Chuck Akre’s 3-Step Framework To Find Great Dividend Growers

If you want today’s article as a video, it’s on the YouTube channel:

Even if you don’t want a video article, heading over and giving the video a like helps us out 🙂

Who is Chuck Akre?

Chuck Akre is an investor known for finding great businesses and holding on them for a long time.

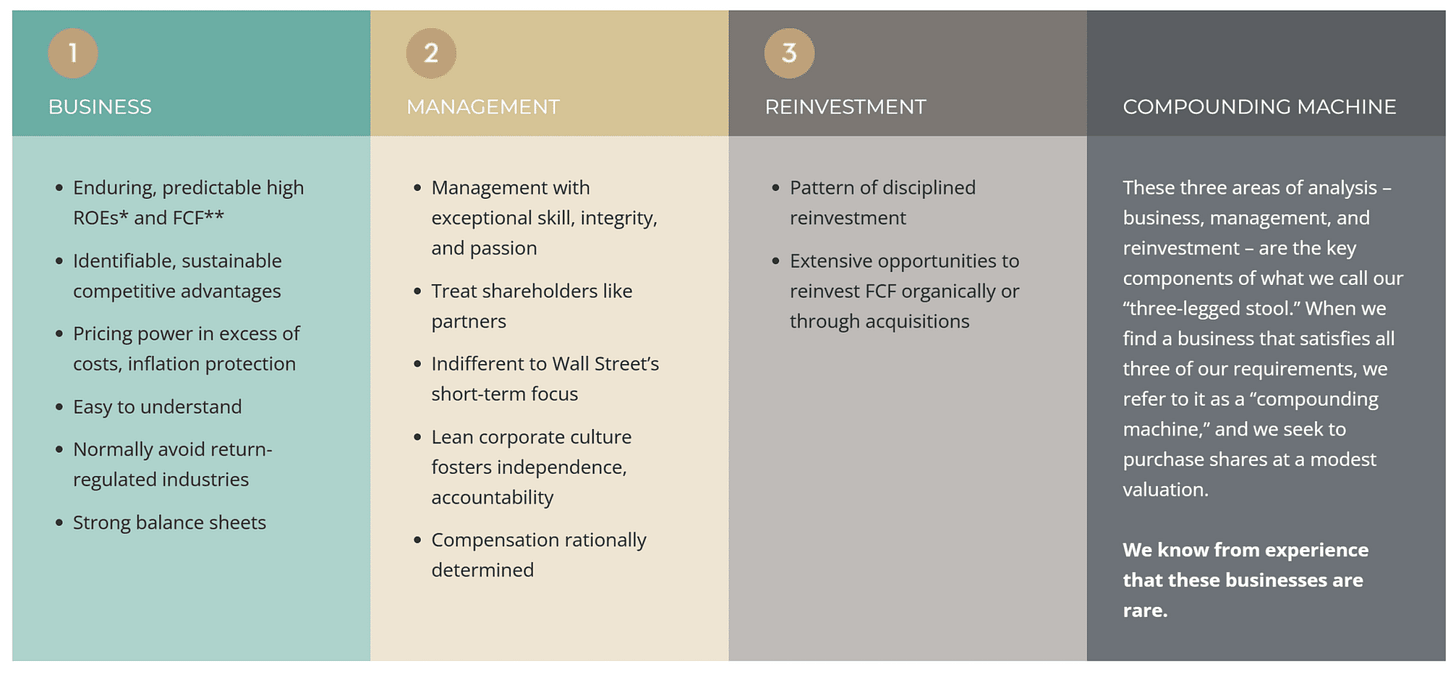

He uses a framework that he calls “The Three-Legged Stool” - a simple system for picking high-quality companies that can grow steadily over many years.

His main idea is simple:

👉 Buy great companies, let them grow, and don’t sell too soon.

Akre’s 3-Legged Stool

Each “leg” of his stool is a key part of a strong company.

If all three legs are solid, the company can grow (compound) your money over time.

1️⃣ The Business: it must be strong and easy to understand

Akre looks for companies that:

Have a business you can understand

Have something that keeps competitors away (a “moat”)

Makes high returns on the money they invest (high return on capital)

Have a solid balance sheet and strong cash flow

As dividend investors, we add 1 thing to this leg of the stool:

We still want a strong business can make lots of profit, we also want one that distributes the extra cash to us as a dividend after it has reinvested in future growth.

Always remember that long-term dividend growth is only possible if the business reinvests in itself and keeps growing profits.

