💸 Certainty Is the Biggest Risk Investors Ignore

A Youtube comment got me thinking about uncertainty.

Many investors are way too sure of themselves.

Today I want to share some thoughts on why that is a problem.

But first, I’ll share the comment with you.

It’s already been proven if you invest in high growth etf for 30 years your balance at retirement will be 3x higher vs investing in dividend stocks. Invest in growth and when you retire take all that money and invest in dividend growth.

Let’s start with really breaking down what’s being said here.

The Obvious Issues

There are a few obvious things that jump out right away.

The assertion that ‘it’s already been proven’

First, nothing in the market is "proven.”

Science has things that are proven.

The temperature at which water freezes.

That gravity makes things fall.

Bernoulli’s principle.

But markets are run by people and emotions.

In that world, there are no sure things.

That the outcome 30 years from now is known

If we knew what would happen in 30 years, we wouldn’t even need the ETF.

We’d just buy the one best stock. Bet it all on black and let it ride.

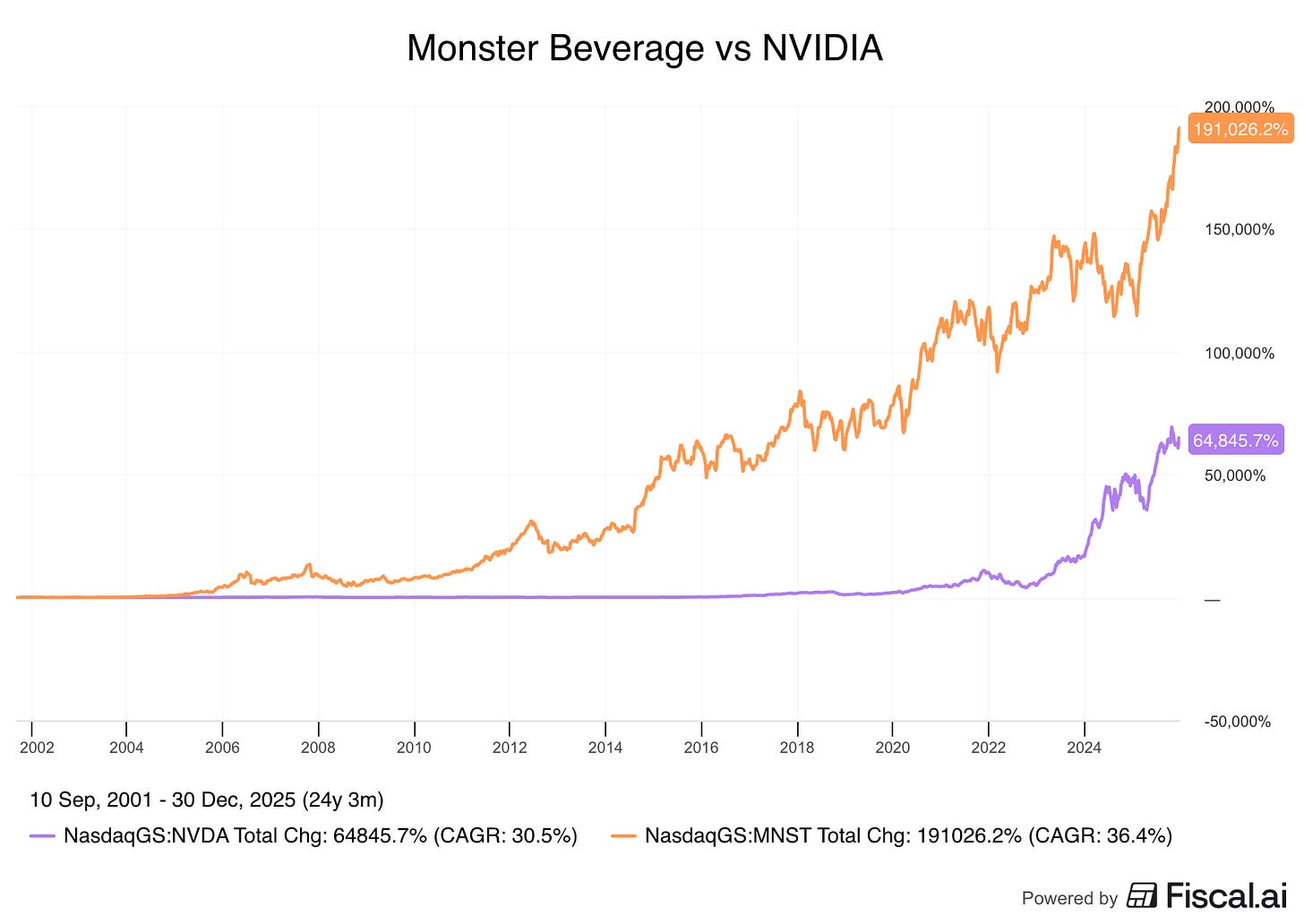

If, in 2001 you knew that Monster Beverage would be the best performing stock for the next 24 years, beating out even NVIDIA, would you buy anything else?

Of course not.

But nobody knows the future.

Those are the obvious issues. Let’s dive into some that aren’t so obvious.

No room for uncertainty.

I’m not talking about the ‘already been proven part’.

I’m talking about the underlying implication that just because growth did outperform in the past 30 years, that it had to.

One of my favorite aphorisms comes from Elroy Dimson, who said that “risk means more things can happen than will happen.”

This seemingly simple statement has massive implication here.

