Dividend Investing 101

Investing in dividend stocks can be very attractive.

It’s nice to receive a cash payment frequently.

But what are dividends and which metrics should you take into account?

Let’s teach you everything you need to know.

What are dividends?

A dividend is simply a way for companies to return money to shareholders.

When a company makes a profit, the managers decide what to do with it.

They have 5 basic choices:

Invest in growing the business - building more factories, advertising, etc.

Grow by buying another company through a merger or acquisition

Pay down debt

Buy back stock

Pay a dividend

Good managers will make these decisions based on what’s best for the company (and its shareholders) in the long run.

Sometimes that means paying a dividend, sometimes it doesn’t.

Why are dividends interesting?

Dividend investing has a lot of benefits. Here are 4 of them:

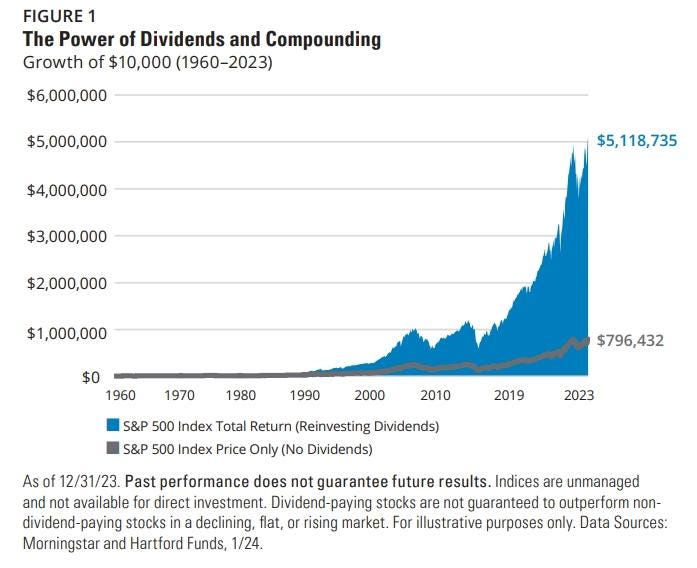

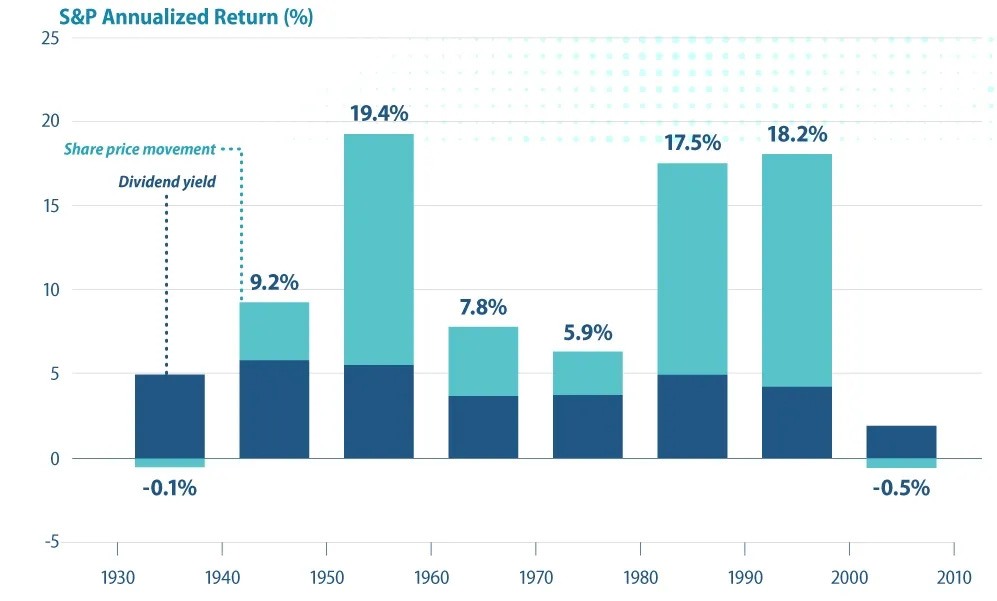

1️⃣ Dividends drive returns

Dividends matter.

When you receive a dividend, you can do two things with it:

Reinvest them

Use them for other things than investing

When you don’t need the money, it’s a good idea to reinvest your dividends.

It will let the magic of compounding work for you even harder.

Source: Hartford Funds

2️⃣ Regular income

When you retire, you'll need income to live on.

Dividends can provide steady income without forcing you to sell your investments.

Just look at how the dividend of Home Depot evolved over the years:

Source: Finchat

3️⃣ Capital appreciation

Income is great, but a company's growth is also important.

When a company grows, its stock price usually follows.

By reinvesting your dividends, you can own more of the company and benefit from its future success.

Wouldn’t you have loved to have bought Home Depot for $100 in 2015 and still own it today at $361?

Source: Finchat

4️⃣ Stability

Dividend payouts tend to be much more stable than stock price movements.

Adding stability to your portfolio during volatile times is something we love.

