Covered Call ETFs: Financial Weapons of Mass Destruction or Opportunity?

A comparison of SPYI, GPIX, and SPYI

Derivative contracts like options are dangerous, right?

Warren Buffett had this to say about them in his 2002 letter to shareholders:

“In our view, however, derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are potentially lethal”

However, in the same letter he later said this:

“Indeed, at Berkshire, I sometimes engage in large-scale derivatives transactions in order to facilitate certain investment strategies.”

Buffett’s Options Strategy

What kind of ‘large-scale derivates transactions’ does Warren engage in?

While many investors buy options to speculate on what the price of a stock will do, Buffett typically sells options contracts.

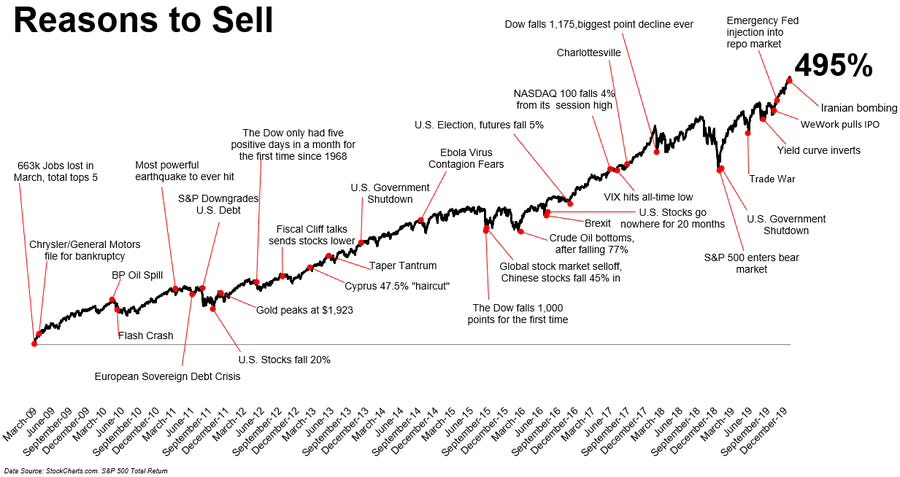

A bullish view on the world’s markets

Between 2004 and 2007, Buffett sold a total of $4.5 billion worth of put options on the S&P 500, Britain's FTSE 100, the EuroStoxx 50, and Japan's Nikkei 225 indices.

He sold an additional $400 million worth of puts in 2008, putting the total premium received at $4.9 billion.

These were very long-dated put options, expiring between 2019 and 2027.

If you’re not familiar with put options, they give the buyer the right to sell a stock at a certain price. Investors buy them as insurance on their portfolios.

By selling the put options, Buffett was essentially betting that the world’s stock markets would go up between 2004 and 2019 - a pretty safe bet, considering that even though there’s often a reason to sell , markets tend to go up in the long-run.

Selling puts on Coke

In 1993, Buffett sold 50,000 put options (equivalent of 5 million shares) with a strike price of $35 for $1.50 per share on Coca-Cola.

Coke shares were trading around $39 at the time.

Let’s look at what Buffett was doing.

Buffett wanted to buy Coke shares, but wasn’t willing to buy them at $39.

Always patient, Buffett was waiting for the shares to come down in price. By selling the put options, he collected a total of $7.5 million in premiums.

He also guaranteed the buyers of the puts that he’d buy Coke at $35 per share.

If Coca-Cola shares stayed above $35, Buffett kept the $7.5 million.

If the price fell to $35, Buffett was effectively buying Coca-Cola for $33.50 per share ($35 – $1.50).

Either way, Warren won. He either kept $7.5 million, or bought the shares he wanted at the price he wanted to pay.

Again, a relatively safe strategy.

Which brings us to an ETF idea - a way to implement a safe options strategy.

Covered Call ETFs

We’ve written about covered call ETFs before.

If you’re not familiar with them, I’d recommend you read the article.

But if you’re not going to here’s a summary:

Covered call ETFs sell call options on owned stocks or indexes to generate income and reduce volatility, but cap potential gains.

A call option lets buyers purchase stock at a set price within a time frame, with sellers keeping the premium.

How They Work: Sell call options for premium income, paid as monthly distributions, limiting stock upside

Dividend Fluctuations: Distributions vary (30-50% yearly) with market volatility

Capped Upside: Underperform in strong bull markets due to limited gains

Fees: Higher expense ratios (0.35%-0.61%) than index funds like SPY (0.09%)

Trade-offs: High yields and stability come with volatile payouts, and weaker performance in rising markets.