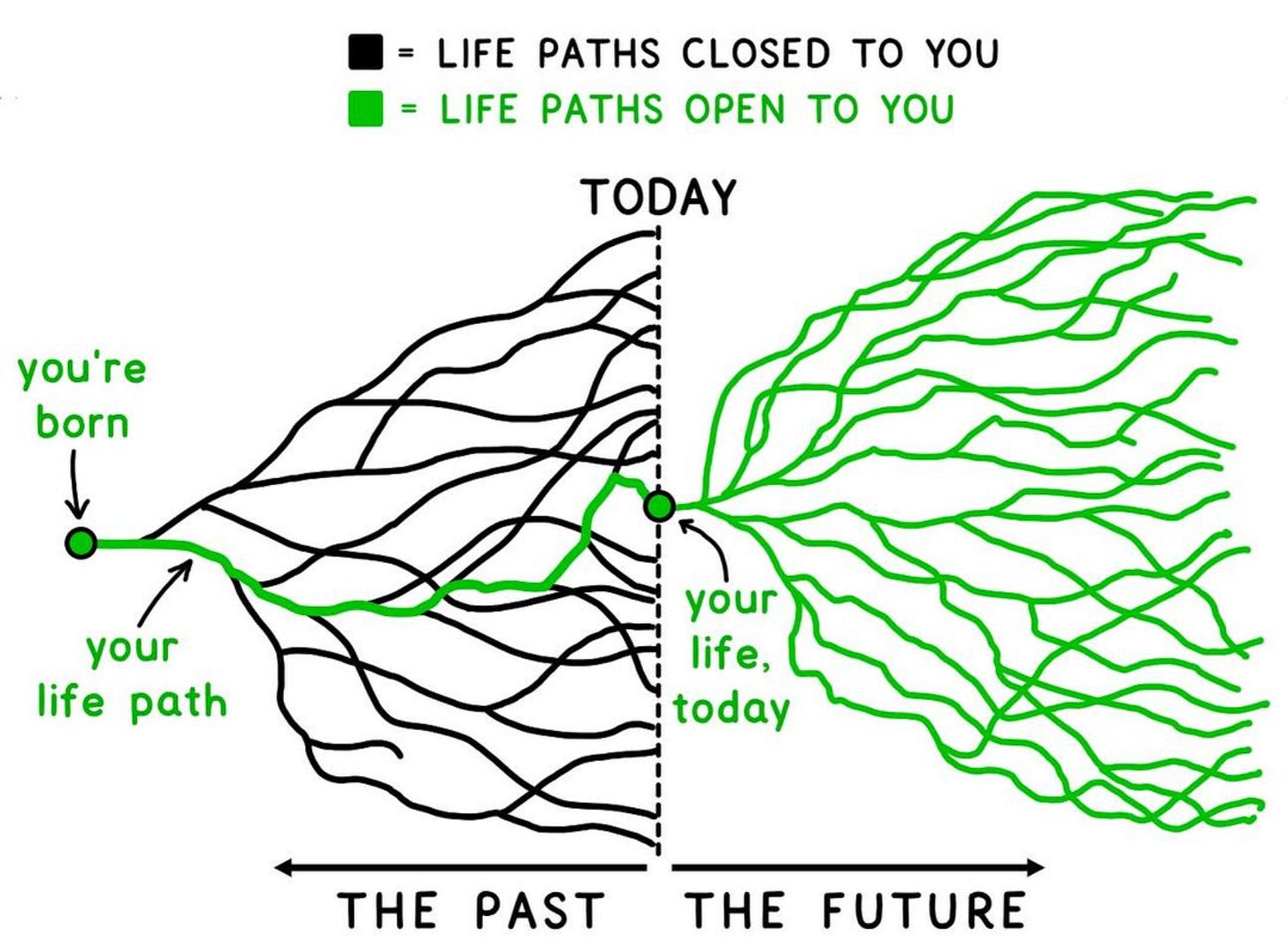

To show you why, I like to think of this picture from Tim Urban.

It’s about your life path and the choices you made, but I think it applies equally to stocks.

We know the green line in the past - what happened.

But we don’t know how many other black lines there could have been, and we don’t know the probabilities of each of them.

We also don’t know how many green lines there are for the future, or their probabilites.

Which means that not only can we not figure out a probability for what’s going to happen in the future, we can’t even figure one out for what’s already happened in the past.

Investing means operating under conditions of massive uncertainty.

Never forget that.

Good Outcomes Don’t Imply Good Decisions

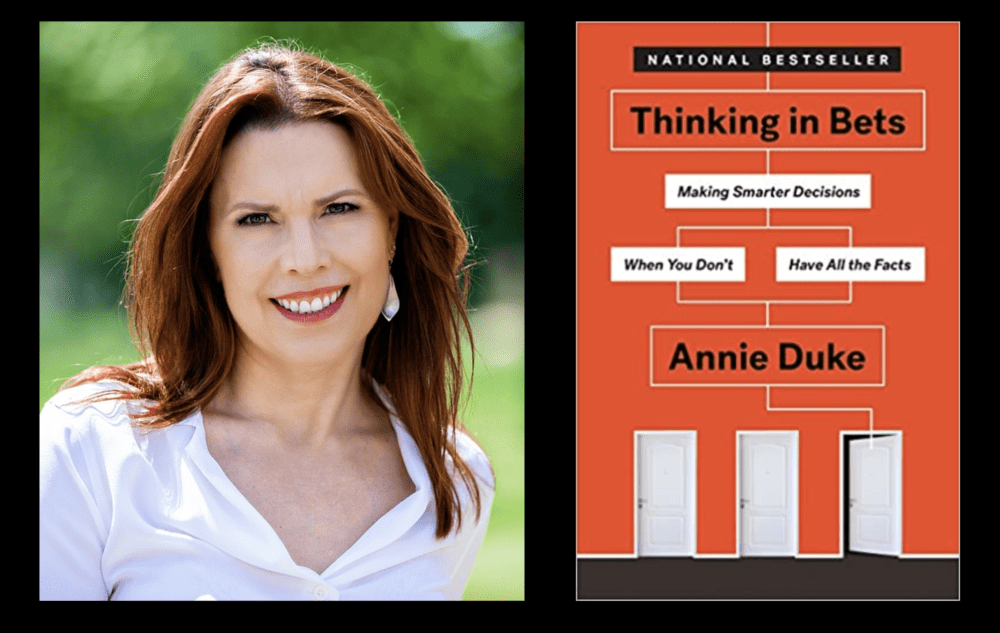

This is closely related an idea from Annie Duke.

Many people judge a choice by what happens next.

This is a mistake called “Resulting.”

Bad Choice, Good Result: If you bet your life savings on a random stock and win, you aren’t a genius, you just got lucky.

Good Choice, Bad Result: If you do your homework and buy a great company, but a freak accident ruins it, you didn’t make a mistake, you had bad luck.

Great investors don’t only look at wins and losses to judge the quality of their decisions.

Instead, they look at the process by asking:

Did I do the research?

Was my logic sound?

Did I follow my rules?

No consideration for the actual businesses

Stocks are ownership shares of real businesses.

Nowhere in this comment is that actually considered.

It just breaks companies down into ‘dividend growers’ and ‘high-growth’.

If you’re a passive investor, you don’t have much choice but to do that.

But I’m not a fan of that view, neither is Peter Lynch.

