Why Most Dividend Investors Fail

Do You Make These 5 Common Dividend Investing Mistakes?

Dividend growth investing can be a powerful wealth-building strategy.

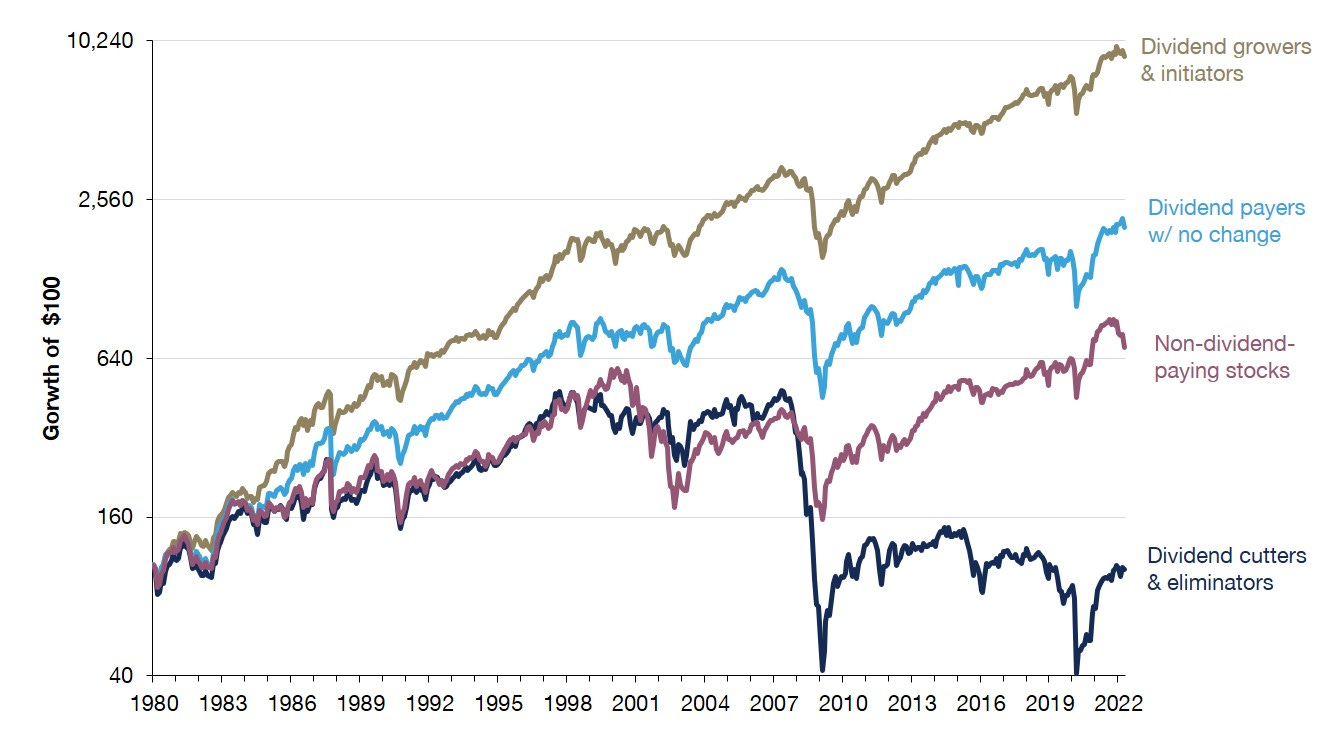

Companies that pay growing dividends tend to outperform.

But companies that cut or eliminate their dividends perform poorly.

How can you invest in companies that will pay you growing dividends and avoid companies that cut or eliminate them?

Today I’m sharing 5 of the most common mistakes beginning dividend growth investors make, and how to avoid them.

Get these basics right, and you'll be on your way to building a successful, profitable dividend portfolio.

Let's dive in.

Mistake 1: Chasing High Yields

If a yield looks too good to be true, it probably is.

A high yield doesn’t always mean high risk, but it can signal a company in distress or unsustainably paying out too much of its earnings as dividends.

How to avoid it: Use the high yield to dig deep into the company’s finances before investing.

A few things to check:

The revenue and earnings

Are they increasing, flat, or decreasing?

How does that compare to the dividend payment?

The Payout Ratio

Is it too high?

Has it been rising?

The balance sheet

Is the company’s debt rising?

Are they using debt to fund the dividend?

Kraft Heinz had a dividend yield of close to 6% in 2018.

But the dividend was cut in 2019.