Source Visual Capitalist: The Power of Dividend Investing

Which metrics to take into account

Now that you know why dividends might be attractive, let’s go over a few important metrics:

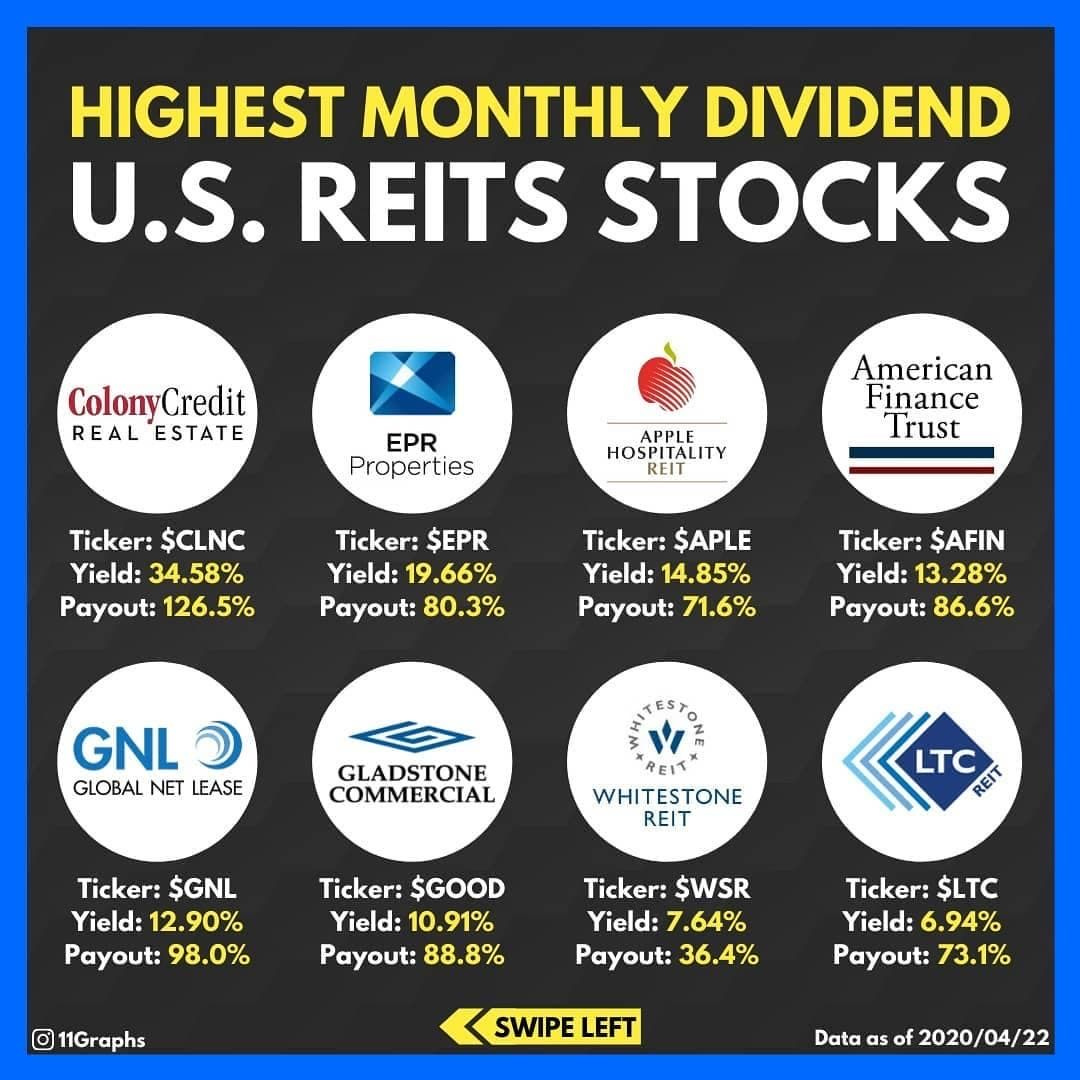

Dividend yield: Annual dividend per share divided by the stock price.

Dividend payout ratio: The percentage of earnings paid out as dividends. A sustainable payout ratio is crucial.

Dividend growth: Look for companies with a history of increasing dividends.

Dividend safety: Consider factors like cash flow, debt levels, company growth, and how stable the industry is.

What type of Dividend Investor are you?

There are 2 main types of dividend investing:

Dividend Growth Investing

High-Yield Dividend Investing

Dividend Growth Investing

Dividend Growth Investors focus on companies that steadily increase their dividend payments year after year.

These are typically stable, growing businesses.

The goal is to earn money from both the dividends and through the increases in share price.

While the dividends start small, they should become larger over time.

Here are some examples:

Source: Dividend_Dollar

High-Yield Dividend Investing

As a High-Yield Dividend Investor, you’re looking for companies that pay a higher-than-average dividend.

When you want to invest in a high-dividend stocks, the payout ratio must be sustainable. This allows the company to keep paying the high dividend in the future.

