Compounding Dividends 2.0 Is Coming -And It’s Big

And an update on Our best performing company so far...

👋 Howdy Partner,

I hope you’ve gotten a lot out of the past year with Compounding Dividends.

An investable universe of over 750 companies

A Buy-Hold-Sell list to filter this very large list

A 10-step process used to evaluate every company that might be added to our portfolio

10 great companies in the Portfolio that return capital to owners like us

A Yield on Cost that puts me more than halfway to my goal of $5,000 in passive income every single month

More than 150,000 other Partners who read the emails every week

And while that list does make me proud of all we’ve accomplished, we’re not done.

I truly believe that the best is yet to come with Compounding Dividends.

To stand still is to go backward.

That’s why I’m working behind the scenes on major improvements to make Compounding Divdiends even better.

🔥 Compounding Dividends 2.0

Here’s what coming:

Upgraded Advice (Strong Buy - Buy - Hold - Sell) for every stock in the Portfolio

A dedicated company page for every company we own

An FAQ for all your questions

A Compounding Dividends Course

British American Tobacco is an example of what can happen when you buy a great dividend company at a great price.

It’s been an amazing stock for us. Our total return since buying it in January of 2025 is more than 60%.

But that’s not the best part – our yield on cost is over 9% already, and we expect that to continue to grow.

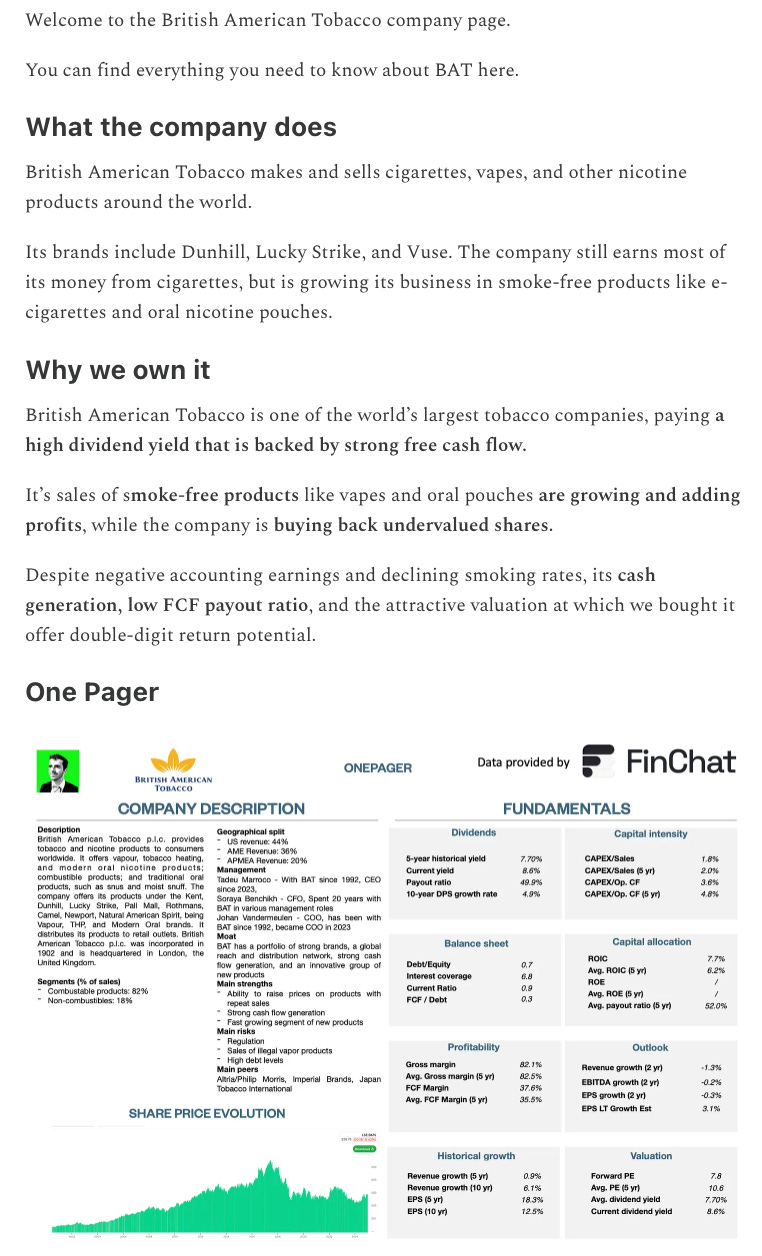

Here’s a preview of what its Company page will look like:

British American Tobacco

I hope you’re as excited about the improvements coming as I am!

British American Tobacco Earnings Update

Summary

British American Tobacco p.l.c. (BAT) performed slightly ahead of expectations for the first half of 2025, and reaffirmed its full-year guidance.

They continue to be committed to dividend growth, an increased share buyback program, and growing profitability in their smokeless products.

Reported revenue saw a slight decline of 2.2% to £12,069 million, mainly due to currency headwinds, but grew 1.8% on a constant currency basis.

Reported diluted earnings per share (EPS) increased by 1.6% to 203.6p.

I’m very happy with this earnings report. This is a high yielder that I expect to continue growing dividends for us.