever you’re ready

Whenever you’re ready, here’s how I can help you:

✍️ Three articles per week (Monday, Wednesday, and Saturday)

📚 Full access to our entire library of data-driven articles

📈 An insight into our Portfolio full of interesting Dividend Stocks

🔎 Full investment cases about interesting companies

The doors for Compounding Dividends will reopen on the 24th of February.

There will be discounted memberships, plus a lot of exclusive bonuses.

You don’t want to miss it? And you also want to receive all the exclusive bonuses?

You’ll also immediately get a copy of my 10 favorite cannibal stocks when you do.

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.