You know that our investable universe contains three buckets.

We have ETFs full of Dividend Growers with dividend yields that are higher than the market average.

Today we’re adding an ETF to cover our third bucket of Cannibal Stocks.

Cannibal Stocks

“Pay close attention to the cannibals – the businesses that are eating themselves by buying back their stock.” - Charlie MungerCannibal stocks are companies that buy back a lot of their own shares.

Why does this matter?

Because buybacks increase your ownership of the company

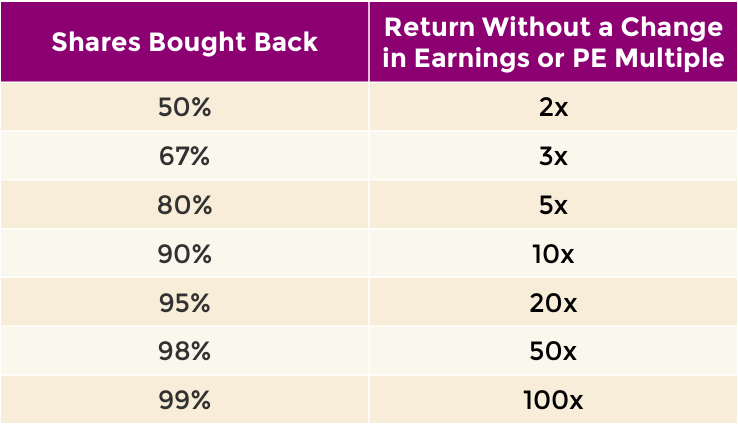

If you own a business that earns $10 per share and the company buys back 50% of its outstanding shares, EPS will increase from $10 to $20.

The chart below shows how different levels of buybacks affect returns:

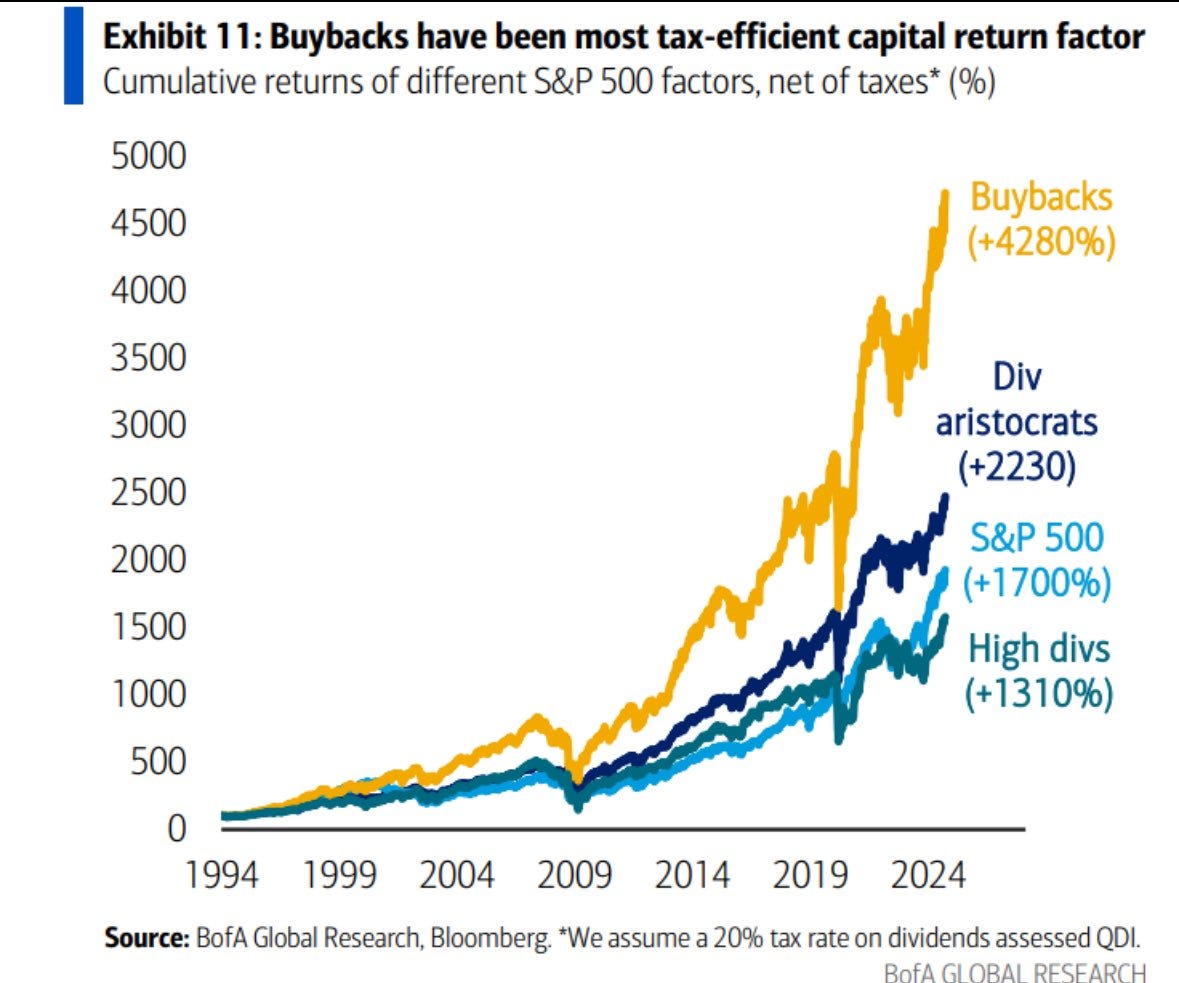

In addition to generating attractive returns, buybacks address one of the common criticisms of dividends - taxes.

The image shows the cumulative returns of different factors, net of taxes.

Shareholder Yield

Buybacks aren’t the only way for companies to return capital to shareholders.

Management teams can return capital through:

Dividends

Share buybacks

Debt paydown

These three added together are called “shareholder yield”.

Shareholder yield performs even better than dividends alone!

Now that you understand the benefit of looking at more than just dividends as a way for companies to return capital to us, let’s add some cannibals to our portfolios!