Coca-Cola is a beautiful company.

It’s one of the favorite stocks of Warren Buffett.

And the good news? They pay a very attractive dividend.

Coca-Cola

👔 Company name: Coca-Cola

✍️ Ticker: KO 0.00%↑

🔎 ISIN: US1912161007

📚 Type: Dividend Aristocrat

📈 Stock Price: $63

💵 Market Cap: $270 billion

📊 Average Daily Volume: $5 billion

Business Model

You probably know Coca-Cola already.

The company makes money by selling drinks. Every time someone buys a Coke or any other Coca-Cola drink, Coca-Cola makes money.

Today, Coca-Cola sells 1.9 billion servings per day (!). This means that 10,000 drinks from Coca-Cola are consumed every second of the day. That’s amazing.

What many people don’t know is that products like Minute Maid, Sprite, Fanta, and Aquarius are also from Coca-Cola.

You can see their 15 main brands here:

Geographical split

The geographical split of Coca-Cola looks as follows:

Source: Finchat

Management

James Quincey is the CEO and Chairman of Coca-Cola. He already joined the company in 1996.

John Murphy is the CFO of Coca-Cola. He has been working for the company for 37 (!) years.

In total, insiders own 42 million shares (value: $2.6 billion).

Berkshire Hathaway owns 9.3% of Coca-Cola.

Competitive advantage

Coca-Cola has a competitive advantage for sure.

The key strength of the business is its strong brand name. Coca-Cola is one of the most famous brands in the world.

When people think of soda, they often think of Coca-Cola first. This strong brand helps Coca-Cola sell more drinks and charge higher prices than its competitors.

“If you gave me $100 billion and said take away the soft drink leadership of Coca-Cola in the world, I'd give it back to you and say it can't be done.” - Warren Buffett

Dividend

Coca-Cola is a Dividend Aristocrat.

They have increased their dividend for 62 years (!) in a row.

This is amazing. It means that when you invest in Coca-Cola, you can be sure you will receive a dividend year after year.

Coca-Cola:

Dividend Yield: 3.1%

Payout Ratio: 74.7%

Frequency dividend payments: quarterly

This means that when you invest $10,000 in Coca-Cola, you’ll receive a dividend of $310 per year.

Coca-Cola’s dividend will continue to increase in the years to come.

Source: Finchat

Valuation

The cheaper we can buy a great dividend company, the better.

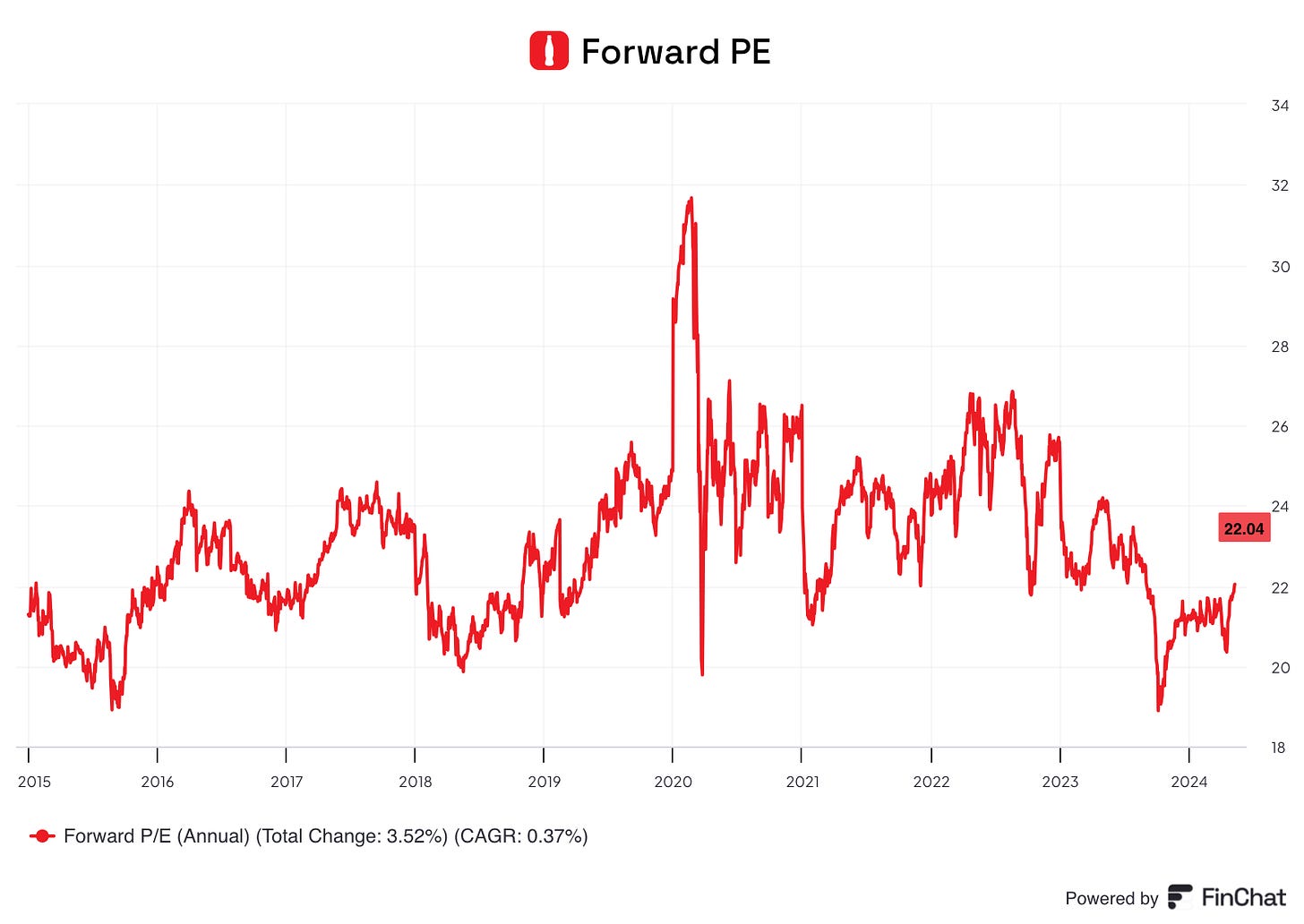

Coca-Cola currently trades at a forward PE of 22.0x.

Over the past 5 years, Coca-Cola’s forward PE averaged 23.8.

This indicates the company is slightly undervalued compared to its historical average.

Source: Finchat

Conclusion

That’s it for today.

Coca-Cola is an excellent Dividend Aristocrat that every dividend investor should know.

Investors receive an attractive dividend yield of 3.1%. This means that you receive $310 in cash dividends per year for every $10,000 you invest.

Source: Finchat

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data