Investors who looked closely would have seen that Kraft Heinz was paying out more cash than it was earning.

Source: Finchat

Mistake 2: Not Diversifying

Putting too much of your portfolio into one stock or one sector is a common mistake.

How to avoid it: Spread your money across a few different companies and industries to reduce your risk.

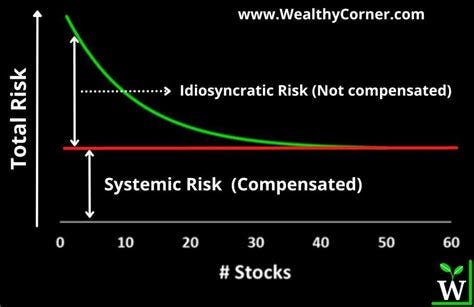

The image shows systemic and idiosyncratic risk versus the number of stocks in a portfolio.

Systemic risk is the overall risk in the economy and includes things like recessions, inflation, and market crashes.

Idiosyncratic risk, on the other hand, is the risk that is specific to a particular company - like bad management decisions, product failures, or regulatory changes.

Holding 20 to 30 companies greatly reduces idiosyncratic risks.

Mistake 3: Ignoring the Payout Ratio

The payout ratio is the percentage of earnings a company pays out in dividends.

When this ratio gets too high, it’s a good indicator that the dividend is not sustainable.

How to avoid it: Set a maximum acceptable payout ratio

A few Payout Ratio tips:

I like to see this number under 60% for most stocks

Adjust for industry (REITs can go higher and use a different calculation)

Track payout ratio trends

Watch for large increases

Mistake 4: Focusing on Yield and Ignoring Growth

Sustainability and growth of dividends is what matters in the long run.

The image compares the dividends you would receive by investing in the S&P 500 Dividend Aristocrats and the Dow Jones U.S. Select Dividend Indexes.

The Dividend Aristocrats are companies that have consistently raised their dividend payments for at least 25 years.

The Dow Jones Select Dividend Index is made up of the U.S. stocks with the highest dividend yields.

Companies that sustainably raise their dividends over time give you more income and a better total return.

What to Look For:

5-year Dividend Growth Rate above 5%

Consistent Earnings Growth

Low Payout Ratio with room to grow

Strong cash flow

Mistake 5: Buying the Income Instead of the Business

Dividend investing isn't about collecting quarterly payments – it's about owning great businesses.

Buy businesses that will keep growing profits and your dividend payments will go up too.

At a minimum you should:

Read last 3 years of annual reports

Understand the company’s competitive advantages

Understand the industry it operates in

Think about what can go wrong in addition to what can go right

The best way I know of to avoid this mistake?

Warren Buffett’s 10 year test:

That’s it for today

Here's what you learned:

High yields can signal high risk

Diversification protects your portfolio

Payout ratios help you know the dividend is sustainable

Dividend Growth is as important as Dividend Yield

Buy businesses, not stocks or income

PS… A lot of people have been asking this question:

“Is there a Compounding Dividends Community?”

Just so you know...

Up until now, the answer has been “not yet”.

One of the most popular features of Compounding Quality has been the Circle Community.

Many Partners of Compounding Quality think that the Community provides even more value than the newsletter itself.

I’m happy to tell you that the Compounding Dividends Circle Community will be launching soon!

BUT only Partners of Compounding Dividends will have access - subscribe today if you don’t want to miss out.

Used sources

Interactive Brokers: Portfolio data and executing all transactions

Finchat: Financial data

In describing Systemic risk you mentioned macro risks of recessions, inflation, and crashes. I would add these risks may find themselves localized to a particular sector. For example, inflation may affect staples more than industrials. With that, I would say we should diversify a little bit among sectors. Don't hold 20 - 30 companies and have them all be staples. Also, the weighting is important - maybe even more so. You could have one bank holding T that outweighs everything, for example.

I'm a little guilty of having a lopsided portfolio as I am heavily tilted toward REITs.

As for the number, I am at 21 in my income portfolio and sometimes that feels like too much. 🥵 Personally, I would reduce the range from 20 - 30 to 10 - 20. But, that's just me.

My breakdown is ...

Business Development Companies - 5

Collateralized Loan Obligations (as a CEF) - 1

Energy (as a CEF) - 1

Financial Services - 1

mREIT - 1

REIT - 11

Staples - 1

I took some major steps in Jan 2025 to rebalance to that point and will now take a breather. There are more companies I want to research and understand but ... time ... never enough of it. 😉

Let's see how the year unfolds.