I find it really hard to have conviction when I don’t really know what I own, and I don’t like the poor control.

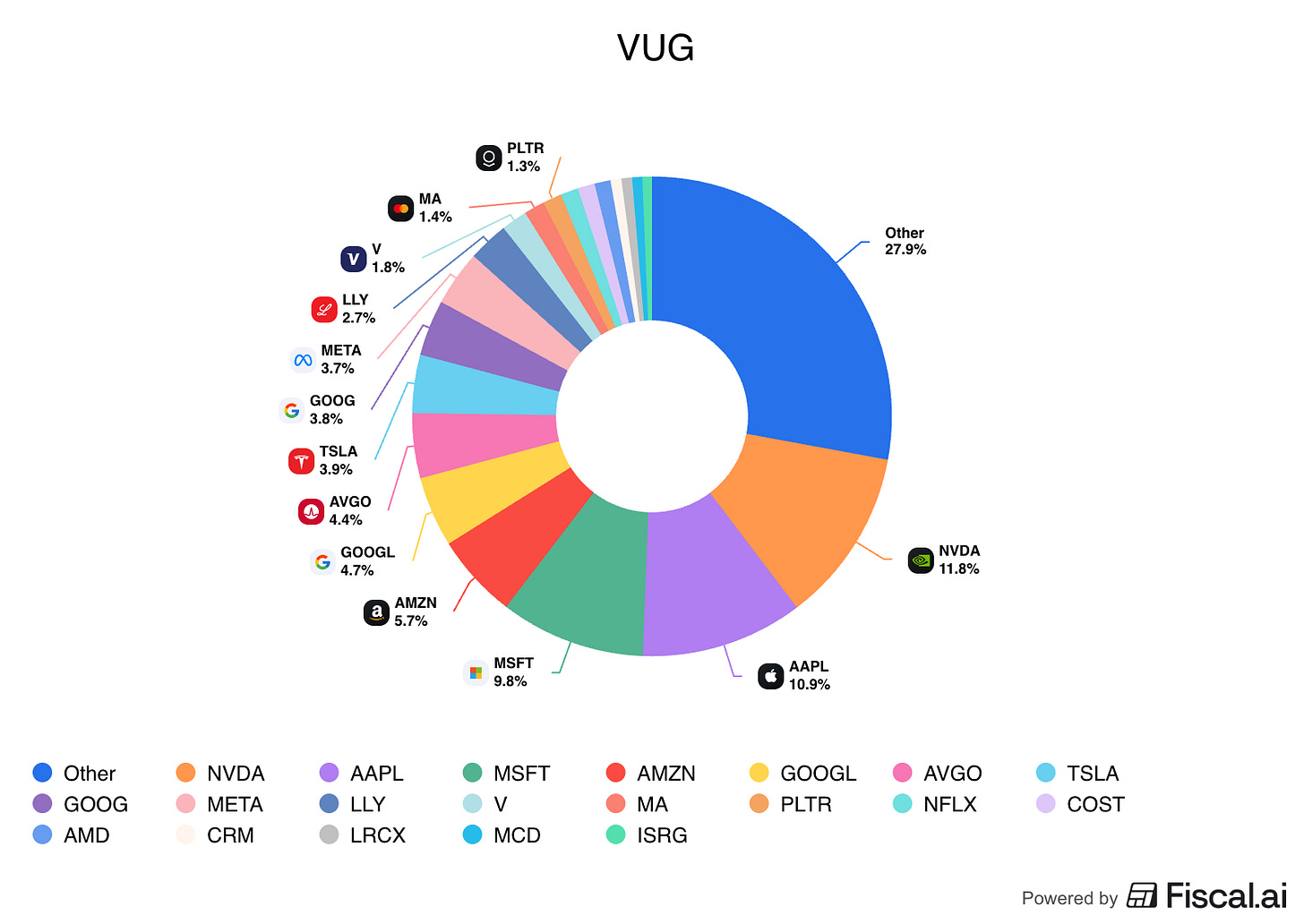

Let’s say I wanted to buy a growth ETF - we’ll use the top holdings for VUG.

Would I want nearly 12% of my portfolio in NVIDIA, or 11% in Apple?

Both are great companies, but personally, no I would not.

