💸 Charlie Munger's 5 Rules of Wealth

Charlie Munger was Warren Buffett’s long-time partner.

He was smart, funny, and always spoke with honesty. He also had a way of making complex ideas simple.

Today, we look at 5 rules of wealth that Charlie lived by.

1. Inversion

Instead of asking “how can I succeed?”, Charlie says you should ask “how can I fail?”

When he worked as a weather forecaster in the Air Corps, he asked: “What’s the easiest way to kill pilots?”

He came up with 2 scenarios:

Planes icing up

Running out of fuel because there wasn’t a safe airport to land nearby

Once he knew the easiest way to run into problems, he obsessed over avoiding them.

This became the core of Buffett and Munger’s investing style too:

In investing, this means avoiding risky things - like buying companies you don’t understand or piling into debt you can’t repay.

2. Stay Calm

Markets go up and down. Big drawdowns, are normal.

Berkshire Hathaway, the company Charlie built with Buffett, lost 50% of its value three times. Yet, they stayed calm.

Charlie said if you can’t handle drops like this, you don’t deserve big returns.

Drops are chances to buy great businesses on sale.

3. Be Humble

You don’t know everything. Neither did Charlie. He said that being humble keeps you safe from big mistakes.

A good example is technology stocks.

Charlie and Buffett often admitted they didn’t understand tech in the 1990s, so they stayed away. That humility saved them from the dot-com crash.

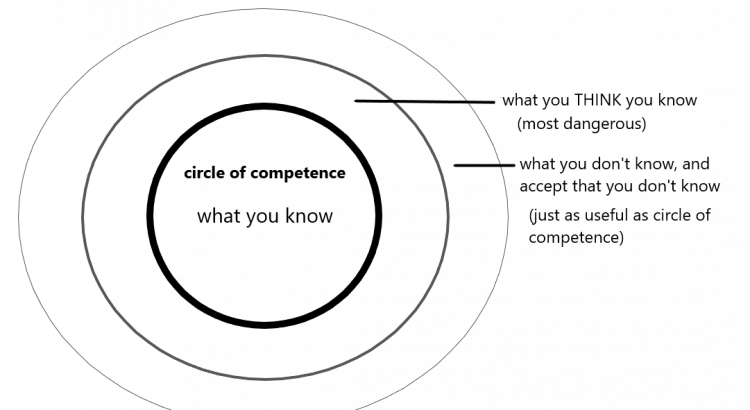

4. Circle of Competence

Stay inside your circle of competence.

This means: invest only in what you truly understand.

It also means staying away from the edge, because you don’t really know where the edge is.

The drawing below shows that the most dangerous part of the circle is the middle area where you think you something, but actually don’t.

Buffett’s circle includes things like banks, insurance, and consumer goods.

That’s why he invested in companies like American Express and Coca-Cola - businesses he could easily understand and explain.

5. Robust Businesses

Charlie liked simple, strong businesses. The kind that didn’t need brilliant management to run.

He also liked predictable businesses.

These businesses have a “moat,” meaning strong protection against competition.

Coca-Cola is a perfect example. Anyone can run the company, but the brand, recipe, and global reach make it almost untouchable.

People all over the world keep buying Coke, no matter what.

That’s It For Today!

Charlie Munger’s 5 rules are simple but powerful:

Avoid mistakes (Inversion)

Stay calm when markets drop

Be humble and admit what you don’t know

Stick to your circle of competence

Choose strong, simple businesses

Follow these rules and you’ll avoid big risks, stay patient, and focus on quality companies.

Over time, that’s how wealth grows.

At Compounding Dividends, we follow these 5 rules every single day. They guide every choice we make - and they can guide yours too.

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data