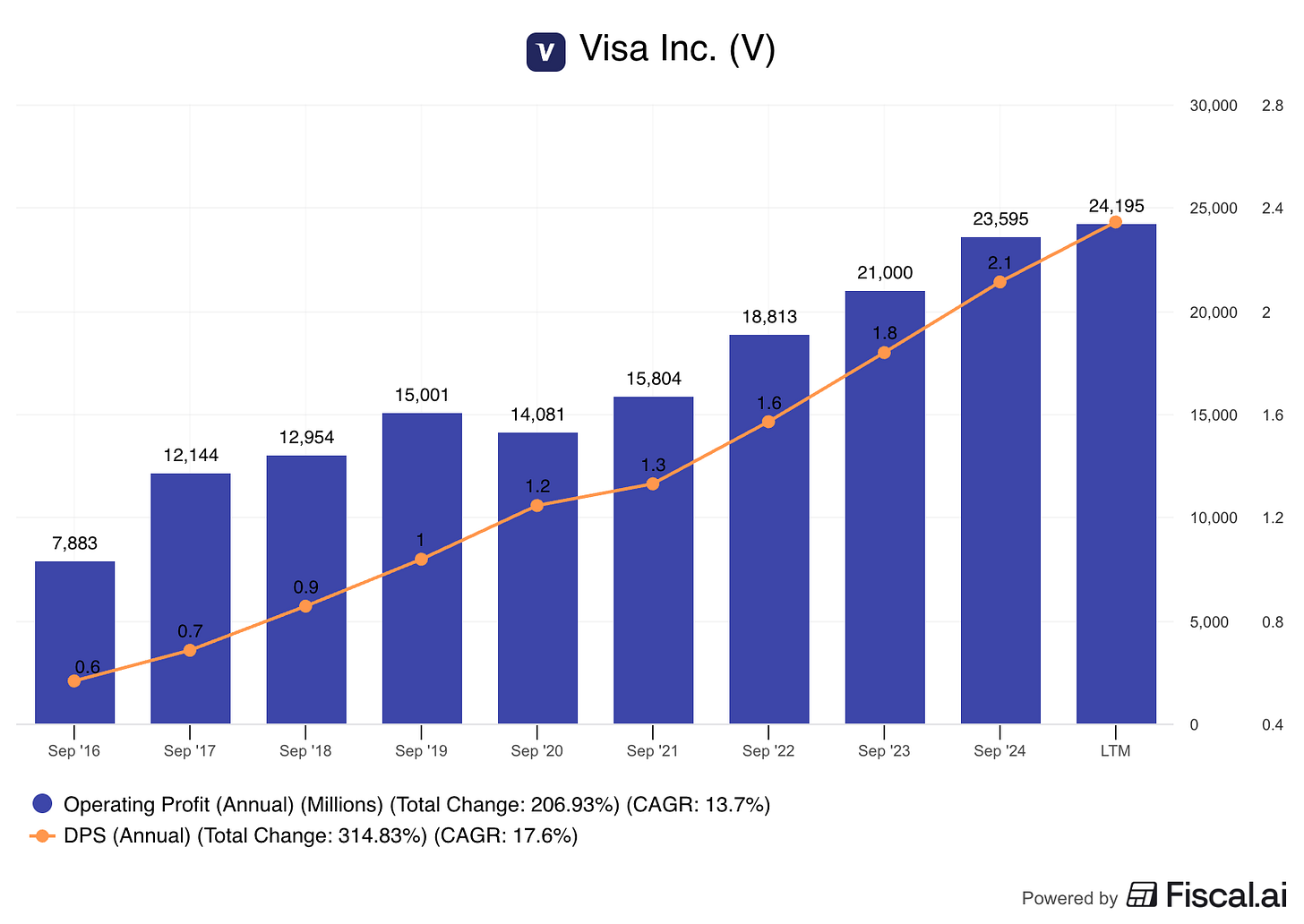

Visa is a good example here.

It’s a relatively simple business - they provide the network for people and businesses to make payments, and take a small cut of each transaction.

It generates a lot of cash, they have very little debt, and profits and dividends grow steadily:

2️⃣ The Management: they make the key decisions

Akre wants management teams that:

Are honest and long-term focused

Treat shareholders like partners

Have a simple, independent company culture

Use money wisely

For dividend investors:

We want leaders who think about how to grow profits and dividends over many years.

These are the people we’re trusting to make the right decisions about how to allocate capital.

Here’s how smart leaders do it:

3️⃣ Reinvestment: this grows your wealth over time

Akre says this is the most important leg.

He looks for companies that:

Reinvest their profits wisely

Can keep finding new ways to grow

Have a “long runway”, meaning lots of room for future growth

For dividend investors:

This is where compounding happens.

When a company reinvests part of its profit and has a lot of room to keep growing, it can:

Make more money each year

Raise its dividend year after year

That’s how your income (and stock value) can snowball over time.