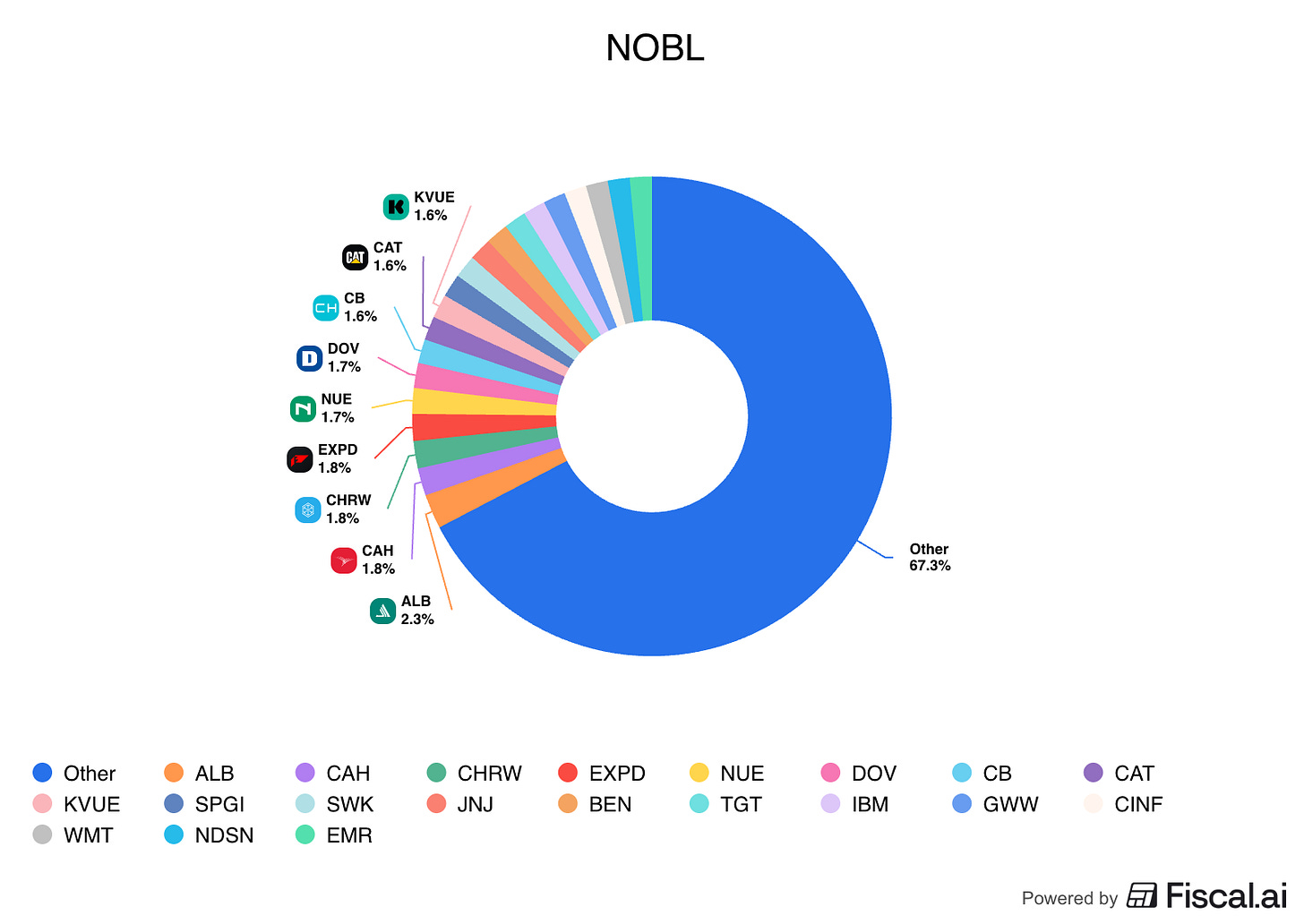

It’s not just a growth ETF issue either.

Let’s look at NOBL - the Dividend Aristocrat ETF.

Here I have the opposite problem.

My top holdings are only around 2% - lower than I’d want for what are presumably the best investments in the fund.

No consideration for the investor’s goals

It’s assumed that the objective is to end up with the highest account balance after 30 years, without concern for income.

This total return argument assumes we are all robots with the exact same life.

It treats a portfolio like a high score in a video game.