Let’s look at a few options.

SPYI and XYLU

These ETFs aren’t identical, but they’re close.

SPYI is available to American investors

XYLU is available to European investors

SPYI - The NEOS S&P 500 High Income ETF

This fund seeks high monthly income in a tax efficient manner, with the potential for upside appreciation in rising markets. SPYI may also buy calls on occasion.

XYLU - The Global X S&P 500 Covered Call UCITS ETF

Follows a synthetic strategy to replicate a buy-write index by selling covered calls, with underlying equity exposure designed to match constituents of the S&P 500 Index.

Why these funds are similar

Both funds are based on the S&P 500

Both aim to produce high income levels

Both funds write calls on a lot of their holdings

SPYI writes calls on 75%-90% of the holdings

XYLU writes call on 100% of the holdings

Advantages and disadvantages

The advantage of these funds is high income, that’s managed to be more stable from month to month.

The disadvantage is that they don’t capture as much of their holdings price appreciation.

JEPI and JEPG

These ETFs are both run by J.P. Morgan and are very similar

JEPI is available to American investors and writes calls on the S&P 500

JEPG is available to European investors and writes calls on the MSCI World Index

JEPI - The JPMorgan Equity Premium Income ETF

This is an actively managed ETF. It invests in a “defensive portfolio of large cap stocks”. It’s all about creating income and reducing volatility.

In addition to the portfolio of equities, JEPI uses equity-linked notes (ELNs) to create income similar to writing covered calls. Here’s how they work:

combines a bond with an investment tied to the performance of a stock or index - in this case, the S&P 500

You get your initial investment back at maturity (like a bond), plus a return based on how the linked equity performs, often with some protection or capped gains

Here are the top 10 holdings

JEPG - The JPM Global Equity Premium Income Active UCITS ETF

This is also an active ETF, and it uses the same strategy as JEPI - buying a conservative selection of large-cap stocks and using Equity-Linked Notes to generate a premium. JEPG uses the MSCI World Index for the ELNs.