Here are some examples:

Source: 11Graphs

Dividend Growth Investing or High-Yield Dividend Investing?

Which style you like will depend on if you’re looking for higher dividends today, potentially with more risk, or for a slower, but potentially more sustainable payoff later.

At Compounding Dividends, we prefer steady, long-term growth.

This means we focus on Dividend Growth Investing.

Which dividend companies to buy?

There are a few things we want in a company that we’ll be counting on for income.

In general, we want it to be:

A stable business

Growing faster than inflation, so we don’t lose purchasing power over time

Unlikely to decline - so we need competitive advantages

Run by good people - so they don’t waste our profits with bad decisions.

Coca-Cola is a great example. They’ve maintained and grown their dividend for over 50 (!) years.

Warren Buffett gets more than $2 million every day in Coke dividends!

Source: Carbon Finance

Why is Coca-Cola interesting?

Coke has an incredibly strong brand.

They’re still growing - EPS has gone up almost 3% each year for the last decade.

They can raise their prices without losing sales.

It’s likely that in 50 years, people will still be drinking Coke, so we’ve got longevity.

With a dividend history spanning decades, we know that management has been doing things right.

Conclusion

Here are the key takeaways from today’s article:

A dividend is simply a way for companies to return money to shareholders

Dividends can offer a lot of advantages to you as an investor

In general there are two dividend investing strategies

Dividend Growth Investing

High-Yield Dividend Investing

We want to invest in healthy businesses that can grow their dividend at an attractive rate

That’s it for today

Compounding Dividends is a new project.

🙏 We would LOVE to get your feedback on this. Like this post, reply to this email or leave a comment on this post to help us take Compounding Dividends to the next level 🙏

In case you missed it:

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

Pieter, I really enjoyed this post! It cleared up some of those tricky, often confusing aspects of dividend investing that I’ve always wondered about. Your insights are spot on.

I’d love it if you could dive into when it’s best to start investing in dividends to get the most out of it, especially with taxes in mind. For example, should someone focus on growing their portfolio with Quality Growth Investing and then switch to dividend stocks just a few years before retirement? I think that would be super helpful to explore.

Thanks for all the great content!

That's a great start! 😀

When investing for the dividends, you obviously want to buy an investment vehicle that distributes dividends consistently and with some growth rate. No dividend or distribution is 100% guaranteed but we can use past behavior as an indication (not prediction) of future performance. You showed a graphic illustrating the dividend growth rates of Costco, Home Depot. Visa, etc and you looked at a 5 year growth. I would expand that to at least 10 years if not 20 - 30. Why such a long period? You want to see how various economic booms and busts affected the dividend. Home Depot paid it's first dividend on Sept 14, 1989 and the latest dividend was paid out on June 13, 2024. That's 34 years! In those 34 years we've seen the COVID crash, the Great Financial Crisis, the Dot-Com bust, etc. The dividend was not cut or suspended in that time! It had an annual CAGR of 13.2% over the entire time!

The downside here is the dividend yield itself. It's a bit on the low side. So, if you wanted to use Home Depot's dividend as income then you may need a substantial amount of capital invested here. What if you don't have that much capital? Then you may become a "yield chaser" and the game becomes a little more risky. Higher yields come about when prices are low and you have to ask yourself why is the price low? Is it because there is something wrong with the company? Is the company fine but growth prospects are low? Ultimately, you have to ask yourself what are the risks to the business and could these risks adversely affect the distribution in the future?

Consider Main Street Capital, ticker symbol MAIN. It's a business development company whose regular August 2024 dividend is $0.2450. The company has a spectacular history of raising the dividend and even distributing special dividends. The forward yield, not taking into account raises or special distributions already declared is 6.04%, which is 2.3x that of Home Depot! It's even higher if you take into special dividends! There's no free lunch here so what's the catch? Main Street operates in a somewhat risky space where they provide capital and financing to small and mid cap companies. Interest rates and the general macro economy can have a huge impact on their operations. They paid a regular dividend on July 15, 2019 of $0.2050 which did not get raised until October 15, 2021 to $0.2100! Why was the dividend frozen? Well, COVID happened in that time among other things! Thankfully, Main Street Capital came out of the crisis without cutting the regular dividend (the special dividends were frozen) and they are back to raising their dividends. Their story is not typical.

Maybe the dividend yield is so high that you don't need the full distribution in cash. Take 3% - 4% and use the rest to buy more stock so compounding can do its work. In that case, maybe you're OK with a frozen dividend. It's more than you need anyways.

So, sustainability is very important! I'm going to lift another line from Bogumil and say you should ask yourself is the company you are interested in buy such that it needs to have a lot of things go perfectly right in order for it to succeed? How likely are these things to happen? These kinds of questions can help you understand the sustainability of the dividend.

There's a neat website called Portfolio Visualizer that allows you to backtest different stock allocations and it shows the annual income from the dividend distribution, with dividends reinvested and not. Google is your friend. I have no affiliation with that site.