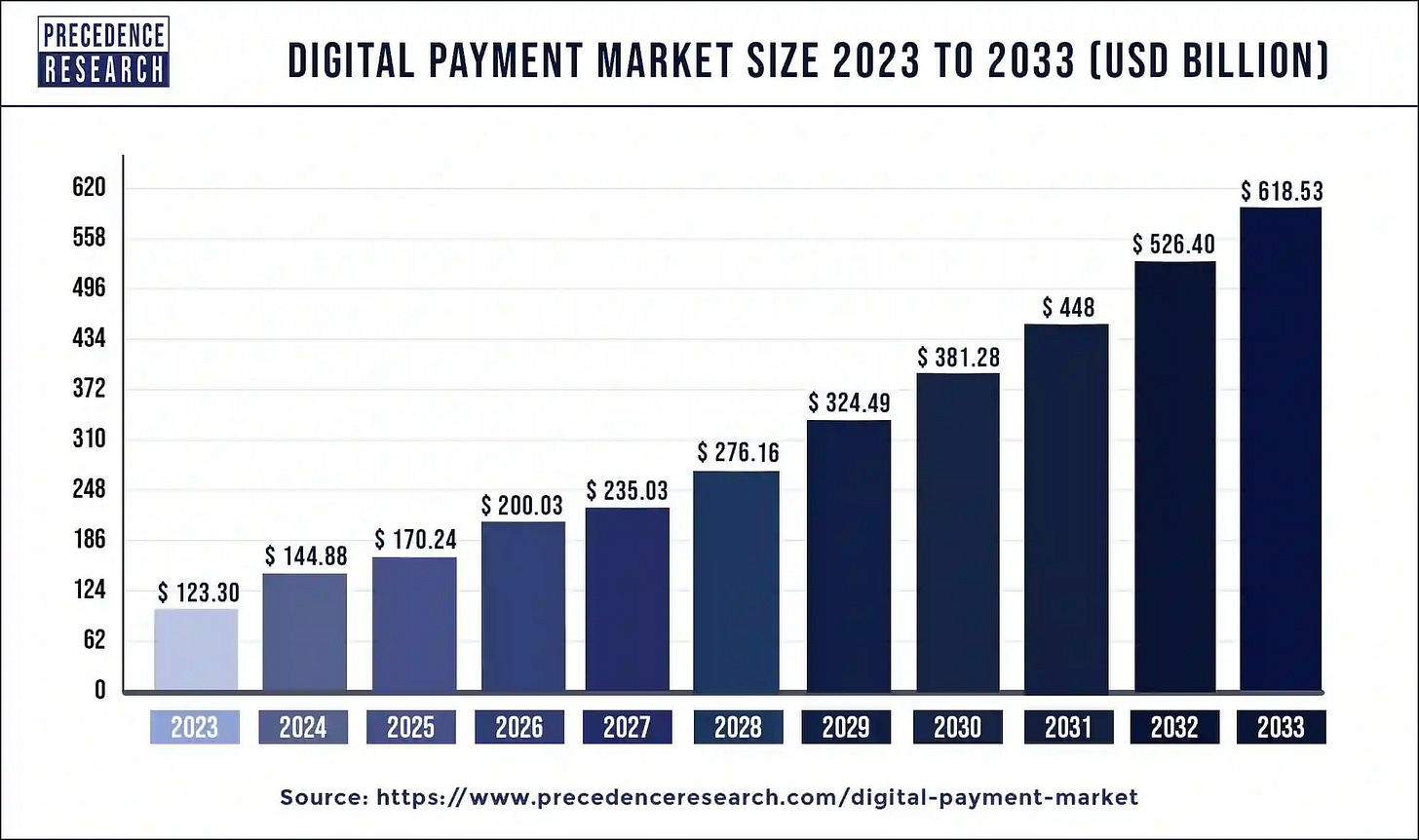

Let’s go back to Visa - people use less cash and more digital transactions each year.

This gives them a long runway to keep growing.

How to Use Akre’s Framework to Find Dividend Growers

Here’s a simple step-by-step plan:

Find dividend-paying companies that have increased their dividend for several years.

For each company, check if they meet the three legs of the stool,

✅ Is it a strong, understandable business?

✅ Run by trustworthy management?

✅ With good reinvestment opportunities?

If so, the next step is to make sure the stock price is fair. Even great companies can be bad buys if you pay too much.

Buy and hold for the long term. Compounding takes time, the longer you stay invested, the more powerful it becomes.

Keep an eye on the company. If one “leg” of the stool breaks (bad management, poor reinvestment, weak moat), reconsider your position.

Why This Works for Dividend Growth Investing

Strong businesses make consistent profits.

Honest managers use those profits wisely.

Smart reinvestment fuels long-term growth.

Together, these things allow a company to increase its dividend year after year, and grow your wealth with it.

This is how you find “dividend compounding machines”, the companies that keep paying and growing dividends for decades.

Buy right, hold on, and let compounding do the work for you.

One Dividend At A Time,

-TJ

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.