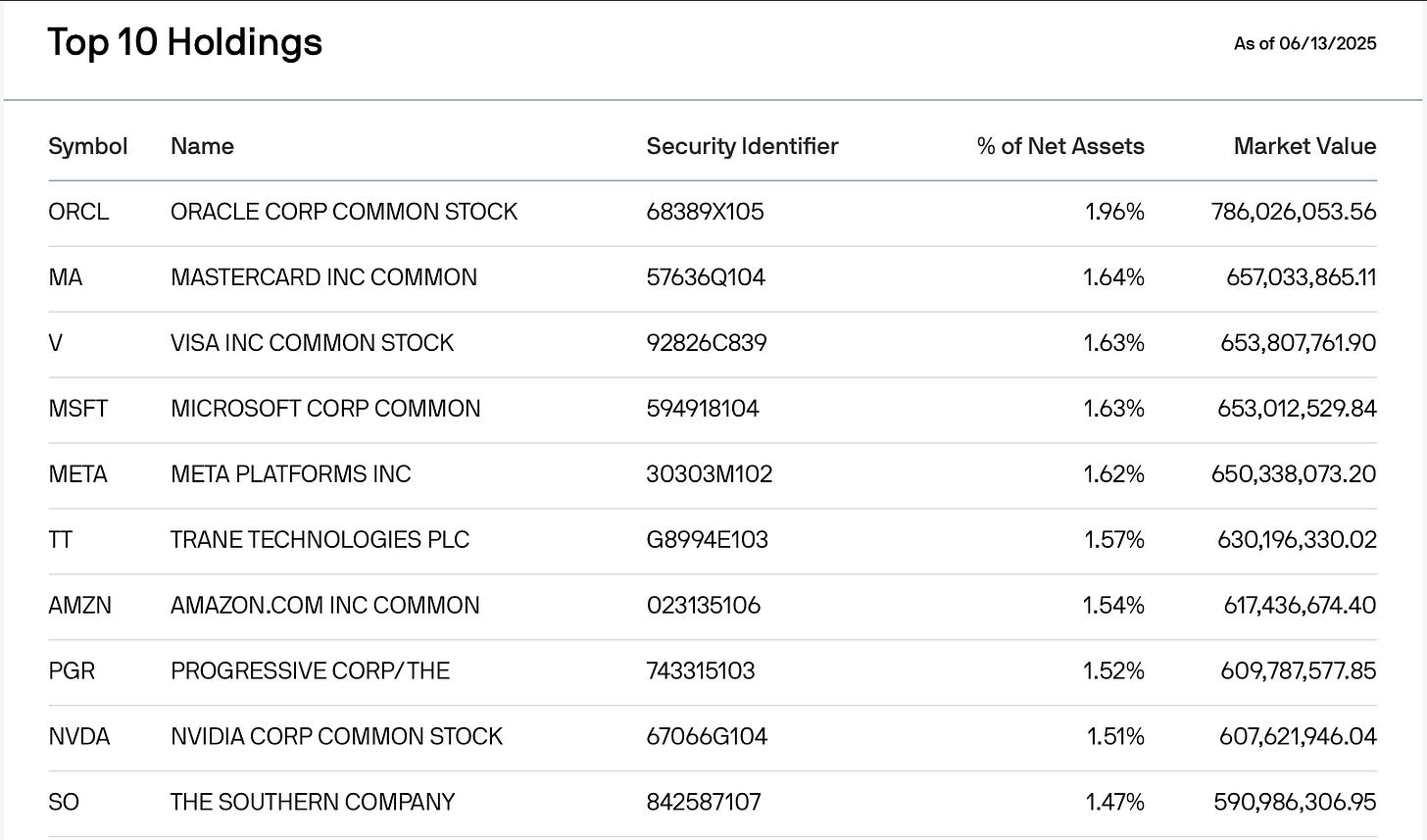

Here are the top 10 holdings of JEPG

Advantages and disadvantages

The main advantage of these funds is a high income level and lower volatility - meaning they won’t fall as far in a market drawdown.

The main disadvantage is that the income from month to month is inconsistent, and that the lower volatility comes with less potential upside in a rising market.

GPIX

This is Goldman Sachs’ direct competitor to JEPI. Unfortunately, I couldn’t find a version available to Europeans. If you know of one, let me know!

GPIX - The Goldman Sachs S&P 500 Premium Income ETF

This is another active fund. It buys the equities underlying the S&P 500, then sells calls on the index. It’s managed to keep the monthly distributions more stable.

GPIX has a few interesting twists compared to JEPI:

GPIX sells options on 25% to 75% of the portfolio

This means they can be more conservative or aggressive

Less calls written = less premium, but more capital gains upside in rising market

Options are sold on the index, not the stocks

Index options can’t be assigned early

Makes them easier to ‘roll’ up or down - allowing more flexible management of the options portion of the strategy

If the market gets really ugly, GPIX can sell all its positions and buy short term treasuries

I’d guess this is very unlikely to happen, but it’s interesting

I take it as another indication that the fund managers are trying to give themselves as much flexibility as possible

Advantages and disadvantages

The main advantages of GPIX are the flexibility, and ability to position to capture more price appreciation of the S&P 500.

The main disadvantages are that you’ll have less options premium coming in and that you’ll also capture more of the downside in a falling market.

A note on yields

Many of these ETFs list different yield numbers. They can be inaccurate because of the way they’re calculated.

SEC Yield - doesn’t include option premiums

Dividend yield / distribution rate calculation: uses the most recent payment/NAV for most recent dividend date

This can lead to artificially high or low yields because the distribution rates vary month to month

Pay attention to the 12-month distribution yield - probably the most accurate due to using a longer time frame

This is calculated by taking the total distributions over the last 12 months and dividing it by the average NAV during the same time frame

Summary

These ETFs are worth considering.

They create a lot of income, and can add stability to a portfolio. But they also cap the potential for price appreciation and dividend growth.

Here’s how I think about each group:

SPYI and XYLU: Create a lot of (relatively stable) income, but cap upside price appreciation

JEPI and JEPG: Create a lot of income that isn’t stable month to month, and minimize volatility - these funds tend to fall the least, but also tend to rise the least

GPIX: Is the most flexible fund - it will have lower income levels than the others, but will also likely capture the most market upside

The chart below shows the total return for the three American ETFs.

JEPI is the least volatile, but also the lowest total return

GPIX has the highest total return, but the most volatility

SPYI is between the two in both total return and volatility

Updating the ETF Portfolio

Since we added our shareholder yield ETFs, we’ve been Dollar Cost Averaging into the three existing ETFs in the portfolio.

You can see the updated spreadsheet here: