💸 Dividends Every Single Month

Today is Dividend Day.

The series where I teach you 5 things about dividend investing in less than 5 minutes.

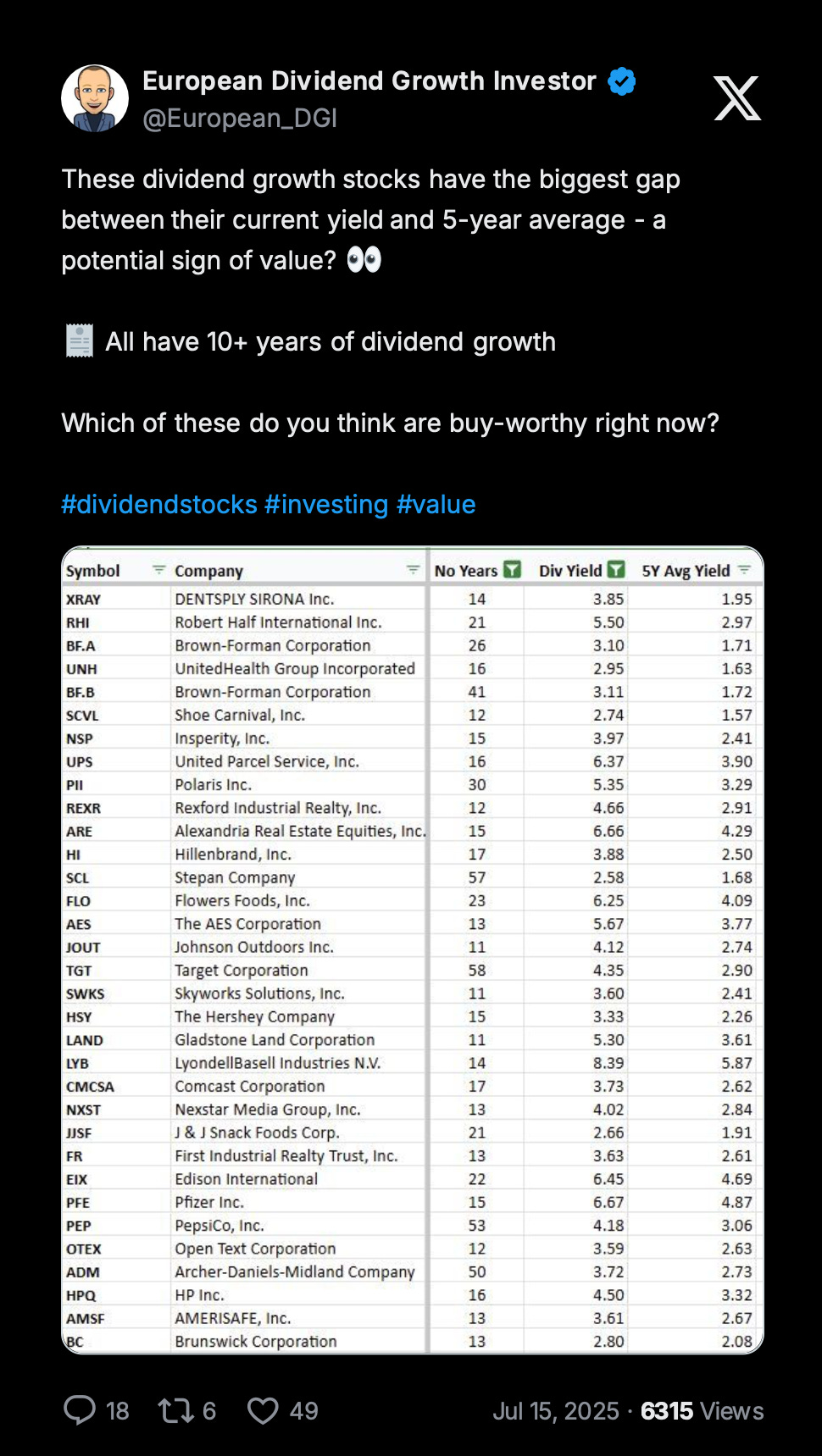

1️⃣ Yield Gaps Worth Watching

Some of the best dividend growth stocks are trading with a current yield far above the 5-year average - a gap that could hint at opportunity:

📈 All have 10+ years of dividend growth.

📉 All have wider-than-normal yield spreads.

Great list from our friend European DGI.

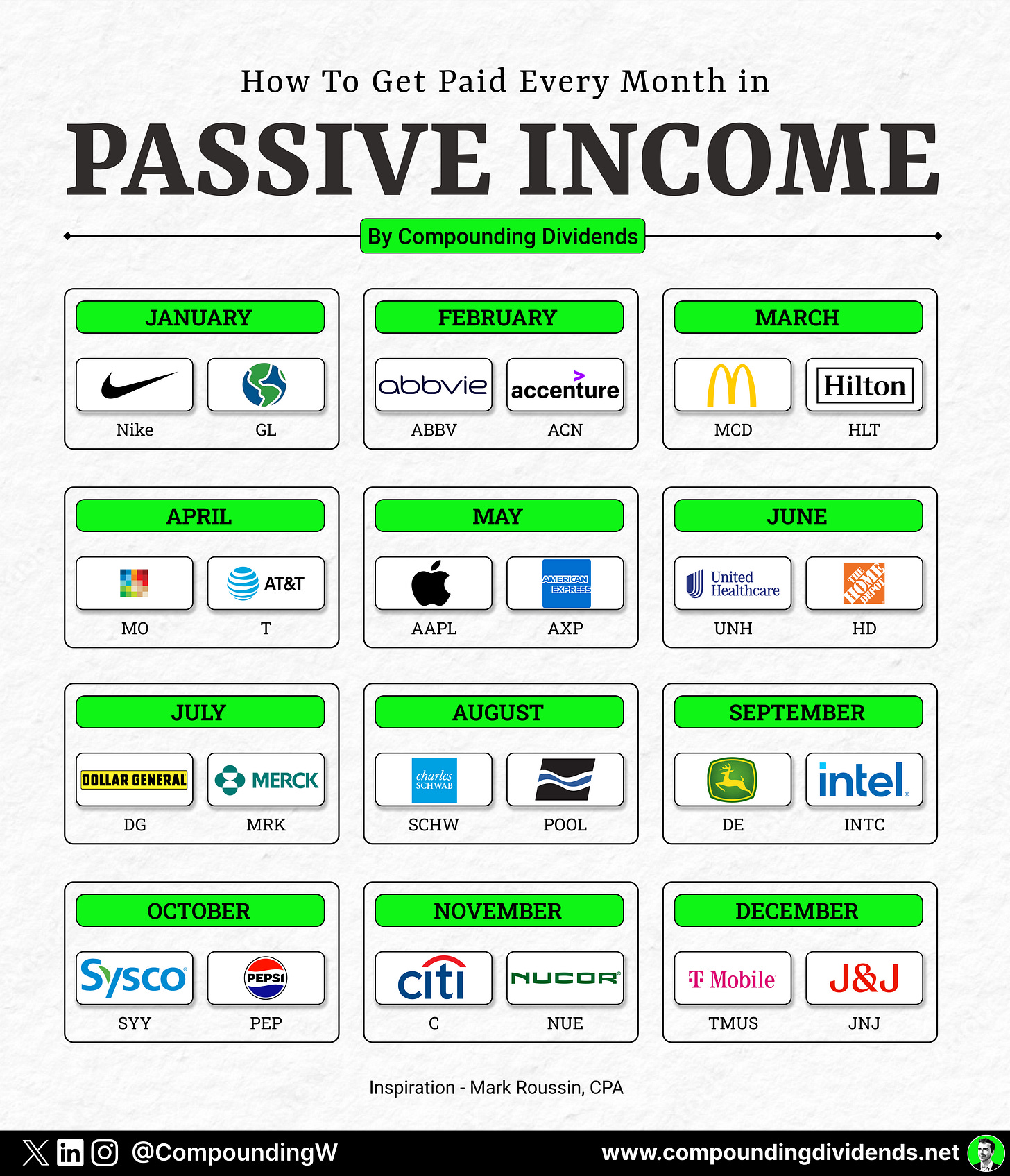

2️⃣Get Paid Every Month with Dividends

Want reliable income 12 months a year? Here’s a sample calendar of dividend stocks that pay in different months.

That means you can build a stream of monthly passive income.

Pay attention to when companies pay and combine wisely = income every month

💡 Bonus: Most of these are dividend aristocrats or contenders

3️⃣ An Investing Quote

Dividend growth investing is the long road.

It’s not fast, but you get:

rising income

resilience through downturns

and real wealth over time.

The long road leads to freedom.

"Take the long road in anything. Life admits no shortcuts."

- Nassim Taleb

4️⃣ 5 Dividend Mistakes

Dividend growth investing is one of the most powerful long-term strategies for building wealth - but it's easy to get it wrong.

Here are 5 of the most common mistakes beginner dividend investors make, and how to avoid each one.

Don’t forget to subscribe to the Youtube channel!

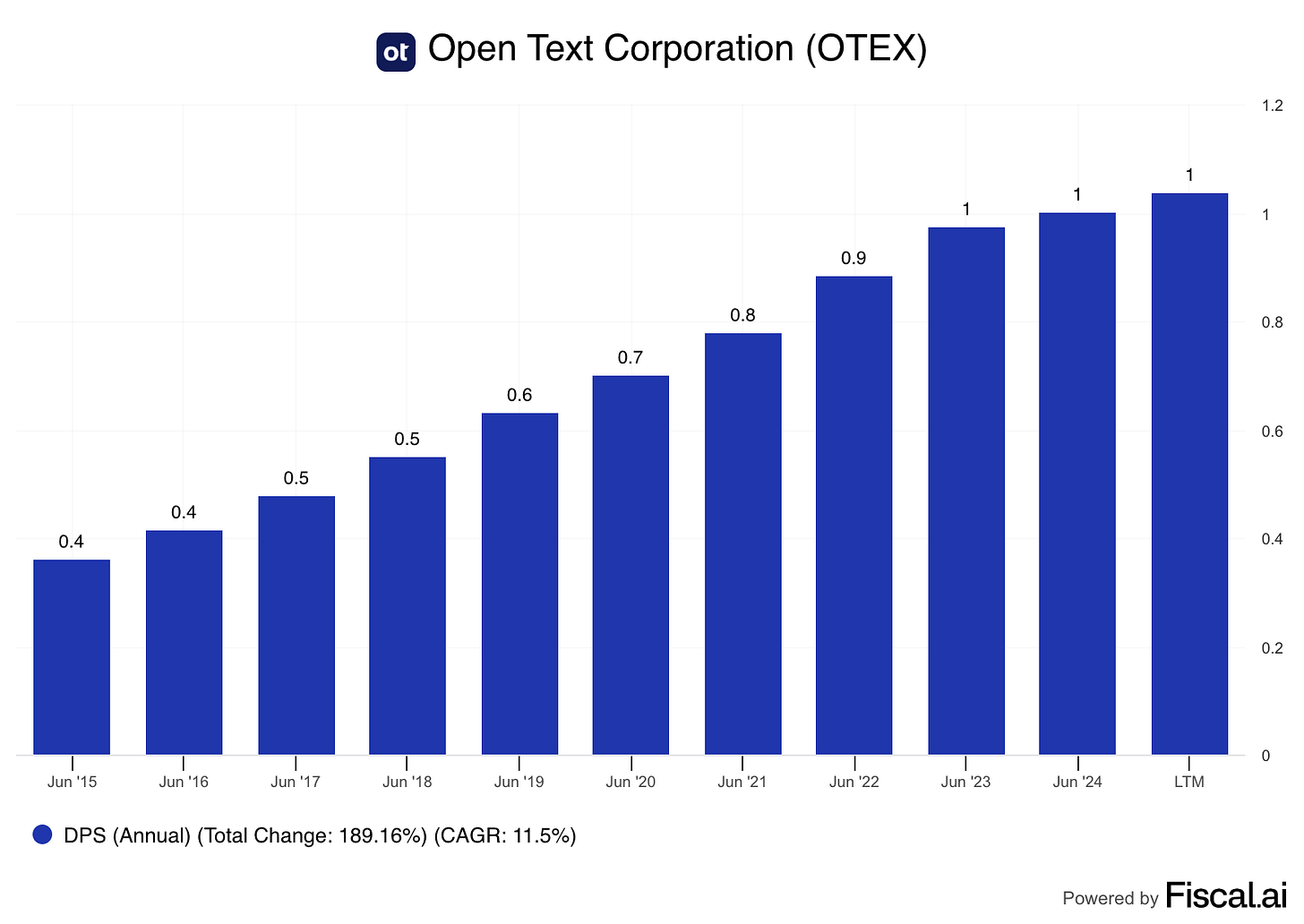

5️⃣ Example of a Dividend Stock

OpenText Corporation is a global leader in enterprise information management, providing software solutions for managing and securing digital content.

The company helps businesses optimize their information processes to enhance productivity and compliance.

Profit Margin: 12.6%

Forward PE: 7.4x

Dividend Yield: 3.5%

Payout Ratio: 42.2%

That’s it for today!

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Fiscal.ai: Financial data

Disclaimer

As a reader of Compounding Dividends, you agree with our disclaimer. You can read the full disclaimer here.