But always remember that unrealized returns aren’t returns until you sell.

Dividends are cash in hand, and that comes with a lot of benefits that don’t show up in the account balance.

Flexibility: A dividend portfolio gives you options today. If you lose your job or a car breaks down, that cash flow is there. You don’t have to sell your stocks at a loss to pay your bills.

The “When” Matters: The 30-year math assumes you won’t touch a penny until the very end. But life happens in the middle. Maybe you want to work less in 10 years, or start a business in 15. A growth-only plan locks your win behind a 30-year wall.

Sequence Risk: What if the growth ETF hits a massive slump right when you plan to retire? If you are forced to sell during a crash, the “proven” math doesn’t work anymore.

No Consideration for the Investor’s Stomach

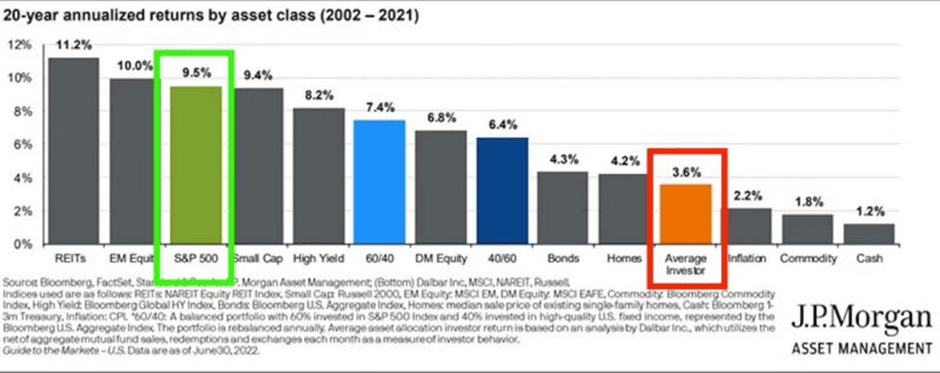

This argument also ignores the Behavior Gap, the difference between what a stock returns and what the investor actually keeps.

You can have the best strategy in the world, but if you can’t stomach the ride, you won’t finish the race.

Most people think they can handle watching their life savings drop by 40%, until it actually happens.

Dividend growth stocks give you a reason to stay invested.

When the market is red, but your dividend check just grew by 7%, you have a reason to hold.

It shifts your focus from the price of the stock to the cash the business makes, which tends to be much more stable.

For most investors, the best portfolio isn’t the one with the highest math-based return. It’s the one you can stick with for 30 years without panic selling.

The proof is in the fact that the average investor tends to underperform nearly every asset class because they buy and sell at the wrong times.

Conclusion

Debates like this one trick us into thinking that if we run enough backtests, we can solve the puzzle of the future.

But the market isn’t a math problem that can be solved or optimized.

It’s a complex system driven by human emotion and unpredictable events.

When we forget that, we stop being investors and start being gamblers.

Respect the Unknown

Some of the most dangerous words in investing are “it’s already been proven.”

You need a strategy that respects uncertainty.

Focus on Process, Not Just Results: You can’t control what the market does, but you can control your research, your logic, and your rules.

Build in a Margin of Safety: Leave room for “more things to happen than will happen.” Whether that’s through diversification, cash flow, or owning durable businesses, make sure you don’t need a perfect outcome to win.

Know Your Stomach: The best plan is worthless if you abandon it during a crash. Build a portfolio that can keep you calm when the world isn’t.

Investing is the art of making decisions with incomplete information.

Never forget how little we truly know about the future.

Keeping that in mind will put you in a much stronger position to handle whatever it brings.

Whenever you’re ready

Whenever you’re ready, here’s how I can help you:

✍️ Three articles per week (Monday, Wednesday, and Saturday)

📚 Full access to our entire library of data-driven articles

📈 An insight into our Portfolio full of interesting Dividend Stocks

🔎 Full investment cases about interesting companies

The doors for Compounding Dividends will reopen to a limited of people on the 24th of February.

You don’t miss it? And you also want to receive all the exclusive bonuses?

You’ll also immediately get a copy of my 10 favorite cannibal stocks when you do.

One Dividend At A Time

TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.

Great article!!! When you talked about risk it’s seems to me like Howard Marks, and that’s the best compliment you can receive after sound like mr Munger or mr Buffett